Annual Report Summary - 2023

Business Offerings and Capabilities

Coromandel International Limited, part of Murugappa group, is a renowned agricultural solutions provider in India. It is the second-largest player in the phosphatic fertiliser industry in India.

Its market position is underpinned by a leading position in Andhra Pradesh and Telangana - India’s largest complex-fertiliser market - and a wide product portfolio.

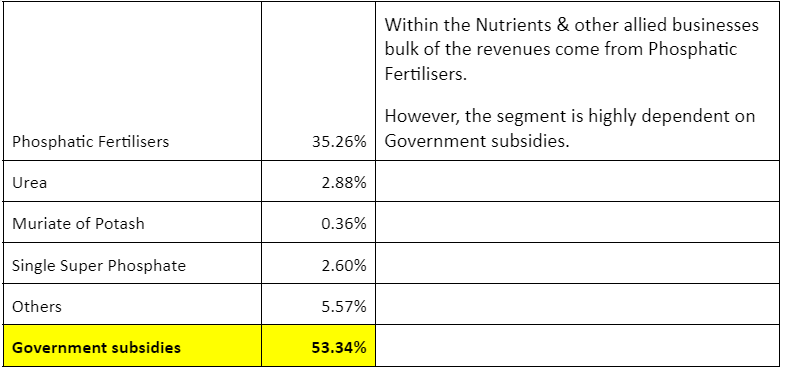

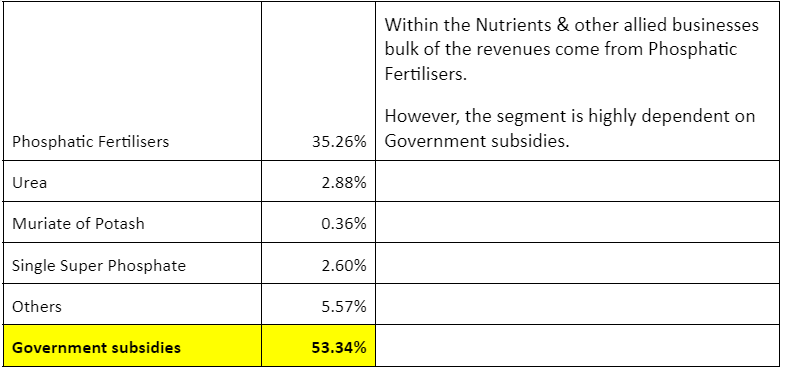

Business Verticals and Revenue Contribution share

The business operations are divided into two major segments: Nutrients & other allied businesses and Crop Protection.

The company has also been gradually increasing the sale of non-subsidy-based products, including crop protection, specialty nutrients (secondary and micro-nutrients of sulphur, zinc, calcium, and boron), water-soluble fertilizers and compost), and bioproducts.

Business Highlights

- Improved NPK & DAP Fertilisers market share (consumption-based) to 17.2% (vs. 16.7% Last Year) on the back of 9 New Product Introductions

- 45% equity stake acquisition in BMCC (Rock Phosphate mining company)

- SAP 3 Project – to be commissioned in FY2024

- Multi-Purpose Plant at Ankleshwar

- Strategic Investments in Agtech startups

- Desalination Plant at Visakhapatnam

Global Agriculture Industry

On the global front, the agri-inputs sector was impacted by the geopolitical uncertainty in the Baltic region. Sudden export sanctions on Russia and Belarus, which together account for 41% of globally traded potash and 25% of nitrogenous fertilisers , resulted in significant volatility in global markets. Export restrictions from China added to the supply pressures on an already reduced global availability

On the crop protection side, an emerging trend of global agrochemical companies looking to diversify their sourcing could be seen, with India being well positioned as a strong manufacturing alternative.

With its rich know-how of complex chemistry, fast-evolving agrochemical ecosystem, sound regulatory compliances, and deep relationship with global innovators based on ethical IPR protocol and cost-efficient manufacturing, India offers a competitive manufacturing destination to the global CPC industry . The next few years can potentially be a watershed moment for the Indian CPC industry.

Indian Agriculture Industry

Over the last six years, the agriculture sector in India has grown at 4.6% CAGR supported by Government’s reformative measures.

United Nations has declared 2023 as the International Year of Millets , emphasizing the potential role of millets in strengthening small farmers, mitigating food security challenges and attaining sustainable development goals.

This along with Government’s move to hike the minimum support price for the crop provides huge impetus to India as the nation accounts for nearly 20% of the global millet production . Additionally, millets are known to have lower carbon and water footprints and have substantial resilience to climate change impacts.

Global and Indian Fertiliser Industry

As per International Fertilizer Association, a 3% recovery in global fertiliser consumption is anticipated in 2023 to 194 million MT of nutrients (+5.9 million MT), returning the consumption levels on par with 2019.

