Where can I find this?

The loan book has increased only in last two quarters. Having cleaned up the balance sheet and restructured the bank business model, the main thrust should now be on increasing the loan book through quality lending keeping the NIM around same level. By the time loan book crosses 2 lakh crore, the cost to income ratio will begin to look attractive, which would push the market capitalisation. It should be possible by Q1 FY 24. That would in turn enable the bank to reach a fair reverse merger along with additional capital, making it stronger. By all appearances the bank is going in the same direction and the market has also taken note. When Q3 data on deposits and loans comes out on 1 Jan 23, it will become crystal clear.

It has to do with a time in 2000-2009

When he was at the head of ICICI retail and there was crisis and loans went bad.

He then joined Icici prudential, then moved to Future Capital. This too is a fun story how they met on a flight, and it was love at first sight.

I don’t believe this narrative. Because Kishore Biyani gave him a huge package not too long after. If he was a crook, then why would he be offered a top job. And at the time this news made quite the fanfare. He was getting paid 50 Cr as a package, best in the nation.

Highlights of AGM 2022:

V. Vaidyanathan:

-

“We expect RoE to tend upwards of 15%. That is how our business is fundamentally structured. When I say 15, I mean upwards of 15, I mean 16, 17 percent return on equity, that is how the underlying economics are.”

-

“Yield, cost of funds, operating costs all may come down a bit. Short point is that it is all making good return on equity. You keep compounding the machine, the bank will get to see very, very good equity.”

-

“Our Board’s internal target for PAT was 1700 crore for this year, but frankly, we’re running a bit ahead of that.”

-

“On the deposit side, we may be letting go of some fee here and there as it is a customer first bank and all that, but I’m telling you, the goodwill of the bank is amazing, just amazing. Because our employees reflect the goodwill. We rarely lose customers on the deposit side.”

-

“We are very happy with our card business. We are touching about 1 million cards, and around 2 million cards, the profitability starts coming in. We think that by this year, that is by FY24, our internal estimate is that we should post 100 crore of profit, and by FY25, our internal estimate is – so please treat it with the skepticism you should because the numbers are not done yet – but our internal estimates are that it will cross like 400-500 crore of profit in the subsequent year. It’s peak takeoff. We have done 2-3 years of serious investment. But that’s how businesses are built.”

-

“We think that our current mix is giving us a proper six percent NIM, no problem with that. If you ask us what our lookout is for 2023, we feel NIM six percent will probably be there. Now if you ask me to look far ahead into FY24, 25, 27, 28, well, I don’t know, it might come down, but at that point of time it could be because by that time mortgage may be a bigger proportion of the book and so on. But I can’t take a definite position on that.”

-

“Only thing we don’t post is our Return on Equity. The only thing I tell you is that when we solve the issue of Return on Equity, I believe our bank will be valued what it deserves to be. And people like Morgan Stanley who are valuing us today at 30-34 bucks, they don’t understand the bank .”

-

“We will open branches as and when required. We have given a guidance of 800 by FY25, we are far ahead of that. There is no fixed number from here on.”

The following are the complete list of his statements in the AGM that I had noted down, in case it gives more clarity.

ADDRESS TO EMPLOYEES

V. Vaidyanathan

“We were ethical and transparent with our customers when we built our credit card business, our savings account proposition.”

-

“We want no hidden charges – we want every penny received by the bank to be truly earned by the bank.

-

Digital doesn’t differentiate between the rich, the middle class and the poor.”

“In the digital world, you can do sachet size transactions for even short tenors as. You can do all these transactions as operating cost is much lesser.”

“Ethical is the way of doing business, digital is the means of doing business, and social is the what, is whom we want to address our products and services for.”

“I have no doubt in my mind that we are building one of the most amazing banks this country will ever see.”

“Those employees who have joined us new, joined us from other organizations, have probably not yet seen the power of what we’re building, you have only seen the portion of your work. But I have seen businesses before and I can tell you that the way we are building our bank digitally, the way we have focus, the way we are focused on technology, on ethics, on social good. We are building in my opinion, an amazing bank. And the amazing bank we are creating, you will get to see not very long, you will get to see it soon, you will get to see in maybe 2 to 3 years only.”

