The Cummins Group

Formed in 1962, the largest entity, Cummins India Limited (CIL), is the country’s leading manufacturer of diesel and natural gas engines.

CIL comprises of four business units - Engine, Power Systems, Components and Distribution.

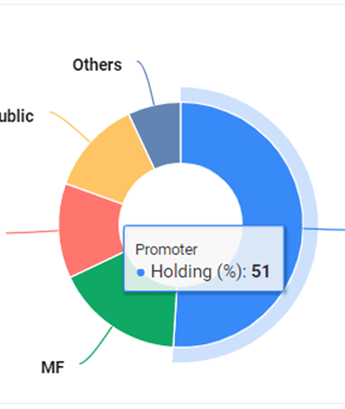

CIL is a 51% subsidiary of Cummins Inc. USA, the world’s largest independent designer and manufacturer of diesel engines above 200 HP. Cummins Inc., the majority shareholder, is the leading worldwide designer and manufacturer of diesel engines from 16 HP to 3,500 HP.

The company has a country-wide network-20 dealerships, 450 service points catering 2,20,000+ customers and a strong presence in the aftermarket with over 6,27,000 engines in the field.

Cummins Inc USA is at the forefront of technological innovation and has been awarded a record 312 patents and the company spends more than $900 million on research, development and engineering for a third consecutive year. Cummins US also paved the way to carbon neutrality by powering the world’s first hydrogen fuel cell passenger train.

Industrial Business

Railways -

Supplies of Diesel Electric Tower Cars (DETC) thereby supporting Indian Railways in its 100% electrification of broad-gauge network. To support Indian Railways’ internation cooperation initiative, CIL supplied engines for export of rail equipment to Mozambique, Nepal, and Sri Lanka.

Mining –

Leadership position in 60 ton dump truck segment, made further inroads in 150 ton and 205 ton segment and expanded into new applications like the 100 ton excavator and underground mining dump trucks.

Marine and Defense –

Caters to the Indian Navy with custom designed and built fullyintegrated 1MW gensets for the Navy’s stealth missile destroyer vessel and survey vessels.

Oil and Gas –

Supplies gas compressors to the city gas distribution infrastructure.

Pumps -

Completed FM/UL certification testing of 5.9 liter and 6.7 liter engine platforms for the global fire pumps segment

Construction -

moved from mechanical to new-generation electronic 4-cylinder and 6-cylinder engines to address the onset of BSIV emission norms from April 2021 for Construction Equipment Vehicle (CEV) applications.

Compressor –

Supplies water rig compressors extensively for industrial usage.

Power Generation, Exports & Distribution Segment

Power Generation -

This segment houses the product that Cummins is a household name for – the genset.

Data Center, Infrastructure, Healthcare, Rental and Retail segments are the key markets for this segment.

It is estimated that 85-90% of gensets will be used as a back-up power source going forward. Hence, the next leg of growth for DG sets will come from increasing government spending in infrastructure (railways, roads, metro rail and defence) as well as industrial capex (telecom, data centres, hotels, malls, hospitals, educational institutions, etc.).

Exports -

This an opportunity to use the Indian company to supply to global clients – a trend of global MNCs to consolidate their global supply chains and use India as their export hub.

Distribution -

This segment caters to after-sales service. This is a business-critical area as Defense, Railways, Telecom, Hospitals, Data Centers etc depend on backup power to be functional at all times.

Growth Avenues

- Indian Railways is set to achieve its target of 100% track electrification of broad-gauge network by 2023 which is driving demand for Diesel Electric Tower Cars (DETCs). CIL is exploring ways to partner with the Railways in evaluating hydrogen fuel cell solutions for Diesel Electric Multiple Unit (DEMU) and other short-distance mainline applications.

- Coal India is planning to invest 87,000 cr by FY 2023-24 in projects related to coal evacuation and mining infrastructure. Also, commercial coal blocks are offered to private players to enhance productivity.

- Increased opportunities for India-built tugs, barges and passenger vessels are leading to a surge in commercial marine segment. CIL has also received its largest ever order from Indian Navy for supply of 400 kWe gensets for anti-submarine warfare vessels.

- Under the Blue Revolution Scheme, investments worth 20,000 cr are planned to increase fish production, including subsidies for fishing boat building industry.