India is the second largest consumer of fertiliser globally after China, servicing over 190 million hectares of gross cropped area and reaching 140 million farmlands. Despite India not being endowed with the major raw materials of fertilisers, it is the third largest producer and meets 70-75% of its nutrient requirements domestically

There has been an increased thrust on reviving the Single Super Phosphate (SSP) industry, the cheapest source of Phosphate providing multiple nutrients like Sulphur and Calcium. In the current elevated commodity cycle, SSP has emerged as a good substitute, especially for oilseeds and pulses for semi-arid & rain-fed regions.

Coromandel holds the top position as the single largest producer of Single Super Phosphate (SSP) in the country, with a consumption-based market share of 13.8%

Global and Indian Crop Protection Industry

The global Crop Protection industry is estimated to grow by 6% to USD 69 billion in 2022, led by improved sales across Latin America and North America regions. Improved crop prices in 2022 supported higher consumption of Agrochemicals during the year

In India, the Crop Protection sector was seen to be impacted by varied factors. Continuous rains across several parts of the country resulted in lesser pest infestation leading to lower demand for key agrochemical molecules. Higher end customer prices and per-acre cost to the farmer as a result of an increase in input prices impacted the demand for agrochemical products.

The industry players started trials for the Drone Application of Pesticides with a push from the Central Insecticides Board & Registration Committee (CIB&RC). CIB&RC has permitted the usage of 507 registered Crop Protection products with drones for an interim period of 2 years.

Coromandel’s corporate venture capital arm Dare Ventures has made an investment in Dhaksha Unmanned Systems , a Drone technology and manufacturing company providing a complete range of Unmanned Aerial Systems (UAS) solutions for agriculture, defence and other enterprise applications.

Future Plans and growth outlook

Backward Integration of Sulphuric Acid Plant (SAP – 3) :

To secure key raw materials by promoting local manufacturing, the company is setting up a new 1,650 metric tonnes per day design capacity sulphuric acid plant at its fertiliser complex in Visakhapatnam at a cost of INR 400 Crore.

The new Sulphuric acid plant will reduce the import dependence considerably and ensure sustainable production of Phosphoric acid, one of the key raw materials for phosphatic fertiliser manufacturing.

India is a net importer of sulphuric acid, and the 3rd largest importer globally, accounting for close to 20 lakh metric tonnes of imports .

Expansion in Chemicals Business:

The country’s Chemicals industry is positioning itself as an attractive sourcing alternative to leverage the macro tailwinds of China+1.

Coromandel has planned to foray into Contract Development & Manufacturing Organization (CDMO) business and diversify into Specialty and Industrial Chemicals segment.

Towards these initiatives, the company has committed an investment of INR 1,000 crores over the next couple of years . As a part of the move to strengthen its core business, the company has scaled up its multipurpose plant at Ankleshwar.

Nano DAP (Di-Ammonium Phosphate):

Di-Ammonium Phosphate (DAP) is the second most used fertiliser in India; however, India relies on imports to meet more than 50% of the DAP requirement. As part of the ‘Atma Nirbhar Bharat’ vision, the government has been focusing on the usage of technology-driven solutions to drive self-sufficiency in meeting the nutrient needs of the nation.

Coromandel has successfully developed a nanotechnology-based fertiliser, Nano DAP, from its R&D centre based at IIT Bombay. The product has been approved by FCO and the company is setting up a greenfield facility in Andhra Pradesh and plans to launch the product in 2023

Potash-derived from Molasses (PDM):

As part of the PM Program for Restoration, Awareness, Nourishment and Amelioration of Mother Earth (PM PRANAM), the government is incentivizing the usage of organic manure, organic & bio-fertilisers. Towards this, Coromandel has been promoting the usage of potash derived from molasses (PDM).

PDM is a by-product from the Sugarcane industry and contains a minimum of 14.5% potassium in water-soluble form. Besides being an alternate source of Potash, the product offers an organic source of nutrition and improves soil health

Strengthening upstream integration capabilities

-

Coromandel has a strategic tie-up with leading integrated players like Tifert (Tunisia) and Foskor (South Africa) for meeting its Phosphoric acid requirements. It has been augmenting its captive phosphoric acid production at the Visakhapatnam plant and is sourcing rock from various countries.

-

Coromandel acquired 45% equity stake in Baobab Mining and Chemicals Corporation (BMCC), a rock phosphate mining company based in Senegal, Africa at an outlay of INR 150 crores.

Rock Phosphate is a key raw material for manufacturing Phosphoric acid, an intermediate used for Phosphatic fertiliser production. Given the high dependence on rock phosphate imports, investment in BMCC improves its long-term sustainability and supply security goals for meeting the country’s fertiliser needs.

The Project has been granted a 20-year renewable exploitation permit in 2018 and at full capacity, BMCC can meet up to one-third of Coromandel’s rock phosphate requirement . BMCC initiated commercial rock production in 2021 and its operations are being streamlined to improve process efficiency and throughput.