@Malolan_R interesting take. So you dont beleive in momentum investing, where stocks who are increasing in price are purchased and ride them and sell when they start their downward journey? No fundamnetal , or business , products to be checked.

How do you even build conviction in such investments when you don’t know about the business?

Does this even work when markets go sideways or in abear market?

Imo Can’t ignore fundamentals if you want to do it at scale, something sustainable.

No need of building any conviction. You are supposed replace your stocks frequently based on price purely.

Company like waaree energy, All defence PSU are dependent on Govt Capex program, stock price can even reflect business of future 6 years assuming market leadership, stock price may sky rocket and PE will take a back seat as analysts have some data for DCF due to 350 GW solar addition by 2030. These type of stock may remain in a long time correction as more capacities are floated in coming years and future prospects start dimming. Its like too many market participants chasing one golden egg. You will never know when time correction will start and in a longer term average return ratios will dilute drastically. See the example of Dmart, Britannia, HUL. I will cooly avoid waree energy at this moment. Solar panel is a commodity and easy to build capacities. Average justified PE can’t be more than 15.

But then with this logic, you wont be able to follow trend which is expected in momentum investing. All trends are always of such nature that pendulum moves in the extreme direction and ppl say good bye to logic. But thats essentially momentum and trend following. With this thinking you will remain a value investor ![]()

![]()

I am unable to judge as individual investor these momentum strategies. so dont intend to spend time or effort in this . Instead spend this time understanding business, company and management better. More familiar I am with this better is my conviction. Also apply margin of safety so you dont overpay. In case you are paying high valuation … there should be leadership and long runway. like you can invest in Titan Industries or Bajaj Finance even given high valuation… Paying top dollar for new listing is a no no… These are just some ground rules of investing. To a certain extent it is inspired by Peter Lynch approach…

Thanks

Malolan

About being a value investor… you cant win all the time. But you should be willing to study and understand… This requires time and effort…

Malolan…

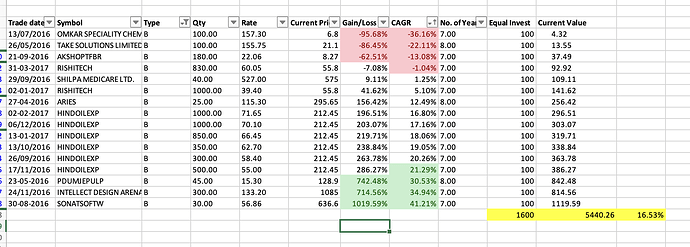

I was wondering what would have happened if I had never sold the stocks I bought in FY 2016-17.

At that time, I had just graduated from college with little knowledge about stocks, and I made most of my purchases based on recommendations from this forum.

Here are the results:

- Number of companies invested in: 10

- Number of stocks that did not outperform fixed deposit returns: 5/10 (50%)

- Number of stocks that did not outperform small-cap mutual fund returns: 7/10 (70%)

Only three stocks delivered phenomenal returns, while three yielded complete capital loss. Even with equal investment in all trades, the portfolio would only yield a 16.53% return.

Perhaps regularly reviewing and adjusting your portfolio isn’t a bad idea if you’re concentrated on small-cap space. Most investments in the small-cap space are driven by temporary earnings surges, so making timely exits when conditions worsen might not be a bad strategy.

And also important is: what you bought instead.

I sold RVNL, thinking it is overblown at 241. Now it is 415. So, it was apparently a silly decision.

But then I bought HGIfra instead at average 900. Today it is 1727.

So, when I compared today, I realised that while I would be up 71% in RVNL, I am 92% up in HGInfra.

Why I did that? HGInfra appeared cheaper, and nobody was talking about it. An ignored stock, as the gurus say.

I am not a very rich person, but the bet paid off.

Your reflection on the risks of “hot stock plays” and the importance of avoiding companies with high debt and cyclical vulnerabilities aligns well with a more systematic, rule-based approach to investing. Here are a few reasons why a rule-based approach can be beneficial, especially in light of your experiences:

Risk Management:

Avoiding high-debt companies like RPower is crucial. Rule-based strategy excludes companies with a debt-to-equity ratio above 1.0, which would have flagged these as high-risk.

Eliminating Emotional Bias:

Your fortunate turn with Tata Motors and Voda Idea underscores the role of luck. A rule-based system reduces emotional decisions by following predefined criteria. For example, investing only in stocks with a P/E ratio below 15 and positive cash flow for the past 5 years can be a useful rule.

Consistent Performance:

Your focus on undervalued large businesses aligns with systematic screening. Using metrics like ROE above 15% and earnings growth above 10% consistently (e.g. 8 out of last 10 years) to identify sustainable investments.

Mohnish Pabrai’s disciplined, data-driven approach is a great example of the benefits of rule-based investing. Combining personal conviction with systematic rules can enhance your investment success, reducing risks and increasing growth potential.

Thank you for sharing, and best of luck in your continued investment journey!

Read more on investment rules (fundamental-ratio-based) in this thread.

We share best investment rules for Indian markets and test them across cycles in the last 25 years.