-

V. Vaidyanathan had visited villages where the bank had transformed the village from no access to credit to a village with high levels of formal credit

-

He visited rural locations to interact with the bank’s customers and to understand their lifestyle, personal cash flow and the cash flow of their small businesses.

MD & CEO’s SPEECH

V. Vaidyanathan

Deposits :

Can the bank sustain the CASA Ratio at ~50%? Competition in Deposit segment is becoming stronger. How will you continue to grow deposit book?

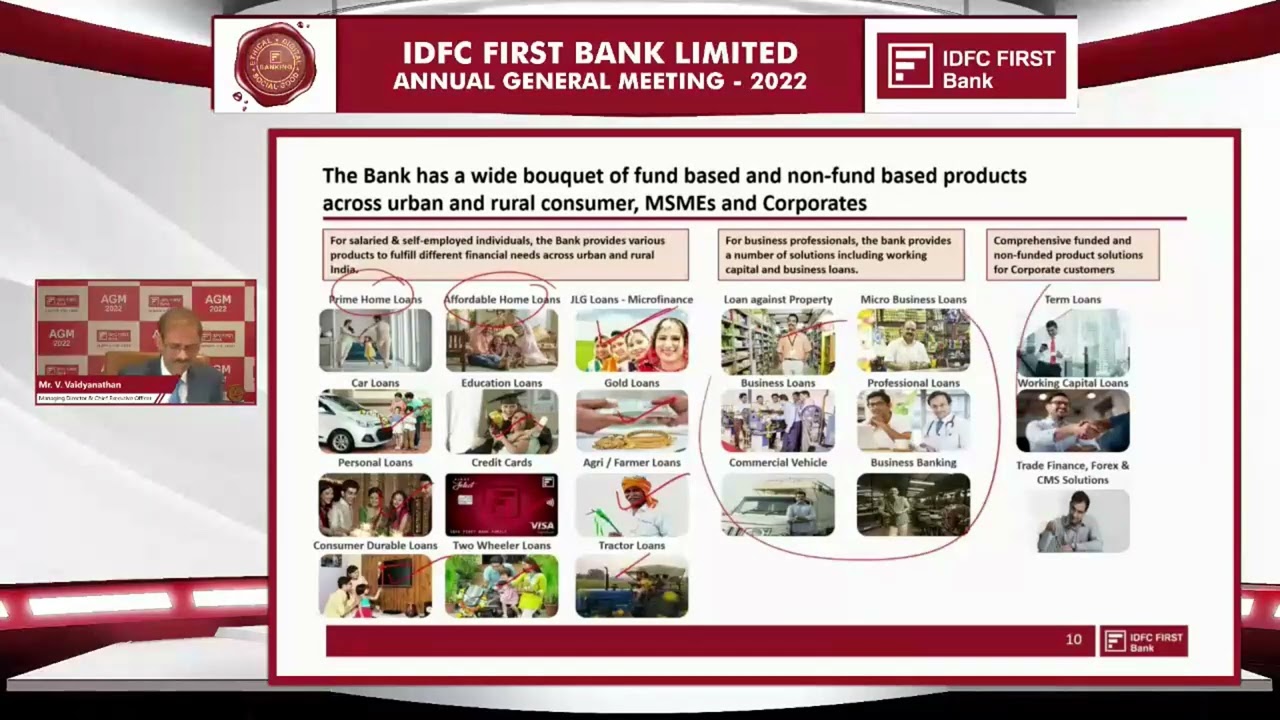

“In the last few years we have launched a large number of products. And each one of these products has a big opportunity of growing”

“During covid, our deposits grew by ~30,000 crore. This sort of goodwill is enjoyed by very few institutions. ”

“At that point of time we were posting losses for 6 quarters in a row for many reasons. And in this loss environment, covid, this sort of growth says something about our bank”

-

“Last year we reduced our CASA deposit rate by 2% yet our CASA continued to grow”

-

“We’re systematically making it into a customer-first bank. All of that goodwill is rubbing somewhere in the bank. This is something that is very important to us. Long-story short, we are paying little bit of an premium, as far as other banks deposit rate is concerned, we can always add more branches if required…I can tell you that on our end, we are not feeling any stress about whether we will be able to raise deposits or not. If we can raise 30,000 crore during covid, in this normal, peaceful conditions, it is nothing for us. We can just moderate it to the extent we need. ”

Growth :

Can you grow your retail book strongly in the context that a number of other players are also focusing on this segment?

