Posting after a long hiatus.

I had posted a few weeks back my thoughts on on IEX and why I love the company:

- Solving real customer problems

The most successful businesses are those created with a business model around solving a real customer problem. By solving customer problems and needs, the business is able to demonstrate tangible value proposition to the customer.

“We’ve been doing this for 6-7 months at APTransco, and we managed to save ₹500 crore in FY20. We were well placed to maximise this benefit when spot prices fell on the exchange during the lockdown in March and April. We saved ₹56 crore and ₹132 crore in those two months. We were able to buy power for as low as ₹1.8 a unit at one point."

- Mr Babu, Joint MD , Transmission Corporation of Andhra Pradesh

A top bureaucrat (customer) publicly acknowledging the savings and value IEX delivers to a state power transmission is a clear testimony of company’s clear value proposition and usefulness to its customers.

The COVID 19 pandemic only but helped to accentuate the adoption by various parties due to sudden demand and supply mismatches brought about by the lockdown. The need to re-look at the Power Purchase Agreements (PPA’s) model for securing electricity became apparent to the the distribution companies.

Also the possibility of buying electricity in the spot market at short notice incase of emergency has only ensured that all key players in the electricity value chain are onboarded into the platform.

- Economic Moat:

While investing in companies , I prefer those which enjoy some sort of economic moat rather than a run of the mill company with no tangible competitive advantages.

Pat Dorsey published a beautiful study on economic moats where four types of moats were identified:

a) Intangible Assets

b) Switching Costs

c) Cost Advantages

d) Network effect

IEX as explained in the beginning of this post enjoys one of the most financially rewarding type of moat: The network effect.

As more Discoms , power generators, transmission companies, electricity boards and other key players in the electricity value chain gets onboard on to the exchange the greater will be the “ value” of the platform for the other participants.

- Market Share

Simply put IEX is not just a market leader but IEX is the market. With a market share of 95%, the company is a Monopoly and virtually rules the market. Month after month we get to read press releases that they have had the best month ever.

- Great Set of Numbers

Everything is interconnected. The company has a strong economic moat with a virtual monopoly and this is reflecting in the numbers. Net profit margins and ROCE hovering around 60% with Zero debt and a growing business, the company boasts of some great numbers.

- Cash generating Machine

Corollary to the above point, with very low Capex requirements, a healthy profit margin and Zero debt , IEX is a cash generating machine. Period.

- Long runway for Growth

A key factor to consider while selecting an investment is to have a view on the long term prospects of both the company and the industry in which it operates. A leader in a sunset industry is not an ideal long term investment candidate.

However, if you invert the logic- a growing company in an industry with favourable growth prospects augurs well for the investor. IEX is at the right place at the right time.

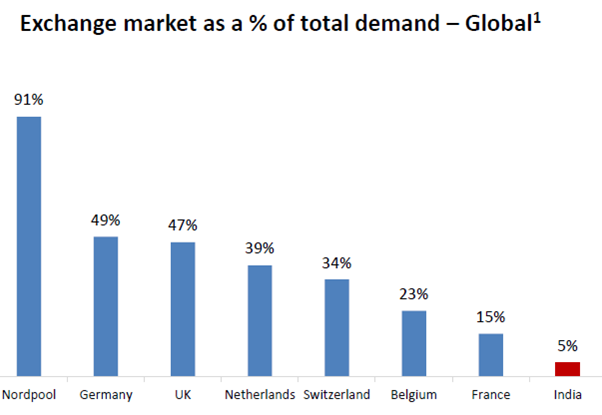

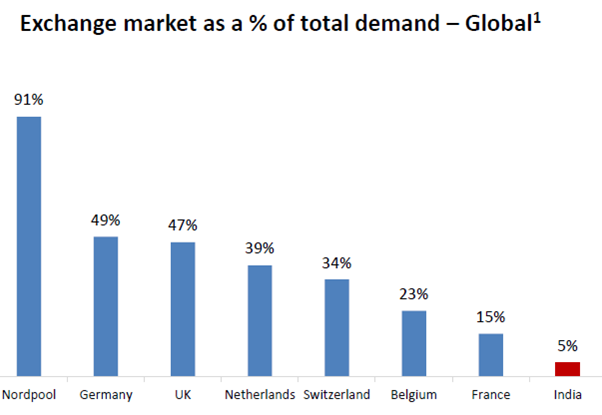

The share of exchange markets in the overall power market in the developed countries are manifold higher. At just 5%. Indian has only taken baby steps in the power exchange market.

