Before we get into details about this company, a few acronyms, that might help

- O&M - Operations, and maintenance

- LCOE - Levelized Cost of Electricity

- FiT Regime - Feed-in Tariff

- IPP - Independent Power producer

- ISP - Independent Service Providers

- PPA - Power Purchase Agreement

- SECI - Solar Energy Corporation of India

- WTG - Wind Turbine Generator

- C& I - Commercial and Industrial

- EPC - Engineering Procurement and Construction

- WPP - Wind Power Plant

Overview of the company:

INOX GREEN ENERGY SERVICES Limited (IGESL) is a major wind power operation and maintenance (“O&M”) service provider within India. Are engaged in the business of providing long-term O&M services for wind farm projects, specifically the provision of O&M services for wind turbine generators (“WTGs”) and the common infrastructure facilities on the wind farm which support the evacuation of power from such WTGs.

The company has close to 10 years of operations. They have long-term agreements in place that enable revenue visibility and our contracts include inbuilt fixed escalation clauses. The long-term contracts ranges between 5 to 25 years.

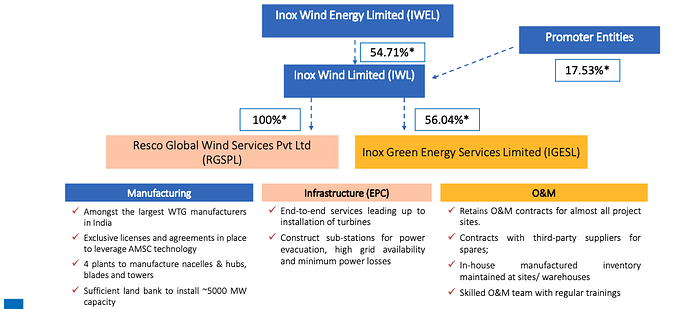

The parent company of Inox green is Inox Wind (IWL). IGESL has an exclusive agreement to O&M services for all WTGs installed by IWL. The promoters structure looks as follows:

The company last year sold its EPC business to its promoter group. The EPC business accounted for a significant portion of the losses incurred by the company in the last three years. This is held in the Resco Global Entity.

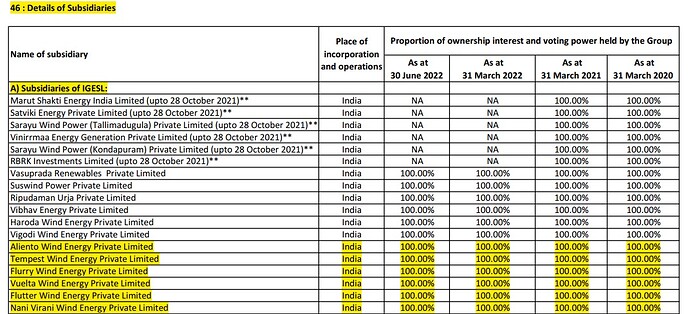

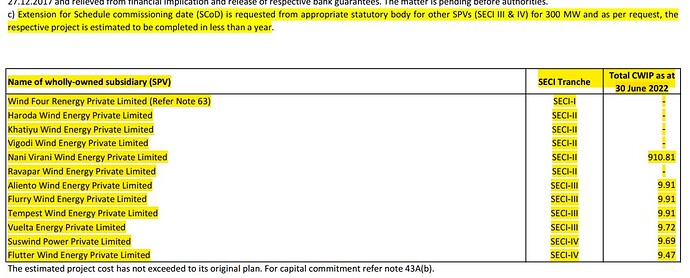

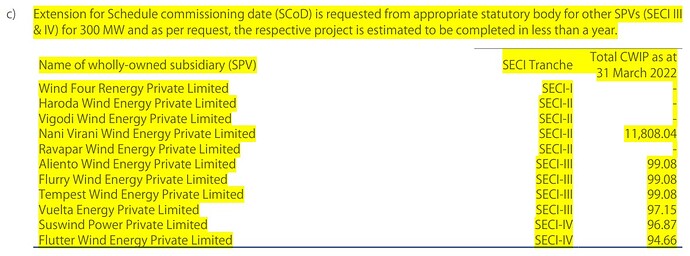

Currently there are two subsidiaries of IGESL:

- Nani Virani Wind Energy Private Limited

- Wind Four Renergy Private Limited

The company is looking to sell 50MW capacity for around Rs 300 crore in the current fiscal.

