Q1 FY 25-

Trigger-

TAN and other capex,

Focus to increase TAN export,

4000-5000cr capex in FY25 and FY26

Capex go live in H2 FY26.

50-55% revenue comes from TAN business.

Risk- Over- capacity of ammonium nitrate bcz Coal and BHEL have signed a JV for setting up 2,000 ton per day ammonia nitrate plant,but capex is not started yet, also Chambal is actually coming up with some kind of new capacity. As I have been telling that they have actually announced that it is an ammonium nitrate capacity which they’re bringing in. But they are also manufacturing fertilizers. So we’ll have to really see where their facilities will get utilized. .( This will mitigate by almost 25% to 30% of the demand actually is fulfilled by imports today)

We are not expecting on long-term basis any capacities which are basically going to be idle, but there could be a few quarters when the business is not doing well maybe there could be some surplus capacity.

- Debt can go upto 5500cr ie D/E almost 1

Screenshot 2024-08-24 230409.png 408.78 KB

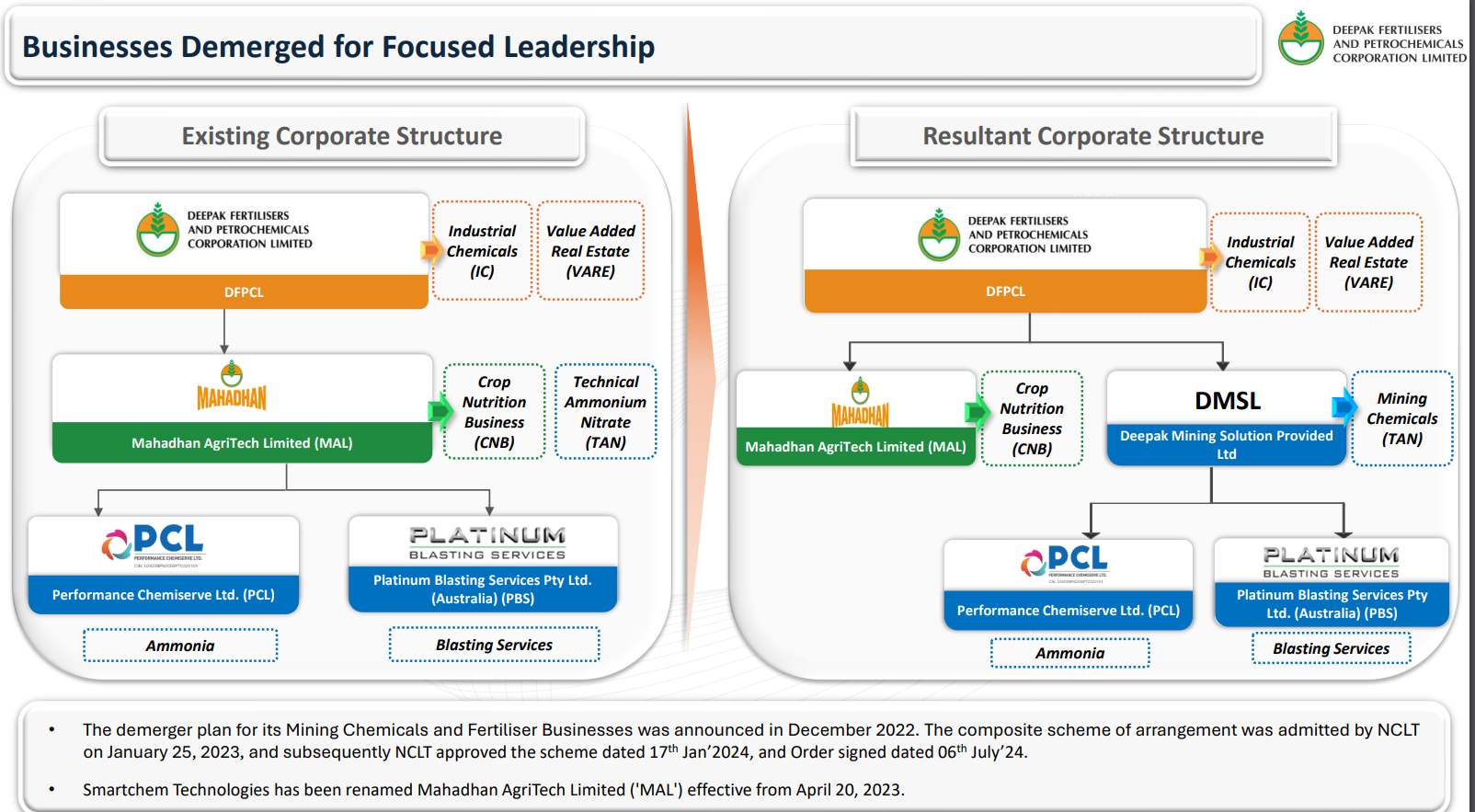

So the demerger happened, which is the subsidiary of Deepak fertilisers, and it is called Mahadhan Agritech Limited, which is an unlisted company. It used to house the CNB business, which is our fertilizer business and also the technical ammonium, which is the Mining Chemicals for us business. Now the Mining Chemicals business is getting carved out into a new legal entity and its name is Deepak Mining Solutions Limited. So that is the impact. And hence, there is no impact on the existing shareholders of Deepak Fertilisers.

we have 2 unlisted entities, which is one is for Mahadhan Agritech, which is an unlisted entity. The other is Deepak Mining Solutions Limited, that is other unlisted entity.

Currently both the unlisted entities are wholly owned subsidiaries of deepak fertilser and petro ltd.

So the answer is, yes, because we would continue to look for technology partners as well as strategic investors to grow those businesses. Whether it is the fertilizer business or whether it is the Technical Ammonium Nitrate business. So whatever growth which we see automatically it will show up in the holding company. So that is how it will benefit all the shareholders indirectly, but not the way that any shares would get allocated to them.

