No correlation here. The bank is trying to recover its due. So, they might speed up the process

Do you mean to say Dish TV will shut down if not bought by any other company? As per mkt rumors they had already got an offer for 20 rs. few years back.

the main point to be noted here is the high rates they offer for savings and FDs compared to other banks. In the financial world risk-return is always proportionate. To take equity risk on yes bank is still understandable but why do people take debt risk on yes bank when returns are so low? fail to understand.

@Shivacii

Sorry for over simplifying the post and giving hard numbers. I meant above 20 it seems to be overvalued and close to 15 the margin of safety is high. I also said 2x/3x so I don’t have 45 in my mind but 30 to 45. You see selling above and buying close to 15 was a good strategy at least for me it turned out good

@Aarti Dist tv in my view has a very low probability to shut down because it is debt free or going to be and second it has positive on an operational level. They constantly purchasing fixed asset and paying off debt. What I meant to say that if they don’t sell dish tv then you might loose money here. One notional loos and two opportunity cost . You will be stuck here for a long time because for them to get into growth phase will almost take 2yrs.

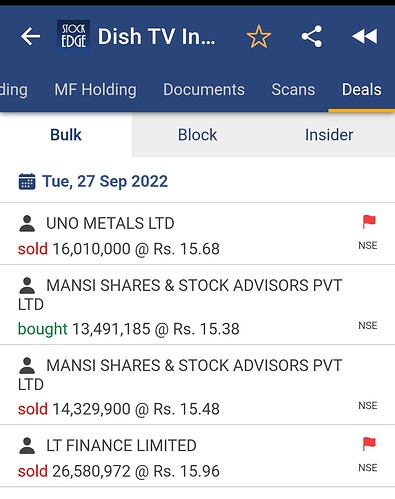

I think this explains why the stock fell on 27.09.22. Need to research a bit into the reason behind why L&T Finance and Uno Metals are selling stake.

20% Upper circuit today

I think JC flower is going to settle but a large overhang in the stock of debt seems over and if ZEE and Sony merger goes through. I think the stock should rally from this price.

“Since signing the agreement, the promoters have paid Rs200 crore and committed to settling the remaining Rs50

crores by the end of November.”

Any update on the same, couldn’t find anything on it? Thank you