Management view on recent regulation changes

Are the valuations sky high though for IWEL?

Hi Folks —— what are views on prospects of Inox Wind VS Suzlon ?

Hi Guys I was thinking let’s re-evaluate the wind and set some realistic targets, my previous work is almost 1yrs old so I thought I’d update myself.

So to avoid confusion I will use “” quotes when I am directly quoting form a report so that we know what are my words and what are not.

What kind of wind installation can we expect in coming times

“”In the ambitious scenario, India instals 26.2 GW of onshore wind between 2023 and 2027, reaching 68.1 GW onshore wind capacity by 2027. It can be segmented into 23.4 GW coming from central and state tenders and 2.8 GW from the C&I sector. Of the 23.4GW volume, 12.5 GW is from existing pipelines and 10.9 GW from new tender awards.””

Now what Suzlon has said in one of the interview few days back is currently there are 12GW with OEM under execution out of which 3GW is C&I and 15GW of orders are yet to be awarded to OEM out of this 5GW is C&I

Now both suzlon and the report almost match but out of this 15GW to be given to OEM there is definitely going to be few drop outs and post july 2025 we would have a slow down as well. So I think it would be fair to assume that 22GW to 25GW is what we are looking btw CY24-27

Another very interesting point I would like to bring to your attention is our target was 140GW by 2030 but the Central Electricity Authority (CEA) indicates that cumulative installed capacity of 100 GW might only be achieved by 2030, This is like 56GW in next 7yrs so the most bullish case also show 8GW per year for next 7yrs.

I personally feel that this would not be achieved, we will further have a cut in our target going forward.

Another interesting point is currently we generate 1642 BU (billion units) of electricity this will go up to 2440 BU by 2030. So to keep an optimal generation capacity mix we need only 100 GW of wind components by 2030 in the mix. as per CEA

Why is the C&I segment still doing wind and what does GWEC think about it? Please note they are a big contributor in demand right now so any slowdown here would impact wind players.

“” Given the lower per unit economics of solar they have become the first choice of C&I segment. In 2022, ~300 MW of wind was installed in the C&I sector, significantly higher than ~100 MW in 2021, however, in the same period, 3.4 GW of solar was installed in 2022 and ~700 MW in 2021.””

“”Main reason for uptick of wind in C&I is saturation of C&I consumers with 20-30% power consumption coming from solar, expansion beyond which is difficult without storage or supportive banking regulations;Despite a huge potential, the market can swing between 200 MW to 700 MW in the coming 5 years, unless C&I consumers’ needs become more specific to wind generation needs””.

So guy storage cost coming down is a real problem, solar + storage would be the preference if they are cost competitive. Lets see some unit economics. These are old figures, current storage might be lower.

Another angle of what we should expect by 2027

““The Ministry of Power (MoP) has given an RPO target to DISCOMs of estimated 57.5 GW by 2027; 33.1 GW is already installed as of 2022 (Excludes 9GW of C&I installed), leading to a gap of 24.4 GW which needs to be fulfilled by 2027. State regulators have already set an RPO target of 19 GW, against which the state DISCOMS have committed to procure 17 GW from wind so far.””

Now on this we can add C&I + some more states will set their targets or increase because 24.4GW is the gap, We can assume 19-20GW from State discom and about 3GW to 5GW form C&I again we are close to the same number 23GW to 25GW between CY23-27

What is the current Run rate?

In CY23 we did about 2.8GW and this year expected to to 3.8GW (heard from some suzlon interview) now compare this to the above image you would notice that the current run rate is going at the base case assumprion.

Now I would analyse Inox with the following numbers at india level CY24 3.8GW, CY25 5.5GW, CY26 6GW and CY27 6.5GW ,so 21.8GW btw CY24-27

There will be some confusion in CY/FY as CY has 2FY in it sorry for that

Guys above is purely mathematical and I might have done a lot of mistakes, I would appreciate if somebody could help

So 33.8cr shares

The O&M business generates 8-10 lakhs of revenue per MW currently they have 3200MW and they expect 50-55% EBITA and inox has 55% stake accordingly I have added the at PAT Plz note the consolidated accounting happens in a different way just to get a ball park I have taken this way

I have taken a PE of 30 which is very high as per me.