-

“The important thing is that, our play in this segment is…We are a very small player actually in that sense as we can grow indefinitely. Let me give you a number. Our retail and commercial book put together is 1 lakh crore. For context, in India, this market in India is 72 lakh crore and this 72 lakh crore is porous. The home loan market is ~25 lakh crore, the car loan market is ~4 lakh crore, personal loan market is ~7 lakh crore, the credit card market is ~1 lakh crore, the education loan market is ~1 lakh crore, the goad loan market is between 4.5-5 lakh crore. On top of this there is the small entrepreneur market, less than 10 crore ticket size, which is ~12 lakh crore, agricultural market is 14 lakh crore. If you add all of these, you will see that this is a 72 lakh crore market. And on top of that you will see that there is ~65 lakh crore market which is the corporate market, that is >10 crore ticket size. So this is an insanely large market…and by the way, it is still growing. Retail market is growing in India by anywhere between 14-15%.”

-

“The fact that the market is large is not the only reason. What is equally important is that we have developed some phenomenal capabilities as a bank.”

-

“On the Corporate Banking side, all of you may know that initially we brought down the corporate book as we had a lot of large exposures which troubled us and all that. But for the last 3 years, it has been stable and marginally on the growth side. We like the business. And at the board level, the board is very focused on ensuring that the quality of credit on this side is also very good.”

-

“Growing at 25% doesn’t look like a difficult thing for us on the retail side. On the wholesale side, we will probably be flat, probably grow by 5-8%.”

Asset Quality:

How will the Bank sustain, ensure the asset quality remains high?

-

“In Q1FY22, during covid, when we had to take the large provision, because we have a formula based provision for retail portfolios. At that point of time, we came and guided the provision numbers for Q2, Q3, Q4 – and we said that this will be the trend, and we guided the total amount of provision we will take in the year. I’m happy to tell you that we landed on the dot. And that shows to you and to us that we are able to model our portfolio and get a really good understanding about what the credit loss is going to be and our models are working. And now our provisions alone…you can see in this quarter, it is barely at 300 crore…0.9% of the book, and GNPA was 2% and NNPA was 0.9%. So we are very clear about what the book is and how it is behaving”

-

“The How of it is that we follow 3 means to evaluate the health of the portfolio:

-

Sourcing and Underwriting Quality: Makes a very big difference.

-

What % of customers we source return their cheques unpaid, and

-

What % of customers that are not returning the cheques, that we are we able to collect.”

-

-

“We all know that GNPA, NNPA can be manipulated by provisions and write-offs, but that’s not the game here. We guide on GNPA, NNPA and provisions and credit loss – this tells you the quality of the portfolio”

-

“We don’t bat one eyelid to reject 40% of our customers as it works for us and that’s how the asset quality shows up for us.”

The bank, at first, had a very high cost of funds and therefore lent to customers with no bureau record. But as the cost of funds decreased, they have lent to better quality customers.

-

“Now our cost of funds are coming down to 5-5.5%…now for any of the big banks, 5.5% if high to them as they are used to very low rates but for us 5.5% is like Nirvana. And now we are going to go to more and more prime segment, as naturally we can afford it at the same margin. Now the percentage of customers that have a bureau record before coming to us is 90% and that does make a very big difference. Therefore, we are going down the risk curve.”

-

“The percentage of customers who had a bureau record above 700 increased from 63% in June 2019 to 84% in June 2022. The bank is onboarding better-and-better customers.”

The combination of a 2% credit cost and 98% collection efficiency all the way back in 2018, right after the merger, was a good enough number according to the position of the company then. But the bank has improved significantly even from that point.

-

“Credit cost guidance for this year is 1.5%, but we will be much better than that. We are currently at 0.9”

-

“We are also expecting a large account to solve in due course, we are talking to the client. It’s a bit up-and-down at the moment. It is not solved-solved, but we feel that it will work out and we will not lose any money.”

