This certainly looks like a challenge for now. But, should keep in mind that exports form only 10-12% of standalone revenue and lots of manufacturing companies are seeing stable demand from EU, if not benefitting due to challenges there.

Elecon engineering Q3FY23 Con call Imp points:

- Maintain our guidance of 2000Cr consolidated revenue by FY2024, Capex 100CR by FY24, Overseas business 50% FY30 (Presently around 10%), start supply to OEMs in European markets

- Net cash surplus 66CR as at 31 Dec 22

- Outstanding retention 66CR

- Arbitration for 60+Cr reaching amicable settlement level

- Open order book – 720 CR (Gear 563CR)

- Industry outlook: Capacity creation in sectors like power, steel, mining, infrastructure, oil & gas

- Technological improvement in manufacturing processes, cost advantage, diversification by

global players away from China and supportive regulatory policies - In MHE no orders for EPC, focus only on supply of materials & after sales. Overall, have seen very good traction. Power sector lot of orders seen.

- Developing new prototypes for Marine industry for overseas market & Indian navy.

- For gear division looking to have own teams at various locations, especially in markets like South Africa, Australia

- Our pricing strategy has changed from yearly review to quarterly & hence we can see improved margins & this gives us confidence to maintain around same for coming quarters

- At 2000CR mark will be at 75-80% utilisation level

- Q4 should be better than Q3

- Expect EBITDA margin to be around 22% at 2000CR mark

- Presently discussing with 9-11 OEM’s outside & 3 have already visited Indian facility

. Gearless technology as on date is far fetched

My notes from concall

Q4 is generally strong

Can do 2500-2600 cr revenue at peak utilizations .

Margins may be around 21-22 % can drag a bit post next year due to OEM supply. ( Scale may go up margins make be little low )

Looking at sectors the company caters to they made in sweet spot for next 2-3 years( oil & gas / power / steel / cement / sugar ) all sectors are reporting good nos and spend on infra will only boost the demand for industrials.

Free cash flow in next 2-3 years will be solid. Intersting from next 2 years view.

Order flow need to be tracked. EV / railway can be darkhorse for them ( 2024/2025 ).

More clarity for 2024 post Q1 .

Elecon is a leader in wagon tipplers.

New Eon gearboxes from Elecon launched recently. Supports remote monitoring. Source: ELECON ने गुरुग्राम में आयोजित फेस्टिव इवेंट में अपने इंडस्ट्रियल गियरबॉक्स NEW EON किया लॉन्च - YouTube

Disclosure: Invested

- FY23 guidance is as Total Revenue: 1500 crs. (Q4 Revenue: 395 cr), EBITDA: 330 CRS. (Q4: 84 cr), EBITDA Margin: 22%.

- MHE segment was loss making last year which became profit making this year.

- Wants to reach revenue of 2000 crs by FY24. Seems achievable. Utilization levels will be around 75-80%.

- 100 crore capex planned in FY24.

Imp points Elecon Engineering concall Q4 FY23:

• Guidance FY24 – Consolidated revenue 2000CR – Gear div – 1700Cr & MHE- 300CR @22% EBITDA margins

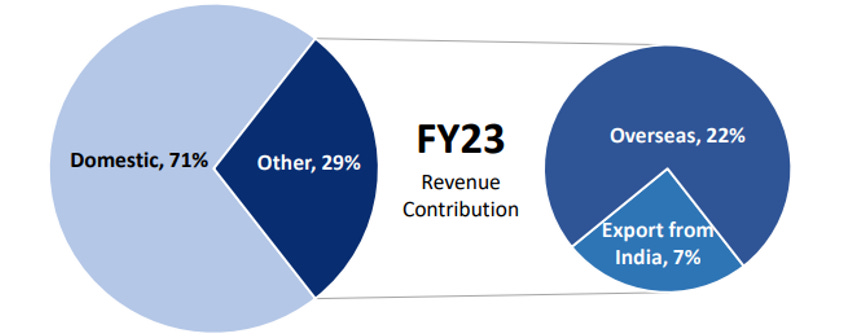

• Fy23 – 71% Domestic revenue, 22% from overseas subsidiary & 7% exports from India, see total overseas share going to 40% from 29%