EDIT

I am sure the merger should happen in 1 year and the discount is 30% so even if INOX is at the same price for next 1year, the PE would be less than 30 because 1.7yrs forward price is 781 and current is 500, I would still make 30%, though I expect to make more but the RR looks good here.

Incase Inox falls by 30% I loose nothing (of course opportunity cost but then INOX becomes very cheap) So I look to trim my position but being invested in IWEL gives better RR

Doc used GWEC-India-Outlook-Aug-2023-1.pdf & CEA report

@nandan_ganatra I say your tweet on inox being 9X FY26 on cash basis, would love to see the break up from your side

Disc- invested, but will look to trim

Great analysis, as always.

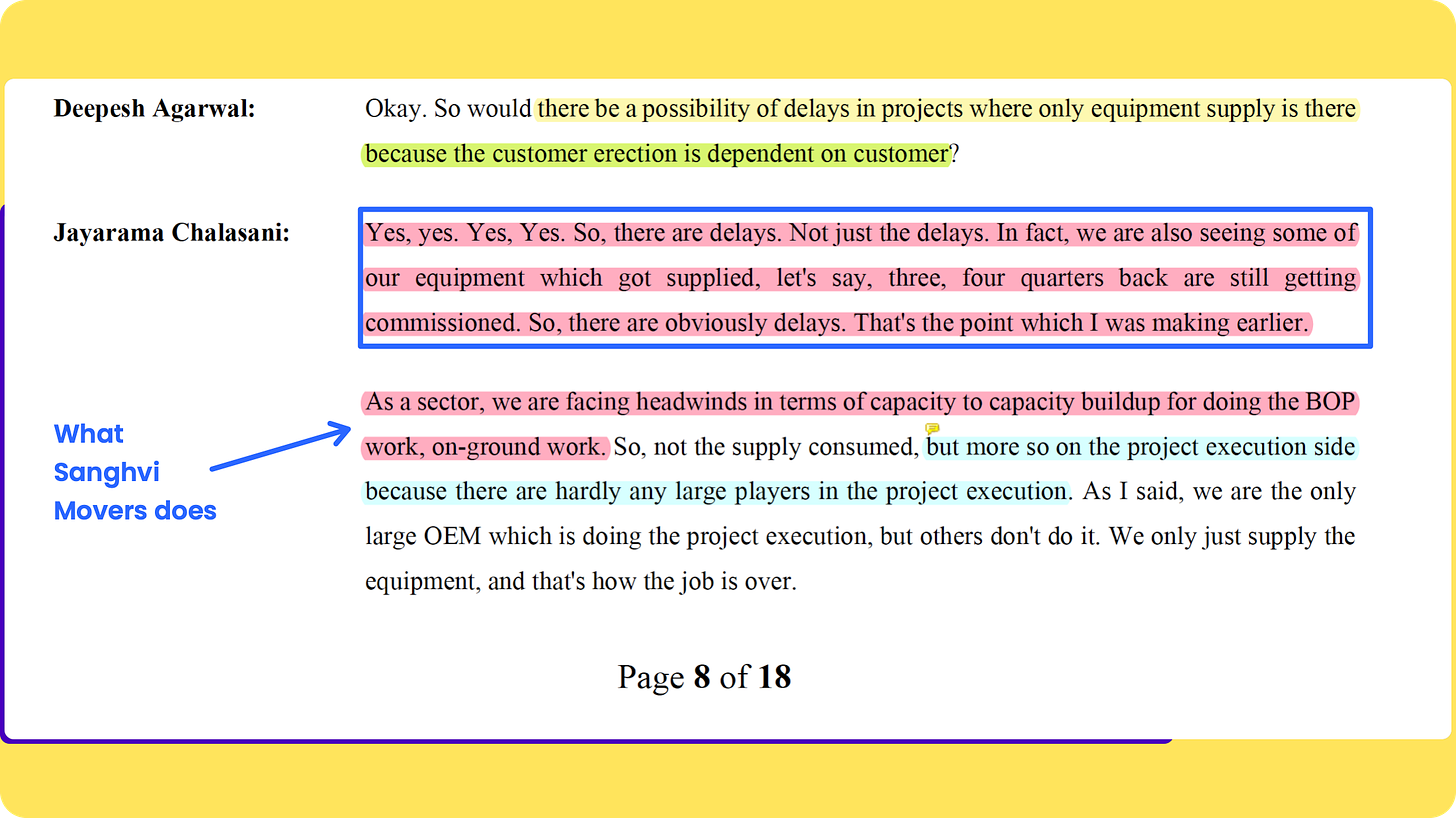

While there is enough comfort on the future order outlook (unless the current government does not come back to power), my concerns remain on execution of the orderbook. Suzlon’s last 2 quarter concalls have been trying to draw attention to this point. If the execution challenges continue on the ground, stock will be down graded considerably as soon as bull market euphoria ends.

For now, I am waiting on sidelines for either valuations to further cool down or get some signs on execution challenges being resolved.

Good analysis!! Few points.

- Does total shareholding include preferential equity to promoters?

