Business Description

The company has 2 broad divisions: Food colors and Dye intermediates.

Dynemic Products is a manufacturer & exporter of food colours, Lake Colours, Blended Colours, US-FDA certified FD&C Colours & Dye Intermediates. Food colors are added to food and drinks to create a specific appearance. The global food colors market is primarily driven by the increasing demand from the bakery & confectionery and the beverages industry.

Various end user applications listed on Company website are:

- Soft drinks & Beverages, Alcoholic & Non-Alcoholic Drinks

- Pickles, Sauces & Seasonings, Cheese, Jams & Jellies, Dessert Edible Ices & Confectionery, Baked Goods

- Animal Feeds

- Bath Soaps, Shampoos, Washing Powder

- Toothpaste

- Decoration & coatings

- Pesticides

- Tablets & capsules

- Writing Inks

- Toiletry Products

- Canned Products

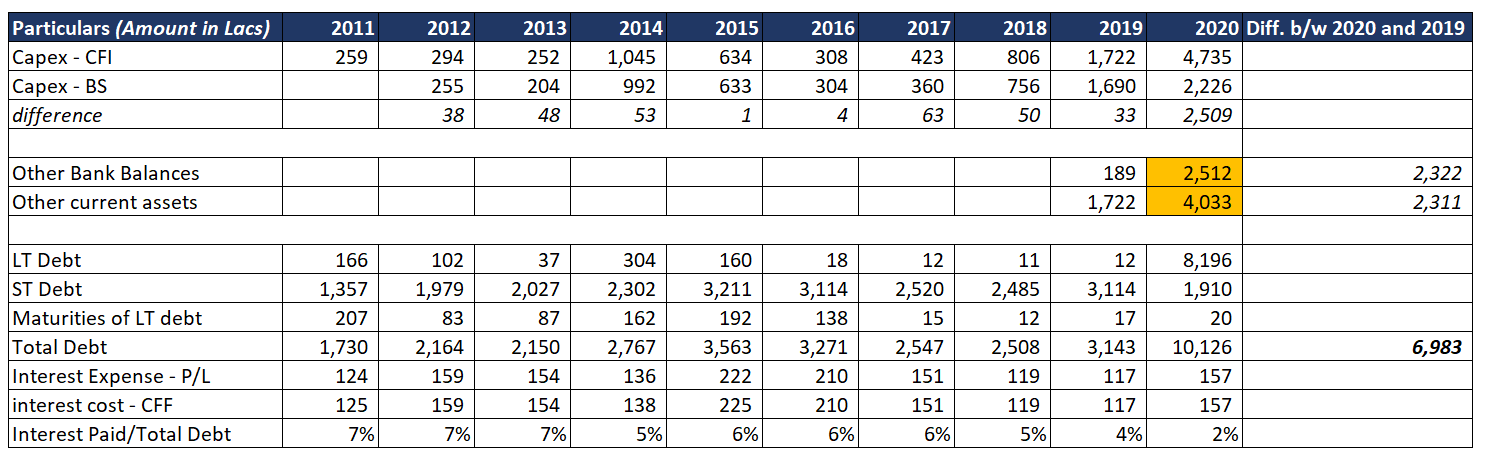

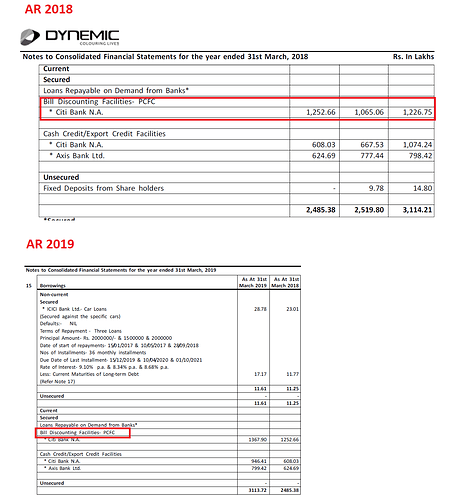

Financial Analysis

One can find on screener that the center of the investment thesis is the Capex (CWIP) (which is 4-5 times Net fixed assets).

I compare Dynemic’s financials with those of Vidhi Dyestuff (listed indian peer) and Sensient Technologies (Largest food color maker). All the data here is for FY19/20.

| Company |

Dynemic Products |

Vidhi Dyestuff |

Sensient Technologies |

| Total Revenue |

180 |

225 |

9400 |

| Revenue from Food colors (in INR cr) |

140 |

182 |

3850 |

| Capacity Utilized (in MT) |

2950 |

3799 |

20000 |

| Realization (per kg) |

474.57 |

479.07 |

1925 |

| Gross Margins (%) |

45 |

46 |

31 |

| Operating Margins (%) |

20 |

22 |

19 |

| Assets Deployed |

138 |

150 |

5284 |

| Non-Current Assets Deployed |

34 |

37 |

3480 |

| Asset Turnover |

1.01 |

1.21 |

0.72 |

| Non-Current Asset Turnover |

4.11 |

4.91 |

1.1 |

| Employee Costs |

9.3 |

7.34 |

? |

| Employee Costs/Revenue |

0.05 |

0.03 |

? |

| Employees |

216 |

66 |

4058 |

| MD Salary (in lakhs) |

42 |

200 |

? |

| MD Salary to Median Salary Ratio |

22 |

70 |

? |

Notes/Caveats: 1. Food color is the more interesting segment to analyze (higher value added, higher realization, higher volume) which is why most analysis is about that segment.

