First a bit about the copper industry -

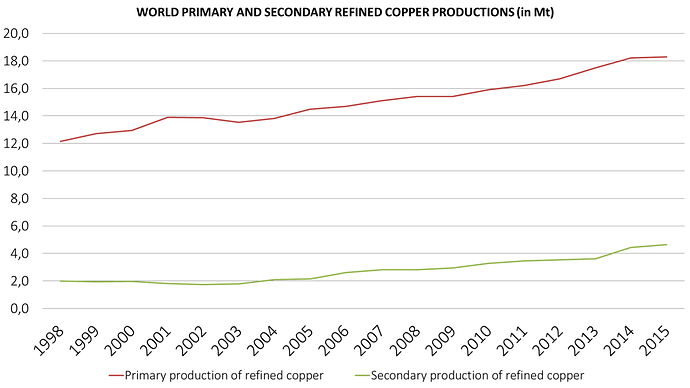

Total global copper production from mines amounted to an estimated 20 million metric tons in 2019.

Chile is the largest producer (5.6 million tonnes) followed by Peru (2.4 MT), China (1.6 MT), DRC (1.3 MT) USA (1.3 MT) and so on.

World copper mine production declined by 0.7% during the CY 2019.

Production in chile the world leader declined by about 1% due to lower copper grade and a few disruptions.

Production in Indonesia declined by 45% due to transition of two major mines to different zones.

Production in DRC and zambia declined by about 3% as a consequence of shutdown of SX-EW mines.

World refined copper production declined by 0.6% during CY 2019.

India saw a decline of production by more then 50% due to shutdown of Vedanta’s Tuticorin plant.

Now lets take a look at the demand side -

The world consumption of refined copper declined by 0.8% to 24.28 million tonnes.

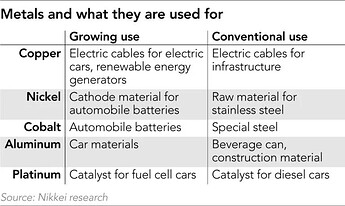

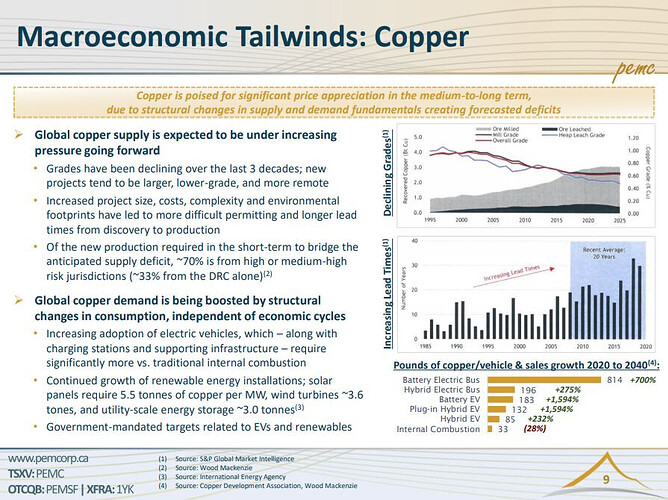

Demand of refined copper is expected to be robust as more progress is made towards renewable energy and electric vehicles.

According to reports an EV uses approximately 60Kg of copper as compared to an ICE which uses about 23Kg or a hybrid which uses which uses about 40Kg.

Now lets look at the scenario in India -

Copper demand is expected to grow nearly 7-8% in India as govt lays thrust to renewable energy and increased demand for consumer durables.

The average per capita consumption of copper is the world is about 3.2Kg whereas in India it is still around 0.5Kg. This is expected to increase to 1 Kg by 2025.

Now lets look at the production facilities of Hind Copper -

-

Malanjkhand Copper project - expansion proposed from 2MTPA to 5MTPA. There was a delay in the completion of the project as the contractual agency went into liquidation. They have awarded the contract to another agency and work is expected to be completed by 2021.

-

Khetri, Kolihan and Banwas mine -

-

Khetri - expansion was proposed to increase production from 0.5MTPA to 1.5MTPA in 2011-2012 but work was disrupted due to extremely bad ground / fault zone encountered while making approach cross below the existing production shaft area. A detailed study was done to modify the design and now tendering is going on.

-

Kolihan mine - Drilling in progress to expand production to 1.5MTPA.

-

Banwas mine - 0.6MPTA production already running.

-

Surda mine - Increasing production from 0.4 to 0.9MTPA.