- PE of 30x is very high for equipment and turnkey business, given the industry is cyclical and competitive intensity coming in with Reliance and Adani foray into wind trubines. Instead of 30, if PE is 15X, then current price deosn’t offer much upside. O&M business might deserve a 20-25x multiple, but its contribution to overall profits is not significant

- In current market, more than valuations, the bull market and trend of green energy has driven the valuations of these stocks to ridiculous levels. I would probably use simple technicals to exit the position than just based on valuation

- At CMP, IWEL is 30-35% cheaper than inox wind, as per merger ratio

Inox Wind - Very good insights about the wind and power industry (Must watch)

Credit - https://x.com/SureshKBN?s=20

NCLT approves Inox Wind Energy and Inox Wind merger proposal.

NCLT has approved joint petition of both the companies and has asked the companies to obtain shareholders’ approval on 1st June 2024. It usually take two to three months post shareholders’ approval to conclude the merger.

158 shares of Inox Wind (INOXWIND) to be issued for every 10 shares of Inox Wind Energy (IWEL). IWEL shareholders may gain about 45% from yesterday’s closing price.

NCLT Order.pdf (140.3 KB)

This is not an NCLT approval order. Steps 4/5 have been initiated, approval is step 15.

Basis the Q4 results & Management commentary on concall, have tried to extrapolate the financials for the coming years. Basis the same, at 20k Cr Mcap, it is valued at ~27x FY’26 projections. However, orderbook gives an opportunity to execute more + New order additions in FY’25 can add more to FY’26 topline.

Key assumptions:

