Received the AR 24, sharing the MD and CEO letter to shareholders. Sharing with you all. Its quite detailed. Hes talked about the issues we normally talk about in our forums, cost to income ratio, credit appraisal processes, then his pet things of long term thinking, customer first, ethics etc.

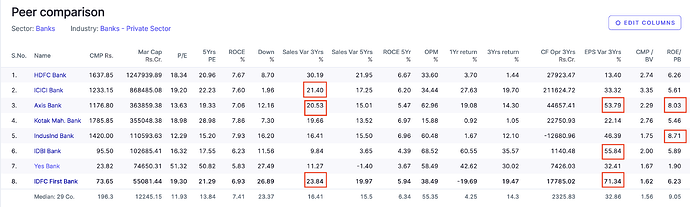

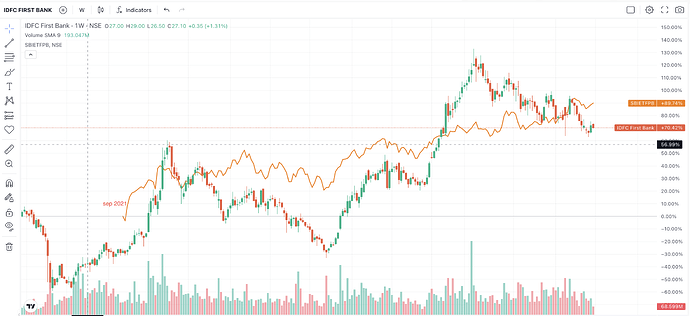

Frankly I am absolutely unable to understand this Bank and the stock market. they posted poor profit, gave bad guidance sying next quarter provisions will be higher, called out JLG, said this year PPOP will go up, but so will normalisation of credit (effectively meaning dont expect much improvement in net profitability or ROA), many of us screamed, etc. but stock price has just not budged from the date of announcement it is still at 75… what does this mean? cant get my head around this bank. even first 6 quarters after merger, they were posting bad numbers (frankly pprofitabulity roa roe of other banks is much higher) but the stock was broadly good (except COVID), till date up 100% since merger date. so not able to understand at all. if anyone can educate. remember even now roa roe is just 1 and 10 or something. anyway here is the VV writeup for shareholders.

Dear Shareholders,

Thank you for taking time to read this document, IDFC FIRST Bank’s Integrated Annual Report for 2023‑24. Since this is a once-a-year letter, we are sharing a detailed note about what we are building, how we are doing it and what is the future direction we are pursuing.

Gratitude

I would like to begin by saying a sincere thanks to every employee of IDFC FIRST Bank for the hard work and dedication, which has brought us to a position of strength. We are immensely grateful to the Reserve Bank of India for their guidance, support, and mentorship on our journey to becoming a strong institution. Sincere thanks to Credit Rating agencies for recognising our progress. A heartfelt thank you to our shareholders for your unwavering confidence and capital support during our early, challenging times. To our Board of Directors, who are laser-focused on corporate governance, thank you for your steadfast support and guidance. And finally, to our customers, thank you for your support and goodwill, especially during our early stages as a bank.

Customer FIRST Bank

Being an early-stage bank created from an infrastructure Domestic Financial Institution, we were not measuring up to peer benchmarks in profitability, leading to performance pressure from stakeholders. Despite such pressures, we took many decisions in line with our philosophy of customer-first, often incurring a financial cost. We simplified our fees and charges, removed complex descriptions and requirements for calculators. The quality of products and services offered by us will gradually spread through experience and word of mouth and will reflect in long-term value creation.

Recently a research report by Moneylife Research report, independently studied Fees and Charges of the industry and called our Bank “A Class Apart Bank” for its “Transparency and Reasonableness in Fees and Charges.” We have taken several measures to improve customer service, including increasing access points to reach us, Root Cause Analysis, business process reengineering, etc. detailed later in the note in the Section Service.