What are the components in an O&M:

- comprehensive O&M contracts cover the provision of O&M services to both WTGs installed on a wind farm and the common infrastructure facilities, such as electrical substations and transmission lines, which support the wind farm;

- common infrastructure O&M contracts relate only to the provision of O&M services on the common infrastructure facilities.

Type of services under this company (per the Annual Report):

-

We undertake Predictive and Condition Based Maintenance

-

We deploy a dedicated on-site O&M team, available 24x7, for maintaining wind power plants (WPP), which also ensures a maximum yield from the WPP

-

We conduct Preventive Maintenance of Wind Turbine Generators, Unit Substations, High Tension Lines and Metering Points

-

We also look after the upkeep and maintenance of Wind Power Plant infrastructure and evacuation facilities

-

We also undertake SCADA operation of wind farm ( *SCADA - supervisory control and data acquisition - is a computer-based system that allows local and remote control of basic wind turbine functions and collects data from the wind farm that can be used to analyse and report on the operational performance. Data-based condition monitoring system uses data already being collected at the wind turbine controller and is a cost-effective way to monitor for early warning of failures and performance issues *). They employ the use of various software technologies such as AMSC’s proprietary Supervisory Control and Data Acquisition system (“wtSCADA”) to monitor 250 WTG parameters. With the data collected, the Company is able to provide its customers with up-to-date analytical data on the performance of their WTGs which can inform future performance of the assets.

-

We initiate technical upgrades whenever deemed necessary, Emergency spare parts are kept handy, within the site, to ensure continuity of operations under all circumstances.

-

We undertake a proactive approach to benchmark our services.

-

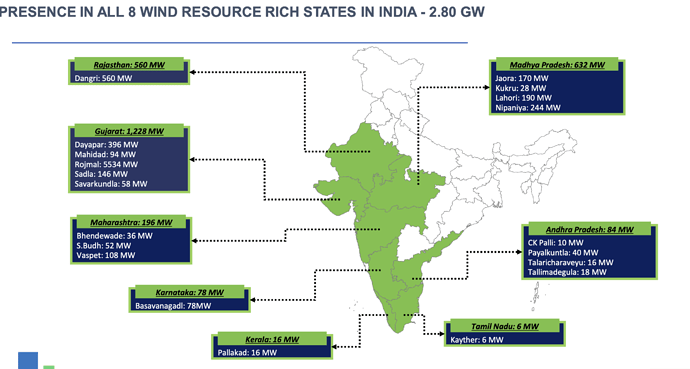

8 states presence:

Industry overview:

-

India has announced a renewable energy target of 175 GW by 2022 and a target of 450 GW by 2030.

-

Operations and maintenance cost form a critical component in the Levelized Cost of Electricity (LCOE) of wind energy. Therefore, renewable power producers adopt various strategies to lower this cost and improve the reliability of the services. In order to make the LCOE competitive with other producers and technologies. Typically, the O&M cost account for 20-25% of the LCOE involving 5 categories, namely, Insurance, regular maintenance, repair, spare parts, and administration.

There are three channels to obtain the operation and maintenance for wind energy generators

- Original Equipment manufacturers: Operation and maintenance services are usually acquired along with the components of the wind turbine generation (WTG) unit. These services are acquired for a time of 2 to 5 years as a part of annual maintenance packages. The key providers of these services are the Original Equipment Manufacturers (OEM), which include guarantees and preventive and corrective maintenance that could be adopted after the expiry of the contract period. These are preferred globally due to ease of procuring spare parts or replacement equipment from OEMs compared to other O&M service providers.