- Realizations hold at Rs.5 / MWt for next 2 years

- EBITDA guidance of 15%+ for coming years

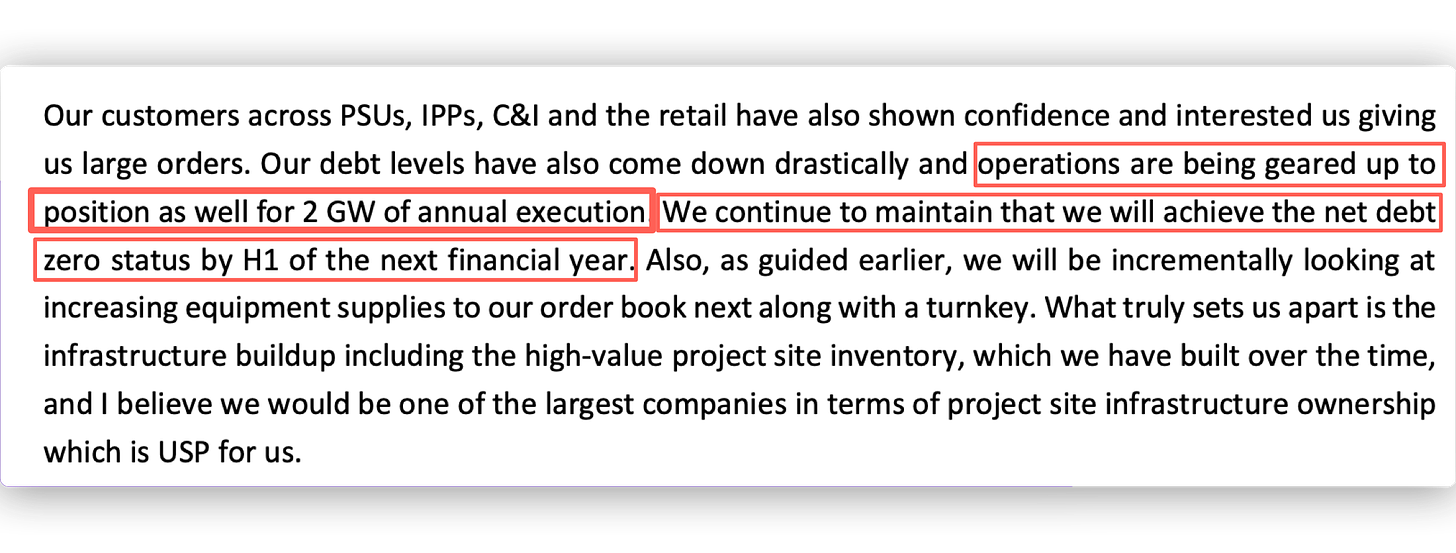

- Mgt. has guided for debt free by H1 of FY’25 and no further capex in the next 2 years considering capacity is already built for 2-2.5 GWt. Hence the overall interest and depr cost should start tapering down as we go ahead.

Disc: Invested

Thank you, thats really helpful. Couple of pointers from concall I noticed:

- Management guided for revenue of 6cr+ per mw in the future. Lower right now due to transition

- Capex of around 75 cr will be required per year for new moulds, etc

Yes, i have baked the realization assumption a bit conservative to be on the safe side.

Also, Q4 margin is already at 19% (demonstrated) but have baked in 15% which also i feel is conservative. The management has a tendency to under promise & over-deliver and hence walk the talk which is a good sign as per me.

The only red flag in my view was the logic for declaration of bonus, it was not required to be frank at a CMP of 600

