“Developing new products is investment intensive, has a long gestation period with uncertain outcome. A new product can fail at any stage of the development process or could fail to get regulatory approval.” - Glenmark Annual Report, 2011-12.

Glenmark - Diversified Pharma Company with a presence in New Drug Development, Branded formulations, and generics business.

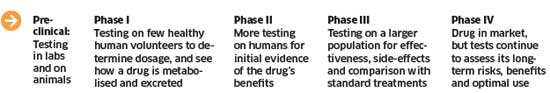

Innovation R&D: Seven novel molecules under different stages of clinical development with 2 outlicenced and 1 molecule completed phase III. So far, Signed 6 out-licencing deals since 2004 and received about USD 250 mn in milestone payments.

Glenmark has 3 dedicated R&D centers. NCE R&D Centre India is 1,25,000 Sqft facility on the outskirts of Mumbai mainly focused on Discovery and development of NCE (New Chemical Entity).

Biopharmaceutical R&D Centre, Switzerland, dedicated to the development of NBE (New Biological Entity).

Clinical R&D Centre, UK which undertakes both NCE and NBE research.

In addtion to the above, Glenmark has 3 more facilities in India to carry out R&D in Generics, branded formulations, and Clinical Research.

Apart from developing new molecules, Glenmark does R&D in NDDS (Novel Drug Delivery Systems). These products achieve their desired effects by altering release profile and safety profile of the drug. Eventhough the risk profile and the cost of development are less than that of new chemical entities, these products require a new drug application process and are protected through longer patent exclusivity periods. These products provide companies with a pipeline of products that can be marketed at a premium over simple generic products.

Formulations Business: Branded drugs with focus on Dermatology, Respiratory and Oncology. Key markets are India (30%), Russia & Africa (14%), Latin America (7%) and central Eastern Europe (5%). Among top 20 fastest growing pharma company in Russia and among top 25 pharma companies in India.

Generics Business: The company has a portfolio of over 80 Generic products in the US market with 40 products awaiting approval from USFDA. Glenmark has one of the largest ANDA approvals in Dermatology (19) and Oral Contraceptives (10) in the US. The company believes that focus on limited-competition therapeutic areas like Dermatology and Oncology, should continue to sustain growth even beyond patent cliff period of 2015 (when the number of generic launch opportunities likely to reduce as the patent expiries begin to recede).

Significant Opportunities for Growth: The company has nearly 75 per cent of revenues coming from the international market and 25 per cent from the domestic market. Drug consumption per capita in India is still among the lowest globally eventhough drug prices supposed to be cheapest in the world. Hence, there is tremendous opportunity in India itself.

Since growth from the US market may begin to taper from 2015, possessing critical mass in the rest-of-the-world market is essential to maintain growth. Most of the “pharma-emerging” markets like Brazil, Mexico, Russia etc are predominantly branded generics market which will be beneficial to Glenmark.

FINANCIALS

Sales up 36% to 4020 Cr from 2949 Cr.

EBITDA up 21% to 714 Cr from 592 Cr.

Profit at 460 Cr v/s 453 Cr. EPS 17.01 v/s 16.76

Equity Share Capital: 27.05 Cr.

Net Worth: 2401.63 Cr & Total Debt: 2244.50 Cr with Debt to Equity @ 0.93.

RoE (Avg): 20.9% & RoIC (Avg): 14%

Generating Free Cash Flow of about 500 Cr since last 2 years.

I am sure there may be better bets in pharma purely on Financial and valuation parameters. What has drawn my interest in Glenmark is the potential of innovation R&D.

A look at the molecules currently in the pipeline:

1). Revamilast - GRC 4039 - PDE4 Inhibitor: This “keeda” of being an innovator started sometime in 2000 with setting up of Glenmark Research Centre (GRC) exclusively for discovering new molecules. The first molecule unleashed was GRC 3015, a PDE4 inhibitor, for treatment of asthma and COPD. There was not a single PDE4 molecule in the market at that time and most advanced was Byk Atlanta’s Roflimulast which was in Phase III trials. Glenmark Receives Innovator award of US$ 75000 from Eli-Lily foundation.

During 2002-03 three more molecules GRC 3566/3590/3785 released as potential Backup candidates for GRC 3015. Other PDE4 under clinical studies by different pharma MNC’s have shown side effects of nausea and vomiting. Hence in 2003-04 Glenmark comes up with a highly selective PDE-4 Inhibitor Called GRC-3886 with no emetic side-effects and enters into a tie-up with Quintiles, a leading global Contract research organization for clinical testing of GRC-3886 in UK.

