Danish Power Ltd:

About the company:

Danish Power is an ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018 certified manufacturer specializing in various types of transformers and electrical control systems. Their product range includes inverter duty transformers for renewable energy projects like solar and wind farms, as well as power and distribution transformers. Additionally, they provide control relay panels and substation automation services.

Product portfolio:

Key products include inverter duty transformers (up to 20 MVA), distribution transformers (up to 5 MVA), and power transformers (up to 63 MVA).

- Inverter Duty Transformers (multi-winding) up to 20 MVA 33 kV Class for Solar Plants, Transformers for Wind Turbine Generator

- Distribution Transformers up to 5 MVA 33 kV Class

- Power Transformers up to 63 MVA 132 kV Class

- Panels includes Control Relay Panels up to 400 kV Class, Substation Automation (SCADA), Bus Bar Protection Panels, LT Panels, APFC Panels.

Cold Rolled Grain Oriented (CRGO) Electrical Steel, Copper Wire, Copper Strip, Copper sheet and Aluminium Wire, Strip, Sheet, Mild Steel, Transformer Oil and Relays these are the raw materials required by the company and procures them either through imports or local suppliers.

Manufacturing facility

Manufacturing facility located at Mahindra World City in Jaipur. And company owns a vacant land in here which will used for expansion plans

Danish Power has received the all India First Licence for Outdoor/Indoor type liquid immersed Distribution Transformers up to and including 2500 KVA, 33KV- Part 3 Natural / Synthetic organic ester liquid immersed as per: IS 1180: Part 3: 2021.

Value chain analysis

- Raw Material Supply: Involves sourcing core materials like copper, aluminium, silicon steel, and insulating materials.

- Core Components Manufacturing: Production of critical components like laminations, cores, windings, and bushings.

- Assembly: Integration of components into the final transformer unit.

- Testing and Quality Control: Ensures each unit meets safety and operational standards.

- Distribution and Sales: Transporting transformers to the market for end-users.

- Installation: Setting up the transformer at the desired location.

- Maintenance: Includes routine servicing, repairs, and condition monitoring.

Clientele:

Their transformers are designed to ensure efficient power transmission and distribution across several industries, with notable clients like Tata Power, ABB India, and Torrent Power, Waaree Renewable, Jakson Green Private Limited.

Over the years, company has established a diversified client base across different customers in the power industry like renewable power EPC projects like solar power plant, wind power farms, other power generation plants, power transmission, electricity sub-stations, power utilities etc. like Tata Power Solar System Ltd, Waaree Renewable Technologies.

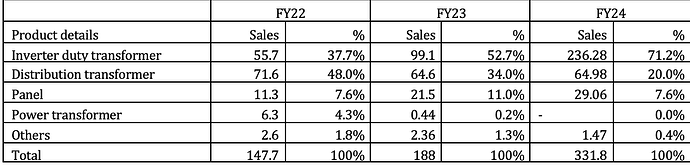

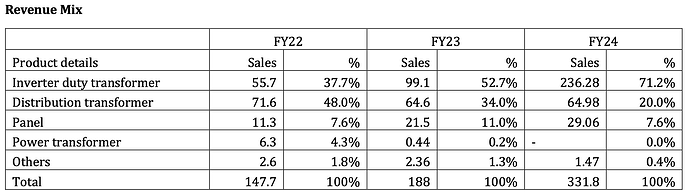

Revenue Mix:

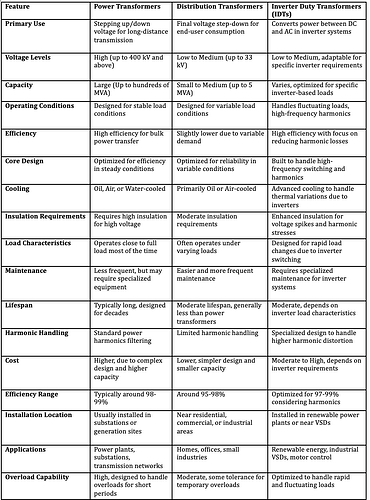

Difference between Power distribution and Inverter duty transformer

Industry overview

• From April 2020 to September 2023, the renewable energy sector in India attracted US$ 6.1 billion in FDI equity investment.

