H1 Results are out and its on expected lines.

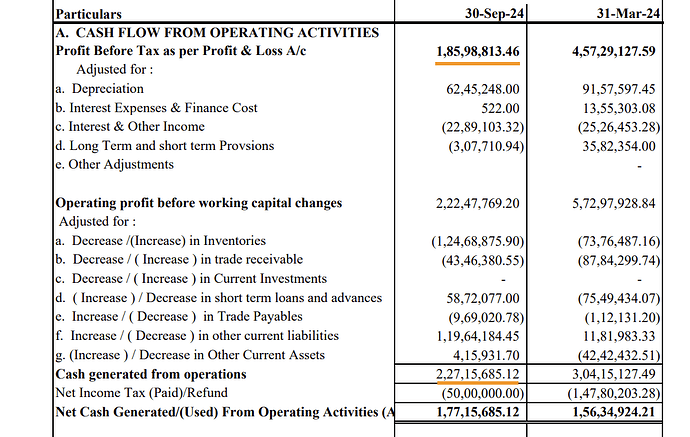

There’s a 21% growth in topline (17 Cr) which is near the max capacity available (3 Cr/month). Margins as expected are depressed due to 1.3 Cr increase in employee costs (8.43 Cr vs 7.13 Cr) without a corresponding contribution to production as the employee count went up from 265 to 350 and these employees are being trained and did not have the machinery to work with, as mentioned in the AR. Also EPS is not comparable as the EPS in H1 FY24 is before IPO dilution. There’s still a healthy 17% PAT growth despite the drag. EBITDA growth is even better at ~35% (PAT also depressed due to higher dep since equipment is capitalised)

If we adjust for the unproductive employees, PBT would have been around 3.2 Cr and PAT around 2.4 Cr (~2x). H2 is the seasonally heavy half and looks like the Plant and Machinery is in place for a 4 Cr/month run rate.

H2 should have a topline of close to 24 Cr without a corresponding rise in employee cost which should add ~4 Cr to PBT (6 Cr PBT possible) and a possible doubling of profits YoY.

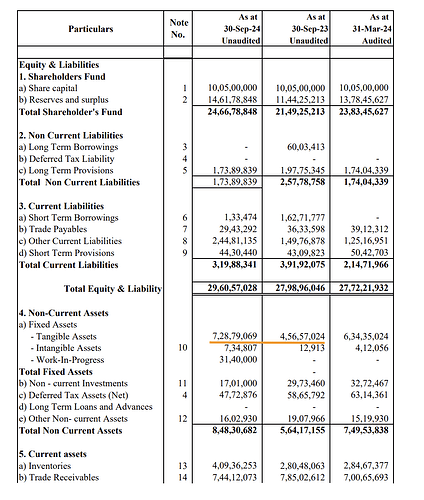

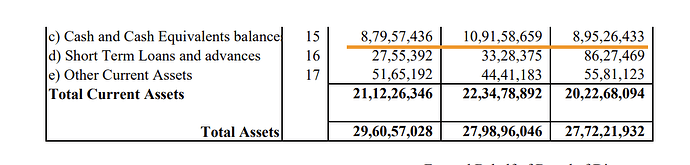

Despite the capex and WC increase (for the microscopes held in inventory), there’s still healthy cash of ~9 Cr in the BS.

There’s also healthy conversion of EBITDA to CFO of 2.27 Cr for H1 (1.85 Cr PBT and Reported PAT is 1.23 Cr)

Overall I think biggest takeaway is machinery being commissioned as per the BS so capacity constraint of the last 1 year shouldn’t continue going forward.

Also, noticed this nice catalog of all their products (They seem to have 3000+ products)

Disc: Invested