Universal Bank

We are building our Bank as a Universal Bank. Over the last few years, we launched or expanded our Cash Management Services, Transaction Banking, Current Account propositions, Corporate Banking Systems, Trade solutions, Credit Cards, Wealth Management, FASTag, NRI banking, Treasury and Forex solutions, Kisan Credit Cards, agriculture loans, small farmer loans, gold loans, tractor loans, education loans, etc. Our Bank is building these out in the longer-term interest for our Bank.

Milestones

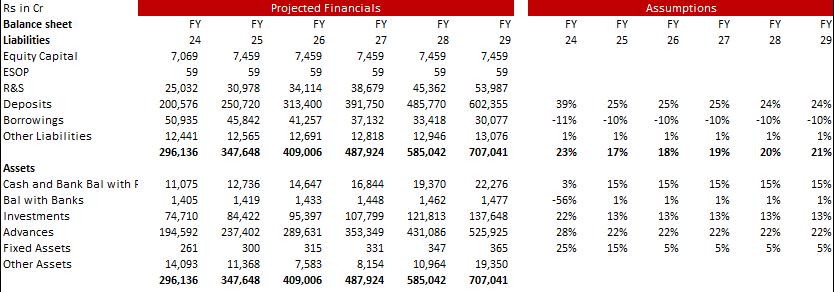

We crossed many milestones during these few years, and each milestone is a step towards strengthening the Bank. Our Bank has crossed Rs. 2,00,000 crore of deposits (Rs. 1.93 lakh crore of customer deposits and Rs. 7,000 crore of Certificate of Deposits). Our loan book has crossed Rs. 2,00,000 crore. These are significant milestones as they give us the necessary scale and income to continue to invest and grow into the future.

80% of our customer Deposits are originated from Retail Branches. Our CASA Ratio is strong at 47%. Our loan book is well-diversified across 25 product lines with no product contributing >15% of the loan book. We have the lowest ever NPA (GNPA of 1.88% and NNPA of 0.6%) in our history. We have the highest ever networth of Rs. 35,361 crore (including capital raised in July 24) and posted the highest ever profit of Rs. 2,957 crore (FY24) in the history of our bank. We have improved our ROA from 0% to 1% in a short time, and look forward to increasing it further because of benefits of scale and operating leverage.

Long term picture

We are in the process of merger with IDFC Limited. Post merger, IDFC FIRST Bank shareholding will be as one of an independent standalone institution like ICICI Bank or HDFC Bank. We can grow for decades to come; today is only the beginning. HDFC Bank and ICICI Bank in India have posted advances at 20-30% for nearly 30 years and still growing advances at 16-17%. To sustain growth over decades, we need strong corporate governance, scalable business model, strong risk controls, profitability, ability to adapt over time and market opportunity.

Market opportunity is provided by India, we are a growing economy expected to reach $35 trillion in 2047. As the economy grows, every industry whether consumption or investment, will continue to grow and will be our opportunity. Formalisation, digitisation, financialisation, and entrepreneurship will be additional boosters.

India needs more banks for such growth over the next 20 years, and we are well-placed to be one such.

IDFC FIRST Bank is a universal bank and is connected to all new digital ecosystems with the latest technologies. On the lending side, we can serve a diverse profile of customers, including small businesses, micro-enterprises, rural entrepreneurs, retail borrowers, commercial & corporate banking customers. We have a pan India presence, and serve our customers across urban, semi-urban, and rural markets. On the deposits side, we can raise deposits at scale (more about this later). With strengths on both sides, we can grow strongly with the growth of the Indian economy for a long time.

From a low loan asset base of Rs. 2,00,000 crore, we are well-placed for growth. So, even if we were to assume growth of at say, 20% for 5 years, 18% for next 5 years, 16% for next 5 years and 14% for next five years, which are very reasonable estimates in the context of our economy, our loan book could be Rs. 46,00,000 crore in 20 years. We have laid the foundations for one such institution coming up in India.

The market is large, we do not need to hurry. If we grow steadily, we can build a great institution for the long run. The key is to maintain top quality corporate governance and continuously upgrading our capabilities to partake and participate in the emerging economy.