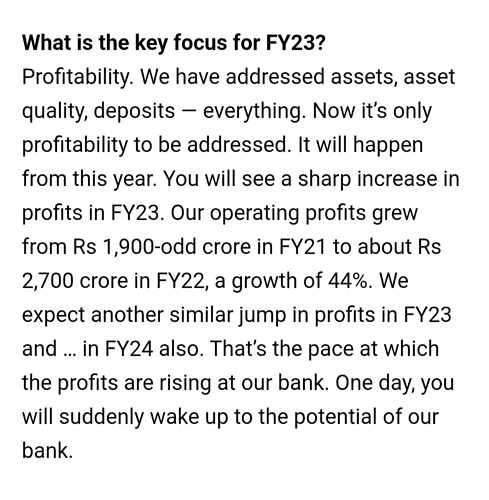

Profitability:

The bank has shown strong improvement in RoA/RoE in the last 4 quarters. Will this trend continue going forward?

-

“If you see the Net Interest Income, you should expect this to rise as the loan book increases. It has to grow. There are no surprises here.”

-

“The Core Operating Profit, for the uninitiated, is the NII + the Fee Income that gets you to the Core Income. And then out of that you subtract Opex, then you come to the Core Operating profit. At the end of the day, we spent a lot of money in the last few years as we had to set up the bank and all that. But the important thing is that the income line was so strong for the bank, the economics were so strong for the bank, and the operating profit is still clawing in.”

-

“One very powerful thing about the bank is that the Core Operating Profit CAGR is 36% but the loan book growth is 6%. Think about it.”

-

“The pace at which RoA has grown has surprised quite a few people. What is commendable about RoA reaching a respectable 1% is that it has come from zero base.”

-

“Our Board’s internal target for PAT was 1700 crore for this year, but frankly, we’re running a bit ahead of that.”

Cost to Income:

Why is your cost to income so high? How will it come down from here?

“We should not forget that at merger, this was a 70,000 crore DFI/corporate book.”

On an already low margin business – because of the nature of the book – the bank incurred expenses, as they had to build CASA deposits. One would go down the hole in such a situation, but according to V. Vaidyanathan, their incremental economics were very strong even then.

-

“Pre-merger our cost to income ratio was at 92%, so now 92% has come down to mid-70s already. So I’m just sharing with you that this will come down from here. Some of you are concerned but you will see the results as they come out in the next few quarters.”

-

“I’m going to give you 3 specific reasons why it’ll come down. “

-

“As you scale up the book, we are not going to add that number of people to make it happen. So our incremental opex will be minimum, at least on the lending side. This straight adds to the NII and the income level.”

-

“Number 2 is, we have fee income. As a bank, we have not yet powered up our fee businesses, I mean, we started the businesses a couple of years ago, but they haven’t been powered up. For example: the credit card business – we just started and it a huge fee generator. That business will come of age and let me say, by next year, by next-to-next year, it is our internal estimates that we will strongly be in profits.”

-

FASTag and Wealth management are also strong fee income generators. The Bank also started cross-sell services but is doing an okay-job at that currently.

“We caught about 23,000 crore or 22,000 crore of deposits we’re paying about 8.8% - we’re going to replace it by 5ish-percent. So if you take 3% out of this, that’s about 660 crore – that is going to add to the income straight away. And of course, we are cautious about spending our money. We don’t want to be frivolous with it.”

Closing Comments:

- “On the growth front, we are investing in the latest technologies. One of the reasons that the cost is also high, is that as a bank we’re still catching up – just think about it – if you’ve got as much current account proposition, someone’s got to build it. Money will come tomorrow, returns will come – but today, somebody has to make the technology, the linkages, the end-to-end chain connection – we had to launch a mobile app – that early stage bank activities. That’s where the cost is.”

… - “At least at the bottom line, our results haven’t been pretty for many reasons, but all of you have given us your faith and confidence and it’s our job to live up to that.”

MD’s RESPONSE TO SHAREHOLDER QUERIES

V. Vaidyanathan

These are questions that V. Vaidyanathan has read out – no questions were asked live.

Q: What is the vision for the next couple of years?

-

“The bank has built a pretty solid foundation. What is a good foundation for a bank? A very good deposit base that is granular, good capital adequacy, a very good lending machine – basically where you can count upon quarter-on-quarter growth in a stable manner, diversified income and many more booster shots in terms of income - which is not yet firing, but will surely start firing soon.”