- Renewable Energy Developers: Large renewable energy developers have also started to maintain their own capacity instead of traditionally OEM based O&M contracts. Currently, there is limited capacity from some of the key renewable energy developers being maintained in house. The major reason for this is to increase the control over the operations of the generation and further reduce the dependence on the OEMs. This also reduces the risk of extended periods of shutdowns resulting in no drop in availability of the plant. Moreover, due to financial hurdles for OEMs, Independent Power Producers (IPPs) have opted to carry out O&M activities in-house to avoid dependence on the any other entity

- Third-party or Independent Service Providers: O&M services are also offered by third-party service providers. This is usually taken at the time of warranty expiration the Annual Maintenance Contracts (AMC) with the OEM or when the OEMs are not preferred with the equipment acquisition due to financial constraints.

Competition

(there are no listed peers for 1-1 comparison in Indian space)

-

The Indian wind farm O&M services market is characterized by strong concentration among a small group of service providers as stated above - (I) the OEM WTG manufacturers (ii) renewable energy developers such as IPPs (iii) third-party/independent O&M service providers. The market share of each of the above is approximately 70%, 20-25% and 5-10%, respectively.

-

Competitors in the OEM bucket:

-

- Siemens Gamesa Renewable Energy, S.A.

-

- Enercon GmbH,

-

- GE and

-

- Vestas India

- Independent Service Providers are typically engaged by WTG owners at the expiry of the OEM’s initial O&M on the WTGs or for other reasons relating to costs. In this category, the company believes that its primary competitors are:

- Renom Energy Services LLP,

- SKF Limited, Windcare India Pvt. Ltd. and

- Kintech Engineering.

Opportunities

- As IWL adds more to its portfolio of WTGs - the O&M services for IGESL will grow accordingly (organic path).

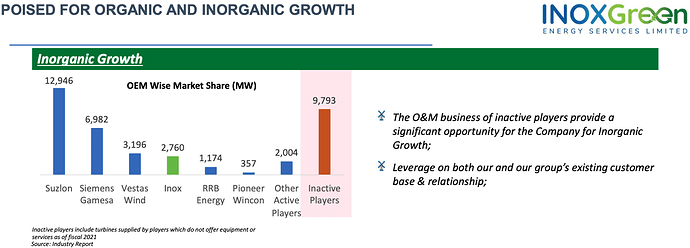

- Per the latest commentary there are 10 GW of independent O&M whose parents are either in financial stress or their parents have exited India and might be available for acquisition (Inorganic path)

-

- There is as much as ~10 GW of wind generation capacity which is now being maintained by players like distressed OEMs, non OEM aggregators/technocrats who are primarily unorganized and financially weak and majority of this fleet is across retail customers.

-

- Customers across the board are looking for a switchover to a strong, credible, renowned and Indian O & M service provider and we are sweetly placed to capture this opportunity going forward.

- Wind project developed by IWL still has significant capacity for further installation of additional WTGs - more will add to their portfolio of ~3 GW. One is to note that to support plug and play, supporting infrastructure such as pooling substations and transmission lines have to be set up ahead of installing a WTG. Once they are developed, it is will be possible to incrementally add WTG (based on the planned capacity of the farm).