What we are building at IDFC FIRST Bank At IDFC FIRST Bank, we are building a new-age, digital, world-class bank for our country. For all of us at the bank and our Board, this is a rare privilege of a lifetime.

External endorsement is the best endorsement. Over the years, all four leading credit rating agencies—CRISIL, ICRA, India Ratings, and CARE Ratings—have upgraded us, with the latest upgrade being from AA to AA+ Stable.

We are just one step away from an AAA rating, the gold standard. I am confident that we will achieve this too because we are building the Bank with strong risk controls, top-quality corporate governance, and robust unit economics.

Safety First:

As a Bank, our first requirement is to be safe. At the time of the merger in December 2018, both IDFC Bank and Capital First were primarily lending institutions. This resulted in Rs. 79,964 crore of upcoming legacy borrowings (Rs. 57,652 crore) and Certificates of Deposits (CDs, Rs. 22,312 crore), which would have caused a serious asset-liability mismatch for the bank. The bank had only Rs. 10,400 crore in retail deposits (8.8%) and Rs. 1,08,019 crore (91.2%) of institutional liabilities at the time of merger.

I am happy to share that, since merger, we have repaid Rs. 61,332 crore of the said borrowings and CDs, by raising retail deposits, a major achievement that has tremendously strengthened the bank. The legacy borrowings have significantly reduced to just Rs. 11,809 crore, and the certificates of deposits have also come down to Rs. 6,823 crore as of March 31, 2024.

Within five years, granular deposits originating from our branches increased from 27% to 78%. Retail deposits are more stable and engaging because customers become accustomed to our services, user interface, branches, relationship management, standing instructions for EMI, auto debits, mobile app, etc. making the deposits stickier and more sustainable.

Credit Deposit Ratio:

At the time of the merger, our credit-deposit ratio was 137%. Including our investment in corporate bonds, which is a credit substitute, the ratio was 169% which has now been reduced to about 100% on a like-like-basis, which is a significant milestone for our bank. Our incremental Credit-Deposit ratio was only 76% for FY24. We expect the credit-deposit ratio to decrease to low 90s this year and enter the 80s by FY26. This has been possible because we built capability to raise retail deposits at scale at our Bank.

IDFC FIRST - A Digital Bank

At IDFC FIRST, we are building a digital bank for the future. We believe that, apart from the benefit of scalability, a digital bank can help us serve our customers in a more personalised manner and reach unserved market segments profitably, that conventional models cannot. With conventional technology, we could not have progressed this far in five years.

We have developed an advanced and contemporary technology stack, including core applications, middleware, CRM systems, channels, data engineering, and a data lake. We have developed advanced data science and analytics using artificial intelligence and machine learning. We have hired skilled professionals in predictive analytics to leverage big data for customer insights and decision-making.

Our team includes professionals in software development, programming, application development, and software engineering to create and maintain digital banking platforms and apps. We have also strengthened our cybersecurity capabilities to protect our digital assets from cyber threats and ensure compliance with regulatory standards.

In terms of soft skills, we look for adaptability and agility, people skills, problem-solving, strong analytical and critical thinking skills, collaboration, and teamwork.

How a digital Bank plays out on business metrics

As you will see below, these capabilities are playing out across our universal banking products, our deposits, loans, and service levels.

Deposits

Within just five years of operation, our deposits per branch have reached around Rs. 212 crore, in the league of large established private sector banks.

As per LCR disclosures, our retail deposits per branch and incremental retail deposits per branch are already in the same league as these large private banks. Our ability to raise retail deposits at scale is a key strategic capability for the bank. Despite this growth, our branches have few footfalls because we offer extensive digital services. Our branches are welcoming, capable of accommodating and servicing more customers, which provides us with operating leverage. Our service levels have substantially improved, and digital capabilities have enhanced our relationship management for individual customers.

We have developed a top-class mobile app, which is a fintech app on a bank platform. We are happy that our mobile app is highly rated with a 4.9 rating on Google Play Store and a 4.8 rating on the App Store. This is not just a regular bank app; it is a hyper-personalised app with end-to-end journeys for fixed deposits, loans, financial planning, retirement planning, card controls, flight bookings, hotel bookings, rewards redemption, categorisation engine, and customer service.