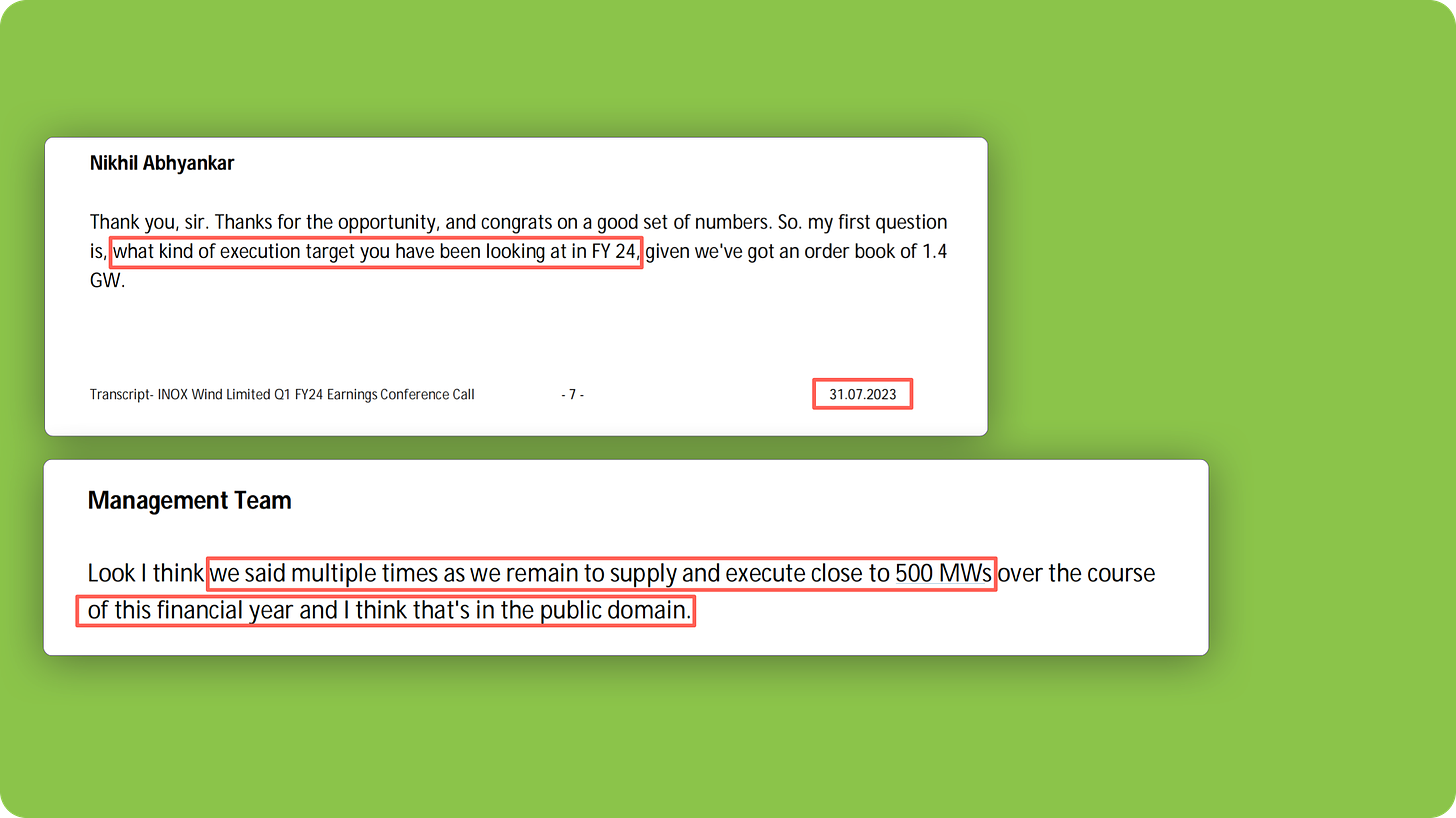

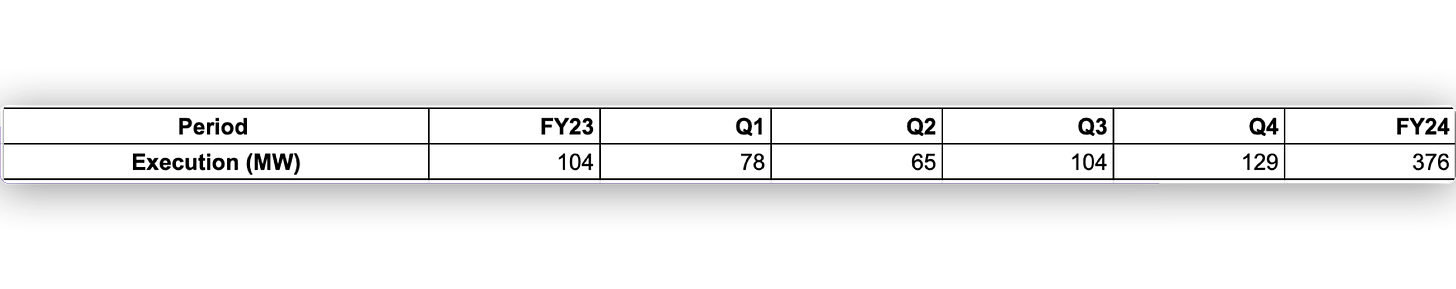