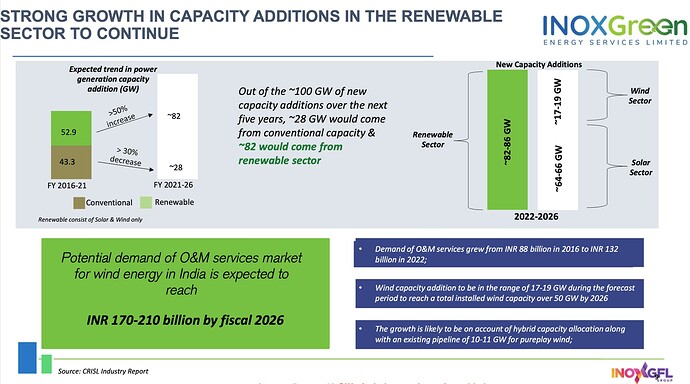

- The growth prospects of the wind sector in India are promising with capacity additions of 17- 20 GW expected over the next five years (i.e., between fiscal years 2023 to 2027) which would entail investments of approximately Rs.1.4 trillion over the period. As a result of this, the demand for O&M services is expected to be in the range of Rs.170 to 210 billion by fiscal year 2026 (Source: CRISIL Report).

-

The transition from the feed-in tariff (FiT) regime to the auction-based regime

-

- Capacity additions have been plummeting since fiscal 2018 on account of multiple factors but majorly due to the abrupt phasing out of feed-in tariff regime by the government and the implementation of the competitive bidding mechanism at the end of fiscal 2017. Moreover, halving of the accelerated depreciation benefit (from 80% in fiscal 2017 to 40% in fiscal 2018) and elimination of generation-based incentives (GBI) of Rs. 0.5/unit also reduced investments in the sector from non-IPPs players.

In February 2017, the government had conducted the first reverse e-auction for wind power, which led to tariffs falling to Rs. 3.46/unit. This was in fact 17% lower than the lowest wind feed-in tariff (FiT) of Rs. 4.16/unit in the state of Tamil Nadu. With such sharp drop in tariffs, several state discoms like Gujarat, Andhra Pradesh, Rajasthan and Karnataka expressed their unwillingness to buy power under the FiT regime even for approved and under construction projects as PPAs were not signed.

- Capacity additions have been plummeting since fiscal 2018 on account of multiple factors but majorly due to the abrupt phasing out of feed-in tariff regime by the government and the implementation of the competitive bidding mechanism at the end of fiscal 2017. Moreover, halving of the accelerated depreciation benefit (from 80% in fiscal 2017 to 40% in fiscal 2018) and elimination of generation-based incentives (GBI) of Rs. 0.5/unit also reduced investments in the sector from non-IPPs players.

-

Tariff ceilings were a cause for lower subscription, removal is a positive policy change for the segment -

A continuous lowering of tariff ceilings in tenders had left little flexibility to developers who were already coping with execution challenges on the ground. -

Per Crisil research - tariffs below Rs 3/unit becomes harder for companies to earn a decent IRR on their investments.

-

- Wind sector witnessed pressure on returns led by competitive bidding; access to high wind density sites and low-cost financing critical

-

-

-

- Previously, the discovered tariffs for competitively bid projects reached as low as at Rs. 2.43 / unit as against Rs. 3.0-3.2 / unit tariff required for earning 9-11% equity IRRs. However, post December 2017, when this low benchmark was reached, tariffs have started to rise up back again. For instance, the weighted average tariff of allocations in fiscal 2022 (YTD - April 2021 to February 2022), have averaged at Rs 2.8/ unit, providing an indication that developers are factoring in increased tariffs to adequately manage risks. The latest auction held in May 2022 witnessed tariffs of Rs. 2.92 per unit.

-

-

-

-

-

- Authorities had set pricing expectations near the Rs 2.8 per unit mark, making it difficult for capacities to be auctioned at higher tariff ranges. However, the tariff cap removal in March 2020, provided an opportunity to developers to factor in the added execution challenges, leading to higher bid tariffs in successive auctions

-

-

-

-

-

- CRISIL Research expects capacity additions of 17-20 GW over the next 5 years (fiscal 2023-27) entailing

investments of ~Rs. 1.43 trillion over the period. Lower interest rate remains a key driver for capacity additions in the near term. ~19 GW in the pipeline is expected to be commissioned by fiscal 2027 factoring in delay due to cost escalation, evacuation infrastructure etc. Owing to 60 GW target by 2022 and a healthy pipeline build-up for the same, fiscal 2023 could witness approximately twice the capacity additions, as compared to fiscal 2022.Additionally, the removal of tariff ceiling has removed the execution hurdles, resulting in faster commissioning of pipeline projects.