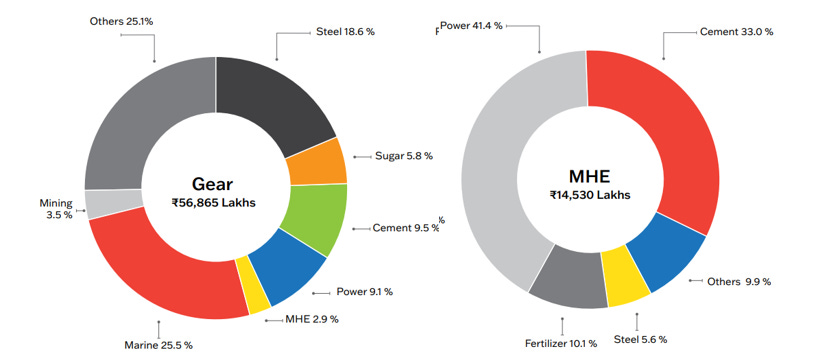

• Fy23 – Gear division 86% revenue contribution & MHE 14%

• New product launch – EON series 2 (6 products)– Caters to Steel, power, oil * Gas, rubber & plastics, water treatment, cement.

• Open order book 714Cr, 569cr Gear division & 145 MHE

• Focus is on targeting European market OEM’s, challenges in local market there present us with a good opportunity there

• Recently got significant approval from paper & pulp manufacturer in Europe (Largest in industry), already supplying some equipment’s to them from India

• 15Cr one off expenses (provisions on spares > 2 years, bad debts 4.8cr & other items), 8cr one off incomes

• Employee cost has reduced on account of actuary report – where provisions have been found more than adequate in previous years

• Gear division utilisation – 70%, MHE – 30-40%

• FY24 expecting Capex 50-60 Crs, utilisation will be FY25

• Goal in long term will be to: 1. Develop certain products where not present 2. Expand reach globally, especially Europe & USA, this includes looking for acquisitions & strategic tie up’s

• Replacement market for us is 20-30%, 70% customers are repeat customers

• Have been able to harness marine opportunities in Europe, looks to be promising.

• Indian navy intends to reorder ships supplied in past where we are preferred suppliers

• Expect new orders from power sector, where we are preferred suppliers due to our past supplies to them

• Since turnaround fast & prices of COGS vary, order book is not high

• Have 34% of organised market share in India

• Since we are conservative & expect opportunities, cash is reserved & hence limited dividend

• Higher numbers will be visible in Q3 &Q4

Hi everyone, can you please help me to understand this I am new and trying to learn this things,

I have recently opened the Elecon march Quater 23 report from screener, also the recent PPT of the company and on the PPT the PAT for 2023 year end is projected to be like this

And on the Elecon march Quater 23 report also it is 237 crores

what I want to understand is are these the future projections of the company and when I see the quarterly results the PAT for march is 68 crores so I need to understand this points:

1)can the company future projections also be updated in the screener as this years PAT(237) objectively.

because these are projections right pls correct me if I am wrong,

2)If we can then we are valuing this company on the basis of future projections?

3)How can the future projections which are not yet achieved can be updated on screener as

actual PAT is it common,

It would be great if you can help me to understand this I am new.

Thank you.

Screener updates data on what is reported not projected. So numbers are as per reported nos.

The 237 is for year 68 is for quarter.

Nos are for April 22- March 2023 .

Suggest you to read more on how to read company results / analyse no’s . SOIC by ishmothit could be a good starting point .

@Marathondreams @rahil_sayta Now I understand how this works Thank you guys.

If we add like below, we get 140 which is march 22 reported reesult and if we add like this we get mar 23 report.

140

AND

237

Thank you.

Elecon Engineering Limited

Few Growth triggers from annual report FY23

-

Reduced working capital days from 101(FY22) to 76(FY23)

-

inorganic growth throw expansion in new geography

-

Set a target to take its overseas and export revenue to 50% of the consolidated revenue FY30 (current FY23 is 29%)

-

New product development and enhancing value in existing products.

-

Capex plans 150cr for FY23 to FY25 funded by internal accruals.

-

Strong order Book for FY24 (At the end of fiscal, the Company’s order book in Gear business stood

at 1,39,668 Lakhs at Consolidated level and in MHE business stood at 22,288 Lakhs at Consolidated level.) -

The Company has now become net debt free at the Consolidated level.

https://www.bseindia.com/xml-data/corpfiling/AttachLive/542f9e3d-340c-49ab-829c-ccd16c421f13.pdf

Excellent result

Annual Report 2023 Summary

About the company:

Elecon Group was founded in the year 1951 in Goregaon, Mumbai by Late Mr. Ishwarbhai B. Patel. Initially, the Company manufactured conveyor systems with a focus on Engineering, Procurement and Construction projects in India.

