Highlights of the Earnings Call that took place yesterday:

MANAGEMENT COMMENTARY

Shrinivasan Vaidyanathan – CFO

• Global market conditions are improving

• RBI raised the policy rate by 100 bps in the quarter taking the repo rate to 5.9%

• RBI has raised rates by 190 bps since May 2022. The stance is unchanged.

• We estimate GDP growth will be around 7% for FY23

• On distribution expansion, we added 151 branches during the quarter, and 500 more branches are in the pipeline to be opened in this Financial Year

• 2960 branches now offer gold loan processing – and increase of 900 branches in the current quarter.

• We expanded by 145 locations in the quarter for Wealth Management.

• Our people have acquired 2.9 million new liability relationships – a healthy growth of 11% QoQ.

• Retail advances growth was robust. Retail constitutes 83% of total deposits. Retail deposits have been the anchor of our deposit growth.

• Commercial and Rural book grew

• CASA book was at 7.59 lakh crore

• Term Deposits grew by 22% YoY at 9.13 lakh crore.

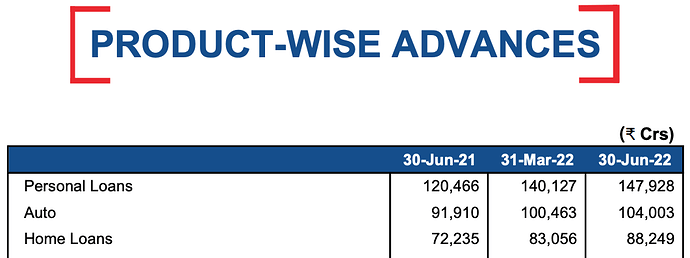

• Advances side was at 14.79 lakh crore – grew by 6.1% QoQ

• We have issued 1.2 million cards in the Quarter – reaching 16.3 million total cards – we closed 2.4 million cards during the quarter during inactivity – as per RBI circular.

• Card spends grew by 9% QoQ.

• Objective is to reach 2 lakh villages. We are at 1.42 lakh villages.

• Technology and Digital transformation is yet in momentum.

• Vyapaar app was formally launched for instant digital merchant onboarding

• Platform is adding more than 60,000 merchants every month

• Over 1.6 million businesses are on this SmartApp Platform.

• In Q2, there were ~30 million unique customers a month on the website on average.

• Balance Sheet remains resilient.

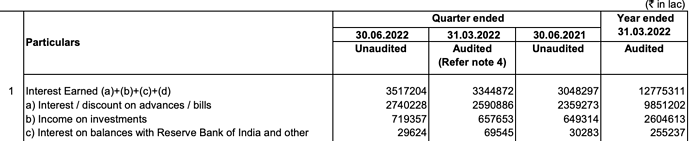

• NIM at 18000 crore. NIM = 4.1%.

• CET 1 is at 16.3%

• PPOP grew by 16.6% YoY and 5.8% QoQ – at 17, 393 crore

• PPOP is 5.37 times of total provisions

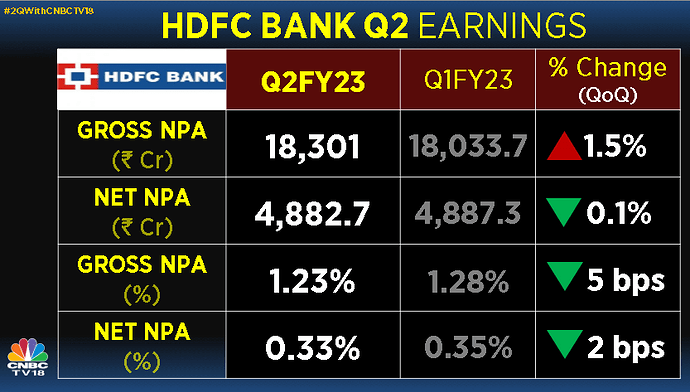

• GNPA was at 1.23%

o Core GNPA was at 1.04%

o NNPA was at 33 bps

• Slippage ratio is at 36 bps – 5700 crore

• Recoveries and Upgrade = 2500 crore

• 6499 branches, 18688 ATMs

• C-I Ratio was at 39.2%

• Write-offs in the quarter were ~3000 crore – 22 bps

• Restructuring under the RBI Resolution Framework stands at 53 bps. 7851 crore.

o Not restructured – 9bps

• Total Provisions = 3200 crore

• PCR was at 73%

• General provisions were at 6800 crore

• Total Credit Cost Ratio net of recoveries was 64 bps – compared to 103 bps last year

Q&A

Mahrukh Adajania - Nuvama

Q: On liability growth going ahead. This quarter was impressive with strong retail growth. Closer to the merger, how will the liability strategy change? Would it be focused on wholesale borrowings and deposits? What kind of borrowings would these be?