Apart from our product teams for whom this is a core job, I am also personally focusing and pushing for great user experience on our App for our customers. I have got my friends and family to download our App and constantly test our app. Just last week, I got feedback from a well-meaning user that our App does not support linking Rupay cards of other card issuers to IDFC FIRST Virtual Payment Address (VPA or UPI id). Another feedback received was that IDFC FIRST VPA is not valid for IPO applications. On another occasion, I noticed that our Video KYC rushed the customer instead of focusing on smooth onboarding for customer. Such feedback flow is continuous, and we improve based on feedback.

IDFC FIRST Bank generated among the highest incremental customer deposits per branch per year in the country. You might think this is due to higher interest rates on savings accounts. To analyse this, let us compare with mid-tier banks with similar Cost Of Funds (COF). Our cost of funds at 6.38% is among the lowest in the peer group of mid-tier new-generation private sector banks, will further come down as we pay off residual high-cost legacy borrowings. Yet, compared to other mid-tier banks that have similar or higher COF than ours, we raised over 2X retail deposits per branch on an incremental basis based on LCR disclosures.

How is our bank achieving higher deposits per branch and at among the lowest cost of funds compared to other mid-size peer banks?

Being an early-stage bank, we make extra efforts to be available to public scrutiny post our results. It’s a combination of transparency, addressing issues head-on, generate trust, attractive products, technology, an exceptional mobile app experience, culture, customer service, word-of-mouth business, motivated employees, and other factors.

Compared to rest of the private sector banks, IDFC FIRST Bank is generating about double incremental deposits per year per branch. Hence at industry benchmarks, we would need about 950 more branches to generate the deposits we raised last year. This would have costed us about additional Rs. 1,900 crore for the year. Thus, you can see the positive impact our strategies of customer service, transparency, brand image, and digitisation are having on the profitability of the Bank.

Lending

Being a digital bank enhances our controls by providing access to the latest information and enabling real-time synthesis. Today, I’d like to share how we underwrite loans using a combination of physical checks where necessary, and new-age technologies and digital ecosystems. The processes have multiple checks and balances. The processes are as described below. (D) denotes digital processes, (P) denotes physical processes

-

Biometric KYC (D): We access UIDAI to fetch the customer’s photograph and other details to validate their identity through fingerprint or iris scan.

-

NSDL Verification (D): We access NSDL to compare the PAN name with the name from Biometric KYC.

-

NPCI Validation (D): We perform an IMPS Penny Drop to validate the repayment bank account, matching the name with the biometric KYC Aadhaar.

-

Credit Bureau Access (D): We retrieve customer behavior, repayment trends, credit lines etc. from credit bureaus like CIBIL, Equifax, Experian, or CRIF.

-

Demographics (D): We collect demographics such as age, residence, etc. from the application.

-

Product Information (D): We get information about the product financed, say MSME, Business, Brand being purchased, etc. from the digital application form.

-

Cash Flow Checks and Scorecards (D, P): We analyse bank statements, GST records, or credit bureau cash flow estimates. We calculate loan eligibility based on average bank balances to ensure the customer can afford the EMI. We support these assessments through scorecards.

-

Fraud Detection (D): We use algorithms to identify potential fraud by the customer, intermediary, or employee.

-

Fraud Monitoring System (D): We used advanced fraud monitoring tools to estimate probability of fraudulent intention.

-

Field Verifications (D, P): We conduct residence checks, office address checks,

reference verification, lifestyle checks, and business activity checks, aided by digital tools like geo-tagging.

-

CRILC and Legal Checks (D): We check for legal cases, disqualification of directors, etc.

-

Financial Analysis (D, P): We analyse ratios, debt to net worth, turnover, working capital cycle, leverage, etc.

-

Property Evaluation (P): We evaluate the title deeds and collateral for legality, validity, and enforceability.

-

Vaahan Access (D): We access Vaahan for vehicle registrations and depository information and such ecosystems as relevant and as available.