-

“The next 2-3 years, we expect the loan book to grow continuously upwards of 20%, between 20-25%. We expect profit to lift off sharply from here. What we saw last quarter, I think it just the start. This is not the terminal item, this is set for significant growth from here. A number of people who have seen our performance over the last couple of years, if you have gone beyond the P&L but went underneath, you must have found the quality of work that is going on. But for those who only believe in the P&L, you will see the result in the next quarter or so. So short point is that, forget 2 years, even if you take a 5 year, 8 year, 20 year view, we believe that this bank is fundamentally set for a compounded growth on deposits and loan book and profits as well. So, that’s what it is”

Q: What would you like to build?

-

“A similar answer, except that we are also very proud…it’s not just the numbers – numbers all institutions post and they grow and the profit they make and the market cap goes up, all that is fine, we too, will do that – but we believe that what we are building at the core is something very, very powerful”

-

“When we say customer first and when we say we want clean income in the bank, I’ll tell you what we really mean by that because that is not understood by people because you’re only looking at numbers. What is important is that, when we say that our bank is making a certain amount…suppose in a few years we make 4000-5000 crore of profit, whatever we will make and supposing out of that income say 400-500 crore which we felt is income we took by the sly, without informing, we took it this way-that way, we tell our employees that listen, out of that money, a portion you’re getting bonus out of that, someone is getting salary out of that, some senior management is getting unstopped value out of that, that is dirty money going to your home…some money comes to my pockets also as I own shares of the bank, dirty money.

We call it dirty money. So, we feel that because our bank is based on fundamentally very, very clean items and none of us want that dirty money to our homes, so therefore, because our bank is built on such fundamental norms. What will happen is that 3 years, 5 years, 10 years down the line, the bank will be made of a lot of goodwill of customers. Today, customer has to really experience our bank and discover this, but hopefully, after some years, they will see the difference when you bank with the bank. So this is the heart of it. This can’t be valued but this has some secret value sitting inside that in a long term sense.

This is not just my view, you can talk to any one of us. You can talk to Madhi (Madhivanan Balakrishnan – COO), you can talk to Suhdhanshu (Sudhanshu Jain - CFO), and we all talk similar language.

And not just leadership, even employees get very proud of that. Yesterday I was at an outpost location and the employees couldn’t stop talking for 15-20 minutes just telling us how well the bank is doing. They were so jumpy, they were so happing. They were sitting on 1 branch – which we had gone to see, and the branch had a CASA of some 30 lakhs and the savings amount of 2 crore or something – it is a startup branch – just started 10 days ago – and I asked them, what will be the size of the branch 1 year from now. I didn’t have to say anything to them, no pressure at all, they said 100 crore. What will it be the next year after that? 200 crore. It’s so amazing. We are building a bank on capabilities.

We are not building on pressure. We say look, do you have enough resources? Do you have the right pricing? Do you have the right technology? If you can’t handle, we will fix it for you. We are creating an enabling environment and numbers are coming by itself. That is the ease with which we are playing this game. And I think all this will show.”

Q: When was the last dividend declared? When can we expect another dividend?

-

“The last time it was declared was in July 2018 at 75 paisa a share”

-

“The board is sensitive about the fact that there should be expectations with shareholders in the form of dividends. And we do think that as and when the bank is in a position to appropriately pay dividends, based on the advice of the board, we will let you know.”

Q: What do you expect the Return on Equity to be?

-

“We expect RoE to tend upwards of 15%. That is how our business is fundamentally structured. When I saw 15, I mean upwards of 15, I mean 16, 17 percent return on equity, that is how the underlying economics are.”

-

“So, at that point of time we will decide whether to distribute dividends or reinvest and compound the equity from there, but that’s that. And we will come to it.”

Q: Why are you so confident about profitability?

-

“Now we are one of the few institutions that has built a lending portfolio where we have developed deep specialization. I am just pointing out to you to that to stay at a GNPA of 2% and an NNPA of 1% over 2-3 quarters could be a fluke, but for 12 years at a stretch, barring covid, that is, it is a phenomenal model. Don’t just look at the numbers, look at the way behind the numbers”

-

“More than just specialization, we are playing at the prime of the segment.”

-

“We get good credit, good processes and good pricing. The reason we get better pricing is that our mix is different. So this is how we are managing to get good yield and good risk by staying in the prime of every segment.”

-

“Yield, cost of funds, operating costs all may come down a bit. Short point is that it is all making good return on equity. You keep compounding the machine, the bank will get to see very, very good equity.”

