Q3 results

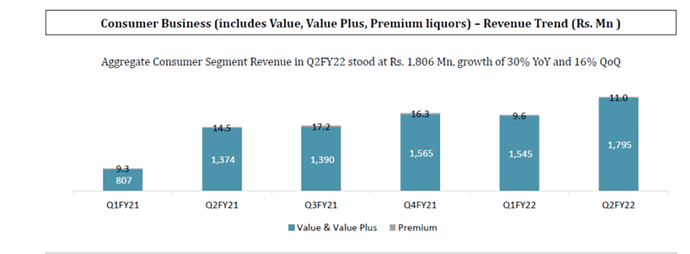

Consumer business share improved to 47 % from 42 %

Sold a total of 3.8 mn cases in Q2’22 against 3.77 mn cases in Q4’21. Capacity utilization came in at 90% vs 98 % in Q4’21 vs 99 % in Q1’22. Flood in Bihar and maintenance shutdown at Haryana Plant reduced overall utilization levels.

Company started talking about value plus segments. And the company talked about close to 40 % market share in Rajasthan in value plus segment.

Value plus has contributed to around 1.3 mn cases which is an improvement of 63 % YoY and 19 % QoQ.

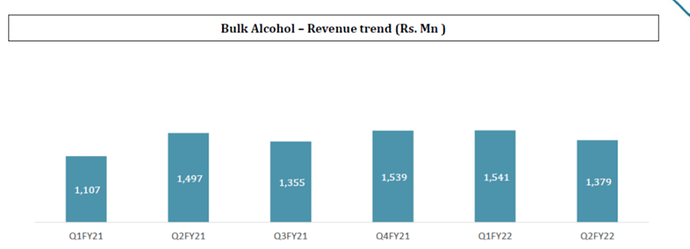

Opportunity cost of closure since August 15 of bihar plant 20 crores , Haryana 5 crores. Revenue from bulk alcohol was seen lower on a Qo Q basis.

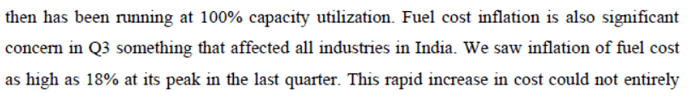

OPM margins reduced to 23 % from 26 % on a QoQ basis. As per the concall there was a fuel inflation of 20-25 %. And slight seasonal increase in broken rice prices.

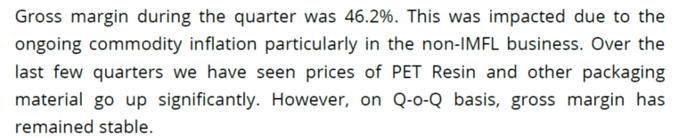

A similar reduction in gross margin was seen in Radico too, which the company attributed to inflationary pressure on PET resin and other packing materials.