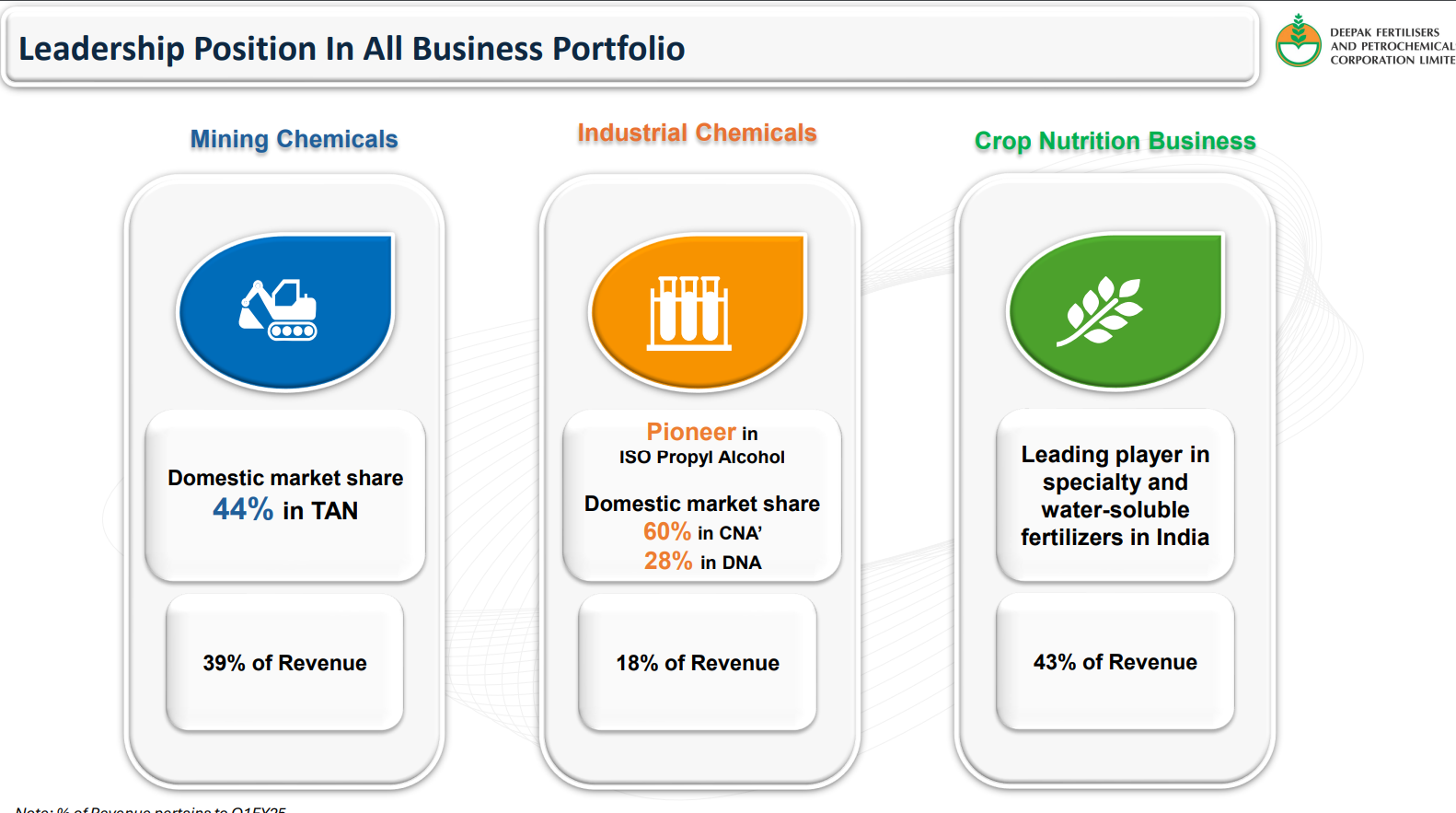

-Three division- Explosive(TAN), Industrial chemicals, Fertiliser

- Mining(Coal, steel) increase will help first segment, Good monsoon,govt policy and tailwing in agro sector help third segment

So, in a nutshell, 3 things. Beautifully aligned India growth story; number two, solid value chain; and number three, move from commodity to holistic solution. All the 3 promises to change the very face of Deepak Fertilisers in the years to come.

The capacity utilization of our nitric acid plant was closer to 90% for the quarter. And for the IPA plant, it was closer to almost 78%.Bulk fertilizer manufacturing capacity utilization was closer to 67% during the quarter

Performance Chemicals Limited, which houses our ammonia plant. Ammonia plant as you know that we basically started this plant last year in Q2. The capacity utilization in Q1 at around 98%.

As we have been telling all our investor communities that the backward integration is helping us and will help us to reduce volatility to enable us to retain the margins within the group.

The ongoing expansion at Gopalpur for TAN and Dahej for nitric acid starts in H2 FY26.Initially with70-80% capacity then go to 90-100% capacity as we did with ammonia capex(now at 98% capacity utilisation).

So we have said that the Gopalpur project, we are going to incur close to INR2,200 crores. As far as Dahej is concerned, we have said we will do around INR2,000 crores.

INR1,500 crores capex will be equally divided between Gopalpur and the Dahej in FY25 and around same capex for bot in FY26

TAN business- We currently have a capacity of around 540,000 tons right now, we are actually expanding additionally 50,000 tons, which will come upstream by the end of September. So obviously, the capacity would go up. We are looking for getting our new plant ready in Gopalpur with a capacity close to 376,000 tons. You can say around 400,000 tons, which would come upstream sometimes to next year.

50-55% revenue comes from TAN business.

So actual exports started only last quarter for TAN , which is the last quarter of the last financial year, which is '23-2024. Now from this quarter the business will start looking at aggressively all the exports to be done.(TAN Business)

Demand is expected to remain strong in TAN over the next couple of quarters driven by growth in coal mining, power, and infrastructure sectors.

Post commissioning of this plant, we will become 3rd largest pure play TAN producer in the world.

The project is strategically located close to major mining hubs to be able to cater to their demand, while its proximity to Gopalpur port provides favourable export opportunities

IPA segment- On a long-term basis or rather short to midterm basis, this trend will continue. So, we are expecting that demand would continue for the next at least a couple of quarters or maybe a couple of years as well.