-

Personal Discussion (P): We conduct personal discussions where necessary (physical or video).

-

Digital Agreement (D): We sign a digital agreement.

-

Electronic Mandate (D): We set up an electronic mandate for repayment authenticated with Aadhaar OTP through e-NACH, Aadhaar NACH, or UPI Autopay.

-

Portfolio Monitoring (D): We monitor the portfolio by segment, LTV, geography, vintage, ticket size, age, etc. using advanced analytics tools.

-

Digital Collections (D, P): In case of unpaid repayment instructions, we send a UPI link for customers to make repayments compared to the earlier processes of sending an agent to physically pick up the EMI.

Following these digital processes (some physical too) and leveraging the new digital ecosystem enables our bank to diversify the portfolio beyond usual banking products, resulting in specialisation in inclusive banking and resulting in higher NIM due to a diversified book. These technologies and controls also help us maintain low NPA.

Specialisation: We specialise in cash-flow financing supported by debit instructions of EMI to the customer’s bank. As you can see, most of the processes are digital, which enables better controls and scalability.

Corporate Banking

Corporate banking is immensely important to us as a Universal Bank and we plan to grow this business, but in a careful way, and to take exposures in line with our risk appetite. It allows us to engage with its entire ecosystem comprising employees, vendors, dealers, and other such support mechanisms.

We have expanded our capability to provide multiple solutions to corporates, including payments and receivables through Cash Management Solutions; assisting their supply chains and delivery channels through various funded and non-funded trade instruments; providing retail banking to their employees; solving for their market risk hedging needs and providing Treasury solutions.

Here too, we are investing in adoption of technology to provide digital transactional journeys for the above products with an aim to help the corporate CFOs, Finance teams and Treasuries be even more efficient and productive.

Service

Customer service is the fundamental pillar we want to be known for. Our internal mission is to become the world’s most customer-friendly bank.

Our digital capabilities also enable us to provide high levels of service to our customers. To begin, we have opened multiple gates for customers to reach us, through website, app, email, branches, and WhatsApp. For instance, we have dedicated a prominent space for customer service on our app and website, with easy access gates for each product, sub categorised by commonly requested service requests. Customers can log into the app or website, access the relevant product, and avail self-service. We have established a root cause analysis (RCA) team that continuously analyses why customers needed to contact the bank in the first place.

We have established a root cause analysis (RCA) team that continuously analyses why customers needed to contact the bank in the first place.

And what can be done to proactively address these issues. This initiative has been highly successful, reducing the number of calls to our agents by 34% over the last 12 months, even as the number of customer relationships increased by 21%. We track this metric product by product and see improvement across almost all products.

Traditionally, Contact Help centres track number of calls picked up within 20 seconds. We have begun tracking % calls answered within 3 seconds to raise the bar on service. We also train our employees extensively to be highly customer-friendly in their approach and demeanour.

We believe our policies play a significant role in our customer experience. For instance, in November 2023, during a visit to review our customer service at the contact centre, I observed that we were receiving around 75,000 calls a month from customers regarding Average Minimum Balance (AMB) charges. Upon investigation, it was revealed that if a customer’s balance was Zero and if the customer owes us Average Monthly Balance charges of say Rs. 250 for non-maintenance of balances, our Bank was marking a lien on the account to the extent of AMB charges due. Whenever any credit was received to the customer’s account, the bank would first deduct the amount due to us. This led to a reduced balance to that extent, which in turn made the customer fall below AMB again, and even causing his or her EMIs to bounce for loans taken from elsewhere.

We immediately decided to stop lien marking customer accounts for AMB. This change was implemented in January 2024, and the number of calls to the contact center fell sharply. If there is balance, we take our AMB, if not, we let it pass, we don’t sweep-in our fees from the next credit to the account. Customers were pleased with the new experience. We go to such lengths to make our customers happy and earn their goodwill, even though the AMB is contractually due to us. We apply such customer-friendly policies in all our products.

