Business overview

EID Parry is part of the Murugappa group, one of the oldest business groups in India with 28+ businesses and a long history of fiduciary responsibility.

- Parry is the largest sugar manufacturer in South India. It started in 1842, when it opened the country’s first ever sugar plant at Nellikuppam, Tamil Nadu

- 30% of the sugar output is sold under the Parry brand, while 70% is sold in bulk.

- The management team have indicated that they are planning to “move up the value chain”, with more focus on their branded line of sugar and nutraceuticals (spirulina , palmetto etc.).

- The Indian government curbed sugar exports in 2023, in order to control domestic sugar prices

- To combat the sugar business’s cyclicality, Parry has also significantly invested in distillery capacity, aligning with the Indian government’s plan for increased domestic energy supply.

- Their branded sugar and FMCG business (27% of their revenue) is scaling rapidly, with the number of distribution outlets increasing from 20k in 2021 to 110k currently

- Apart from this, they also have a power generation and sugar refinery businesses, both of which have struggled to maintain profitability. These two business have depressed the margins over the last five years, which were around 1% on average.

- Even if loss-making units break even, margins would only increase to a razor-thin 2-3%, reflecting the commoditized nature of the sugar industry.

The Murugappa group took over EID Parry in 1981 and now own 38.3% of business:

EID Parry, in turn, owns 56% of Coromandel International (ValuePickr page link), which it had co-founded in the 1960s.

- Coromandel is the largest private phosphatic fertiliser manufacturer, and 2nd largest overall. The company enjoys 60% market share in the ‘Rice Bowl’ regions of Andhra Pradesh and Telangana

- Around half of Coromandel’s sales come from exports, where they see significant headroom for growth

- IFFCO, which is a Fertiliser Cooperative, is the largest fertilizer producer in India, with roughly twice the revenues of Coromandel. Coromandel has been gaining market share, with revenues growing ~11% CAGR since 2019, while IFFCOs sales have remained flat

Balance sheet and capital allocation

-

EID Parry had significant debt before 2020 but has since paid down a majority, leading to a fortress-like balance sheet and net cash of ₹23 billion (₹2300 crore) as of March 2024

-

This gives them flexibility to invest in sugar-adjacent businesses (like distillery & nutraceuticals) and buy depressed assets during market downturns.

-

Capital allocation has been hit-and-miss, with some of their ventures like Coromandel and the sugar distillery investments generating high ROCE , while other ones like the refinery have had very poor returns.

- Overall , ROCE has been exceptional, averaging 26% since 2017

- The management has expressed interest in further inorganic expansion in the FMCG space, but they have been pretty prudent so fair in sizing their capital investments, while maintaining a pristine balance sheet

- Parry have also reduced their Coromandel stake from 60%+ to 56% currently. But don’t seem to have any plans to further trim their position.

-

They haven’t fully reinvested their earnings. So, they do pay out dividends and have built up a cash position. An approximate capital deployment break-down over the last few years:

- 50% re-invested into CAPEX

- 30% paid out in dividend

- 20% going to debt repayment or cash reserves

Valuation

Many of the previous valuations I’ve read online seem to take a comparative valuation approach with a “Hold-Co discount” added on top. However, I chose to employ a discounted cash flow analysis, assuming the earnings of Coromandel will flow through to EID Parry shareholders eventually, either via dividends or incremental equity ownership.

Warren Buffett follows a similiar approach, by using “look-though earnings” to value Berkshire Hathaway and other holding companies. Subsidiaries should only pay dividends if they cannot re-invest capital in their business at a high hurdle rate.

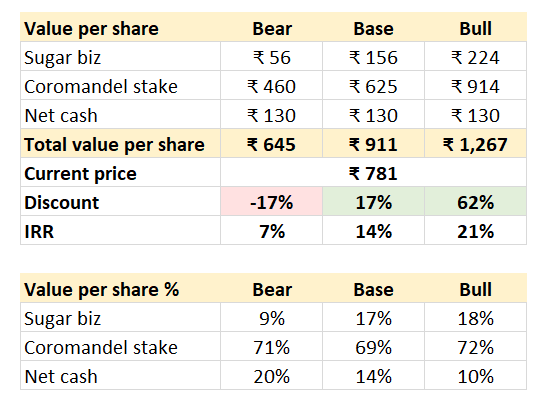

My estimates for value per share are given below. The full assumptions can be found here.

Notes:

- The Coromandel stake represents ~70% of EID Parry’s value per share, so it forms a core part of the investment thesis. At current prices, you are essentially getting the sugar business and assets for “free”, as the Coromandel stake and net cash are worth ₹755

- If I valued the Coromandel stake at their current market price instead of using a discounted cash flow method, EID’s 56% ownership of Coromandel equals ₹1112 per share (after subtracting 25% in taxes) - 20% higher than my bull case estimate of ₹914. The markets seem to be valuing Coromandel with double-digit growth expectations for the next decade.

I had initially bought EID Parry in March 2022 and added to my position subsequently, so my average cost is ₹508 (much lower than current levels). The stock now looks close to fairly valued, with the gap between price and value narrowing significantly since the beginning of 2024. The stock currently represents 10% of my India portfolio - I plan to hold it for the next several years (or ideally forever).

PPFAS has also invested in EID Parry since January 2024. However, it currently represents a small portion (0.2%) of their flexi-cap fund. They appear to have stopped adding to their position since February 2024, when the share price was around ₹600.

Future growth potential

The current stock price seems fairly valued, but provides some free “call options” that I haven’t consider yet in the valuation:

- EID Parry

- Indian sugar consumption could grow significantly: Indian per-capita consumption is around 22kg per year, while developed countries are at 36kg per year.

- The Indian government drops the sugar export ban, leading to higher sugar realization prices

- The Indian government ramps up the Ethanol blending program to reduce reliance on energy imports (similiar to Brazil)

- FMCG grows to become a significant part of the business (similiar to ITC’s successful scale-up)

- The freehold land bank owned by EID Parry, which they estimate to be valued at ₹394 Cr (or ₹22 per share of EID Parry)

- Coromandel could significantly ramp up export volumes: their current capacity is 4.5MMT (million metric ton), while the largest global crop nutrient manufacturers are close to 20~30MMT

Risks

- EID Parry

- Global sugar prices plummet lower than EID’s production costs, leading to under-utilization and losses

- The Indian government sets the MSP (minimum support price) for sugar purchases from farmers and could end up squeezing EID’s sugar margins.

- Poor monsoons or pest related issues in South India, leading to lower sugar cane yields

- Coromandel faces significant litigation risks related to toxic chemical handling. The most recent example was a gas leak at Ennore on Dec 2023, which resulted in a fine of ₹6 Cr.

Let me know your views and if there are any risks I didn’t mention.

Disclosure: invested, potentially biased.

Thanks,

Sharad