You can’t really value a aggressively growing company with an existing metric. If you do, it always looks like overvalued.

That is why you look outside the company and how it impacts future of the company(revenues, sales etc)

Somehow my question is not understood. I’m just asking about how to value a wealth management company…not how to value Nuvama or implying if it’s overvalued.

What I have found so far is that most common multiples used when valuing wealth management firms are EV to EBITDA, EV to AUM, and EV to revenue multiples.

That said I have a specific question about Nuavama.

Their asset under management is some 70000 cores but 12 months trailing annual revenue is 2800 which translates into roughly 4% fee. I believe that’s way too high for a wealth management firm. Given that a big chunk of their revenue is concentrated in wealth management, what could be reason for such high fee? Is it sustainable?

₹2,41,837 Cr Client assets as of Dec 23 for Wealth Management.

I guess you have not even had a look at presentation or any one con call of the company… If you watch above video you will get quite an insight about this business, and if your seriously thinking to invest then irrespective of your question you must watch the video.

Jio + BlackRock entry into this space,

Does anyone know the tax implication of selling stocks aquired via demergers? Might help if someone can summarize or provide some links to read.

Following is the scenario for context:

I purchased Edelweiss stock in Feb-Mar 2022. So I had the holdings already for more than a year before the allotmemt of Nuvama stocks in 2023.

Now, I have sold all the Nuvama holdings in Apr-2024. I dont know whether it will be taxed at LTCG or STCG? Also, what will be considered as the buying price to calculate profits to be taxed?

I still own all the Edelweiss stocks purchased in 2022.

I think a price based on your edelweiss price will be calculated and LTCG will be applied.,

Eg:say at feb 2022 your Edelweiss at rs 70 , then Nuvama price will be rs 1900 during demerger

Con Call Notes for Q4-24 (CMR 80) . PPT

Co-Lending

-

Making a lot of backend investment. 2/3rd focus is building the backend.

-

HFC 880 cr equity. Following the old model Housing Fiance model 1.0.

- HF 2.0 - Co-Lending

- In 4 to 5 quarters, will be double-digit ROE (from 3% in Q4). Expect a fairly good uptick in it.

-

ARC dominant player- 40% market share

-

Wholesale reduction will take another two years, but it is becoming more and more insignificant.

- Projects are going well. Sell down are expensing. 15/20% more expensive.

- There are 4/5 projects we might have to go to NCLT, but wholesale is becoming insignificant

-

In the next two years- By selling, AIF/Nuvam will be liquidated in 2 years. Current net debt shall be reduced from 7500 to 3500 cr in the next two years.

-

Business will start giving dividends from the underlying dividends.

-

Insurance business losses have peaked. They will reduce going forward

Mutual Funds

-

NON-ETF- 100,000 cr in another 18 months.

-

MF industry- A good driver of profitability is equity AUM. In the next couple of years, we aim to achieve 50% of equity AUM. Most good players are between 50-60%

-

Equity AUM has an upfront cost.

-

Good cost to income 50 -60%. Ours is 85. Aiming to bring it in line with the industry

-

Last year invested. Opened new offices in new cities. Only in 30 cities. We could go to 100 cities.

-

Each branch takes 50/60 lakhs to set up. The branch will break even in 6/8 months, depending upon the product mix.

-

Staying power is very important.

-

13rd largest AMC in India

-

It is a scale business.

-

It takes about 5 yo 7 year and 100,000 to get to scale. New players needs 5/7 years and 3000 cr of investing to come to 100,000 cr AUM and need lof of AUM.

Corporate Debt

-

13,000 cr now

-

3000 cr of liquidity is holding

AIF (Alternative)

-

Lot of competition in private credit.

-

They are on third funds in most of our strategies. Carry income from the first and fees from the second coming in.

-

They have a track record. It matters when you are scaling your business. It need strong distribution within India.

-

They have distribution in India and abroad.

-

Deployment of around 7k in FY23 and Fy24.

-

The primary focus is risk management, not deployment.