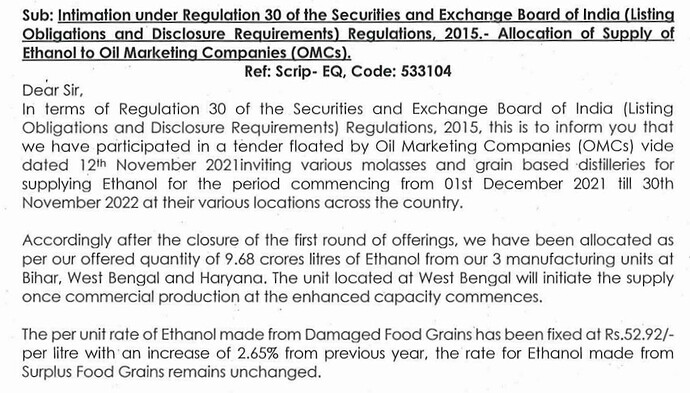

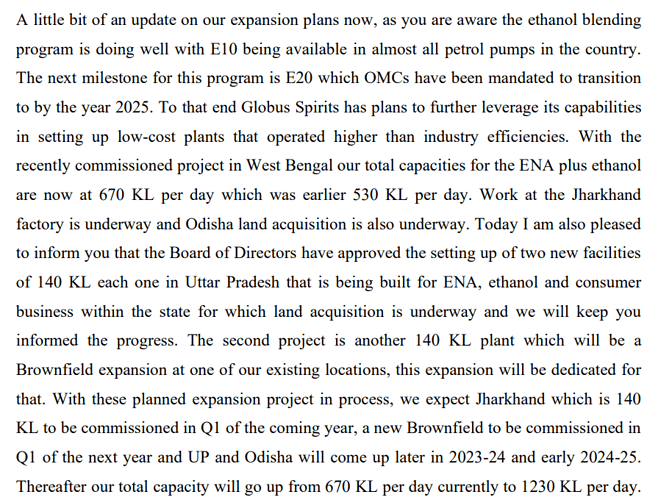

Ethanol opportunity

Company also received a 10 year volume contract from OMCs for supply of ethanol for units at Jharkand, Haryana, Bihar, Odisha and West Bengal giving assuring volume offtake.

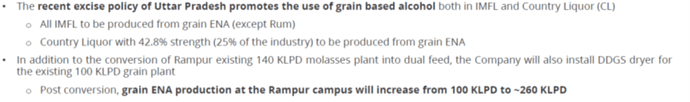

Govt announces prices for molasses based ethanol, The Cabinet Committee on Economic Affairs (CCEA), headed by Prime Minister Narendra Modi, raised the price of ethanol extracted from sugarcane juice to Rs 63.45 per litre from the current Rs 62.65 per litre for the supply year beginning December 2021.

The rate for ethanol from C-heavy molasses has been increased to Rs 46.66 per litre from Rs 45.69 per litre currently, and that of ethanol from B-heavy to Rs 59.08 per litre from Rs 57.61 per litre. However, prices on grain based ethanol are fixed by OMCs and are yet to be revised

Outlook for Q3’21

Planned maintenance shutdown of Haryana Plant for 30 days in Q321.

Bihar plant may not be operational at all for Q3’22. West Bengal expansion to be completed by Nov’21. Expects to have 25% capacity utilization in Dec’21. And 100 % capacity utilization by Q4’22.

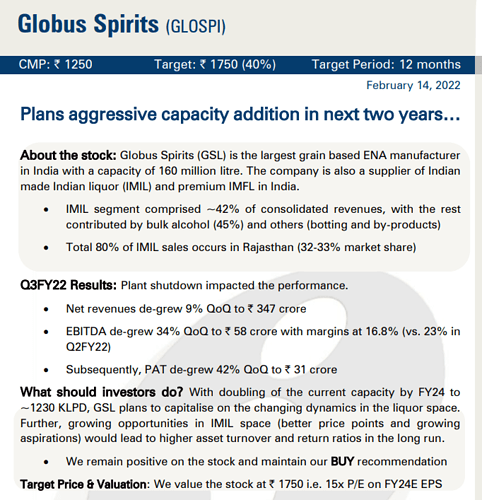

We may see lower capacity utilization as well as volumes for Bulk alcohol / ENA for Q322 and lower revenues. However, the sales from value and value plus segment will be interesting to watch out for. Currently the market share in WB is only around 2 %. The company plans to start local production of its brands in WB and cater to a wider market in WB. It needs to be seen whether this will help the company improve its volume/market share in WB.

Company expects to have full utilization of its expanded capacity in WB in Q422. Bihar plant is also expected to be fully back in Q4’22. So we may see some good revenue growth in Q4’22.

Key positive is that company mentioned that they expect Jharkand capacity to be fully operation by Q1’23.( I will take that with a pinch of salt considering the progress of WB expansion). Plans for Odisha are underway and a third site is under consideration by the management.

Discl: Invested and biased