-

“On the deposit side, we may be letting go of some fee here and there as it is a customer first bank and all that, but I’m telling you, the goodwill of the bank is amazing, just amazing. Because our employees reflect the goodwill. We rarely lose customers on the deposit side.”

Q: How we see Digital versus Physical?

“Answer is simple. We want to be in both. But we are of course, more digital than physical as we are a new bank. And therefore, we have the benefit of not that many legacies. So incrementally we are very, very digital.”

Q: What about the profitability of the credit card business?

“Short answer is that we are very happy with card business. We are touching about 1 million cards, and around 2 million cards, the profitability starts coming in. We think that by this year, that is by FY24, our internal estimate is that we should post 100 crore of profit, and by FY25, our internal estimate is – so please treat it with the skepticism you should because the numbers are not done yet – but our internal estimates are that it will cross like 400-500 crore of profit in the subsequent year. It’s peak takeoff. We have done 2-3 years of serious investment. But that’s how businesses are built.”

Q: About profitability of branches…

“Our banks are as profitable as any other reputable institution in the space. We also know that we have more to do, in terms of cross sell.”

Q: About demat…

“Actually, we are also going to build our own demat. We’ll also have a few partnerships. We’re actually having partnerships and we are building one more partnership. We feel that we don’t want to put up a broking firm as it is a very long lead time for returns. We really don’t want to go there. We are happier to be a bank and plug in a broking firm.”

Q: How will the balance sheet look like 3 years from now?

“We already spoke about this and have guided for 20-25%. Now if the balance sheet grows by 20-25%, the profit will grow faster than that. Because the incremental profitability of the bank is that much strong.”

Q: About new launches of products…

“Over the last few years we have launched many, many new products. Gold loans, new car loans, prime home loans, Wealth management…I mean the bank has rolled out one product after the other but what is very special about the bank is that we are very true to this philosophy that every product will have something special in it. I am telling you, as a shareholder, well depending on your risk appetite, you may choose to buy or sell our stock, but as a customer, everyone should be a customer of our bank because something is special about our products. You will feel it, you will experience it, and then hopefully, you will get to appreciate it.”

Q: About cross-selling…

“I agree that we need to do better. But frankly, we have developed some good capabilities for that. What we don’t do, is that we don’t put pressure on them, we don’t say, oh you have to sell this much insurance, mutual funds…that kind of thing will spoil the culture. So if you see my notes to the branches, you’ll always find a note saying that don’t push the customers, don’t sell them things they don’t need, only if there’s a real need for the customer – they might not be doing as much, but we will moderate it, we will give them better tools.”

Q: Can we maintain NIM at 6% in this competitive market?

“Short answer is that we think that our current mix is giving us a proper six percent NIM, no problem with that. If you ask us what our lookout is for 2023, we feel NIM six percent will probably be there. Now if you ask me to look far ahead into FY24, 25, 27, 28, well, I don’t know, it might come down, but at that point of time it could be because by that time mortgage may be a bigger proportion of the book and so on. But I can’t take a definite position on that. We will play it by the year, but broadly we feel that our mix gives us a better yield and remember as the yield also kind of moderates a bit, our operating costs will come down because the scale will go up by maybe 20-25% a year so that gives us income.”

Q: Can we reach a Cost to income ratio of 50-55% by 2024-25?

-

“Let me just say that we put out a bunch of long list of guidance when the merger happened. You can see only that far. And so because you know in today’s stimulus world, five years also, you can really see that far. But I’m just happy to tell you that almost every single guidance we put together in the December of 2018, for five years from then, I am just saying that whether it is NIM or retailization of assets, RoA, RoE – we’ll get to every single one of them.”

-

“Cost to Income, I think, is a bit on the edge. May not be 55% - may be 65% - But still, adjusted for that, the RoA, RoE, we’ll get there. And it is not just any RoE, some RoEs command 5x, 8x price-to-book and some of them command just 1x price-to-book. We believe there is something special about our RoE as the quality of income is going to be fantastic. It is not normal. It is very granular, and more than granular, it has got all sustainable income inside of that.”

-

“Only thing we don’t post is our Return on Equity. The only thing I tell you is that when we solve the issue of Return on Equity, I believe our bank will be valued what it deserves to be. And people like Morgan Stanley who are valuing us today at 30-34 bucks, they don’t understand the bank .”