-

FY24 will focus on closing funds, and FY25 will focus on deployment. Hope to scale the business in Fy25

-

Clocking 250 to 300 cr annualised profit (based on 75 cr PAT in Q4)

-

In the next six months (Oct to Dec quarter), long-term plan for the business including listing.

-

There are 5/6 segments called AIF. We are only in two

1- PE. We hope to do business

2- Private Credit

3- Infrastructure

4 Real estate (e.g. REIT)

5- Hedge Funds (PMS/Public)- No there -

Enough space to grow within existing spaces and also to enter into new spaces.

-

The key is expertise, which takes 5/10 years to build and build a track record and distribution.

-

Globally, when there is a fee plus carry, it is called an Alternative.

-

Valuation

- AIF trade to 10-20% of AUM

- Blackrock acquired a company and paid 15% of AUM.

- India - PE multiple is 30 to 40 for different asset management companies

RBI action.

Quick Google:

The Reserve Bank of India (RBI) has imposed business restrictions on two Edelweiss Group companies, ECL Finance Ltd and Edelweiss Asset Reconstruction Company Ltd (EARCL), due to material supervisory concerns. These actions are based on observations from supervisory examinations, which found that the group entities were acting in concert to engage in structured transactions for evergreening stressed exposures of ECL using the platform of EARCL and connected alternative investment funds. This was done to circumvent applicable regulations.

Specifically, the RBI has directed EARCL to cease and desist from the acquisition of financial assets, including security receipts (SRs), and reorganizing existing security receipts. For ECL Finance, the RBI has directed it to cease and desist from undertaking any structured transactions in respect of its wholesale exposures, other than repayment and/or closure of accounts in its normal course of business.

The RBI has also highlighted incorrect valuation of security receipts by both EARCL and ECL, and other supervisory observations for ECL include submission of incorrect details of its eligible book debts to its lenders for computation of drawing power, non-compliance with loan to value norms for lending against shares, incorrect reporting to the Central Repository for Information on Large Credits system, and non-adherence to Know Your Customer guidelines.

The RBI’s actions are based on concerns that these activities circumvent regulations which permit asset reconstruction companies to acquire financial assets only from banks and financial institutions. The restrictions will be reviewed after the rectification of the supervisory observations by the group to the satisfaction of the Reserve Bank.

Given market buoyancy and positive feedback received, EAAA may also explore IPO/listing – more update in next quarter ![]()

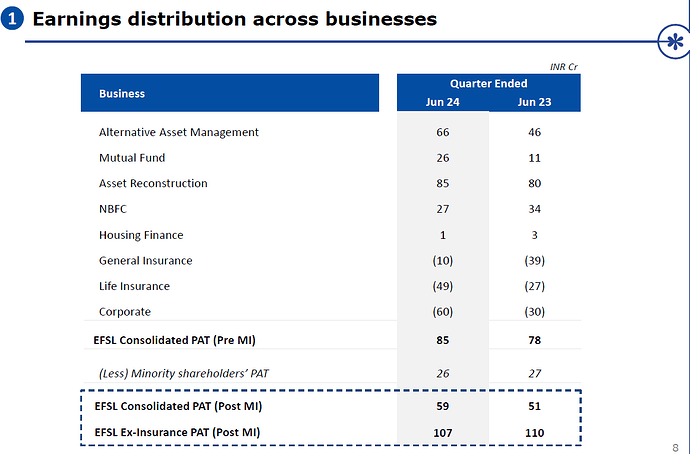

Edel declared Q1 result today.

My 2 cents:

At the current rate, AIF annualised PAT is around 250 cr. However, as the rate is accelerating, it could be 28-300 cr PAT just for AIF.

The mutual fund business is also taking off, with the best PAT ever of 26cr. Their SIP portfolio is growing at a good rate, and they are getting more equity MF. This could be 80/100 PAT for Fy25.

They are setting off AIA spin-off again. I think they should distribute the shareholders the same way they did for Nuvam instead of IPO. In the case of IPO), Edelweiss may get money, but as a shareholder, I want money to be in my hand and not in the hands of management (as they have made a lot of capital misallocation in the past). The Nuvama spin-off was rewarding. I hope AIF/MF follows in line.