• Focus is on execution

• Relationship based growth continues to remain the focus

• We are building momentum in retail

• Branch network is there – and the pipeline for the next 3 years continues to remain the same

• Currently, it is about harvesting and utilization of branches

• 50% of those branches are shifting from 1 vintage bucket to another vintage bucket

• There are other market borrowings that opportunistically happen – and that will continue as per the market

Q: Any outlook on margins on a standalone basis 2-3 quarters down the line? As we know, Merger will put pressure on margins.

• Think about what the margin means -

• We have typically operated between 3.14 and 4.45%

• In this range, the mix of products is very important – retail mix between 53-55% and the wholesale mix will be 40-45%

o Overall, in the last 4-5 years, it has switched.

o Retail is now 45% - wholesale is at 55%

• And now you can see a pickup in the margin as rate cycle has gone up as the pass on is laggard.

• 45% is fixed rate – the rest is floating

• You have seen pickup in the margins due to a switch in the mix

• You will continue to see the mix change

• And now momentum is picking up

• Economy is 60% consumption led

• We have had need in the retail.

• Last quarter retail book advances growth was at 5% and was similar in the June quarter

• As long as you can see that move up, you will also see the mix moving – this gives opportunity for the margin to move up

• These are the 2 aspects to think about when projecting margins

Suresh Ganpathy – Macquarie

Q: On deposit rate…RBI has hiked rates by 190 bps. None of the banks have hikes their rates even by half the amount – they have only gone up by 50-60bps in the last 6 months. There is a significant gap in terms of monetary policy transmission. What is the outlook on deposit rate? How do you see that panning out?

And the 2nd question is on branch growth? You have a target to 1500 – 2000 branches every year. Do you think 2nd half is going to very strong?

And what about NCLT guidance to conduct a shareholders meeting? Does this mean the pace of approvals are better than expectation?

• CASA is a different aspect – the way we earn time deposits – we think about public and private sector peers

• The way we approach deposits – we have to be competitively priced

• We are in line with the private sector banks – not at an advantage or disadvantage. It is only about the execution capabilities.

• It is not a sales-based process but a relationship based one.

• If you think about public sector peers, there are certain points of the curve where we are higher – typically in the medium to long term; and in the short term, in some places we are lower. Not by our design – our term deposit yield curve is upward sloping.

o That is how we monitor that.

• There is no formula for repo pricing or other kind of t-bill or g-sec kind of pricing.

• It is about the demand – and that’s how we approach it

Branches:

• We have been a bit slow in the first half and it is typically like that.

• We do see a ramp up happen in the 2nd half of the year – in terms of branches

• It is medium-long term goal – but as you open a bank – you track the New Account Value

• We have more than 500 branches in the pipeline in various stages of readiness and completion

NCLT:

• Are we on the timeline? Yes. Maybe there is a scope for a few months early.

• NCLT goes to various agencies in the country –and that is a long-drawn process – after shareholder meeting

• There are callings for comments, hearing in newspapers, etc.

• After shareholders’ approval it will take 7-8 months – after which we will get approval.

• Continue to be in dialogue with RBI for exemption.

Kunal Shah – ICICI Securities

Q: W.r.t payment products growth, it is lagging in growth compared to the industry but we are not seeing any loss in market share with respect to spend. Is it more in terms of the behavior of the transactors vs revolvers - or is it other payment product contribution that is leading to near 2% sequential growth?

• On spend, we see good amount of traction coming in.

• And it is transactor-driven – and the customers who are spending have very good liquidity.

• If you look at our card customers liability balances it is close to 5 times the loan balance of these customers – total average

• We see normal amount of liquidity

• Revolver rates have not picked up and are yet at 70-75% of pre-covid level

• In 1-2 months, we will see revolvers coming in

• We see the people who have a tendency to revolve over a larger period of time have actually come down.

• We do see something – but haven’t seen credit card customers revolvers come back up after covid.

Q: With respect to commercial banking, there is improvement as far as retail is considered. But commercial ex of agri is yet stable. Given inflation impact in industry, what is your outlook on commercial banking? And what incremental measures are we taking in such a global slowdown?

• The strength of the commercial banking – especially MSME segment – we see extremely robust growth here.

• There are origination models, management models, relationship models of the customers

• Lending is one of the value propositions.