2. Figures in bold apply for the entire company whereas those in normal font apply for the Food color segment.

4. Sensient does not have salary/Employee costs related data. Food color is only 25% of the revenue for sensient. Food colors segment is most profitable for Sensient (highest operating margins). Food Color segment also saw slowest degrowth, largest acquisitions and largest amount of accounting goodwill (indicating previous acquisitions).

5. For Dynemic, I have excluded the CWIP while calculating asset deployment since it would not tell us about the operating efficiency of already deployed assets. To find the segmental assets deployed, I have multiplied the company level number (eg: Total Assets for the segment = Total assets for Company*(Percent of revenue from the segment). This assumes that the asset turnover is the same across segments. Due to lack of any granular data, this simplifying assumption had to be made.

6. For Vidhi, they do not provide a breakup between Food and dye segments. Only between Manufactured and traded products. I have excluded the traded products.

7. Sensient provides the cleanest segmental data (except gross margins). Used as is from 2019 AR.

8. For capacity utilized, for Dynemic I have relied on 100% utilization. For Vidhi, number is taken from AR. For Sensient, number is taken from VP public threads.

Observations from the data:

- Operating margins are very similar across the companies.

- Gross margins are very similar for Vidhi and Dynemic. Gross margins might be low for Sensient due to the number available being company wide number.

- Asset turnover is much higher for Indian producers. This stands out specially when looking at Non-Current Asset turnover.

- Realizations are much higher for Sensient. This either means that Sensient sells much higher value products or it means that if Vidhi and Dynemic can produce the same product, then for any client, buying from Dynemic/Vidhi makes a lot more sense. (This can be a reason for high export growth).

- For driving the same topline, Dynemic employees a much larger number of employees. This needs to be investigated further. This could either be a source of advantage (if they are hiring employees for the new plants) or a source of weakness (if they are simply less efficient as a company). Looking at FY15,16,17 numbers for number of employees, it appears to be more of latter.

- MD salary is much higher compared to median salary for Vidhi than it is for Dynemic.

Product Analysis

In this part, I have looked at the synthetic food colors that Vidhi and Dynemic make.

Raw data is attached.

Key learnings:

- Dynemic and Vidhi make exactly the same food color products (except 1).

- Even the USFDA approvals are for the exact same colors.

- Export Prices have broadly increased by 60-70% in last 10 years implying a CAGR of 5%.

- Export Volumes have broadly increased 2x in last 10 years, implying a volume increase of 7% CAGR. Together these imply a broad realization CAGR of ~12%.

Next steps for this analysis:

- Extending for other colors (eg: natural food colors)

- For some food colors the export price/volume data is not easy to parse. More effort needs to be invested in figuring these out.

- Few colors have higher import volumes than export volumes with import prices being higher. This implies that for these colors, domestic demand outstrips supply. These could be clear growth drivers for Vidhi and Dynemic.

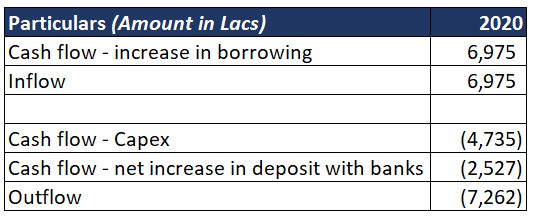

Upcoming Capex

| Company |

Dynemic |

Vidhi |

| Location |

Dahej |

X in dahej and 2X in roha |

| Capex Size |

110 |

90 |

| Revenue from Capex |

400 |

500 |

| Status of EC |

Got EC in Sep’18 |

Dahej got EC in Dec’20, Roha has not received yet |

| Status of Capex |

110 CWIP already. |

No CWIP |

| Expected current Start date |

Apr’21 |

FY24 |

Sensient has no planned/ongoing capex. Dynemic is clearly ahead of Vidhi in terms of status of capex.

Key Open questions

- Understand why Vidhi has higher asset turns. Any efficiencies?

- Understand sensient’s products and whether Vidhi/Dynemic’s products are of similar quality.

- Understand nature of contracts between Dynemic/Vidhi and clients. Whether these are long term/can RM price increase be passed on etc.

(Google sheets version of same data which is attached, if anyone prefers that).

Dynemic Products (2).xlsx (81.4 KB)

Disc: Invested, full latest PF here.

Revenue post capex:point_right:600 cr

Revenue post capex:point_right:600 cr :

: