First Concall by the company…My Notes (Invested and biased)

Air Spgs - Key Product

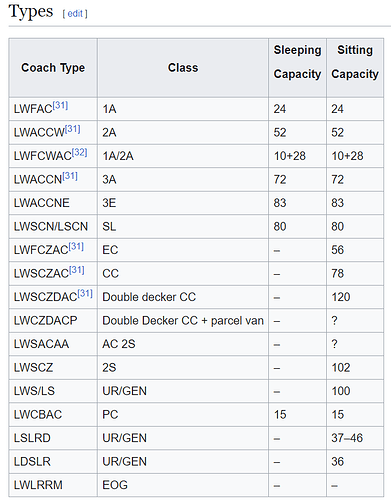

Used in passenger, metro coaches, Loco

Last yr IR demand was 3k coaches, CFY 5k, NFY onwards 8k per yr

TAM from NFY INR 600-800 Cr,

Only mfr in the country (03 current suppliers to IR, new entrant will take 2.5-3 yr to get RDSO approval)

Competitive Edge : Tech collaboration with conti with NIL rejection rate (others alligned with Chinese, with relatively lower quality), more than 70% sourcing is indigenous and hence qualifies for 'Make in India"

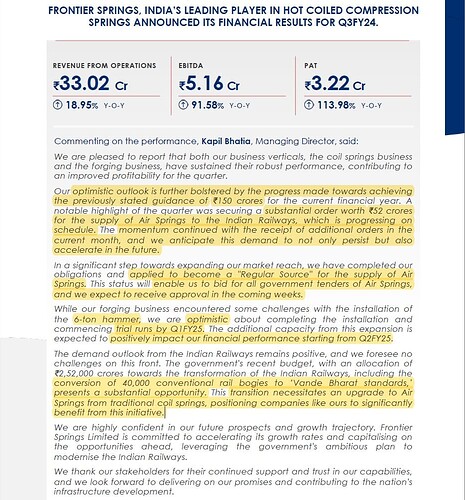

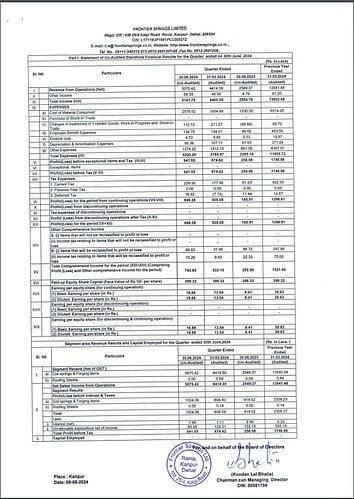

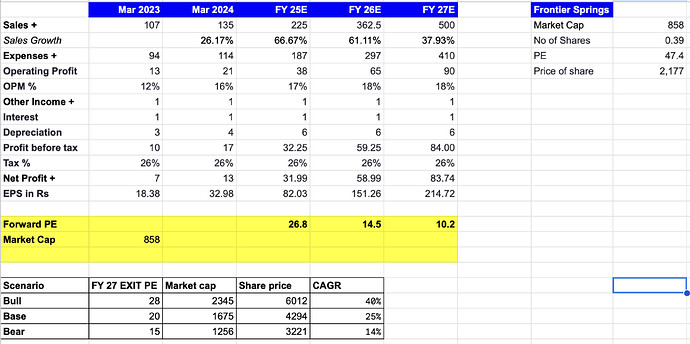

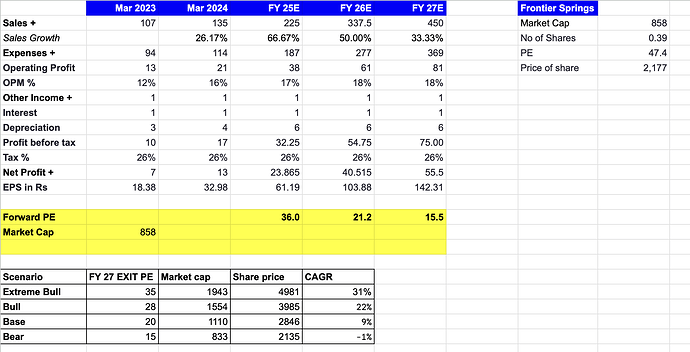

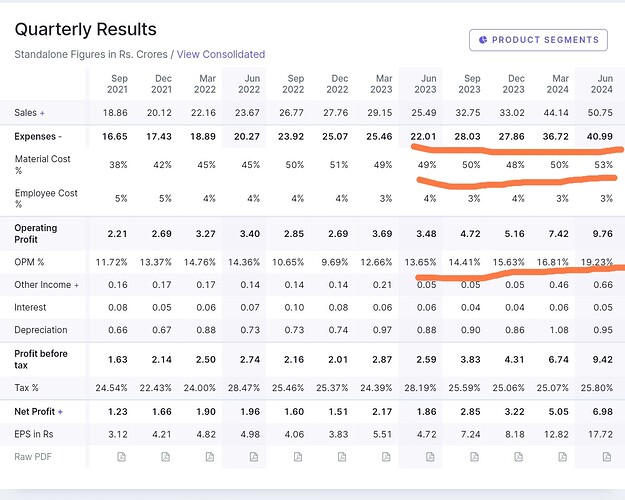

Earnings Projection :

CFY : 150-160 cr (up from 100cr)

Nxt yr : 200 cr

500 cr by 2027

Segment Rev :

CFY -Air springs 20 cr, Coil Springs-60Cr, Forging 70 cr

Diversification from Railway Biz

Entering def due to better margins

New defence order likely from BEML

Nxt area will be Tractors

Capex:

Total capex of 10-12 cr from int accurals

5 cr for air springs, bal for 6T hammer (forging)

Company to remain debt free

No further capex reqd to scale to 500 cr topline

Cap Utilisation:

Coil springs 70%, forging 50-60%, Air spgs- just started

Air spg capacity: Current 120 coach set per month ( 4 spg per coach= 480 spgs per month), being enhance to 800 spgs per month (capex - 5 cr), rev potn of 12 cr per month (144 cr potn per yr). This vertical started recently, will contribute 15-20 cr in CFY, VB coach per has 4 air spgs + 16 Coil spgs

Forging Outlook:

Expecting significant incr in forging (key area for diversification from railway biz)

Adding 6 T hammer

6T Hammer - trial prodn in Jan 24, comm prodn in NFY Q1

Rev profile : Currently 50-50 split for wagon:coaches, in future 70: 30 for rail: def

Significant growth targetted through forging in future

Mkt Share:

Dominant posn in mkt for both Air and Coil Sp

Can bid only upto 20% for air spgs, this is a limiting condn, likely to over come this nxt yr under push for ‘Make in India’, Bal 80% with other mfrs

FSL is 3rd or 4th mfr approved by RDSO

Replacement Mkt:

Coach/ wgn life 22-23yr

Spg gaurantee for 5 yrs, need replacement after that

Spgs are fungible across various mfrs

3 open bidding cycles/contracts thru life cycles

Quality:

Rejection Rate - NIL for air spgs (condn for RDSO apprvl)

1% for Coil spgs

Order Book : Current 69 cr done, bal 80 cr in CFY, continously receive orders from all wgn and coach mfrs. Will do 200 Cr NFY

Margins expectation (consolidated basis):

15% in CFY, NFY tgt 0f 15-18%

Coils -14-15%

Forging - 12-14%

Air Spgs - 22-23%

Misc:

Per wagon Rs 50K loading, pricing power exists, high demand from wgn mnfrs

Exports happening indirectly thru bombardier/siemens/Alstom Metro sales

Pl do supplement for better understanding