• In may we presented, the self-funding ratio, that is the liabilities generated by this segment through their own cash management account, through their promoters’ account and through their employees’ accounts – more that 80-85% self-funded. This ensures good model for credit management.

• More than 85-90% is secondary collateral – which is very important. Additional with primary collateral. There is much more skin for the bank and the business to work together.

• Even during covid, this sector was quite unscathed and quite good.

• We see strong cashflows coming in.

• We consider these types of loans on a case to case basis.

Rahul Jain – Goldman Sachs

Q: Can we understand the headcount size? We added about 9000 in this quarter. How many more do we need to hire for this year? We may have preempted hiring for branch growth and expansion. For the next couple of years, how do we think about headcount?

• Some level of hiring will happen for new branches and has happened. This will continue as soon as the locations is signed.

• The broader question you asked, yes with digital efforts we are putting through – we are seeing a lot of traction on the digital front – so thereby, we don’t need to add at that rate.

• But we may get a few subsidiaries on board – and that may impact the total headcount number.

• We will ensure high end relationship management.

• There are about 45,000 – as reported in March – in the salesforce that is there.

Q: On credit deposit that has expanded in this quarter. Incremental share in deposits has increased in the past year or so. How can we think about the combination of credit and deposit growth? Can we sustain this incremental market share gains, because the system is rationing up efforts of deposit mobilization rates by offering higher rates, etc.? Or will we have to up the game there?

• In terms of the CD ratio, or the deposit and advances growth – I know we are in a particular interest rate cycle – but if you have to go back to 5-10 years in the past – and see what has happened then – through the interest rate cycle over a period of time – 2.5-3 times is the kind of rate of growth.

Abhishek Murarka – HSBC

Q: Going back to the NIMs conversation, you mentioned that the mix is where it is and that is why you are the lower end of the range, the rates that are going up, so suffice to figure for this that as deposit rates start catching up, we should get back to As deposit rates catch up – will we use 4% nims or is that not the case? Or will you be able to maintain the existing spread that you have got?

• If you see the rates that have changed – there is more to come in the November and March quarter

• As rates go up, there is continuation of this effect

• It is also about deposit mix funding – we have an opportunity to increase our penetration in time deposits.

• Time deposits grew by 72% - we only have 14-15% of our customers we have penetrated on time deposits

• There is an enormous opportunity here. Depends on the mix and the need and how long the rate cycle goes.

Q: With the same mix, you expect deals to be going up more…and deposit growing strategy will not be completely rate dependent – and to that extent you can gain on spreads – is that a correct understanding?

• Till the extent that we need the rate on advances and deposits it is upcoming

• It depends on market circumstances

Q: On HDB, GNPA on a sequential basis they are pretty flat. What’s happening there in terms of asset quality? What’s the restructured book there? How much provisions are you carrying on that?

• The HDB asset quality trajectory is improving and will continue

• Provision Coverage on secured book is 46% and on unsecured book PCR is 92% - and on the overall loan book – 75% of the total loan book is secured loan book – so it’s a good type of book

• And the customer segment was significantly impacted during covid as part of the NPA – as economy became stronger, there is quite an improvement – but there is more to go in that.

Q: Restructured book in HDB?

• There is some management overlay that we do have and continues to be there.

• But restructured book we haven’t published yet.

Q: We still have trading losses – you alluded to corporate bonds attributing to that. What is the reason behind that?

• If you look at the corporate bond book – not the T-bills – the certificates that are predominantly PSL driven certificates which are there – the base rate that determines the valuation of the bonds and the PTC published by Suvidhaa and other associations…the base rate is the g-sec rate

• The 6-month rate is up 77bps in the quarter – the frontend part of the curve is up but long-term bonds’ rate is down by 9 bps.

• If you look at the disbursement of the bond book, it is a pretty good normal distribution around that 2-2.5 years range bucket

• G-sec rate on the frontend of the curve is one of the elements of valuation

• The 2nd aspect is the bond spreads. That have come down.

• Bond spreads in the front-end are down 6bps on a 6-month basis, 21 bps down on a YoY basis, 11 bps down 2-year basis.

• The bond spread is another element of the valuation.

• Until the bond spreads grow past that level – they can’t drive Gsec for corporate bond book

• The co-efficient portfolio at normal distribution is therefore around the 2-year mark.

Shashank Kumar – Sunidhi Securities

Q: On credit card business. What will be the impact of UPI on Rupay Credit card, transaction value due to MDR differences, or it will be settled down 2.2-2.4%? You can give some colour…

• These are variable cases

• We’ll have to wait and see how the market reacts

• We are predominant in the Mastercard issuer – and Rupay cards is a small base in our credit cards

• The growth in UPI and the pricing of the same, we’ll have to wait and see

• Currently, what we have through Mastercard and Visa, the transaction size is very good for us.