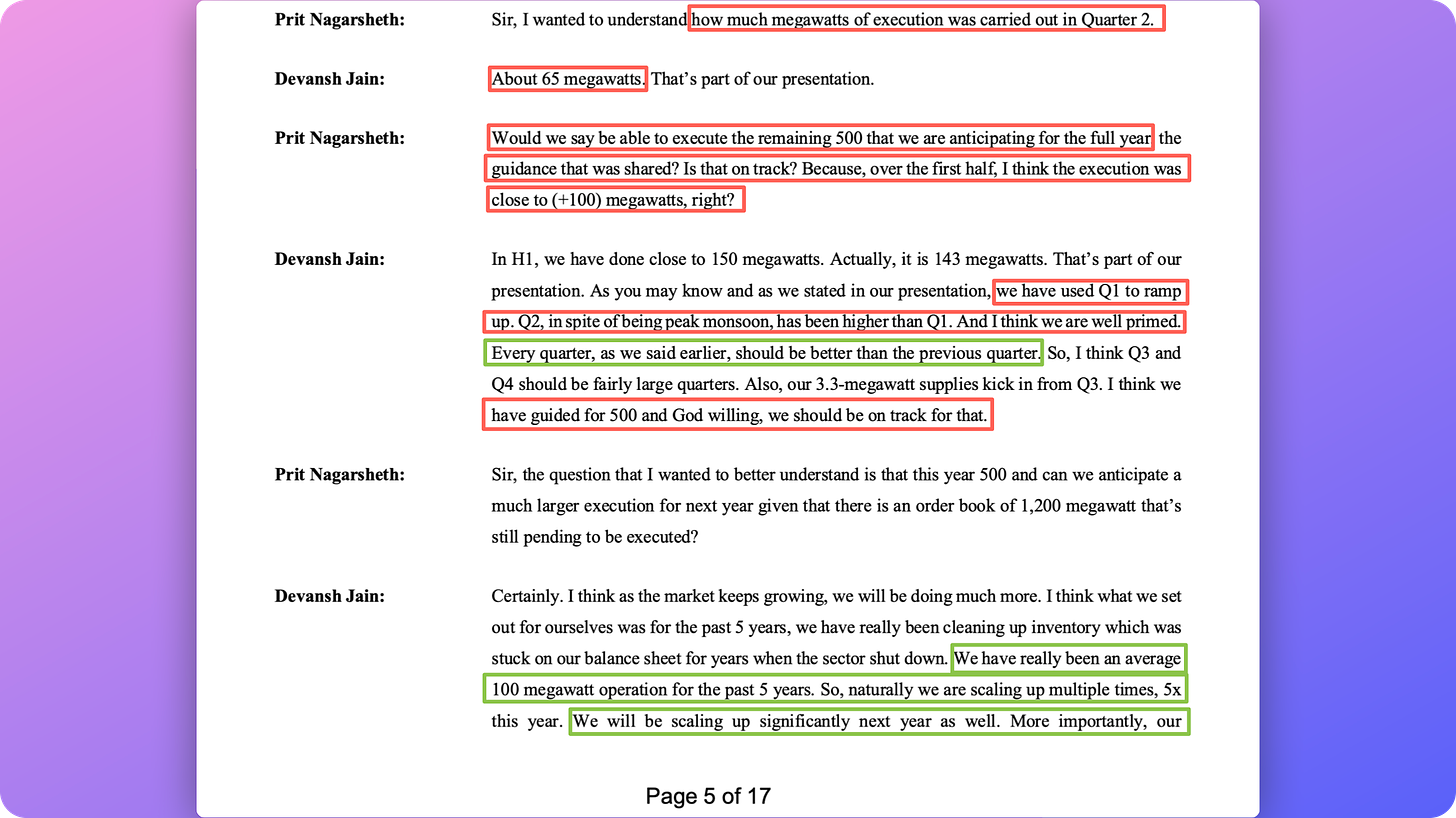

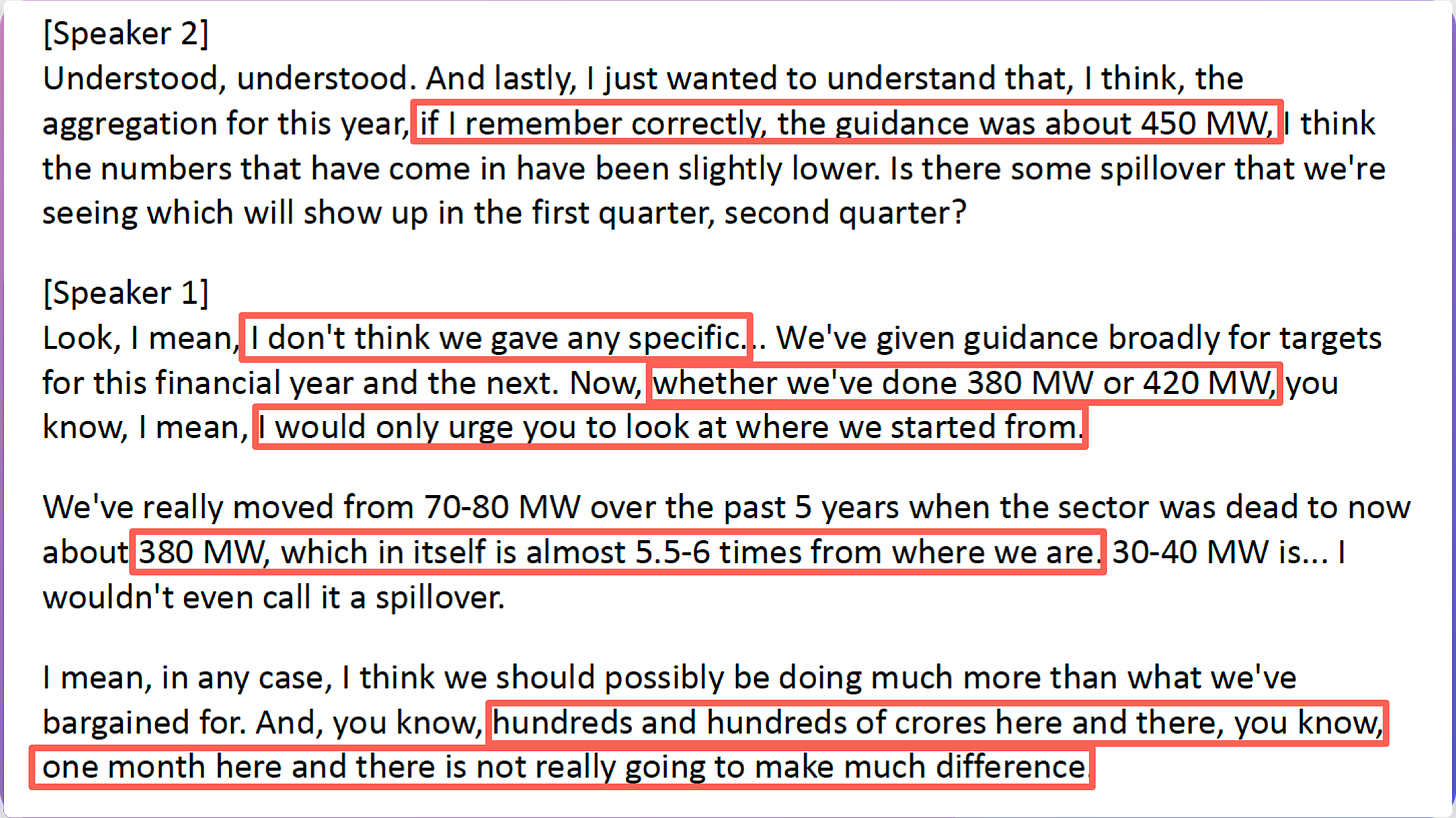

Inox Wind Ltd was expected to deliver (or Execute) ~500 MW of Wind Energy Equipment in FY24.