We educate our employees to devise processes and systems to systemically enhance customer friendliness. This includes designing customer-friendly products and a culture for exceptional customer service. We are not perfect but are continuously improving and are raising the bar on service levels every single day keeping our internal mission of being a customer-friendly Bank in mind.

Disclosures on Credit Quality

As a bank, we disclose not only Gross NPA, Net NPA, and credit costs year-over-year (YoY) and quarter-over-quarter (QoQ), but also the entire funnel of risk management.

Public disclosures show that our NPAs and provisions benchmark well against other players in similar segments and who are considered among the best performers in the market.

We share the following:

-

Our detailed 10-step underwriting processes

-

Percentage of cheques returned on presentation for the first EMI

-

Collection Efficiency Percentage excluding foreclosure, source bucket (currently 99.5%)

-

SMA 1 and 2

-

Gross NPA, Net NPA for 14 years, including all cycles

-

Provision as % of Advances

-

Gross and Net NPA by product segment

-

Vintage analysis, showing 30 DPD delinquency of loans booked in different years (enabling like-to-like vintage comparisons for portfolio quality). We provide 30 DPD data for 3 MOB, 6 MOB, 9 MOB, 12 MOB, etc. (MOB refers to Months on Books performance). Our MOB analysis shows portfolio quality has been improving over the years.

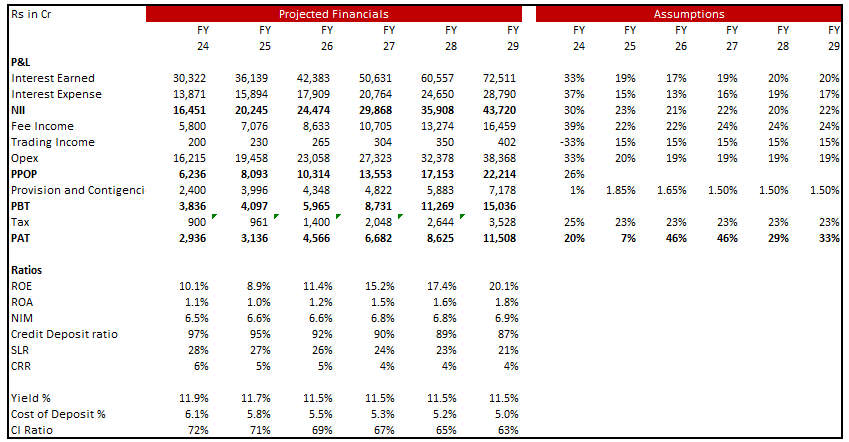

In the Annual Report FY21, I shared our commitment to maintaining our Bank NPA at the 2-1-2 formula on a steady basis: i.e. Gross NPA of 2%, Net NPA of 1%, and Credit cost of 2%. I am pleased to report that we are in line with this guidance and currently are at 1.9% - 0.6% - 1.3% for FY24, performing better than the benchmark. For FY25, due to normalisation of COVID impact, we expect our provisions to be at 1.85%

For FY25, we expect provisions to be more upfront in H1-FY25 due to normalisation of credit costs post COVID, impact on MFI book in recent floods in Tamil Nadu, and a reduction in center-meeting discipline in MFI, among other factors. We havecommunicated this during Analyst calls for Q4 FY24 and Q1 FY25. We will monitor performance on this portfolio and will share with the street faithfully. Except MFI, the rest of the book is performing on expected lines.

The microfinance business is crucial for us as it helps meet our PSL targets of lending 12% of the portfolio to weaker sections. Therefore, in terms of risk-reward and profitability, this business is important to us.

Overall, over the past five years, our credit performance remains within our overall internal risk frameworks and aligns with our public guidance.

Strategic capability built on Priority Sector Loan Origination

We were short in meeting Priority Sector Lending (PSL) targets five years ago because we were an infrastructure DFI converted to Bank. We had to invest Rs. 3,368 crore into RIDF at low yield for the same. One of our biggest achievements over the past few years is that we built the capability to originate priority sector loans organically.