AIA profit (AIF +_MF) at annualised rate is 300+ in Fy25. Assuming 20/25 PE, that business is worth around (6,000 to 7,500 cr) at today’s price, which is Edelweiss’s market cap at CMP.

Wholesale reduction of 200cr is on target, less than planned thought. I think this is a sticking point. If wholesale is to be removed from their business, Edelweiss will be quoted at multiple times the current price. But it is not likely to happen. Most of the pending Wholesale must be hard to get rid of , so time is the medicine here. They want to reduce to 1250 cr in June 2026, which is eight quarters away. From 3900 to 1250 (reduction of 2650 cr) in 8 quarters equates to a reduction of 325cr per quarter. They are nowhere near that rate in the last 6 months, so current projects look optimistic at the moment.

General insurance losses are reducing further. Hopefully they keep the momentum. Life insurance is not showing sign if getting better. Hopefully from Fy26 onwards their looses reduce (long if).

Nuvama has declared a dividend of Rs 81 per share, for a total of 289 cr. Edel owns around 14%, which means they will be getting 40cr of dividends in Q2, which will be handy. Additionally, this dividend will be a regular affair going forward.

Note: Long term invested

Hii @paragbharambe

I am just sharing my guess and views ,

Disclaimer - please anyone don’t take it as buy or sell recommendation

Views

-

EAAA - they will go with IPO route , I don’t think they are getting right valuation for it as EFSL itself is trading at low valuation and( I don’t know it is possible or not )they can distribute the shares of EAAA to EFSL shareholders can delay (FY26) as majority earnings comes from this business and other businesses are still not mature

-

MF - great this business is growing But I think they should also focus on Alternatives currently they have around 1100crs AUM as per MF annual report fy 24 (it is from 2018 ) but couldn’t scale, let’s see latest business update mansion it

-

credit businesses - no hopes

-

Insurance businesses - life insurance business is struggling with grow but there can be upside if new accounting rules comes

-

ARC - management should give some clarity how the business will look in 3-5 years, how they will create value to shareholders as can’t be listed, and under which business it will do (I think mostly credit business) very very deep cyclical business ( for 12 -15 Years it can remain out of favour), they are continuously reducing the ARC debt

-

corporate debt - in the last AGM 2023 management gave range something around 7500- 8800cr currently they have exceeded it to 9300cr ?

Amc

Credit business

Life insurance

I think this will be the structure for value unlocking and once management shared during concall and all the businesses will require capital so IPO route and as Edelweiss will not trade on rich valuation to raise for its businesses (assumptions - they don’t want to be a holding company)

Debt reduction ways -

- nuvama wealth - 3000cr 3500crs (more upside possible) ( can sale stake after 1 yr locking period ends after 26 sept 24 )

- EAAA stake sale 1500 - 2000crs (possible upside IPO ROUTE )

- EAAA investments - 1300crs (can’t say )

- NBFC business current equity 3500crs will go down to 1500crs so 2000crs ( can’t say )

Real estate - 1500crs (can’t say )

Investments - 800crs (can’t say)

Any other businesses stake sale (possibility) may required to grow them as well ( strategic)

So that’s were my views please don’t take it to buy or sell recommendation

guys please share your views too

Seems a little optimistic on the AIF valuation given poor ROE…overall Nuvama stack, plus MF at 3K valuation gives enough cushion for valuation - assuming they don’t do same mistakes on the lending side

Disc: Invested

I think they’ve made their intentions for a value unlock pretty clear. Rashesh has committed to putting out a plan for the same.

The valuation today is justified by the Mutual Fund and Alts business alone - they are the key assets here.

Take those out and you’re left with 2 poor NBFC, sub-scale Insurance businesses, and an ARC that has ceased to be an attractive business anyway. The only hope is in insurance.

Very good reports by ValueQuest on wealth management and AIF, which is relevant to Edelweiss.

Valuequest-Riding-the-Wealth-Wave.pdf (5.0 MB)

@Worldlywiseinvestors has done very good YouTube video on AIF/Wealth which covers edelweiss.

Edelweiss prepares to list its alternatives arm