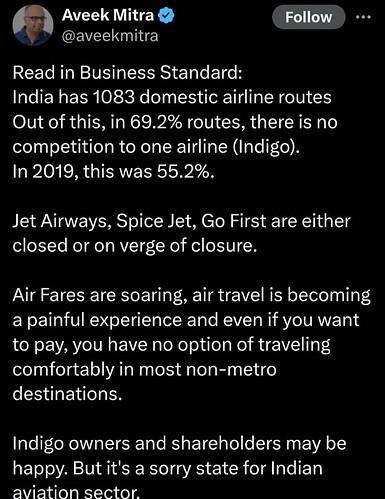

Indigo is the only choice for as many as 20% direct routes. Also highest number of direct destinations. This will remain for next few years as Air India just does not have the planes to add routes or increase capacity in popular routes across metros and BLR/AMD.

as per report ![]() the airline company has a sustained lead on load factors as its peers falter on customer experience.

the airline company has a sustained lead on load factors as its peers falter on customer experience.

Some Insights

- About 40% of airlines’ cost is fuel.

- Crude prices have reduced by 16% this year.

- The ATF (Aviation Turbine fuel) prices are revised monthly. So next revision will see the correction in prices.

- Coming months are the months of festivals and weddings. Surge in air travels expected.

- This directly relates to higher margins and Profitability for Indigo. Especially during the high traffic months.

- Management aims to be a major global airlines company by 2030.

- Management is looking into enhancing cargo business.

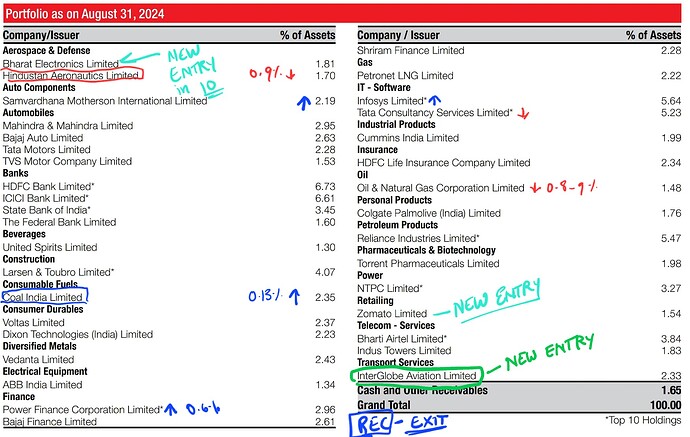

I have been tracking Nippon’s Quant Mutual fund since few months. I saw that in August Month, Indigo has come up as a new entry in Top Holdings of the Fund. It was missing in the July 31st disclosure. And this also very well corresponds to the jump in Indigo’s price from 4200 range to 4700-4800 range in past Month (due to big chunk of money coming at once). Ever since than, it is lying in this range more or less after climbing high for a day or two.

This shows that the fund is seeing opportunity in the stock for atleast 1 Quarter to 3 Quarters. Generally funds dont sell top Holdings after buying within a month or two.

Disclosure: This is my personal analysis. Remain well invested in the stock.

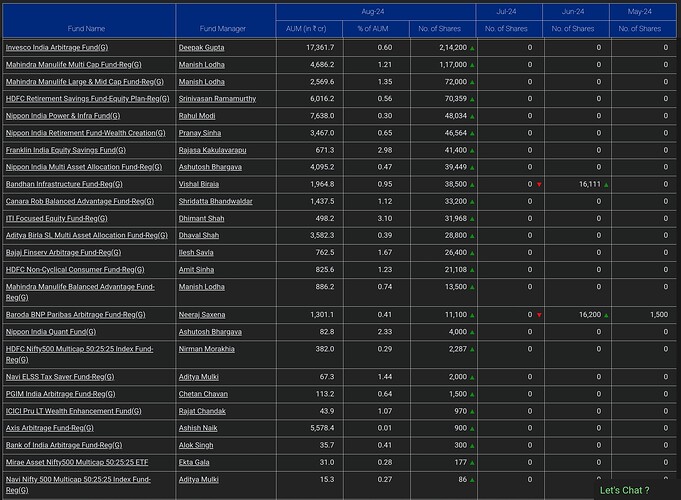

Not just Nippon, ICICI, Mirae, Axis, HDFC, Kotak, SBI, Invesco, Birla etc. have increased their positions, some substantially. Nippon’s quant fund made a fresh purchase of just 4000 shares, ICICI flexi cap fund made a fresh purchase of 4,00,299 shares, next fresh purchase is by Canara small cap fund’s of 2,52,706 shares, next is Invesco arbitrage fund with 2,14,200 shares, Mahindra funds with 1,17,000 shares and 72,000, HDFC retirement savings fund with 70,359 etc.