With expertise of over six decades, the company has successfully established its position as Asia’s largest gear manufacturing company , directed by its global presence in Asia, US, UK and Europe.

Within the last decade, the Gear Division has doubled its manufacturing capacity.

The Engineering Sector and Gears :

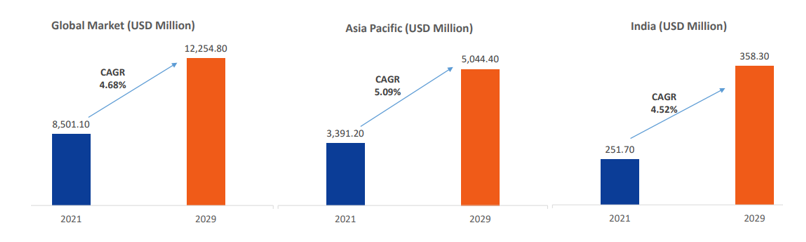

The Indian Engineering sector witnessed positive growth momentum on the back of increased government spending in core segments such as power, railways and infrastructure development as well as private sector investments in cement, steel, etc.

Capacity creation in the manufacturing sector along with technological improvement in manufacturing processes, diversification by global players away from China and supportive regulatory policies such as PLI bodes well for the growth of the industry.

However, the industry faced challenges in the form of higher commodity and fuel costs on the back of the Russia-Ukraine conflict which disrupted the supply chain.

Rising interest rates and concerns related to inflation and economic uncertainty could act as headwinds to growth prospects for the sector.

There has been a significant shift in the share of industrial exports from developed nations to low-cost base countries like India over the last few years and the trend is expected to continue going forward.

The market is benefitting from increasing investment in renewable power generation, especially wind power , for addressing increasing energy needs and reducing reliance on fossil fuel-based power.

Company Overview 2022-2023:

The gears business witnessed strong demand from end-user industries like cement, steel, sugar, power, etc.

The MHE business saw a remarkable turnaround with consistent improvement in performance due to strategic initiatives and is expected to keep up the positive momentum going forward.

Relentless focus on bringing down receivables has led to a decline in working capital days and all the legacy projects have been cleared and settled.

The company has now become net debt free at the consolidated level.

Elecon is actively engaging with leading OEMs and working towards becoming the preferred supplier in the European market .

The Company has set an ambitious target to take its overseas and export revenue to 50% of the consolidated revenue by FY30 .

The company is exploring opportunities in the defence space and is currently the only customized and complex Gear Manufacturer for Defence for the Indian Navy in India.

Orders in Hand as on 31st March 2023:

Recent Achievements:

- Elecon managed to complete the Coal Handling Plant at NTPC Mouda by overcoming various problems.

- They have successfully completed a 100% indigenous Urea bagging plant at RFCL, Ramagundam.

- They have executed the order for a wagon tippler with associated equipment for the third time consecutively from Paradip Port Authority by replacing the old tippler.

- They have successfully commissioned 2 sets of Wagon Tippler for M/s. BHEL at Wanakbori TPS, GSECL, Gujarat.

- They are about to close the order from Singareni Collieries for Relocatable conveyors for their mines located in the Ramagundam area. No load trails of the conveyors are successfully achieved and about to commission with load in Q1 of FY23-24.

- They have successfully completed an order from SAIL Durgapur for Barrel Reclaimer for their Plant.

- They have also received the order from SAIL Burnpur for a similar Barrel Reclaimer in FY 22-23. The supply & installation is completed and the machine is likely to be commissioned in Q1 of FY23-24.

- They have successfully completed the orders from Shree Cement for Jharkhand & Maharashtra plants and the Wagon Tipplers with associate marshalling equipment are commissioned.

Risks:

The company could be susceptible to strategy, innovation and business or product portfolio-related risks if there is any significant and unfavourable shift in industry trends, customer preferences or returns on R&D investments. Elecon does have the benefit of being very well entrenched with many of its customers, involved in their critical and strategic initiatives. Therefore, client concentration-related risks are mitigated to an extent.