Q: On the asset quality size, what is the slippages, write-off and recover?

• Slippages in Q2FY23 were 36 bps or 5700 crore

• Recoveries and uograde were 19 bps or 2500 crore

• Write-offs about 22bps 3000 crore

Saurav – JP Morgan

Q: On corporate banking fees…on 9% QoQ growth…where it is coming from? Are you displacing some public sector banks or large corporates?

The consequence of that build-up, the NIMs should come up – but at the RoA level is it a 2% business? How do you think about it?

• On RoA, all our pricing decisions as well as business model decisions based on the returns it provides – not the NIMs it provides.

• It is quite good relationship-based businesses in the wholesale

• We have quite good traction

• Large contributors have been telecom companies, energy companies, PSUs – we will get returns in line with the bank’s overall returns

• When the price is not right, we let go of the volumes, we let go of the transaction, not let go of the customer as they are good relationships. Keep good relations, if that particular transaction doesn’t work, it doesn’t work.

Q: In an interview, you said that half the digital transformations is over and the IT cost will peak out – and you will reach about 21 million merchants from 3 million at play. How should you think about this impacting your Opex? Or you chose to reinvest any gains? On credit cost or your NIM on Opex side, how do you think about this?

• 1 aspect is in terms of digitalization itself. The context of that was that the merchant Vyapaar app that we formally launched – and has took off very well

• We get quite a good traction. We get in almost 60,000 merchants per month in the recent month. And more than 1.6 million signed up under the Smart Vyapaar app.

• It is not just a payment product relationship. It is also a liability relationship, asset relationship in addition to getting the payment relationship.

• And there is a lot of value for the merchants to do business with us.

• The 2nd part of what you asked, our cost to income before covid was about 39.5 and through covid, the retail kind of transaction, we came down to 36-37 – and now we are back to 38-39.

• It can go to 40-41% QoQ. You can imagine on the yearly basis that we will be at 40 as we make those investment to come.

• As we see…denying credit, as the average credit cost you see in this quarter…80-90bps…last quarter 90-95bps…so there is an opportunity to become lean there and get the maturity cycle up, from branch maturity cycle – which is18-24 months - to people maturity cycle – which is 6-9 months – So the thought of what the investments go do…This contributes to the overall return framework

Q: These 20 million merchants is just HDFC bank and doesn’t include your fintech partnerships?

• That is right. Merchant relationship is with the bank.

Manish Shukla – Axis Capital

Q: Can you remind us the key dispensations and relaxations you sought from RBI for the merger? And realistically, by when will you get visibility on the same?

• What I said in May stands true even today.

• SLR, CLR, side pass will continue to focus on greater and faster credit growth supported by us – That is something what we are discussing

• In terms of the priority sector lending which kicks in 12 months after the effective date – so September 2023 will be in November 2024 is where it’ll come

• We wish to organically originate

• We have moved to 1.42 lakh villages now – we were only at 1 lakh villages if you go back 12-15 months ago – come here and we wish to tap to 2 lakh villages – and that is how we go about building this.

• In terms of opening up and reaching 3000 mark on branches originating gold loan – we want to do around 5000 branches that originate gold loans – again that is a part of that initiative to ensure that we take the right kind of quality on the priority sector lending

• These are the action plans that comes for organic – but we organically do this.

• We will continue to have conversations about this with the regulators.

Q: By the time you seek shareholder approval, towards end of November, are you expecting any visibility on any of these?

• There is no particular timeframe for this

• These conversations are private so no details about the same.

• The verdict or model is not dependent on that – it is good to have but not necessary

Q: On liabilities, once you acquire a large mortgage book from HDFC, potentially you can fund it using long term affordable housing bonds, so what are your thoughts around the same? How many of those bonds you can issue? Does that mean in the interim your LDRs as a merged entity would be higher than what you have historically seen for HDFC Bank standalone?

• That is part of the equation and we would consider opportunities to do that.

• From a cost point of view, we are indifferent – as the assets on the other side are floating rate assets, priced off the market benchmark, and there are hedging instruments in the market through which interest rate risks can be managed.

• At the same time, liquidity maturity is also managed through these affordable bonds – and they provide us and offset from CLR and SLR subject to certain criteria.

X.

Ps. There have been certain omissions/paraphrasing in these notes. It is not a transcript word-for-word.