-

Indian Copper Complex(ICC) -The company initiated action to re-open the closed mines and development of new mines at Singhbhum Copper Belt.

-

Kendadih mine - The mind was re-opened in December 2017. Equipments were mobilized in a phased manner and in 2019-20 it produced 43200 MT of ore.

-

Chapri Sideshwer and Rekha mine - It was planned to augment production to 1.5 MTPA by reopening of closed Rekha mine.

The company plans to expand the production in 1st phase to 12.2MTPA by 2028-29 and then expand it to 20.2MTPA in 2nd phase.

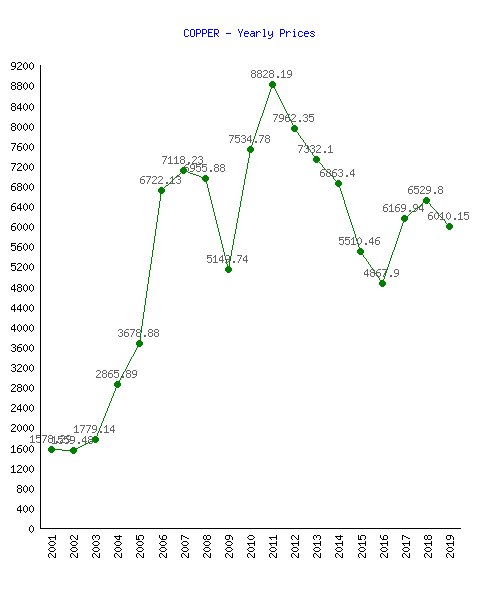

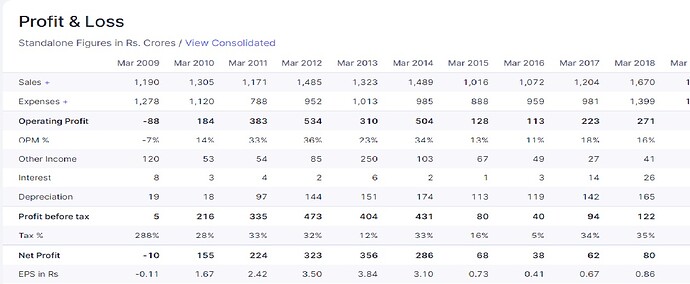

Below is a 20 year snapshot of the spot prices in USD and the 10 year P&L of the company

From the above it can be understood that leaving 2020 aside by far FY2009 was their worst year in which prices crashed to around 5200$ but then prices revived and inched higher but again crashed in 2016 to 4800$ levels but that time the company managed to stay in black.

So on an average when the prices crash the company is able to manage OPM of around 10-15% and on an upside the company is able to maintain around 30-35%.

What i understand from the whole scenario is that if there remains a shortfall for some years to come and the price manages to stay in the range of 7000-7500$ the company would be able to make around 25% OPM and add to that the new capacities coming up would give the bottomline a nice kick.

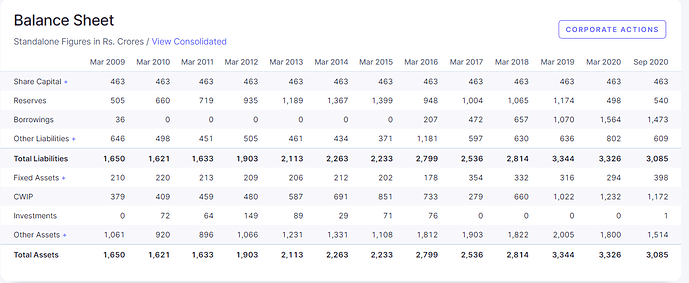

The company was having nil debt till 2015 but since then the debt started increasing and is presently at around 1500 crs. This may have increased to fund the ongoing expansion project the company is undertaking. But it is surely something to keep a watch on.

Risks -

-

If we look at the 20 year chart of copper it can be easily said that copper has remained quite volatile and that will affect the stock price directly.

-

The expansion plan of some of the mines started in the 2012-2015 periods but it has not been finished till date with the company facing hinderances in some and the awardee in some. I am no expert in this field and have very little knowledge regarding the same. So i would like seniors or people with knowledge in this area help me out with it.

-

The company in its annual report mentioned that the equipment which they are using is very old hence the efficiency and reliability is a big question mark.

-

Being a psu is the biggest risk of all. We will never know when the govt. will leave the company cash starved or do something else which might not be in favor of minority shareholders.

Disclosure - Invested 2% of my portfolio from lower levels and may look to add more. Am invested in the company so views may be biased. I am not a SEBI registered advisor.