During 2003-04 GRC 3886 completes phase I trials in UK. The company collaborates with Forest Lab for North America (Sep 2004) and Teijin Pharma for Japan (April 2005) for developing and commercializing the molecule. GRC 3886 named as Oglemilast and goes into ph-II trial in US in April 2006, targeted to be launched in 2009-10 and receives USD 35 Mn as milestome payments.

Then, in Aug 2009 bad news comes from Forest Labs that Oglemilast did not show satisfactory reuslts during phase IIb of clinical trials. Glenmark Shares tumble over 17%.

Current molecule GRC 4039, again a PDE4 inhibitor is in clinical trials since 2006 and is in Phase II for treatment of respiratory disorders and Rheumatoid arthritis.

2). GRC 17536 - TRPA1 antagonist: During 2005-06, GRC 6211 - TRPV1 antagonist, molecule for a range of pain including osteoarthritis, enters pre-clinical stage and in 2006 completes Phase I. In October 2007, enters into an agreement with Eli Lilly and receives USD 45 Mn upfront payment. Then, on October 24, 2008, again bad news hits the market that Eli Lilly has

decided to stop further development after certain adverse findings during clinical trials. Glenmark shares hit lower circuit following the announcement.

Now, the current molecule GRC 17536, is in trials since 2010. It has completed Phase I trials for treatment of inflammatory and neuropathic pain in Netherlands and has obtained approval for Phase II studies in UK and Germany.

3). GRC 15300 - TRPV3 inhibitor: The molecule gets into pre-clinical stage during 2008-09 for treatment of Neuropathic, Osteoarthriic and other inflammatory pain. In May 2010 signs an out-licencing deal with Sanofi-Aventis and receives upfront payment of USD 20 Mn. Completes Phase I trials in UK. Phase IIa concept study is currently on.

4). Vatelizumab - GBR 500 - VLA2 antagonist: In July 2007, Glenmark purchases 2 New Biological Entities (NBE) antibodies from Chromos Molecular Systems Inc; CHR 1103 & CHR 1201. CHR 1103 named as GBR 500, is an anti-inflammatory compound to treat Crohn’s disease and Multiple Sclerosis. Phase I studies completed in US. In May 2011 out-licences to Sanofi with an upfront payment of USD 50 Mn. Subsequently it was named as Vatelizumab and currently is in Phase II studies.

5). GBR 900 - TrkA antagonist: In October 2010, gets an exclusive worldwide licence from Lay Line Genomics to LLG’s entire intellectual property in anti-TrkA field. Now known as GBR 900, completed pre-clinical stage and is in Phase I trials for chronic pain in Switzerland.

6). Crofelemar - CFTR inhibitor: IN July 2005, gets into an agreement with Napo Pharma, US to develop crofelemer for treatment of HIV-related diarrhea. In December 2011, Napo terminates the deal but Glenmark goes to International Centre for Dispute Resolution (ICDR) and gets a favourable interim order. Currently in Phase III of clinical trials.

It’s been more than a decade since they started Innovation R&D and still there is not a single new molecule that is in the market. Even if something comes out of all the above, what is the guarantee that it will become a blockbuster? I have invested in Glenmark and hope that it will be in my portfolio for a long time.

I have gone thru Annual Reports from 2001. What gives me confidence is certain comments of Mr. Glenn Saldanha:

Annual Report 2008-09: “The excitement of a rapidly progressing innovative pipeline clouded by a below-par business performance. What affected us at Glenmark was a mix of macro-environmental issues and certain unprecedented business events. The company was also impacted by inability to monetize any portion of its pipeline in 2008-09. Setback on GRC 6211 was the first reversal we faced on a fairly advanced NCE.”

Annual Report 2009-10: “We began the financial year on an unsteady note against the backdrop of tumultuous change in the industry and an ongoing global recession. The preceding year was one of the toughest Glenmark had ever faced - almost all of our business were impacted severely. Our drug discovery R&D lost out on potential revenues as global pharma was wary of acquiring any molecules that were under development. In addition, as sales slumped across markets, we were hit badly as our fixed ouverheads continued to be high due to significant investments we had made into fixed assets just before the crisis emerged.”

“However, we beat the odds and managed a transformation in less than a year…”

“The key aspect of our strategy was to improve our cash flow position. We focused on cost optimization, targeted improving working capital cycle, and managed to reduce net working capital.”

And finally, Annual Report 2011-12: “With limited capital expenditure expected and no acquisition plans for next couple of years, the business will continuously generate free cash.”

I have limited understanding of pharma business and my only investment in Pharma, Zydus Cadila, was not encouraging (I am no more invested in it).

I am eagerly looking for Hit Ji and other members’ view on Glenmark.