Although on a yearly basis, the execution was ~3.5X compared to last year, Markets are forward-looking and Expectations of 500 MW had been ‘priced in’. The Actual execution was close to ~25% lower than ‘Expectations’.

At the end of Q2FY24, when asked whether 500 MW would be on track, Management said we’re ramping up and rightly so, every Quarter has been better than the last.

By the end of the December 2023 Quarter, Managements outlook and commentary was still bullish (104 MW Execution in Q3) and references were made to ‘2W Annual execution’

Meanwhile, Suzlon was reporting scarcity of EPC guys (think : Sanghvi Cranes) and slow execution on account of the Evacuation Grid not being ready.

“It appears that its Customers (IPP - Independent Power Producers) are running into execution problems - Land Acquisitions, Grid Connectivity, and a shortage of EPC guys (such as Sanghvi Movers) - Suzlon Valuation Note

Inox Wind Management used this opportunity to sh*t on Suzlon while at the same time highlighting the merits of their Order book i.e - EPC + Equipment Delivery, alluding to the fact that while Suzlon may have EPC issues they do NOT because of their ‘plug & play’ Infrastructure and ‘EPC capabilities’

Finally, It turned out that by the end of Q4, Inox Wind has fallen short of their 500 MW target/expectation by a significant margin (I still remain cautiously optimistic)

Bottomline is :

-

Q4 Results were NOT ‘as per expectations of 500 MW execution’ ! However, from the vantage point of FY23 executions, 3.5X in FY24 is obviously spectacular but all that is already ‘priced in’

-

IWL Management has NOW upped the FY25 Execution to 800 MW !! I remain skeptical until proven otherwise [Watch Q by Q developments closely & Track Suzlon & Sanghvi as well]

-

The Biggest Trigger for boosting Earnings is the hoped for reduction in Interest Cost. Every Single Cr saved goes straight to the bottom line ! The co’ is expected to be ‘Net Debt Free’ which means Debt - Cash = 0.

Thank you for detail answer

What will be the effect on Inox wind if government changes as on today They have order book for next two years then too, market is worrying about government changes as the same we saw in yesterday‘s price moment. I don’t think so. If government changes, renewable energy sector will be in focus for next 5 to 10 years for any government As this is the necessity, appreciate your views, thanks and regards,

disclosure-invested

Personally, I have no opinion Sir, maybe someone else has one on this topic.

While the results were rightfully off vs. the estimates which is leading to the correction as well, Change is Govt will bring in complete uncertainty in the entire theme of green energy. While the transition still has to happen globally, the vision of current govt and the pace of execution has far higher confidence vs. a change. Personally i take help from technical factors during such times in terms of price volume.

If you see - 650 is a strong resistance now and we are moving closer to the support of the trendline - Around 520-530. The stock should spend some time between 520-650. Hopefully it reverses from here and makes a new high post June 4th

Stock reversed beautifully from the trendline as shared above. Interesting development in the inox gfl group

https://x.com/etnowlive/status/1790955498096959957?s=48&t=taDyVj4_oT168hw6IQLVFA

They did clarify that it will be infused back to IWL.

ef7faa40-3f75-49ff-899c-7898dea6bd55.pdf (871.4 KB)

" Inox Wind Energy Limited raises ~ Rs. 900 Crore through Sale of Equity Shares of Inox Wind Limited; significant step towards completely deleveraging external debt in IWL

• Inox Wind Energy Limited (IWEL), the promoter of Inox Wind (IWL), successfully raised ~ Rs. 900 Crores through sale of equity shares of Inox Wind via block deals on the stock exchanges

• Transaction witnessed strong participation across marquee Institutional Investors"

The funds raised are proposed to be infused into Inox Wind Ltd to pare down Inox Wind’s debt and augment the working capital needs of the company thereby strengthening its balance sheet further.