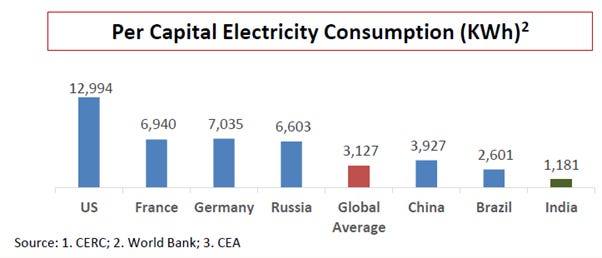

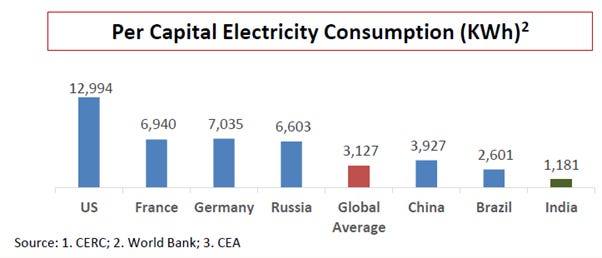

The per capita consumption of electricity in India is a third of the global average as depicted in the table below:

As the Indian economy engine starts revving up again post COVID slowdown and the sustained thrust for Atmanirbhar Bharat continues, the demand for electricity is bound to go up manifold.

Rapid urbanization also drives up the demand and expands the electricity market. Just to put it in perspective, 17 of the 20 among the fastest growing cities in the world are in India.

All these augurs well for IEX.

After decades of neglect , the current Government has launched various schemes and undertaken various policy initiatives to light up the nation and give a boost to the power sector.

The Ministry of Power, in fiscal year 2020, continued its thrust on flagship schemes such as Integrated Power Development Scheme (IPDS), Ujjwal DISCOM Assurance Yojana (UDAY), Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY), Saubhagya, UJALA, Urban Jyoti Abhiyan (URJA)

All these policy measures are a big positive for IEX.

- Strong technological competency

To be successful in this digital era, every company needs to be technologically savvy. When I read some parts of the management commentary I began to to wonder whether If I was reading about a technology company or a power utility exchange.

I found mentions of IOT, Smart contracts, Blockchain, Robotic Process Automation and many more of the latest technological trends which we normally associate with technology leaders.

The management seems to have got their priorities right by investing in the latest technologies as well as by close collaborations with the academia and research.