- CRISIL Research expects capacity additions of 17-20 GW over the next 5 years (fiscal 2023-27) entailing

-

-

The following points are from their Qtrly ppt:

-

There is a major thrust on renewables across the globe. A key takeaway from the Russia-Ukraine war, is that countries across the globe are working on energy security (uninterrupted availability of energy sources at an affordable price) and see renewable energy as only the solution.

-

India has announced a renewable energy target of 175 GW by 2022 and a target of 450 GW by 2030.

-

Leading Indian companies, like Adani, JSW, Reliance, Renew and Sembcorp amongst others, have announced ambitious plans for setting up RE capacity over the next few years. They have cumulatively announced setting up RE capacity in excess of 200 GW.

-

PSUs like NTPC, SJVNL, NHPC etc. are working on mega investments in renewable energy sector and actively participating in tenders and issuing tenders.

-

The retail segment has also revived and become attractive given various states have now announced captive policies and renewables like themselves have been the cheapest source of power in most cases.

-

There is significant demand which is visible from Group Captive and C & I segment of customers due to i. ensuring long term hedging of energy cost, ii. ESG compliance and iii. energy security.

-

Maintenance: Major components such as nacelles, turbines, generators, hydraulics, and electronics require constant monitoring to ensure smooth operability. Traditionally, reactive maintenance was carried out when the equipment had shown severe operational faults or complete failure or during scheduled maintenances. The failure or reactive maintenance resulted in longer shutdowns and low availability of the generators. On the contrary, predictive maintenance accurately forecasts the component failures before they occur based on historical data. This is a critical service in wind generation as it addresses the issues associated with reactive maintenance as described above. Furthermore, the proactive maintenance reduces the operational cost by reducing the wear and tear of the equipment in the system. As a result of implementation of predictive maintenance techniques replacements and major repairs in the wind energy have declined considerably over the past years. Therefore more and more developers are going for predictive maintenance as compared to reactive and scheduled maintenance.

Points to consider

-

IWL Order book – Important indicator for IGESL revenues; 1,424.7 MW

-

IWL is in the process of receiving orders on the new 3.3 MW WTGs thus more revenue growth is possible for IGESL. (3.3 MW WTG is a game changer for the Indian market. Earlier it was a 2 MW (a 65% increase in capacity, but it has increased yield by 30% on a given site)

-

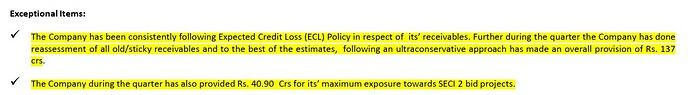

This is a Cash flow generating business, why does it even have Debt on its BS? 1000 cr pre-IPO?

Irrespective of the company (IWL) if it could sell or not sell a turbine, this O&M biz will have CF and thus Bankers wanted to lend only to this entity rather than the inox wind, the equipment manufacturer - pre-demerger. Thus this company took on debt in this entity. Now, they are trying to reduce and become debt free. (Check links on mgmt. commentary on this topic)

- If the company does start generating profit & clears its outstanding debt:

-

- the current interest expense would be eliminated and thus Operating profit would fall straight to their PBT

-

- they have a good set of tax losses from previous years which it can offset on PBT; thus more profits will fall to the bottom line i.e., PAT and thus PAT can grow faster.

