Hi,

It is a pretty decent result

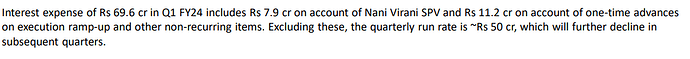

- Interest cost is the same. This should reduce by at least 20cr in next quarter

2… They still have 50MW of nani virani to be sold and they have been executing a 150MW NTPC order since august 2022 and it is still under execution so does the recognition happens after 100% execution or some other way. If it happens after 100% then this should reflect in Q2 or max Q3 this is like approx. 700cr.

As of now I can see this 200MW definitely coming up in Q2 or Q3. Now form H2 I have higher expectation and next quarter is monsoon season so I don’t have high expectation for Q2 as well. It would be grate if this 150MW NTPC comes up in Q2.

After con call I will have better understanding and as of now I am confident of them at least doing 2000cr.

I would urge everybody to go through my recent Suzlon post which gives a good Idea on valuation which I feel wind companies deserve. Is Suzlon a turnaround story after FY16 - #516 by manhar

This year for me the key thing is top line and leverage because I don’t have big expectation at PAT levels.