IRB InvIT has declared June 2024 toll collections which have increased ~3% y-o-y. The increase in toll collections has been tepid in April and May as the annual toll rate hike was deferred due to the model code of conduct being in place for the elections. The toll hike was finally implemented on 3rd June and despite this even June toll collections have registered a tepid increase y-o-y. Can anyone throw some light on the reasons behind this?

Q1’25 results are here.

Came on 26th, post market. At first glance, the fine print in maint provisions seems to be putting the comparison, not like to like.

DPU is the same 2 but the breakup is a tad different.

The next trigger has to be addition of a project and that somehow seems to be elusive. The wait continues.

I also thought that the DPU must inch up a tad, based on concall but that did not happen either and there lies the key difference between IRB and Indigrid

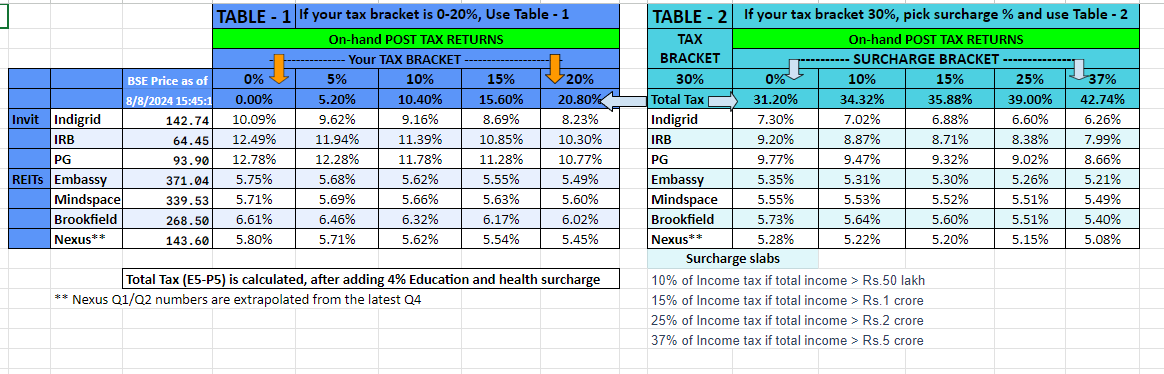

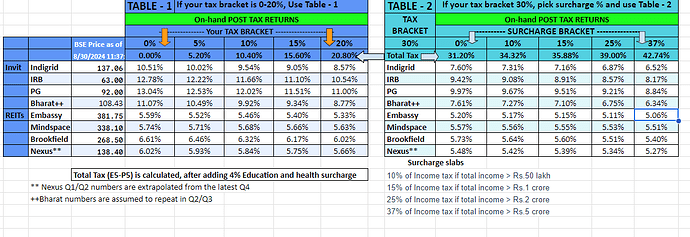

This is after updating all the Q1 numbers…as always, I calculate these based on running 4 Qtr numbers

Hey Kalyan, thank you so much for this.

Yet another low in price took place today and it is very concerning to see the continuous fall. While we can suspect the usual theories (someone is unloading etc…because volumes are steady)…I am curious to know more on what is eating up the price, especially at a time, when the interest rates can start reducing in a gradual manner, from here on

hi guys the company at current valutions looks to good to be true considering it gives 12% div yield and the peers five a div yield of about 6 or 7 odd % .why is this the case?

Is it because the divdend yield will fall in the future considering the tolls will become older than 15 years and pass onto the goverment and in case of peers value of property will rise and so will the yield as escaltion in the rentals

Immediate past history shows that Invits have had higher yields (9-12%), in comparison to say REITs (6-8%). In the case of IRB invit, there is one of the asset that is terminating in 2027 and the talk of replacement assets is just dragging on. My guess is that the combination of things 1) tone of the management in being sure about replacement assets (intent matters, along with action)…here is where Indigrid has been more proactive than IRB 2) increasing trend of DPUs, however minor it may be - again walk the talk matters…indigrid has scored here too in comparison to IRB 3) parent group/ promoter’s action. IRB parent is on a good wicket, with many FPIs investing in it and good projects but that does not mean that the invit will get the benefits 4) this is a slow wicket…everything takes a whileeeeeeeee…for example, due to elections, the normal tariff increase that should have happened in April, moved by several months…who will pay for the lost revenue? A representation is made ot NHAI and they will take their own sweet time to decide. Sarkari moves happen in months and years and not the gati shakti they talk about…also, IRB invit too has to pay some money but that is old news…the promoters have a private invit too …all said and done, this much of a price fall non-stop is a concern…someone seems to know more than what is out in the public domain…

I have added Bharat Invit (assuming that the remaining quarters, will continue with same distribution, as their recent annoucement…in fact, that is their guidance as well) to the table

Is this the reason, why IRB invit has been falling?

