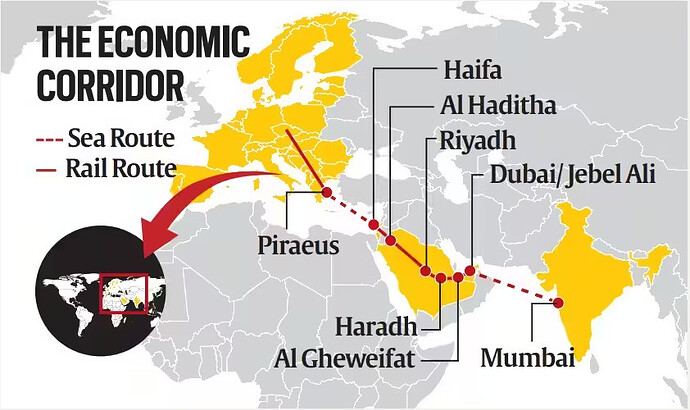

The Indian Express headlines it: “Data to oil, gas to goods: seamless sea-rail corridor from India to Europe.”

It goes on to say, " The use of the land route in the Arabian peninsula could mean bypassing the congested Suez Canal that cargo ships currently take. The project eventually aims at laying out a seamless corridor running all the way from South East Asia to Europe."

It is supposed to be a connectivity corridor spanning India to Europe via West Asia and " entails an ambitious project than could leverage railway tracks and shipping corridors to help physically link up a vast stretch of the Eurasian subcontinent, and in the process improving digital connectivity and catalysing trade among countries, including energy products such as green hydrogen."

In fact what is remarkable is that the project is not in the dreams of some bureaucrats, but " “India, USA, UAE, Saudi Arabia, France, Germany, Italy and the European Union Commission have signed the Memorandum of Understanding to establish the India-Middle East-Europe Economic Corridor (IMEE EC)."

So, this brings us to which companies should benefit from the project.

(i) It goes without saying that the Rail Infra companies like RVNL, IRCON and RITES would be involved in the Railway infra work. It could also involve other infra companies like J Kumar.

(ii) For electrification, expertise of companies like Siemens, ABB, Powergrid etc may be useful. Companies like C G Infra and HBL Power may also have a role. Electrification also brings in cable companies like Polycab. And perhaps companies in aluminium and copper.

(iii) The airconditioning companies would definitely be required.

(iv) May be the financing aspect will bring in IRFC, and the communication part may benefit Railtel.

(v) For wagons, Titagarh, Jupiter, and Texmaco may be candidates.

(vi) For reaching the railway tracks, and roads and perhaps some tunneling too, infra-structure companies like L&T, Patel Engineering etc may have to be involved.

(vii) The shipping companies must be licking their chops, Shipping Corporation of India is one of them. The ship making and repairing companies may include the known names of Mazgaon Dock, Cochin Shipyard etc and some lesser known companies like Knowledge Marine.

(viii) The exporters would be happier.

(ix) It should help the logistics companies like Tiger Logistics too.

I look forward to members with deeper domain knowledge to correct me and add new dimensions.