Company Background:

- The company was started by 3 ex-Citi bank employees Jaithirth Rao, PS Jayakumar, Manoj Viswanathan

- Manoj Vishwanathan is the MD and CEO of the firm

- Board has some well-experienced people like Chairman-Deepak(ex-MD HDFC and ex-MD and CEO HDFC Life), Sakthi prasad Ghosh(ex-ED NHB), Sujatha Venkatraman(Current Global head of credit bureau management, HSBC)

- The company focus on the affordable housing market with an average loan size of 10 Lakhs

- Predominantly an urban-focused and salaried class-focused company. (Company focuses on bigger markets where bigger HFCs and banks actively operate and do not focus on rural side unlike their affordable space peers like Aavas, Aptus…)

- Company highly focused on digital and has a good rating for their apps in play store

- The company has a very good TAT for loan disbursal.

Company products:

- The company majorly do home loans(92%) and LAP(6%) and have less exposure to shop loans(1%) and developer finance(1%)

- Customers are salaried class(74%) and self employers(25%) and corporate(1%)

- Company finance both under construction and purchase home loans. Under-construction project loans will be dispatched in tranches and purchase home loans are disbursed at one go

- They provide pre-payment without any penalty. There might be some conditions to it, but they are providing this to customers to pay some small prepayment

Market Area:

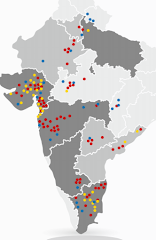

- The company market area is highly serviced areas, unlike their peers. The company selects states and districts where market size is high and does not focus on areas where market size is less even though that area is untapped. This is evident, as 3/4th of the company’s loan book is concentrated in 4 highly penetrated states - Gujarat, Maharashtra, Karnataka, Tamilnadu

- Even districts covered in the above states are concentrated around the bigger cities of the respective states

- In Quarterly Investor call also highlighted, they will choose high market size areas and will serve nearby areas by having digital branches(yellow dots on the map)

Key Metrics

- The company has a CRAR ratio of around 50% and the company wishes to maintain this in near future, as this will have positive effects on credit ratings.

- Debt to equity is maintained around 2x.

- Spread is currently at 5.5%(Q1 FY22), Elevated spread is because of lower borrowing cost but this is not sustainable, once we see a rise in bank repo rates, the spread will reduce and management is confident of maintaining it around 4.75%

- All the operational metrics ROE, ROCE, Opex, cost to income are low but are consistently improving

- Opex to Asset will be around 3%, current lower opex of 2.5% may not be sustainable, since due to covid restrictions opex is less, this will move higher in normal days

- Cost to income ratio consistently improving

Digital and Loan TAT:

- All their apps for Customers, RMs, Connectors in the play store have very good ratings.

- The company has a very diversified lead generation.

- 93.7% of connectors are registered in the connector app

- 67% of customers are registered in the customer app

- The company digitized loan approval processes and having more focus on reducing the TAT.

- 91% of loans disbursed in Q1 FY22 are having less the 48 hours of TAT.

- The company makes sure a customer will interact with only one RM for counseling, loan approval, disbursement, collection. Other firms, they maintain separate people for these(Evident if you see employee reviews in AmbitionBox, that they don’t like being asked to handle all those). But by keeping a single point of contact, their TAT is significantly improved.

- All the customers will have e-NACH debit to their bank account for EMI, But the company making effort to make sure all their customers are enrolled in their app and do prepayment or even EMI payment in their app and handling queries of the customers.

Asset and Liability:

- ALM has no mismatch and the company is confident of maintaining a 4.75% spread.

- No commercial paper borrowings

- Consistently able to raise money from securitization route and constitutes for 20% of funds.

- Having a low debt to equity ratio of around 2x enables the company to raise debt efficiently

- The company takes credit life insurance plans for the customers which will pay the company outstanding loan amount in case of death of the customer. And this is a non-commission product and the company will not earn any income from it.

Key Questions:

- Can they sustain competition from banks and bigger HFCs with a difference in the interest rate of 5%

- How do these affordable home loans go without PMAY benefits?

Key Flags/Risks:

- The cost of borrowing might increase with a slight impact on asset quality, but management keeping liquidity of 1000 Crores, gives the confidence to credit rating/banks to service at a lower rate.

- Asset quality, as of Q1 FY22, impacted with 30+ dpd is at 5.8% compared to 4.1%. Being a lock-down quarter, there are some slippages to bucket 2, but bucket 3 is stable. Q2 might give a clear picture in this part.

- Since 75% of their loans are provided to salaried class and the company being urban-focused and 70% of their customers have an average credit score of 736, there is a real risk in sourcing these customers in the future.

- Balance Transfer is another risk, as customers having upgraded their credit history after series of consistent payments, they don’t have a real reason to keep their loan at a higher interest rate. For FY20 it’s been around 4% of AUM and the same is dropped to around 2% in FY21, But being a covid period, need to check if this is sustainable or this is getting increased.

- The company has a legacy NPA of 26 Crores in the NCR region and management highlighted the sale and recovery of the loan are not moving in a satisfactory manner, the company is taking additional provisions.

- The company has a 4/5 rating in AmbitionBox and the most common concerns of employees are work-life imbalance and they are asked to handle the entire lifecycle of the loan themselves, as against the common practice of multiple teams involving. On contrary, this might improves the customer experience.

- When comes to the promoter, anyway promoters are PEs and somewhere they will sell part/full shareholding and management salary is reasonable. One of the founders, Manoj has 1% of the shareholding and the annual report does not have any shareholding info of the other two founders.

Disclosure: Invested