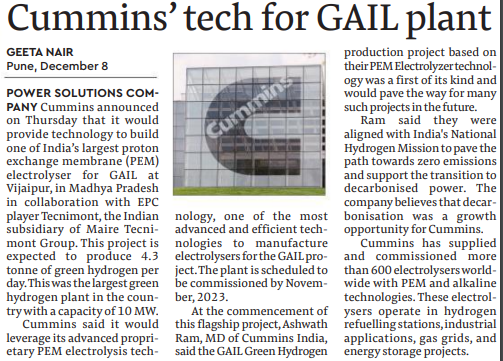

- Targeting an increase in the share of natural gas in India’s energy basket from 6% to 15% by 2030, Government plans to invest 4 lakh cr over next 5 years to develop gas supply and distribution infrastructure. This should create strong demand for gas compression engines.

- Under “National Infrastructure Pipeline”, government has made an investment plan of 102 lakh crore spreading over the next five years, whereby more than 60% of infrastructure projects are from construction intensive sectors like Roads, Railways, Irrigation, Urban infrastructure and Ports. CIL is a leading engine supplier in the Construction equipment segment.

- The roll out of faster and reliable 5G mobile network as well as expansion of Internet of Things (IoT) infrastructure offers growth prospects for Power Generation products. Especially in Asia Pacific and Africa regions, CIL has opportunities for growth in Telecom segment. CIL won a major deal in the Asia pacific region for the 5G telecom network upgrade in FY21.

- CIL is also tapping into opportunities available in Industrial segments such as Rail, Marine amongst others in Asia Pacific.

- While Powergen segment was impacted by COVID-19, segments such as Healthcare, Telecom and Rental offered growth opportunities.

Management

Chairman - Steven M. Chapman

Managing Director: Ashwath Ram

The compensation for the MD Mr Ashwath Ram was 2.4cr in FY21, which for the size of company seems on the lower side. CIL does not have a Stock Option Scheme and no severance fees are payable to any Director.

CIL has contingent liabilities of ~55crs of which 49crs is related to duties and sales tax.

Promoter Holding:

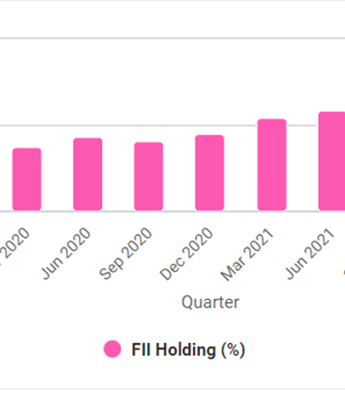

FII Holding:

RISKS

- In light of rising pollution levels, particularly in metros and large cities, the draft electricity Bill states that the electricity distributor shall ensure uninterrupted (24×7) power supply so there is no requirement of running diesel generating (DG) sets.

- The Draft Bill further states consumers using DG sets as backup power shall endeavour toshift to cleaner technology (such as RE with battery storage) within 5 years of the date ofpublication of the Amendment or as per the timelines given by the State Commission – the timelines are still ambiguous.

- Onus to lower DG set consumption on DISCOM: The Bill mandates the distribution licensee to simplify the process of providing temporary connections to consumers for construction activities or any other temporary usage.

- Domestic Powergen forms 27% of Cummins’ revenue and the Distribution segment (28% of rev) drives growth from the installed bases of the Powergen and Industrial segments creating a risk to the company’s primary operations.

- The industry was prepared for engines to be upgraded to a better emission standard, but the reaction to this was not taken well. We await the final proposal on this Bill.

- Cummins has multiple private companies in India and there is always a possibility that the more profitable businesses be diverted to the private companies rather than through the listed entity.