This news came today…I would like to understand the implications of this to the toll collector like IRB New toll rules: Pay only for distance covered, no charges for first 20 km - India Today

No toll tax for private vehicles up to 20 km, govt amends 'National Highways Fee Rules' – India TV

But wouldn’t this affect BHINVIT as well? It seems to be rising over the past few weeks.

Dear Kalyan,

You have righty pointed out ALL the important and real issues with IRB INVIT. I am holding fairly large quantity IRB INVIT since long (purchased between 2-4 years back). I do track management commentary in earning calls. I don’t know whether management is aware of concern raised by people like us or they simply do not want to listen to it.

I am retired person, tracking and investing in equity market since @ 30 years. My fresh investment has been now directed to INDIGRID and BHINVIT, simply because they are dynamic and foresee assets which can generate higher DPU.

My opinion is that the share price of Invits need not be exactly synchronized with the interest rate changes. The price can change 1 year after interest change occurs.

For example, when the interest rates were increasing between May-2022 and Dec-2023 by 2%, invits like PGINVIT and IRBINVIT share price increased by 30-40%. This is also not logical. So they are not exactly synchronized.

But definitely, when rates reduce by 1%, the share price of Invits that are giving >10% yield with minimum growth prospects are expected to increase by 15% and also Invits with 13% yield like IRBinvit and PGinvit are also set for price increase. Its just a matter of time.

I chased them for more information on project addition and They replied in a standard manner that all the news is in public domain and they have nothing more to add.

@KS16 Thanks for all the informative post you bring for the forum.

What you all think about IRB Invit and Bharat Highway against NAV to traded price. IRB Invit is loaded with BOT asset and Bharat is loaded with all HAM asset. IRB Invit no visibility when next asset will be loaded . Bharat is awaiting for approval from NHAI on take over of GR Aligarh Kanpur Highway . Bharat also has a ROFO agreement with GRIL , nothing as such for IRB Invit though stable asset generally comes to IRB Invit from its sponsor. But IRB also has another private Invit but mostly focused on construction of asset.

As on March-2024 IRB Invit has NAV of INR 98.32 and market price at steep discount of 62.

As on March-2024 Bharat Highway NAV INR 114.12 . Market price tracking NAV almost.

Generally there remains a discount to NAV for traded price. Even for GR Aligarh Kanpur Highway Private Limited HAM project takeover by Bharat , valuation arrived for the project at 420 cr but Bharat has negotiated a price around 390 cr which is paying 92% of valuation.

But looks like market is giving better price to Bharat over IRB mainly due to assured annuity of HAM project and better takeover pipeline for Bharat.

Bharat certainly commands better respect in the market, in comparison to IRB Invit and this is especially true, in light of the rapid price rise in the last 2 weeks or so in case of Bharat. Bharat has promised yield of DPU of 12 for the year, which means 3 per quarter will continue. IRB on the hand has struggled to even inch up the DPU from 2/qtr, even by a very tiny amount. Ultimately, intent and assured growth alone catches the fancy of markets

I have a basic question.

How NAV of IRB Invit is estimated as INR 98.32 when they are capable of giving only INR 8 as DPU ?

I mean 8/98.32 leads to 8% yield out of NAV. But generally for Invits, it must be 10-12% like in case of PGInvit (12/85 = 14%), Bharat Highways (12/114 = 10.5%), Indigrid (15/144 = 10.4%).

Even PGInvit’s NAV estimation looks conservative. It must be close to INR 100 so as to give 12% yield.

how do you estimate INVIT should give 12% or any other certain number? it’s an quasi equity instrument, yield depends on price and many other factors.

For reference only AMT( American tower ) in US which behaves like an invit has dividend yield of 2.5% although price has ran up a lot. Hence don’t take it for granted that invit are obliged to pay a certain percentage.

PGInvit has disadvantage of being owned by PSU which itself has execution and delivery issues, They have to take clearance from ministries before selling assets to Invit hence lower valuation than Indigrid. PGInvit isn’t comparable with IRB.

Bharat Highways price is appreciating for simple reason of demand and supply, it has just been listed, float is limited moreover their entire portfolio is made up of HAMs which are more attractive in high rate environment. hence demand is higher. we have to see how invit performs in rate cuts.

that being said I think the thing going for Bharat highways is that promoter is aggressive in acquiring assets. If they grow assets base without diluting equity I think it would be worth looking.

@Abhinav_007

what you have mentioned is market estimation of value based on growth prospects but what i am asking is about NAV estimation done by the company itself which has no connectivity with public or private and growth of 5% or 0% which company also cannot predict. Even if they predict such growth prospects for 15-35 years, it is bogus.

The NAV is estimated based on 2 critical factors.

- guaranteed future cash flows based on contracts signed already

- discount rate.

I hope you got my point.

Okay I thought you meant something else. Also I don’t think IRB calculated nav based on discount rates or future cash flows. you can read more about that in their valuation reports, but I think they decide it based on asset market price - loan on invit per unit.