LIC, SBI, Orix to subscribe to Rs 4500 crore IL&FS rights issue

DHFL on 27/9/18 has informed premature redemption of some quantity of three NCDS totalling about Rs. 475 crore. These were 0DHFCL2019A ( 304 crores) followed by DHFC19B and 11DHFL2019. First two NCDs were cumulative NCDs & 3rd was 11% p.a. NCD. All issued in 04-Jun-2014 and were to mature on 04-jun-2019. See two reasons for DHFL accepting premature redemption 1) high interest rate 11% 2) These are being frequently traded in large nos.in corporate debt market & so to reduce pr. on yields in secondary debt market.

Point (1) may be more true. Good step to retire high interest NCDs which were anyway maturing in about next 8 months.

Just wondering what kind of expenses a finance company can capitalise?

I don’t know

Thinking loud: 1)Debentures with a coupon rate and not bearing yearly interest being capitalised instead of shown as yearly/monthly interest

2) reduce npa than actual

3) capitalise customer acquisition cost into loans

Before someone starts arguing, I am not saying dhfl is doing any of this, just that looking just at roe might not bring these problems into the open

Recent decline in HFC stocks caught my eye and I got particularly interested in DHFL owing to ~50% slump in share price.

It’s trading at 1.06 times its Book value now!

This is undervalued and attractive, but the question is that is it the best investment choice to make?

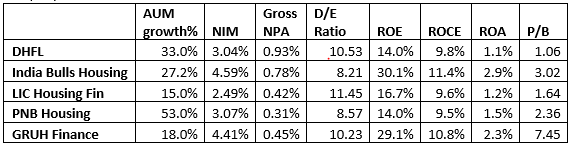

I tried to compare DHFL figures with some of its peers and found nothing extraordinary about the company.

DHFL has a very good AUM growth rate of 33% but an ok NIM at 3.04%. But, in addition to having Gross NPA (0.93%) and D/E Ratio (10.53) on a higher side, DHFL figures show mediocre returns in terms of ROE/ROCE/ROA with respect to its peers.

Having said that, I personally think that Mr. Market has been too harsh on DHFL as there is nothing unusual going on with the firm (or we haven’t heard it yet?)

I am looking to invest in DHFL but would like to know experts’ opinion. Do you see a multi-bagger potential in DHFL in coming years? What did I miss in my analysis?

My bigger question although is: (As I have limited knowledge of the sector)

Is it the right time to invest in any NBFC/HFC at all?

Really appreciate your opinion in advance!

Add few more columns … i.e. Capital adequacy, exposure to builder loans. I have not understood why DHFL’s RoA is so low. Let’s think about it … we had lots of liquidity, govt support and low interest rate and top it all DHFL’s high D/E ratio. Still they make RoE in mid-teens. What happens to RoA when the tide turns which is the case now? What is the earning sensitivity to the compression in RoA? I would say very high so this has to be very high beta stock and not to mention ever present corp governance issues. I will not consider any of them except Gruh on correction and PNB after stake sale clarity.

Disc: No holding in any.

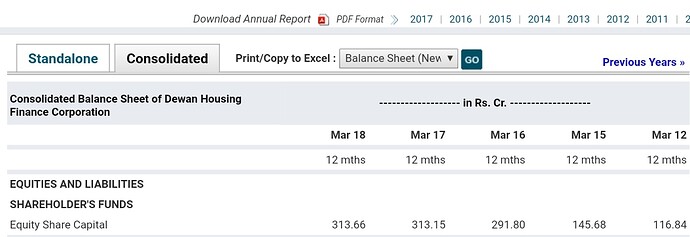

DHFL has increased equity capital every year or every alternate year. I think, this is the reason of low RoE, RoA and Debt to Equity.

I will take that as a red flag if they keep raising equity so frequently. Low RoE I can understand due to lower D/E but why RoA will be lower due to higher equity.

DHFL has been actively issuing ESOPs from 2009-10. However, the last tranche of around 30,000 ESOPs are supposed to expire this year. These are the final tranche of ESOPs that DHFL has issued. It didn’t issue any recently. You can find this in the 2017-18 AR.

Here I was trying to say is that -

- Assets = Liabilities + Equity.

- RoA = Net Profit / Assets

Like I said, they’re essentially money received via the employees (Including Promoters) encashing their Share Warrants/ESOPs. The last tranche of around 30,000 ESOPs under the 2009 ESOP plan will expire in 2018-19. That’s what caused the dilution so far.

They haven’t issued any recently, however.

Don’t understand what are you trying to prove.

Higher equity – > higher NIM --> higher profits–> higher RoA --> similar RoE since leverage is less. So RoA is inflated for DHFL since higher equity dilution? That’s more worrying scenario as they are at their peak leverage. What levers they have improve RoE?

I am not proving any point here, just trying to identify, is there any link between equity and RoA?

For reference.

Dewan raised quite a bit of capital at current interest rate probably assuming interest rates are going high and they can then lend at mortgage markets

How will they make money from those debentures now ?

The sector is broken . Don’t try and catch a falling knife

They are redeeming debentures as and when possible to make sure that liquidity stays high and debt stays under control. But if today’s fall continues further, there won’t be much redemption possible.

The govt is doing its part

Hello Dinesh,

I was just curious. It is evident that DHFL has an asset liability mismatch. While the market for CP’s is quite illiquid because of what is happening and also it is unlikely that DHFL will be able to raise money through this route. On the bond front, if there was a nervous buyer willing to sell a AA rated paper for 11% yield, Im guessing there are very few people willing to buy it for any less. Clearly, at 11% a housing finance business is not sustainable. While DHFL has liquidity to tide over the short term, I am guessing they will have to stop disbursing loans. For every day that they dont disburse a loan, their balance sheet keeps shrinking as old loans are repaid. The branch network and cost structure remains the same and the cost to income ratio is likely to rise badly as a result of this denting the ROE. This to me looks like a recipe for disaster and as such paying even 1 times book might not be good enough. Is there something that I am missing? Would love to have your point of view.