Leveraging 40 years of credible experience in Nitric Acid, DFPCL will become ‘Asia’s Largest Manufacturer’ of Nitric Acid post expansion

I’m also happy to share the positive impacts emerging from the recently announced Union budget. From a larger perspective, the Finance Ministry’s continued strong support on the fertilizer subsidies, the growing outlay for the agriculture sector, and the strong support to infrastructure. All of them will go to provide a strong and positive tailwind to all our business segments. Additionally, our recent partnership with Israel-based Haifa Group will help to promote high-performance specialty fertilisers.

NCLT Mumbai has now formally approved the demerger plans, now paving the way of unwinding each business into a separate corporate entity. So the Chemical business will be housed in 1 entity, the Crop Nutrition Fertilizer business in another one and the Technical Ammonium Nitrate Mining Chemicals in the third.

The restructuring will also open doors for strategic global investors focus on specific businesses to join us and besides that, it will also further improve the specific business visibility for the investors in general.

Now with this strategic restructuring, this aligns very well with our vision of evolving from a commodity player to one that provides specialized holistic solutions.

Now turning to our business performance. In case of Mining Chemicals, Technical Ammonium Nitrate(TAN businesss), showed a robust growth, resulting in a 23% increase in the technical ammonium nitrate sales volume year-on-year. This growth is supported by improved prices and increased demand in key end sectors such as coal mining, steel production and both showed around 11% growth.

As far as the industrial chemicals goes, the business delivered lower volumes in nitric acid due to an extended repair job at our Taloja Nitric Acid plant and partly due to reduced demand from the downstream industry following a temporary shutdown of the GNFC TDI plant, leading to an oversupply of their asset in the market.

IPA volumes were a little lower due to a plant shutdown. So that was as per plants. Having said that, our specialty products in the Chemical segment - Industrial Chemicals segment, including the pharma grade IPA and the stainless-steel grade nitric acid continued to grow based on the positive customer feedback as regards their value propositions

When it comes to the Crop Nutrition Fertilizer business, the business delivered 11% year-on year increase in sales of manufactured bulk fertilizers, whereas sales of specialty products like Bensulf have surged by 51% over last year. During the quarter, the business launched Croptek grade for soybean and Smartek grade for paddy and pulses, taking us forward in our cropspecific nutrient journey.

From an outlook perspective, as Mr. Mehta said, post demerger and the TAN business would get into a separate legal entity now. And it will establish itself as a fully integrated technology solution provider for all our customers. As you are aware that the export ban was lifted last financial year. We have already started exports from March '24 onwards,

So we basically feel that we have a very strong case and whatever demands which the commissioner of income tax has actually saying, we continue to obviously fight that at various levels. And we will go to the highest level because we think we have a very strong case to defend us.

We are actually creating the market for it. So we’ve been telling our investors is that we will be definitely, we are very aggressive in expanding it, but it will take some time before we get there. And this will become a material till the time it becomes a material part of the business. So we are still a few quarters or a few years away from where we should be right now.

TAN business- But so far, there are no antidumping duties. But in the new budget, as you would have read is that the duty has actually been increased for importing ammonium nitrate. So 2.5% of the duty has gone up, part of it would create some kind of a deterrent for the importer, but we’ll have to see. I’m sure that the government is taking more steps to be able to at least give some competitive advantage to the domestic manufacturers as well.

State-GST benefit - Incentives for the ammonia plant. So last year, as you know, that we have actually got in Q4 around INR89 crores. For this quarter, we have done closer to almost INR35 crores. We have booked it which is prorated for the year. We expect similar if the volume obviously, if the prices goes up, it may be even higher in the future quarters.

So, we always continue to reduce debt. But there are ongoing projects, which would require new debt for funding those projects. So whether it is Gopalpur or whether it is Dahej. So overall even though we may be repaying the existing debt, but overall, the debt portion may go up because the new debts are coming in for the new projects. And it should peak out sometime next year… And hence, we would start seeing some reductions there on.

So it depends how we see it. But more or less, it should be between INR5,000 – INR5,500 crores to INR6,000 crores is what we think right now, but it can be lower than that as well.