Quant funds AFAIK get in and out quickly, so there have been reduced positions from such funds and from other funds too, but August was a bought month with 43.5 lakh shares by fund houses. Hence the stock posted a new ATH surpassing the previous high made in June.

Initiated a position.

Numbers from.

This is very useful information and link. Thank you so much for sharing this. Really thank you.

One analysis I see is that 25 Mutual fund schemes have made fresh entries in indigo in August ranging from 80 shares to 2Lakh shares.

As we know, it cuts both ways. Institutional buying while takes the price higher than we had expected, their selling will have the opposite effect. If they find better opportunities, they will exit their positions, even at a some loss, along with them decreasing their positions regularly for reasons like valuation or future outlook or reasons which are yet to reach us, and we will know about their selling after some delay. So things like these can be used as a data point, an insight, that can add some benefit to our positions.

Isidro Porqueras:

- #Educational background: PhD in #Physics and MBA from IESE Business School (Barcelona, Spain).

- Former COO of Volotea, a fast-growing European airline.

- joined IndiGo in April, 2024 as Chief of Transformation and has been engaged in several operations related projects over these past months.

- It is the second reduction in Aviation Turbine Fuel (ATF) in 30 days. In past 1 month, total reduction in ATF prices has been roughly 10%.

(While our petrol and diesel costs same…! ![]() )

)

Another social backlash against Indigo.

Indigo needs to amend before its too late. Frequent such issues can create a sticky negative impression that would be hard to rub off at later stage. At any point in time when Indians might have choices, indigo will lose in all those occasions. Three imminent dangers visible right now:

- Spicejet revival. Multiple firms are keenly interested in resurrecting spicejet. If things do go right, it would be just matter of months before it can snatch as much as 10-15% of market share, the share that it had lost.

- Lack of visible govt backing. Indigo doesnt seem to be dear to govt just as Adani, Ambani stocks are. The ruling party friendship equation doesnt exist to act as a veto for its growth.

- People’s Fav Tata may change the game. From bringing connected perks to increasing luggage limits to perceived empathetic customer service, Tata group can bring up any ball game to toss of indigo into a different battlefield. The way they did for tata motors by shifting the battlefield from features and price points to safety rating to gain a traction and reach #2 spot in the Cars market share.

Although indigo knows very well the business, it seems to take word of mouth and customer satisfaction absolutely for granted. This is not the strategy that a long term vision perhaps could sustain.

To think spicejet is going to challenge Indigo is foolishness i guess. I have been tracking spicejet for years now and i can tell you with a lot of confidence that the only thing that spicejet challenges is spicejet itself. but one thing, a cat has 9 lives. spicejet has 18. it refuses to die.

Valuepickr should add into it’s guidelines to give disclaimer if one is already invested in a stock or its competitor.

Now a days since valuepickr has been advertised on youtube by influencers few of the folks are coming in here to promote buy/sell calls for 3 to 4 months movement.

Hi If that response was directed towards me, apologies to not make it clear. I am invested in Indigo and have add more of it too in recent fall. And yes, not invested in Spice jet.

To be clear, I’m putting up my views of both angles to Indigo - the positives ones and the threats one to remain aware of complete risk reward paradigm.

Disclosure in previous post.

Spicejet has had a ton of bad luck, first with the Marans and then with Covid and has still survived. I am fairly confident that under Ajay Singh whenever the airline catches even a small break, it will capitalize on it completely. Indigo is running mostly because its scale has given it an impressive moat but as soon as a viable options comes along, it will face a lot of pressure.

Disclaimer: Invested in both Indigo AND Spicejet. Aviation as a theme for growth is solid in India.

Food for Thoughts:

Will there be a new entrant in Indian skies in times to come?

How does this relate to entry of new entrant in India. For context, Southwest Airlines is struggling airline in US, which lost its charm in last few years. Elliott Investment an activist investor has bought shares of the company and it is trying to get the existing management and board members out and put its own people in place to revive the airlines. See this interesting deck https://strongersouthwest.com/wp-content/uploads/2024/06/Stronger-Southwest_06102024.pdf

I am closely tracking this airline as Rakesh G. might even become CEO here and his airline business acumen is second to none. He was one of the main architect of modern day Indigo low cost model. Read this amazing book https://www.amazon.co.uk/Sky-High-IndiGo-Tarun-Shukla-ebook/dp/B0D1RNB6HF