GANESH BENZOPLAST LIMITED

Introduction

Ganesh Benzoplast is a three decade old company started with

manufacturing, exporting and importing premium range of specialty

chemicals and have added Liquid storage business 2 decades ago. Had

some unrelated business like salt making and operation of vessels (safety

vessels which carry out evacuation or fire fighting for the operating sites)

for ONGC. Salt making business got destroyed in 2001 earthquake and

ONGC terminated contract. So the trouble started in 2001 and 2003.

Company is in BIFR and it has planned to come out in FY 2017-2018.

Company’s chemicals are very much in demand and they will be in near

future as they are used in food, pvc and lubrication industries. Tank farm

business will be the key growth driver for the company as it has gross

margins in the range of 45 to 50%.

Business:

Food preservatives, Plasticizers for PVC and polymer, Petroleum

Sulphonate and lubricant additives. More than 70 chemical products are

produced. This business has been the drag on the overall profitability of

the company for many years but now as the time is passing it is showing

the strength and has come to operating profit level which will be the extra

positives from the current improving situation for the company.

Chemical and oil storage business at JNPT (Mumbai), Goa (Mormugoa)

and Cochin. With total capacity of 3000000 Kilo Liter. JNPT is operating

at full capacity and the expansion at this site has been initiated. New

steel pipe has been laid to cater expanding need. This liquid storage

business requires the continue upgradation and monitor of existing

infrastructure so that the new capacities can be added and the safety

aspect of the operation is taken care of. Company has been on capital

expenditure mode for last few years to expand and to cater more liquid.

Services such as Product Blending, Logistics support via inland Rail

Transport, Bunkering-Barging, and Drum Filling and on site product

quality testing are also available.

Financials:

*Financials have been lumpy from time to time. One cause for this would be the fluctuation in

the prices of its raw material (crude oil) price coupled with slowdown in global market, as they

export their chemicals to Middle East, Latin America, Europe, USA, Canada and South East

Asia. They have been continuously working on the profitability. During the year, they have

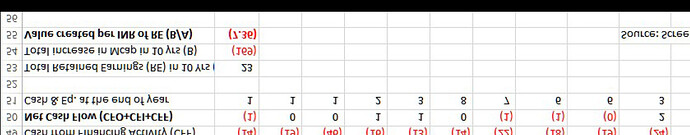

FY T sales T Profit Chem Rev./% P/L chem StorageRev/% TProfit storage 12-13 1183 216 557/47% -69 626/53% 285

13-14 1153 176 557/48% -92 596/52% 268

14-15 1222 41 564/46% -143 658/54% 184

15-16 1194 267 504/42% -62 690/58% 329

15-169M 895 173 393/44% -16 502/56% 190

16-179M 869 232 307/35% -58 562/65% 291

This slide shows that the cash flow is very strong and it has been used for

debt financing and not much for the capex. This is a very good sign of a

decent business for investment.

Investment rationale:

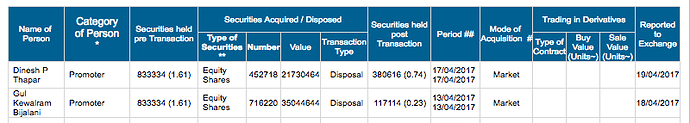

Company has been doing working capital expenditure since last many years and its chemical plant has been upgraded with new machines and equipment so no new heavy expenditure in near future. Tank farm require constant upgradation and safety instruments installation so going forward we can assume that 5 crore per annum expenditure would be more than sufficient. Extra cash would be used to enter at new place. Expansion is in the pipeline for new places and capacity expansion at existing facilities. Promoter have been increasing their stake since last few years.

Company’s Specialty chemical business was suffering due to high input cost low realization and one major cause was working capital stress. As company is progressing they are generating very good amount of cash which can easily take

care for the future growth plan.

Debt is down from 470 crores in 2007 to 150crore in 2016 with the help of cash generated by Liquid storage business and write offs of debt by the lenders.Total Equity has come to negative 30 crore on sept-2016 from negative 166 crore. Company have not gone to any type of equity dilution since last 6 years (may be they were not able to find the takers but for now this is a positive point for me).

Its liquid storage business possess moat. It has very high entry barriers like extensive experience in handling every class of liquid (classified as A B C type of liquids), to get land at port, heavy capital expenditure for new capacity and have to fight for the contract in front of ISO certified companies.

Future demerger of both business will unlock huge value.

Capacity utilization at Goa and Cochin is 80%. In coming quarters the new capacity added at JNPT will also come online. Growth of few quarter can be seen till the full capacity utilization is done.Planning to add LPG storage tanks at Goa site.

If the future of chemical industry is very bright in India then import and export of chemicals will be beneficial for this company. Valuation is reasonable in this unreasonable market.

Trade receivables have always been low with comparison to revenue and trade payables. This is also a sign of investment grade business.

Management pedigree:

MD is young and dynamic person and has been doing fairly in turning around the company.

We can find a lot about the MD Rishi Pilani in this interview afternoondc.in

of-a-turn-around/article_9449

Have not gone for any stupid decision in past many years.

Some Analysis by others:

We can refer to following report

http://www.nirmalbang.com/Upload/Investment%20Picks%20Diwali%202016.pdf

Blogger

Recent good comments by Brickworks rating.

http://www.brickworkratings.com/Admin/PressRelease/Ganesh-Benzoplast-BankLoan_46.50Cr-Rationale-

22Jun2016.pdf

– Top 10 Potential Multibagger Stocks To Buy Now

Risk:

No new capacity addition in Chemical storage business.

Major leaks at site and the liability part of environment can destroy the company.

Entry in to unrelated business and repetition of past mistakes of giving loan to associate

companies.

Disclosure: No holding.