The MD frequently visits the bank’s website and is actively involved in making customer experiences better. For example: He recommended that registering a complaint is easier with mobile number/email id authentication compared the friction caused by the requirement of the Loan Number, something that customers will usually not have at the tip of their tongues.

“Our vision is that, today we are at 1 lakh crore, tomorrow we’ll be at 2 lakh crore, then 5 lakh crore and so on – as our loan book multiplies, there shouldn’t be a need to multiply call centers in the same proportion. So we are making a very digital customer service proposition. Of course we are coupling it with good culture, good empowerment and all that.”

Q: About share price appreciation and current position

-

“Our Book Value per share at the merger time was 38 rupees, now for whatever reason, maybe the loans that took us back, maybe the lack of profitability, our book value per share has come down over the last 3 years from 38 rupees to ~33 rupees. I am not proud about that. I am just sharing facts with you. That it has come down. It’s amazing that the share price at the time of the merger was Rs. 38. Today it is at Rs. 42-43. Now basically, shares rerated on the book value have come down – Again I’m saying that I’m not proud that the book value came down – but I’m just sharing that the market has appreciated more than anything else. Somehow the price to book has gone up by 49% since the merger.”

-

“The point is that we still have the goodwill of customers. We believe that when we start delivering on the Return on Equity and the market will see that that is the only thing missing for us – and then the equity will compound and then hopefully the share does well from there on. This is early stage. I have run companies before also. The first 3-4 years when the business is under construction, it feels like that. You can see the finished product form this year onwards.”

Q: On Branches…

“We will open branches as and when required. We have given a guidance of 800 by FY25, we are far ahead of that. There is no fixed number from here on.”

Q: About the merger…

“It is such that both institutions have expressed their interest. We have not started discussing value and valuation. All that stuff will play out when it’ll play out. But in-spirit, the 2 organizations have agreed that the merger will happen. When we have anything material to share with you, we’ll share with you.”

X.

All are requested to take basic questions in the relevant thread & do not clutter the company’s thread. Any violation will not be tolerated.

I posted this above but deleted as it seems like another one of those manipulative news items from business news channels…

they said vodafone idea paid entire amount and then also said IDFC First sanctioned fresh loan of 500 Cr. …but this is an old news…what is the motive of showing it now if that 500 Cr. is not paid back then nothing new here…

.

I hope management is not involved in this due to reverse merger getting near or otherwise…

IDFC First Bank received ‘Best Savings Account Product’ 2019-2020 Award

Hi Guys,

I would like to present my view on this stock today,

So I would take IndusInd bank for comparison because IndusInd bank is one of the most efficient bank in my view. Please note efficiency means NIM(net interest margin) but efficiency need not result into profitability because profitability is NIM + asset quality.

If IDFC BANK maintains a NIM of 25 to 40bps higher than IndusInd at IndusInd size it will be an achievement.

Today IndusInd is double the size of IDFC bank so let us assume IDFC bank grows its balance sheet at 25% in this case it is going to take 3.2yrs to reach that size. Let us also assume it grows is PAT at 20% for this period.

Today IndusInd has 48k cr as equity and Idfc has 21k cr in its equity. IDFC will need 27k cr kind of money to reach that size. Let us assume this year it gives a PAT of 2000cr and there after grow at 20%. So for next 3.2 yrs including this year its total PAT comes out to be 7.3k cr.

This means a 20k cr kind of money will be required to reach that size. Now for a bank like IDFC raising money more than 1.5PB is extremely difficult but still we will assume it raises money at 100rs so the total shares issued comes out to be 200cr.

Currently it has close to 620cr shares which will go up to 820cr share by Fy25 end(3.2 yrs assumption period including this year).

The Fy25 profit grown at 20% form this year assumed 2000cr profit comes out to be 2900cr profit. EPS of 3.62 and even if I take a PE of 30 the price comes out to be 110.

My overall point is by FY25 end even with such high growth assumptions it is going to be difficult for the price to be more than 120-130rs. So if you have an average price of 30-40 you have high margin of safety here but if your price is above 55-65 then it is an extremely risky bet

Now this is a growth stock which generally has 6 to 10 quarter of future performance already priced in so if investors see 1 or 2 quarters not as per expectation the volatility in this stock will be like a 30% to 50% fall.