Risks emanating from changes in the global markets such as the recent financial meltdown, regulatory or political changes and alterations in the competitive landscape could affect the Company’s operations and outlook. Any adverse movements in economic cycles in the company’s target markets and volatility in foreign currency exchange rates could have a negative impact on the Company’s performance. This risk is mitigated to some extent due to the Company’s presence in multiple and diverse markets. The Company also takes necessary steps such as forex hedging to mitigate exchange rate risks.

Elecon operates in a highly competitive industry , replete with multiple competitors, in both India and abroad. Shifts in clients’ and prospective clients’ dispositions could affect its business. While the Company has strong domain expertise, robust delivery capabilities and significant project experience, there is no guarantee that it will always get the better of the competition.

The Company’s operating performance is subject to risks associated with factors that may be beyond its control, such as the termination or modification of contracts and non-fulfilment of contractual obligations by clients due to their own financial difficulties or changed priorities or other reasons. Elecon does have mechanisms in place to try and prevent such situations as well as taking insurance cover as necessary.

Management:

Chairman and Managing Director:

Prayasvin B. Patel has 48 years of experience in the engineering industry. He started his career as Sales Director of Prayas Casting Pvt. Ltd, Vallabh Vidyanagar. Thereafter, he joined Elecon Engineering Co. Ltd. as Joint Managing Director on 1st July 1983.

From 1st July 1993, he has taken over the responsibility of the Managing Director of the Company, and in the year 2006 took charge of the overall responsibilities of Elecon Group of Industries as the Chairman and Managing Director.

Prayasvin Patel also holds top positions in many other companies. He is Director in companies like Eimco Elecon (India) Ltd, Power Build Pvt. Ltd, Prayas Engineering Ltd., Emtici Engineering Ltd, Elecon Information Technology Ltd, Elecon Peripherals Ltd, Eimco Elecon Electricals Ltd, Elecon Hydraulics Pvt. Ltd, Madhubhan Resort and Spa (a resort) amongst other small organizations. He also handles the responsibilities of Charotar Vidya Mandal (CVM) as the President.

Q1FY24 Concall KTAs

1. Outlook

-

Commitment to achieve consolidated revenue of INR2,000 crores with an EBITDA margin of 22% by FY24

-

Consolidated order book recorded order inflows of INR497 crores (Gears - 446 crores & MHE - 51 crores) during Q1 FY24 and the total order book as of 30th June stood at INR793 crores - INR 138 crores for MHE division and INR 655 crores for gear division

-

Singed five OEM business in European market with an estimated annual estimated business of approx Euro 5 million. The prototype is under development and to be supplied to OEMs in Q3FY24. Commercial production is expected to start by FY25. OEMs cater to industries like steel, rubber, plastics etc

-

Going to set up a wholly-owned step-down subsidiary in South Africa to cater demand in the African continent, primarily in mining and minerals turnkey projects. These plants require large quantity of gear boxes that are normally bought from Europe and US.

-

Exports are expected to be 40% of the revenue in FY24 vs 29% in FY23

2. Industrial Gear division

-

Domestic demand was driven by power, steel, cement, sugar, mining, and infra sectors, and the government’s thrust on industrialization and localization. Q1FY24 also witnessed a higher (33%) percentage of replacement demand, which will normalize to 20–30% going forward.

-

Remains one of the largest suppliers in industrial gears in India, with 39% market share in FY23 against 34% in FY22 in the Tier 1 domestic market

-

Target to achieve INR1,700 crores of revenues in FY24.

-

Increasing investments in marketing and sales activities. Utilisation in industrial gears stood at 76% and revenue can be scaled up using sub-contracting. Hence, the management is expecting only nominal capex for modernisation and upkeep, with no major capex over the next 2-3 years.

3. MHE division

-

Target to achieve revenue of INR 300 crores in FY24

-

Margin can touch 18–20%. Improvement in operating performance in the MHE division, due to change in product mix and higher sale of after sales and repairs, led to an EBIT margin of 23%.

-

Surge in business fueled by revival of the capex cycle and strong demand from industries such as power, fertilizers, cement among others

-

Focus on supply of products and aftermarket business, while discontinuing involvement in EPC project businesses.

-

In the past 12-to-18 months, have successfully turned around our MHE division resulting into a profitable business

From the Q1 Concall, And Annual Report, Some of the growth drivers as per management are -

- Focus on marketing in Africa to tap the business from minerals mining customer’s

- Additional business from OEMs across the world, particularly from the 5 OEMs in Europe from whom they are seeing good opportunity.

