Nice one. Very useful & helpful for novice investors.

Deepak nitrite #deepak

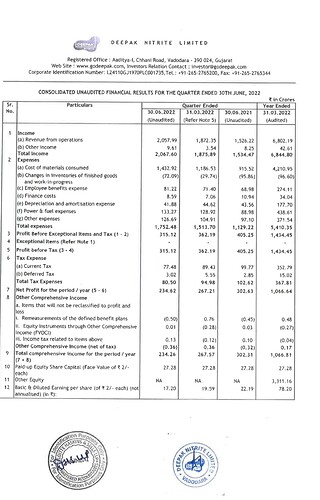

Despite operation stopage at one of plant for 1 month. Manage to get good top line growth.

Bottom line below expectations.

#deepaknitrite https://twitter.com/momentum_stock/status/1554478617350275077/photo/1

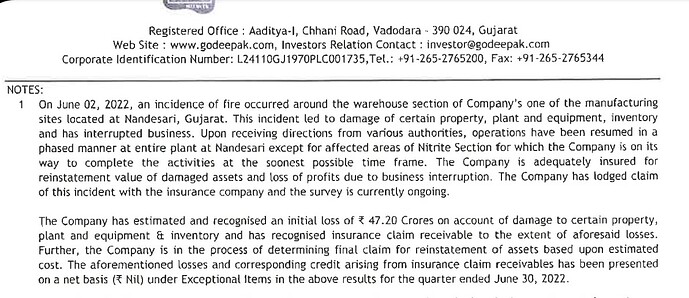

Surprised to see no exceptional item/provision for loss. My experience with incidents like fire, flood etc is that, at first , companies say its all covered by insurance and hence no impact on bottom-line. Then, few quarters down the line, get surprised by seeing big one time hit once insurance amounts get finalized. Don’t know why they don’t make some upfront provision when everyone is prepared (since news is fresh in their mind). Guess conservative accounting is out of fashion these days… ![]()

May be companies are ready to show conservative accounting but analysts and Investors dont take it gladly and promoters dont want to disappoint them.

They mentioned it exactly as I said. Loss of 47.2 Cr is recognized and also insurance claim against the same amount is recognized. (Nil under exceptional items) In simple words, no provision made for losses… ![]() . I started detesting this verbal gymnastics companies get involved into. This is the second time company involved in word play…

. I started detesting this verbal gymnastics companies get involved into. This is the second time company involved in word play…

As I see it,the statement is perfectly strightforward. The company surely knows better about the likelihood of successful claim than us outsiders ?

If someone attended AGM, please post notes.

The company has suffered a loss in this quarter and are refusing to show it, negating it with potential future earnings. It is very dishonest accounting to be frank and is disappointing to see. If they can do this then technically they can do the same with other earnings or one time events. 95% of other firms would account the loss in this quarter as a one-off and then when the insurance payout is realised they would show a one time gain.

Key takeaways from the AGM

• Dynamic changes in the chemicals industry

Chairman and MD Deepak Mehta shared his views on existing scenario of the global chemicals market. Price volatility has not stabilized post COVID and inflation has reached at exorbitant levels. There is acute shortage of gas and oil post Russia-Ukraine conflict, which would leave concerns across the globe as well as India. Mr Mehta pointed that there will be shortages in agri-output due to sharp inflation in fertilizer prices.

Mr Mehta believes that such volatile and inflationary trends have completely changed “rules of the game” in the chemicals business. He believes that economies of scale, focus on niche products and geography are no longer “the right approach” to sustain in the chemicals business model. The companies are required to have unique strengths, presence in global supply chain and product diversity in order to grow sustainably.

Comments on FY22 segmental performance

- Basic Intermediates – Segment witnessed input cost pressures, given the sharp rise in bulk chemicals. Prices of caustic soda and nitric acid have almost doubled from last year. However, Deepak Nitrite (DNL) was able to manage inventory timing and price hikes across products, leading to a decent performance in FY22.

- Fine & Specialty Chemicals – The products broadly cater to agrochemicals and pharma applications. Management is not satisfied with the FY22 growth achieved in this business and expects higher growth and margin improvement going forward.

- Performance Products – DNL managed to double margins in FY22, off a depressed base in FY21. Performance products find application in detergents, textiles and paper industries.