You can just calculate the beta of this stock or standard deviation or a regression analysis to verify my above point.

So if you have a weak heart and your average price is above 60rs then this is not the right stock for you and your probability of making money out of this goes down.

The above calculation are completely mathematical but this is my style of investing where I tend to calculate a range of possible target on the bases of certain assumption then I dive deep to support those assumption. Also note at 120rs it trades at a mcp of 1 lakh cr.

I am not aware of the merger of IDFC bank with IDFC and how much capital it will provide and how much dilution will happen so my total analysis might be wrong. Also I would like to add that each and every bank goes through asset quality problem at least once in 5yrs so assuming it constantly grows profit at 20% will be a very risky assumption.

Now the FY25 profit can be way higher than my assumption but then dilution might be lower than my assumed price or it might take longer time to double. So net net everything will adjust each other because all my assumption are extremely good so you can keep a 110 to 140 kind of price for FY25. Please not these prices are kind of above average value and IDFC might trade way higher when it is at expensive valuations moreover nobody can quantify investor sentiments in price.

Disclosure- This stock is 4% of my portfolio at 40rs and I don’t tend to take it above 5%.

.

management’s guidance about profitability and they have always delivered above their guidance on every front until now… so I have no reason to doubt them on this also… profit for F.Y. -25 can be around 4500 crore and stock price can be 200…

@manhar If IDFC first’s balance sheet grows by 25%, PAT will certainly grow at rate much more that 25% as operating leverage will kick in. There are several products that they have launched which are not yet profitable (eg. Credit cards business).

What management is guiding is ROA of 2%. Let’s assume that if that happens and their asset grows by 25% CAGR what you have stated.

FY22: Total assets 190,146

Est. FY25: Total assets 371,379

ROA of 2% will imply FY25 PAT of 7427 cr

Let’s assume that some dilution will happen and total share outstanding will go to 820cr. Even then, EPS would be 9.05.

If we take 30 PE (which I feel is higher), stock price will be around 271rs.

That would be 75% CAGR from current levels.

Profit growth in my opinion is going to be much more than what you have assumed on account of replacement of high cost legacy borrowing , reduction in operating cost and profit from credit card business in additio to normal growth of banking business. I do not know about the share price ,but company is going to do very well in next 4 to 5 years

I would agree on mostly everything else, but this. I think its ulta.

Market is being cautious about this stock, and only factoring in what has happened in last quarter. Market is playing it quarter to quarter.

Reason: Retail lending is a slippery slope. NPA can spike. Many a bank has taken a hit. List is long.

Lately, i have been observing the energy with which VV sir appears on LinkedIN videos, and conf speeches. Also a flag.

It is good that from time to time somebody comes along on the thread and pushes back the expectations from the company as long as it is factual. In my opinion even at the time of merger it looked like a good bet and over the next three years it has become a much better and stronger bet. Last month it gave another opportunity to get in or add on at under 40 level.

After Q2 results are out and if they are on the same lines as previous three quarters, the upward price trend would get further consolidated till next quarter results.

With a bloated equity of 620 cr after IDFC merger, hiw do you see growth prospect in long-term, to me it looks a long long term.

@Gurvinder_Singh @Ragnar_Danneskjold

I feel valuations is very subjective and every investor has a different style while valuing a company. In my opinion we should be valuing a company on bad to average future performance. If we value on the best possible assumptions then it is going to be kind of risky.

I mentioned in my last point that even if I am wrong at one part the other part will balance off. Like if I take a profit of 4500cr in FY25 then the money raised at 100rs has a probability of only 5%. So the total dilution instead of 820cr will be 1020cr at 50rs. So 4.41 EPS and PE of 30 gives a price of 130. Again I am taking 30 as PE.

Now if IDFC is growing at 2x compared to industry in future and we are going to expect it will maintain same asset quality even at such high growth then that is also going to be risky.

IDFC has a provision coverage of 73% including technical write off at IndusInd size it will need to take it above 80% this is also going to eat profits.

My point is that we should not be projecting linear growth especially in banks because there is always uncertainty in future and I feel as of today above 60 is expensive.

Now as new quarterly performance comes in and it is better than most of my assumptions then I can increase my targets accordingly.

I feel most of the assumptions taken by me are pretty good and chances of bank outperforming all of those looks difficult as of today.