Rakesh Ji ,

Could you kindly list out the stocks for making an entry into the copper industry ?

India doesn’t have any copper plays except Hindustan Copper. It’s a PSU company, very illiquid, already very high valuations. Tread with caution.

Yes, agree with Rakesh view on Hind copper. But if there is any initiative of strategic sale of this Psu to private hands then it would be game changer for this company and we can see huge upside from here also…

A 6 month old report. It was then posted as a negative in nmdc thread.

Whats a good source to get petchem prices ?

Supreme petchem reported very strong numbers. Presuming other companies will also report extraordinary results. Trying to look up petchem prices relevant to players like Supreme, Manali etc

A blog written on Guinea world’s largest iron ore and bauxite rich nation is now gearing up for upcycle in Commodity bull run with the help of many MNC’s infrastructure buildup. Interestingly one of the major beneficiary is a Ashapura Minechem from India which has already started to export iron ore and will export bauxite also from its own jetty build in a river. It will be very interesting to see the current quarter results of same.

Discl: Holding some

Manali has been on a tear for a while now after the windfall results of last quarter. Prices of propylene glycol in India have shot through the roof on supply shortages due three reasons: (1) US polar storm hurting US manufacturers, (2) Container shortages disrupting imports, (3) Additional anti-dumping duties.

I spoke with some propylene glycol suppliers via IndiaMart about prices and found that the peak prices were in Feb-March and proces today are also much higher than normal. So expect another windfall quarter.

@Rakesh_Arora is it too late to enter the sugar rally now? The re-rating has been swift. But I don’t think the upcycle has matured yet.

Keen to see how the results will pan out.

Another good article on Iron Ore prices - It predicts some softening in second half of 2021 but overall the outlook for iron ore prices is very strong.

@Rakesh_Arora For Godawari, Market cap between 4,000 - 6,000 Cr. is a prudent exit strategy based on the risk appetite given the Ebita of 1,000 cr?

Below is the sensitivity table. It’s between 3200-5400cr mkt cap. You decide based on your comfort level

As Rakesh Sir mentioned in an interview, iron ore & related products demand is all about China. China won’t let the rising steel prices hit it’s economy hard for much longer. Sector such as properties/real estate are having bad time. All eyes on China.

Another article on steel demand/price - mentions two things - a. Steel companies hiking prices even if the demand has flattened, b. The CCI suspects cartelisation among steel players because it is hitting Indian infra companies hard.

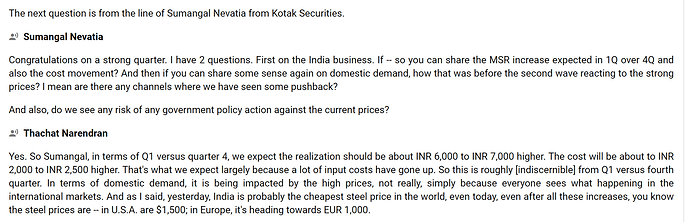

Tata Steel in their analyst conf call has said that they expect steel margins to improve by Rs4000/t QoQ in Q1. Still Indian steel prices are at the lowest globally. Below is the excerpt from the transcript.

Btw most conf call transcripts are now available at GIA Stocks within 1-2hr of conf call happening. Login required but it’s free

@Rakesh_Arora Sir, would like to know your view on Prakash Industries which is integrated steel player with capacities above 1 MTPA.

Sorry don’t track it closely due to corporate governance issues

One of the stock research houses claims that Tata steel bsl is likely to merge into Tata steel.

Thanks for this, yes looks like BSL merger into TSE has been approved at 1:15. The brokerage said BSL is trading at a 30% premium which is puzzling. . Wonder how tied stocks are rallying differently. I think this news is being kept deliberately low key.