- Phenolics – DNL reported the best-ever quarterly performance in 1QFY22. For the remaining 3 quarters of FY22, management focused on generating optimum volumes, which gradually grew from 200Ktpa to 250Ktpa. Mr Mehta pointed out that he has never seen benzene prices at such inflated levels of >$1,400/t.

- Capex incurred in FY22

– Debottlenecking of Basic Intermediates and Fine & Specialty chemicals capacity;

– Doubling of IPA capacity from 30Ktpa to 60Ktpa. This has reduced imports quite significantly.

– Debottlenecking of phenol capacity by 20% from 200Ktpa to 250Ktpa;

– Commissioning of boiler plant for captive power consumption by end of FY22. It aided in saving power costs in the last two months. The boiler plant is now operating at peak load and management expects real cost savings to get visible once coal prices stabilize.

Updates on fire accident at Nandesari unit

1QFY23 performance was impacted due to one month’s loss of sales resulting from a fire accident at Nandesari. The fire occurred in one of the godowns and across adjoining engineering sections. As a result of this incident, the whole plant was shut down in order to ensure stability.

The plant manufactures products across Basic Intermediates and Fine & Specialty chemicals such as sodium nitrite, sodium nitrate, nitrotoluenes, amines and fuel additives. Except for sodium nitrite, the remaining product lines are now operating at optimum utilization. The sodium nitrite plant is operating at 50% levels and is expected to rebound in the next few months.

Mr Mehta highlighted that the plant is fully covered with insurance for loss of goods, loss of profits and costs for reinstatement of the plant. The company has recognized preliminary insurance claims receivable amounting to Rs472m towards loss of assets.

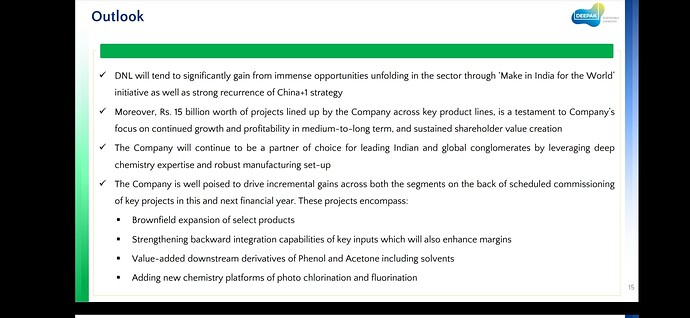

R&D capabilities

DNL will add new chemistry capabilities such as photo-chlorination and fluorination in the next two years. New products will be a blend of new chemistries and existing technologies of nitration and hydrogenation. At present, DNL has on board 50 scientists. With new R&D centres coming up at Dahej and Savli (near Vadodara), the R&D headcount will double.

Short-to-mid-term capex plans and capability building

Mr Mehta laid objectives set by the company for the next 2-3 years. The capex announcement of Rs15bn will comprise of:

- Debottlenecking of several capacities across plants in FY23.

- Introduce new intermediates for fine & speciality chemicals.

- Debottlenecking of phenol capacity by 25% from 250Ktpa to 300Ktpa in FY24. This will maintain DNL’s market share in phenol and facilitate new downstream products.

- Capex of Rs7bn towards phenol-based downstream products. This consists of 40Ktpa MIBK (Methyl isobutyl ketone) capacity, which is completely imported in India at present. Besides, DNL will also introduce MIBC (Methyl Isobutyl Carbinol). These solvents find application in agrochemicals, pharma and lubricant oil additives.

From a mid-term perspective, DNL plans to enter into specialty polymers segment through polycarbonate. 50% of phenol volumes are consumed in polycarbonates. It is imported in India and is used in construction activities. Besides, polycarbonate is also used in new-age applications such as semi-conductors and 5G technology. Mr Mehta pointed out that polycarbonate is a distant project and will take at least 2-3 years before finalizing capex plans. However, DNL will add small but critical specialty polymers in the next 2-3 years.

Changes in the board

The company has appointed three new independent directors:

- Mr Punit Lalbhai (Executive Director, Arvind),

- Mr Vipul Shah (Ex-Chief Operating Officer - Petrochemicals, Reliance Industries; associated with Dow Chemicals for 26 years), and

- Mr Prakash Samudra (CEO & MD, Thyssenkrupp Industrial Solution India).