- Continue to build on the turn-around that have happened in MHE division to improve margins

- New opportunities from Defense for gears required in marine engineering

- Benefit from the capex taking place in Power, Mining and Minerals, Steel and Cement sectors in domestic market. Govt of India have made good number of allotments for the mines over last couple of years. Subsidiaries of Coal India have plans to execute several new projects(which looks likely given surging power demand due to buoyant economic activity in country).

- Potential foray in manufacturing gears required for Metro as well as Looking out for opportunities in mechanical power transmission drive.

- Develop new products with investment in R&D for the existing customers

Being debt free and having about 250 Cr. cash in hands will help the company to take up new opportunities. Their capacity utilization being 76% percent and plans to improve sub-contracting percentage to deliver increased business to keep capex only in range of 10-20 Cr. will improve the return ratios and profitability.

Disc-No investment as of now.

Snippet from Annual Report -

Decent amount of mutual fund buying during Jul’23

Price run up has been steep i expect some positive suprise going forward. Some immedite relative have also bought shares from open market around 830 levels.

I believe their MHE division should show a strong growth as overall infra companies are getting good orders . Gears division looks on track to deliver as promised.

Margin expansion could be a possibility with benefits of scale being achieved by company.

Overall need to watch out growth plans for next year & MHE orders and and order book for exports markets where lot of.efforts are being routed

Invested since June 2021 . No transactions lately

Elecon Engineering company - latest results highlights-

One of Asia’s largest Industrial gear manufacturing company. Capable of making complex gear boxes for Defence applications (Indian Navy)

Has widest range of gear applications across Industrial sectors - industry agnostic

Mfg and assembly plants in India, UK, Sweden, US and Netherlands

Has in house foundry and fabrication facility

Has robust Mkt Share in highly fragmented and unorganised Mkt

Industries served - Power, Cement, Sugar, Steel, Defence, Rubber, Mining etc

Export revenues @ 30 pc

Also has a material handling Division. Has now turned profitable

Q1, FY 24 highlights -

Sales - 414 vs 328 cr, up 26 pc

EBITDA - 96 vs 72 cr ( @ 23.1 vs 21.9 pc )

PAT - 73 vs 42 ( @ 17.6 vs 13 pc )

87 pc revenues from Industrial Gears, 13 pc from Material Handling business

Segment wise performance -

Gears - Sales - 485 vs 361 cr, up 26 pc. EBIT - 89 vs 55 cr, up 60 pc

Material Handling - Sales - 54 vs 43 cr, up 25 pc, EBIT - 12 vs 5 cr, up 160 pc

Past 5 yr CAGRs -

Sales- 12 pc

EBITDA- 34 pc

PAT- 38 pc

Current consolidated order book @ 790 cr

Aim to hit FY 24 sales @ 2000 cr with 22 pc EBITDA margins (with a scope of margin improvement)

Company witnessing increasing demand from Africa. To set up a fully owned subsidiary to cater to that demand

Company has a net Cash surplus position of aprox 250 cr at the end of Q1

Have entered newer Mkts- Australia, South America. Seeing good response here

Have got 5 new OEM orders in Q1. Can generate an annual revenue of around 40 cr from these OEMs

May lead to bigger business going fwd, as the relationship matures-company is bullish about the situation

Expecting good orders coming in from Defence sector from next FY onwards. FY 26,27 also look promising iro defence orders

Replacement sales in Q1 as a proportion of total sales was at 33 pc

Company sees a ROSY demand picture in FY 25 and beyond as well

Likely to start supplying gear boxes to Railways and Metros in near future

Current capacity utilisation @ 76 pc. Nominal capex required for next 2-3 Yrs as the company can also resort to sub-contracting

At present, 70 pc of company’s customers are repeat customers

Disc : planning to take up a tracking position

Highlights of Q2 FY 24

Management is confident of revenue guidance given earlier of 2000 cr

Margins have been north of 24 % in latest Quarter and with cautiously optimistic view it looks like margins may sustain or improve based on product mix going forward as well

MHE had a 50 cr new order and we may see some more orders going forward .( my reading )

Exports segment is a WIP and should yield result in due course.

Cash on hand and may explore opportuniry at opportunite time to invest / diversify / expand capacity.

Current capacity 73 % gear division and scope of going upto 85-90 % + outsourcing possible

Steel / cement / power / sugar * sectors expected to contribute positively to the order inflow.