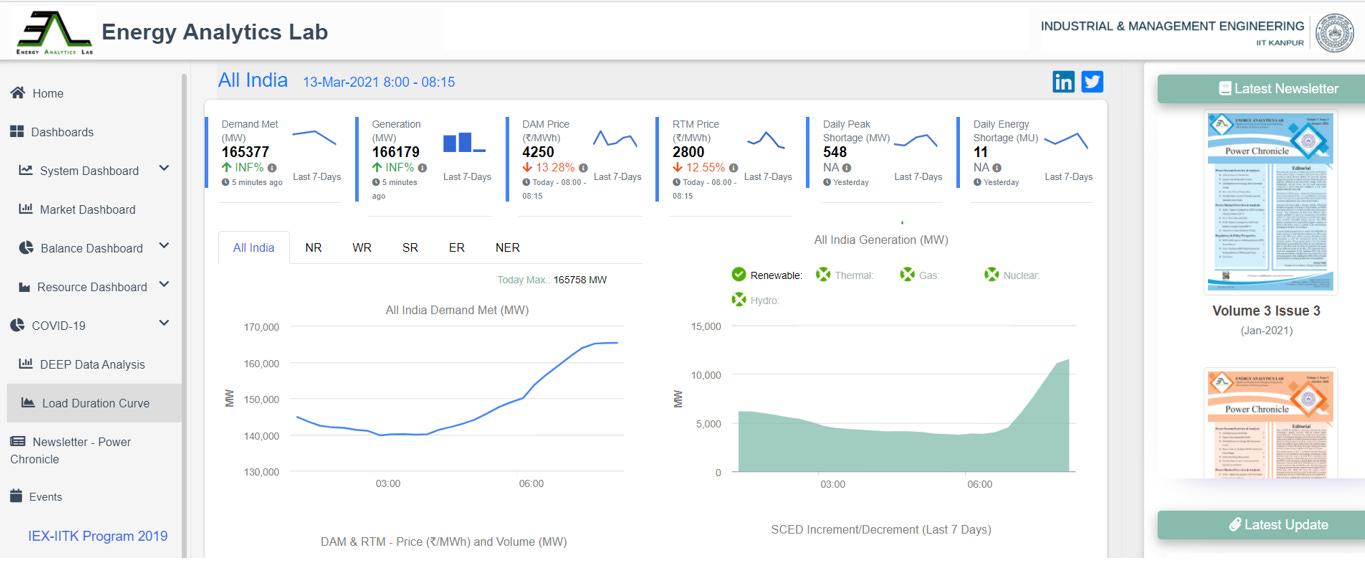

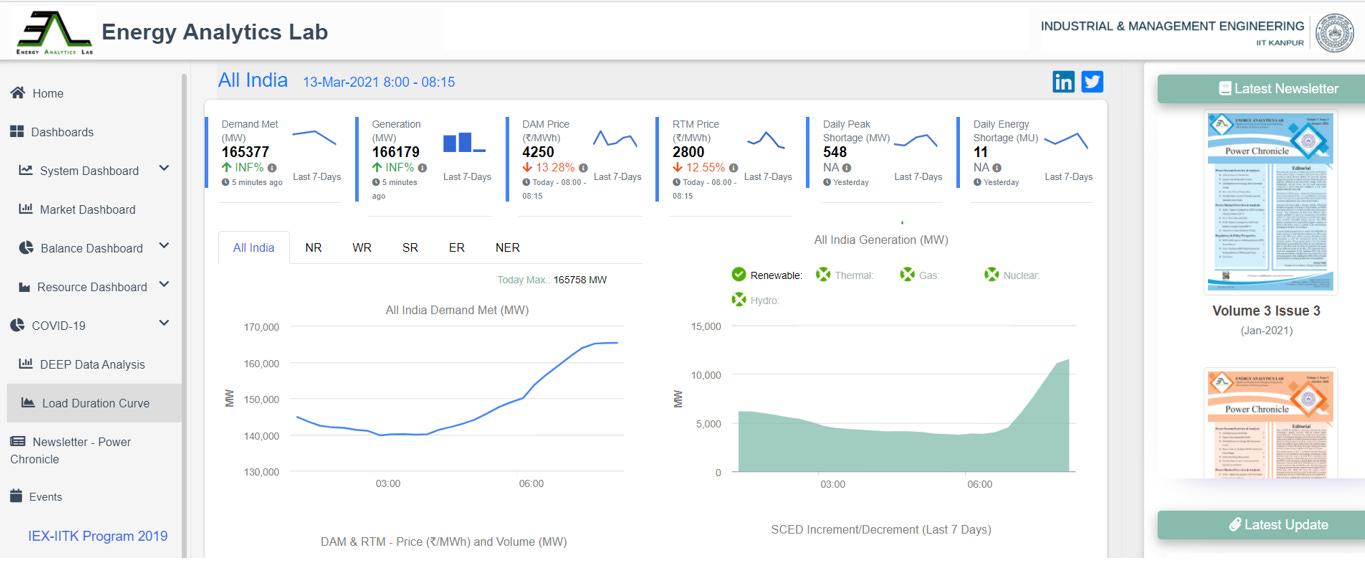

Energy Analytics Lab (with IIT Kanpur)

- Mega Trends with favorable tailwinds

IEX is propelled forward by some strong mega trends and tailwinds namely: Decarbonization, Decentralization, Digitization & Democratization.

Each of these trends are self explanatory. Decarbonization is the global thrust for moving away from fossil energy sources and a focus on sustainable “green” renewable energy sources. Additionally with India being a signatory of Paris Climate agreement, there is a deadline for cutting down on fossil energy sources.

- India Gas Exchange (IGX)

The company has set up the first gas exchange - Indian Gas Exchange in 2020. The company launched on 15th June 2020, is India’s first automated national-level trading platform for physical delivery of natural gas. GAIL, NSDL have all picked up stake in this.

With Natural Gas set to play a pivotal role in the future energy mix of the nation, IGX is well positioned to reap the rewards. So will be the investors of IEX.

I could go on and it must be very apparent to the reader that there are multiple reasons why I simply love this company. However, just as every rose has a thorn, it is prudent to be cognizant of some of the “thorns” which may come back later to hurt the investors.

You can read the reasons not to invest and general intro in the link below:

My thoughts on IEX

Happy investing