• India has received a cumulative amount of US$ 3.8 billion in foreign direct investment (FDI) in the solar energy sector over the past three fiscal years and the ongoing fiscal year until September 2023.

• India ranked fourth in the list of countries to make significant investments in renewable energy by allotting US$ 77.7 billion between 2015 and 2022

• In the Budget for 2024, the government’s 14 power sector initiatives have been allocated funds that are 50% higher. Increased funds have been allocated to green hydrogen, solar power, and green energy corridors in line with the renewable energy target for 2030.

• In order to meet India’s 500 GW renewable energy target and tackle the annual issue of coal demand supply mismatch, the Ministry of Power has identified 81 thermal units which will replace coal with renewable energy generation by 2026.

CEA: Distribution System Plan 2030

Projected Installed Capacity by March 2030:

• Expected total installed capacity: 786 GW.

• Compared to March 2022: Increase from 400 GW to 786 GW.

• Renewable capacity percentage: Envisaged to be around 62.6% of total installed capacity.

Current Power Sub-Station Statistics (as of March 31, 2022):

• Total number of power sub-stations: 39,965.

• Total installed capacity: 4,82,810 MVA.

Planned Sub-Station Expansion (2022-23 to 2029-30):

• Planned addition of sub-stations: 12,192.

• Total power substation capacity addition: Approximately 1,41,522 MVA.

Projected Cumulative Sub-Station Capacity by 2029-30:

• Cumulative sub-station capacity by 2029-30: Around 6,24,332 MVA.

• Increase compared to March 31, 2022: 29.31%.

National Electricity plan:

The budget outlay for the National Electricity Plan (NEP) for 2023–2032 is ₹9.15 lakh crore.

Planning for Future Demand: The NEP outlines strategies to meet the country’s projected electricity demand over the next 5-15 years, ensuring energy needs align with economic growth.

Renewable Energy Focus: It emphasizes increasing the share of renewables like solar, wind, and biomass to reduce carbon emissions and move towards cleaner energy.

Infrastructure Development: The plan includes proposals for expanding and upgrading the transmission and distribution networks to support reliable power supply and reduce losses.

Energy Efficiency and Security: NEP aims to enhance energy security by reducing dependency on imported fuels and encourages energy efficiency across sectors.

Grid Modernization: Focus on modernizing the power grid with smart technology and digital solutions, including battery storage systems, to handle renewable energy’s variability.

Support for Universal Access: Prioritizes providing electricity access to all households, particularly in rural areas, contributing to socio-economic development.

Five-Year Update Cycle: The NEP is updated every five years to reflect technological advancements, policy changes, and shifting energy demands, keeping it relevant to current needs.

Growth in Transformer Allied products

Transformer Oil market 2028 $3 Billion 5.90%

Oil immersed transformer market 2028 $28.2 Billion 6%

Transformer monitoring market 2028 $3.7 Billion 9.10%

CRGO steel market 2032 $20 Billion 5.90%

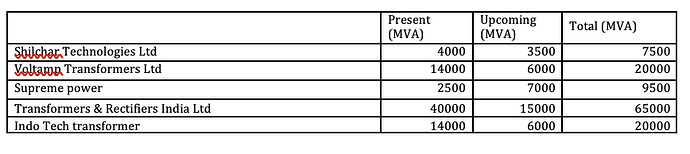

Peers capex plans

Growth Triggers

• Diversified Product Base

- Company is involved in manufacturing of different types of transformers including inverter duty transformers which are used in renewable power projects like solar power plant or wind farms, oil and dry type power and distribution transformers, control relay panel along with substation automation services.

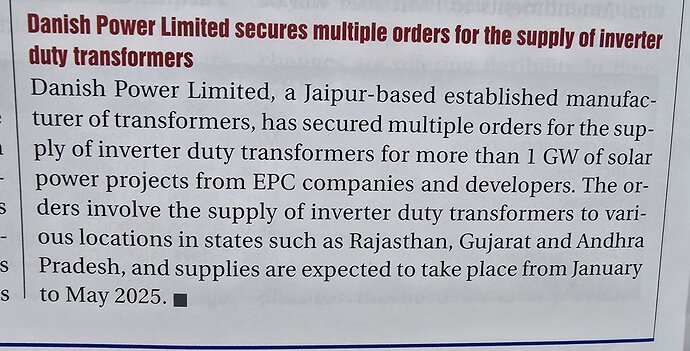

• Industry Tailwind - Due to increased demand for power projects, need of transformers is increasing rapidly.