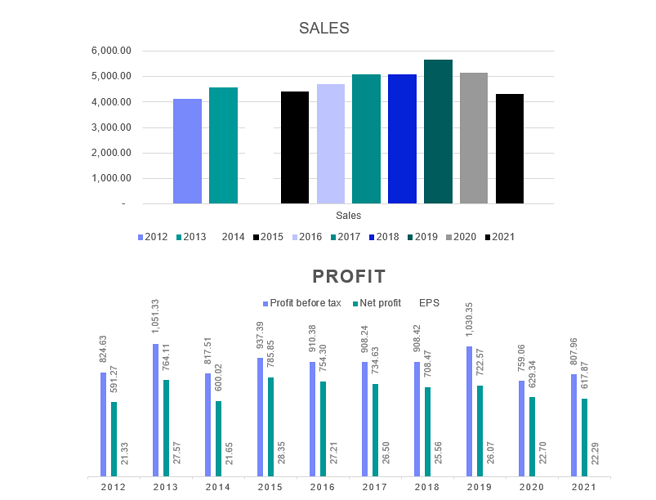

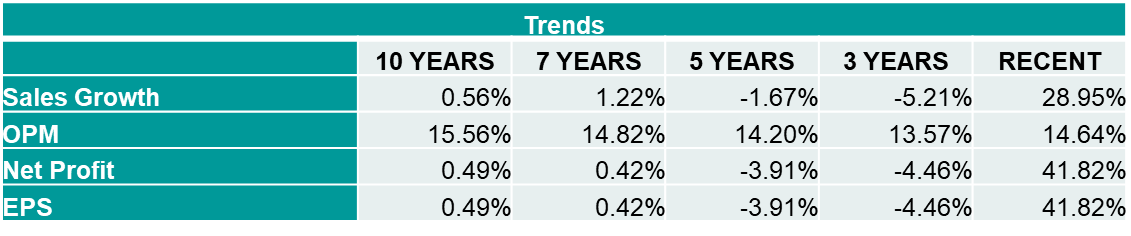

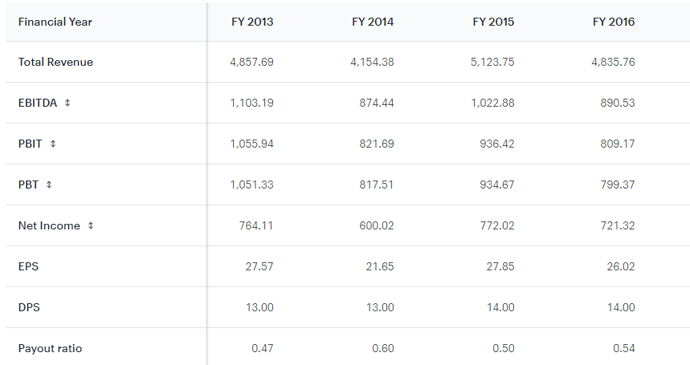

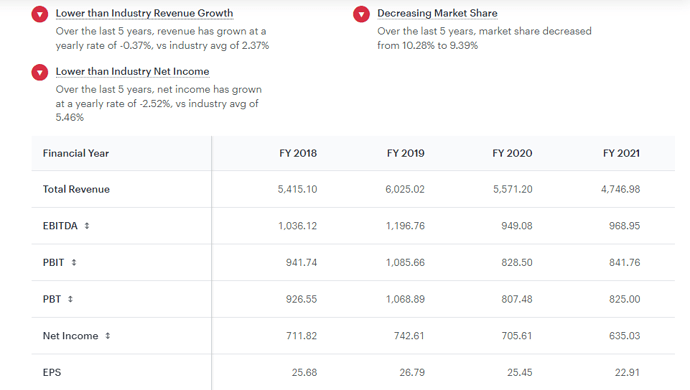

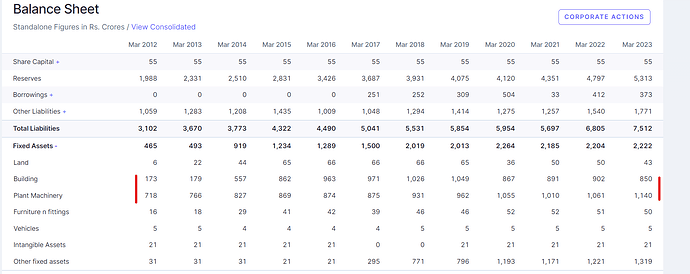

FINANCIALS:

https://www.screener.in/company/CUMMINSIND/

DISCLOSURE:

I am personally interested and have advised clients on this stock. Please do your own due diligence before investing. I may change my views at any time.