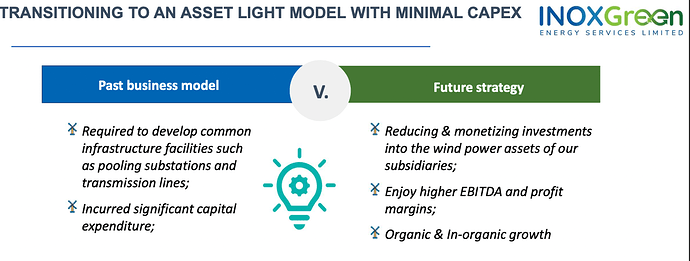

- They are also strategically moving to an asset-light model:

-

-

- from their DRHP filing: Under our current business model, we develop common infrastructure facilities such as pooling substations and transmission lines and have incurred significant capital expenditure in doing so. This was partly as a result of successful project bids which required us to develop such infrastructure prior to securing investors to establish wind farms on a plug-and-play basis. While most of our common infrastructure capacity is currently utilized by such investors, there still exists some unutilized capacity for the installation of WTGs as of March 31, 2022, which we intend to fill. While such capital expenditure is expected to continue in the short-term as a result of our ongoing prior commitments, we intend to transition to an asset-light model with minimal capital expenditure by, among others, reducing such project bids and investments into the wind power assets of our subsidiaries. Moreover, we have seen a gradual increase in large wind players such as IPPs bidding for wind projects and taking on the responsibility of developing the common infrastructure facilities thereby reducing the need for us to do so or compete in this space. Moving forward, we believe that our business model of entering into long-term O&M contracts, which allows us to generate steady and predictable income, coupled with future low capital expenditure and costs, among others, will enable us to enjoy higher EBITDA and profit margins which we can utilize to fund our future expansion plans and/or for dividend payments.

-

- For inorganic growth: According to the Directory Indian Wind Power 2022, Suzlon had the maximum number of turbines supplied accounting for 9,169 turbines followed by Siemens Gamesa, Vestas Wind and Inox Wind. Out of the total 36,538 turbines in fiscal 2022, 17,290 turbines were supplied by players that are currently inactive. These turbines pose an opportunity for the O&M service providers as the players in the current market especially the OEMs, which hold the largest share of the O&M services in Indian market. Therefore, most of the turbines supplied by the now inactive players will require renewal of such contracts or newer contracts. The O&M contracts are structured mostly for 2+8 or 2+10 years to incorporate the price escalation of the services over the years. Post the tenor the contracts are then renewed for another 8 to 15 years. If the contracts are done for more than 15 years, there are clauses to renegotiate the service cost in between the term.

Risks

- It is currently entirely dependent on Inox Wind Ltd., its promoter for business.

- The renewal rate of service contracts may decrease in the future and customers may move from comprehensive O&M contracts to common infrastructure O&M contracts

- “Timely execution of planned capacities is key as renewable energy projects take only 1-1.5 years to come online while transmission capacities would take roughly 2-3 years.” So any delay in not only setting up WTGs but any bottleneck/delay in the evacuation of the generated power might impact this company ( read: grid infrastructure )

- “Out of the total proceeds of the IPO, Rs. 260 crs will be utilized to deleverage the business. The Company has already paid Rs. 250 crs towards the same. A further reduction in the debt will happen in due course.” > if this debt reduction does not happen or is delayed - the profits might not come to be. Key monitorable.

- if customers who elected for comprehensive O&M contracts with IGESL but later decide to use their own/in-house O&M services - loss in revenue opportunities.

Some Useful links:

- latest quarter presentation

- INOX Green Energy Services Ltd IPO Highlights By Promoter Devansh Jain, Ex. Director, INOX GFL Group - YouTube (IPO talk)

- IPO Adda: Inox Green Energy Services' Rs 740 Crore IPO - YouTube (IPO talk)

- SEBI | Inox Green Energy Services Limited - RHP (DRHP)

- How a Wind Turbine Works - Text Version | Department of Energy

- How do Wind Turbines work? - YouTube ( how turbines work basics, visual & its components)

- Documentary on installation: The Making of a Wind Turbine | Exceptional Engineering | Free Documentary - YouTube we see all the components here by Siemens Gamesa

Disclosure: Invested