- India has set Target of 500GW of renewable energy by 2030 which will require substantiable amount Inverter duty transformers.

- All the stake holders in the industry have announced aggressive capex plans to cater to the upcoming demand

- By 2035 Indias peak power demand is expected to be 1400 GW.

- Budget outlay of INR 9.18 lakh crore which will significantly increase the demand for transformers

• Existing relationship with the clients - As company is in B2B business segment they operate in business due to delivery of quality product and timely delivery.

- Top 10 clients contribute 87% of the revenue.

- Their existing relationship with the clients have helped them to acquire new clients.

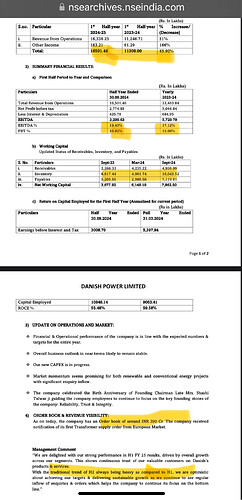

• Guidance - Revenue growth of 15-20%

- Net profit margin of 11-12%

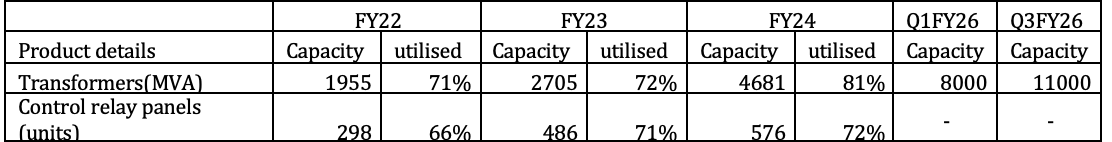

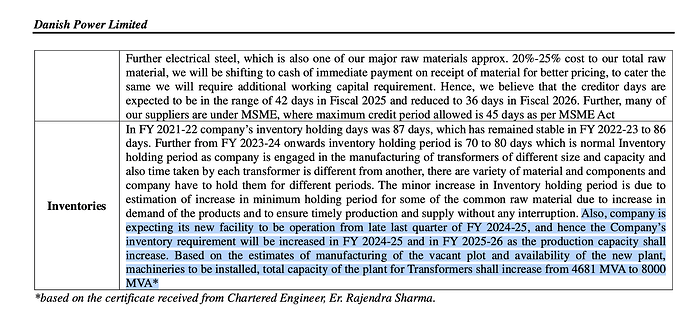

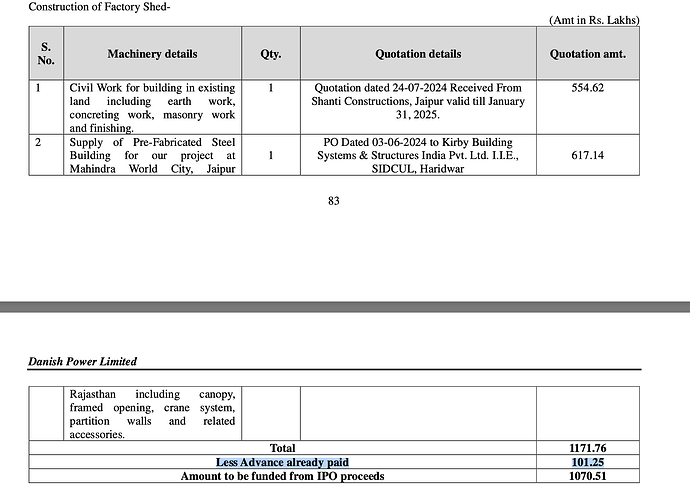

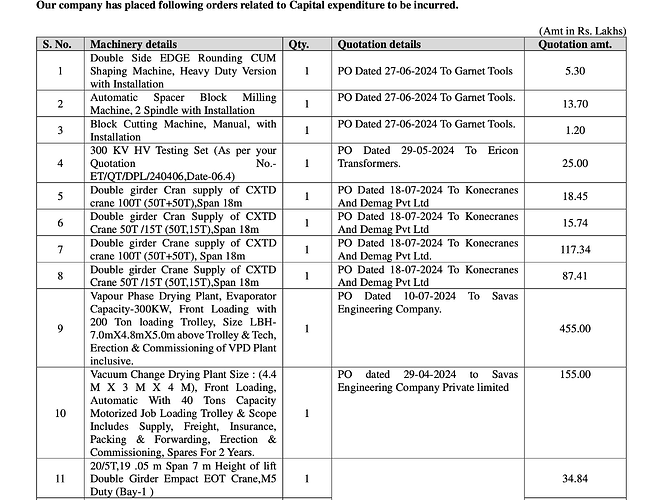

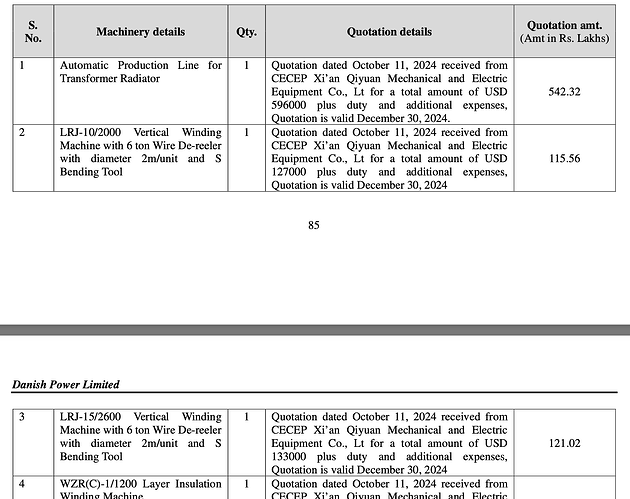

• Capacity expansion - Increasing capacity from 4681 MVA to 11000MVA which will significantly increase sales.

- Aims to improve revenue mix from Power transformers to reduce the share of Inverter duty transformers.

• Experienced Promotors & Management team - Dinesh Talwar, Whole-Time Director, has 39 years of industry experience in transformer and panel manufacturing, while Shivam Talwar, Managing Director, brings 17 years of expertise.

- The promoters’ deep industry knowledge has been instrumental in the company’s consistent growth and business expansion.