Cost to income Ratio

We had a high cost-to-income ratio of 95% (pre-merger). This fell to 85.2% on merger with Capital First, because Capital First had Cost to Income ratio of 48%.

We had to invest to build infrastructure (Branches up 4.5X and ATMs up 10X) for the Bank. But yet we reduced C:I to 72.9% in five years by undertaking numerous cost-saving projects. On Assets, our cost to income ratio is under control and is only 53.2%.

On deposits, for the reason cited above, the C:I ratio is high. There are two reasons why our C:I will come down. One, many digitisation projects are bearing fruit and has helped us reduce costs. For instance, under our digitisation initiative, we centralised 86 CPAs (for loan processing at local level) across the country into only three centralised processing centres. Two, in all our businesses, our C:I ratio will come down through economies of scale. For instance, we plan to grow our branches by only 10% annually but grow deposits by ~25% CAGR until FY27. Many digitisation efforts are under implementation.

Together, we plan to reduce the overall Cost to Income ratio by about 800 bps from 72.9% in FY24 to 65% by FY27 and continue to improve from there. This will meaningfully improve our profitability.

Profitability

The key issue at the Bank on merger in December 2018 was not legacy infrastructure loans, but low operating profits because this was a DFI converting to a Bank.

Since merger, our Bank’s core operating profit has increased from 0.76% of Total Assets (after merger) to 2.25% of assets in FY24 which based on the strong business model of the Bank. Improving operating profits was a hard to fix issue for us, as the entire business model had to change.

Because the foundation that has been laid, we expect our Opex to grow only by 19-20% this FY25, while income is expected to grow by about 23-24%. This will result in continued increase in Core Operating Profits. During FY25, we expect provisions as a % of Assets to normalise, as the recovery from COVID provided portfolio has tapered off. Going forward, we expect provisions as % of assets to be stable.

We expect the phenomenon of Opex growth being lesser than the income growth to play out consistently over the next few years. This will structurally improve the profitability of the Bank. Based on this, we are planning for our PPOP% to reach around 3.3-3.5% of assets, on a core basis, in five years from levels of 2.25% in FY24. For context, the Opex growth for Q1 FY25 was only 20.5%.

Our Bank is now posting strong profits as seen from the following graph.

A graph of a profit

Description automatically generated with medium confidence

Culture

Since our inception, one of our core values has been ethical banking. We believe this must reflect in our practices and policies. We emphasise to our employees that every penny earned by the bank should be earned ethically, as it finds its way into our pockets in the form of bonuses, incentives, or salaries. We want our employees to confidently sell our products to their friends and family, near and dear ones.

Governance

We believe that the multiple lines of defense, including Business, Risk & Controls, Internal Audit and Compliance play an extremely important role in the Bank, and we greatly appreciate the value they add. We respect the independence of these functions. We explain to our employees that control functions at the bank are like the brakes of a car—you can never feel safe driving unless your brakes are strong. For us, Governance is everything.

ESG

Many of our business are naturally ESG-aligned and compliant, but over the past two years, we have specifically focused on enhancing our ESG efforts. We have financed over 300,000 MSMEs, provided over 3 million livelihood loans (cattle), 3,50,000 WASH loans (water and sanitation), financed over 60,000 rural homes, and 2,00,000 electric vehicles. Notably, around 55% of our rural borrowers are women.

We have allocated ESG responsibility to a senior leader Shikha Hora, directly reporting to me. The Board and the Chairman is personally keen on this, and no discussion in the Board meetings end without his cross questioning on ESG.

With digitisation, we have reduced millions of pieces of paper at the Bank. For instance, in some loan categories, applications have reduced from 20 pieces of paper to 1. On two million loans, that is 38 million pieces of paper saved. Moving forward, we plan to focus on green financing.

We believe our efforts are not enough yet there is a lot more focus required from our end. Especially the “E” of ESG.

I thank you all for a patient reading. Surely, we are working to build an institution all our stakeholders - our employees, Board, RBI, shareholders, customers, and the country is proud of.

With Best Wishes

V Vaidyanathan

Managing Director & CEO

IDFC FIRST Bank Limited