sir, how we come to know that management only lure investor . is there any stuff have you written please send me .

Hi Anant,

I am not sure if there is a sureshot way to know if management is acting in their interest or that of shareholders. (If there was, I’m sure no Enron would ever happen.)

What an aam investor can do is some due diligence and hope (or pray) that things won’t go south.

What I do with my investee companies (small caps) is to read quarterly concall transcripts and check quality of answers management provides to analysts’ questions. I also follow corporate actions (e.g. fund raise, preferential allotment), third party transactions, legal disputes, relevance/quality of investor announcement (and their timings) etc. If something seems odd or fishy, I either get out of stock or avoid it completely (if I’m not invested yet).

Others may debate this approach but I feel at peace knowing that I’m not stepping on a visible landmine.

There is no guarantee that I wouldn’t end with odd companies with hidden landmines and that’s the risk I will have no choice but to accept. As they say in stock market it’s important to not only have rules for what you want to buy but also have rules for what you will never buy.

Dear Hemant sir,

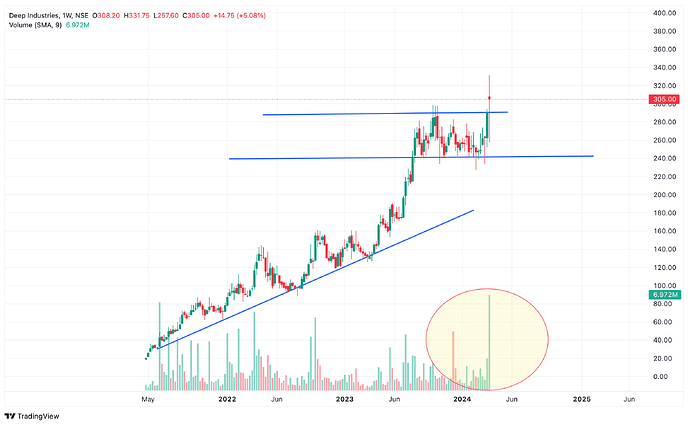

what ever you said is correct .but technically the stock is in Bull run .till the stock close below 286 once can hold .we can see a breake out with huge volume that is very good positive sighn .normally fundamental changes will not factedin immediatly it will take time .best approche is take entry and exit based on technical .

hemant sir please give some insight about this approch

Dear, sorry but since I don’t invest in stocks based on technicals, I’m afraid I won’t be able to comment on your question given my lack of knowledge on this subject.

With my limited understanding, what you need for your stock to do well is earning momentum and liquidity and these two should drive technicals. So if you understand most common techniques for chart reading and your stock has tailwind of both earnings and liquidity behind it, I’d say stick to your technical thesis for entry and exit points.

Rest I’d let expert chartists on this group to comment on.

fOR kORE DIGITAL: has allotment of 4,88,000 Equity shares having face value of Rs. 10/- each issued at a

price of Rs. 795/- per share in meeting of 27 March 24.

https://nsearchives.nseindia.com/corporate/KDL_27032024201439_Outcome_sd.pdf

disclosure: I have neither invested nor intend to at this juncture. Not reco . I just brought the point I noticed.

Mostly all the companies that are mentioned here have a really high PE. I am new to microcap investing, so wondering how should one look at PE ratios in microcaps?

If you are following screener for PE than it will show false PE.

In smes and microcaps one needs to calculate PE in 2 ways

- Multiply H1FY result PAT by 2 and than divide by market cap to get actual PE

- by rough guesstimates one can guess next FY PAT to get rough forward PE.

Not all are overvalued. I agree Insolation is on over valued side but some other businesses are still under 30-40 PE

One also needs to go thru PEG ratio manually rather than PE alone

And also can blend technicals with Fundamentals for prompt exits.

Hope this helps

Annapurna Swadisht is guiding for a growth of atleast 50% CAGR for the next 4-5 years. Their guidance in inline with their recent performance and their filings confirm that they are on their guided path.

Jimmybhai…can you pls help me understand this, incase you may give an example that would be really nice !

I hold bunch of micro/small names, most of them have PE ~100, as per screener and others.

You can example of Annapurna Swadisht

Market cap is 652 cr

PAT of FY23 is 7 cr which means a PE of 93 on FY23 basis

But if you look at H1FY24 results than PAT is 7 cr. If you consider that in H2fy24 also company posts a PAT of 7 cr ( I have assumed no growth here for very conservative calculation, you can increase PAT by your understanding, scuttlebutt or management guidance ) than PAT for FY24 comes out to be 14 cr

Hence PE will be 652/14 = 46

If you further can extrapolate for FY25 company is guiding for 50% growth than PAT can be 14*50% =7 cr incremental profit and 14 cr of FY24.

Hence total PAT of 21 cr

FY 25 PE = 31

This is how most of the brokerage firms calculate forward PAT, EPS AND PE

Disc , given eg of Annapurna for illustration basis, no buy sell recommendations by any means

Gravita India is another company which is providing a guidance of 25% revenue growth and 35% PAT growth over the next few years. A couple of things that support the management claim is as follows:-

- Historical growth of the company is in similar lines

- Government policy with BWMR and PWM 2022 can result in tailwinds in the industry

Also, a large part of the sector is unorganized. If it can shift to organized players over the next few years, this is a story that can play out pretty well.

What about the companies with seasonality? Like with Agrochemicals companies for which sales in a specific quarter is more than the other quarters.

I just looked at the company and find last three years numbers quite impressive. Business model also looks quite compelling.

Any idea what triggers led to price rerating of the stock as it did nothing for its investors for more than 10 years before covid?

In my personal view price re rating is led by 2factors:-

- Growth driven earnings

- Industry tailwind in Reality. This acts as a proxy

By doing nothing for shareholders do you mean dividend or buy backs ?

My personal view is having a strong earning momentum is the best way to create shareholder value. Typically buy backs and special dividends are given when company has excess cash and not enough places to invest. I blv Carysil has not reached that maturity level yet.

I was referring to Gravita India. Stock price was flat from 2010- 2020. So wanted to understand what are the triggers. Query wasn’t about Carysil.

Another noteworthy development is their recent adoption of inventory hedging practices, which commenced around 2019.

Ah ok. I misunderstood.

There are a couple of reasons:-

- The policy tailwinds from the govt. with EPR and BWMR. This should rapidly formalise this sector. At present 65% is unorganised.

- Gravita has started hedging. So margin volatility should reduce

- This sector takes 7-8years for network development. I believe that phase of tolling is over which was a low margin business. Operating leverage should now play out. Current plant utilization is only 57%. Should inch towards 80-85%

- Recycled products take long time for customer approval. These approvals are available with Gravita now.

So barriers to entry are high and policy tailwinds clubbed with operating leverage should give it a kick.

Hope this answers the query.

However, this is purely my personal opinion.

any idea about sj logistics , looking at the latest quarterly numbers was really good

Amara Raja is setting its own 150,000 tons battery recycle facility, which is roughly 35 to 40 per cent of its requirement. How this will impact Gravita?

As per the mgt, no impact at all considering the market size is huge.

So, the opportunity itself is huge. So, currently if you look at the total capacities in the organized

sector, they are not capable to fulfill the entire requirement. So, every battery manufacturer, just

because he has to comply with the new regulations, would have to find solutions. So, part of it

is going to come from contract manufacturing with companies like us, organized recycler. And

part of it is going to come by their own internal capacities. So, I think because the opportunity

itself is so huge that even if their capacities come, it will not overall impact growth that we have

envisaged for the next 4, 5 years.