- Shivam Talwar holds a Bachelor of Engineering in Electrical & Electronic Engineering, enhancing the team’s technical and leadership capabilities.

Key Risks

• Reduction in Govt spending in capex could result in lag in revenue recognition.

• Delay in Company’s capex plans could affect the guidance given by the company.

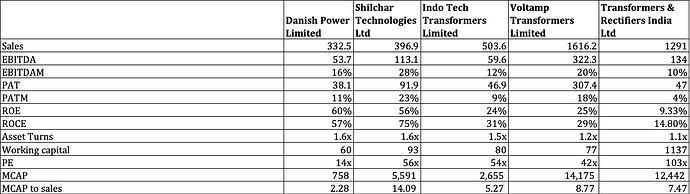

Peer comparison

Assuming Shilchar realization per MVA is 10Lakhs and capacity fully utilized at 7500MVA.

Here Danish power is compared with Shilchar Technologies is because of their similarity in product profile.

Conclusion

Danish Power Ltd. is an attractive investment opportunity in the growing renewable energy and transformer manufacturing sectors in India, especially with the government’s goal of achieving 500 GW of renewable energy by 2030. The company boasts a diverse product portfolio, including inverter duty transformers essential for solar and wind projects, and is expanding its capacity from 4,681 MVA to 11,000 MVA to meet increasing demand. Danish Power is well-positioned for sustained growth with a solid financial performance, established relationships with key clients like Tata Power and ABB India, and a favorable forward price-to-earnings ratio compared to peers. Despite potential risks related to government spending and capital expenditure delays, its proactive strategies and experienced management make it a compelling choice for investors looking to benefit from India’s renewable energy boom.

Disclosure: Invested since IPO levels and Biased