They will replace three retiring independent directors who have been part of the board for almost a decade: Dr Richard Rupp, Mr Sudhir Mankad and Dr Swaminathan Sivaram.

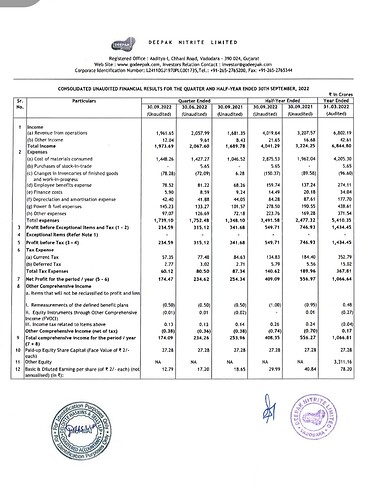

1QFY23 result highlights

Revenue: Rs20,580m

Ebitda: Rs3,560m

PAT: Rs2,346m

Despite a dip in earnings on QoQ due to a fire accident at the Nandesari unit, Deepak Nitrite’s performance was fairly good. Management clubbed all its erstwhile standalone segments into a single reporting segment ‘Advanced Intermediates’. The standalone Ebitda declined 32% QoQ. Deepak’s Ebitda from Phenolics grew 6% QoQ. This partially offset pressure from earnings decline in the standalone business.

Link to Q1FY23 Investor Presentation

Management didn’t utter a word about the cause of the incident and what they are going to do mitigate such risks in future. (If anything was said in the AGM please share, I am hoping someone will ask questions on this in Q1FY23 concall )

Just having responsible care logo is not enough. PI stands out

“PI is also Gold Rated by EcoVadis in the last business sustainability assessment with 96th percentile rating in the agrochemical manufacturing companies in the world.” Link

From PI Q1 FY 23 Investor Presentation

World class infrastructure for Environment Management

Moving Bed Biological Reactor

Online Analysis of Effluent Treatment

Sensor-based Data Capturing for KPI Monitoring in Utilities

Emissions (Liquid & Gas) monitoring at Plants to be Continuous & 100% Online (Example )

No wonder why PI has top innovators as it’s customers.

If insurance claim gets settled I will have 3rd party assurance that due care was taken for preventing such accident and it was really an unfortunate accident

Sir, your basis and inputs for such observations, will help our understanding.

I have created a DCF model for Deepak Nitrite from scratch for next 4 years. I just don’t know if my calculations are right or wrong. So I am attaching the excel sheet here.

DEEPAK NITRITE DCF.xlsx (12.6 KB)

Your help will be much appreciated

Not good result from Deepak nitrite.

With fall in revenue (expected). Why there is no fall seen in raw material cost, fuel and power for many companies are falling now. But here it is different.

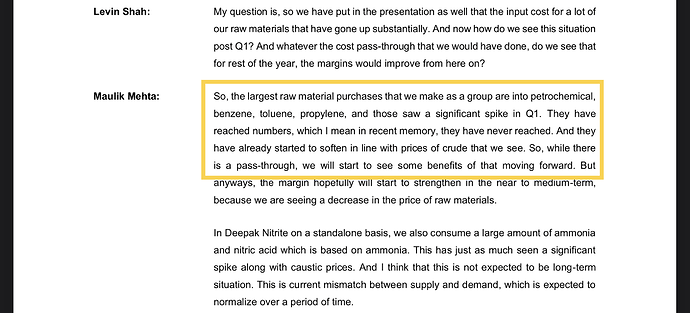

I think standalone numbers are quite good, only the Phenolics division showed stress due the higher input cost. Benzene prices had been going up, but they are normalising now. They peaked out at around $6.5-7 per gallon in Aug, and now they have come back to $3.2-4 per gallon range in September and October, which is more of a normalised price.

Also, Maulik Mehta mentioned in the last concall that the RM prices are softening and they will pass through the cost in coming quarters as they have formula-based pricing.

I don’t think QoQ power and fuel costs have gone down completely. And I am not talking about DNL only, but the other manufacturing companies (not only from chemical sectors) that have reported their numbers have shown higher power and fuel costs QoQ (YoY is obvious).

We will have to wait for management commentary for more clarification, but I am hopeful we should see improvements in numbers in Phenolics going forward as Acetone realisations become normal and input cost keeps on going downward.

Disc: Invested. No transaction in last 90 days.

.