dear Chaitanya Ji,

I am not against

- Getting more returns than Index

- allotting time in the market to understand benefits, disadvantages and pitfalls.

- maximizing returns in legal ways

- tweaking and tinkering products in personal finance

- aspiring for mercedes

- introduction of unheard companies and finding multibaggers

But if you notice all these efforts does not come under “Passive Index Investing”

Value picker Tag line " Separating the Wheat from the Chaff"

inspire us to able to distinguish “Separating The Active Investing from Passive Index Investing”

If we are following Passive Index Funds, what must be the purpose of introduction of ETF funds? If we ponder on this , we can easily gauge that, its merely for motivating trading behaviour of investing communities.

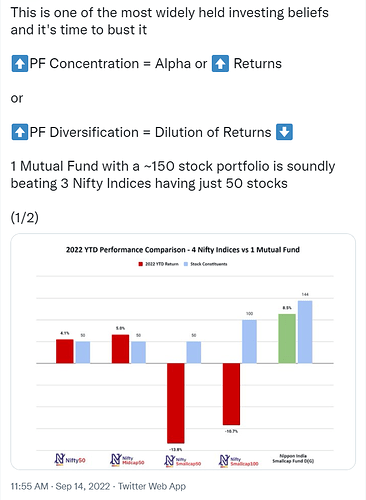

The basic tenet of Index Investing is to believe in the Indian Economy and its long term prosperity. It completely disregards, market levels, market entry and exit and individual stock selection. In ETF index, we are violating the basic principle of market level agnosticism. Thats why John Bogle will cry in heaven because, this is not distinct and multiple use, which he could not think about , but its blatant opposite of what he meant by Indexing. But I understand that this would happen , because market players need this. What we are currently seeing in Indian Mutual funds industry, alpha startegies, Smart Beta, Low volatility Index , Equal weighted index…All these variations are not refinements and improvements of basic indexing. These are just back door entry of active investing in the disguise of index investing. And their financial welfare is at stake. They benefit from misguiding us. This is not meant by John (Jack) Bogle…