Don’t think it is 2 to 3 years. That was some years back but not now.

My source of the timeline is historical concalls of other names. The video on dye intermediates by VP Quest 8 months ago mentioned similar timelines. Sure enough bull market has changed the timelines.

My first reaction was that 2/3 years for EC sounds too much. I’ll try and search for other cases and what’s the timeline there.

Article of 2019

Government has reduced time of environmental clearance

Clean science likely to see a $11 million inflow as a part of FTSE rebalancing.

Valuations are high, of course. But their financial metrics are also good. Even with such pressure on raw material & power costs, their net profit margins are at 32%. And steady capex ensures regular revenue growth as well.

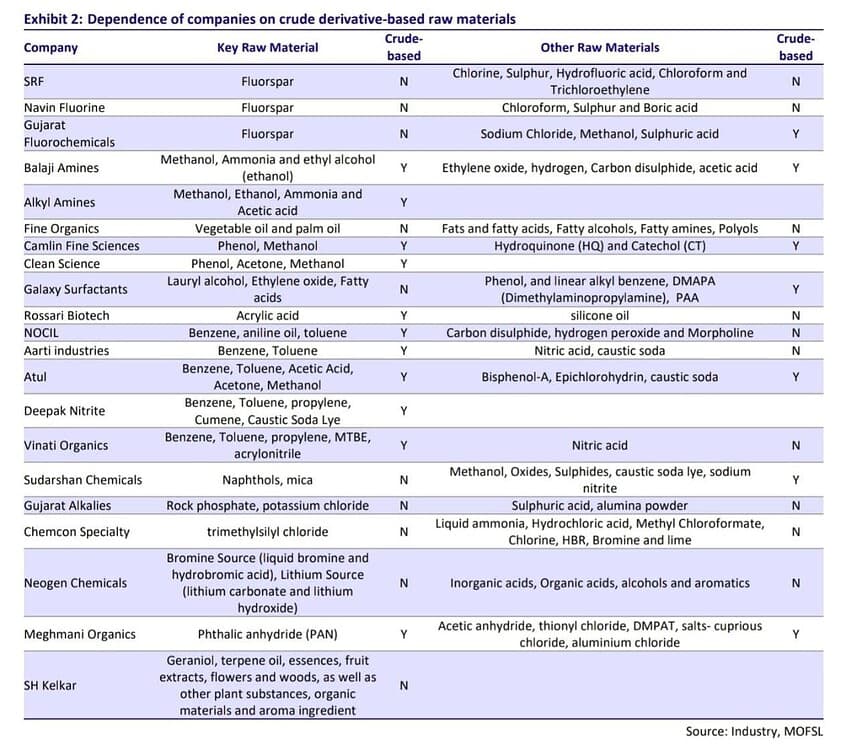

As crude prices are soaring due to the Russia/Ukraine crisis, will raw material costs increase further or stay at Q3 levels for chemical companies? Most of KSM are derived from petroleum products, if am not wrong

Their key raw material is Phenol, so I think Co might see some input pressure now and some more time.

Yes, but probably to a lesser extent as their USP is on process innovation. So compared to Camlin Fine Sciences for similar products, although both will face increased RM costs, the net effect of that for CSTL will be lower than Camlin.

Check out Which Chemicals Stock Will Get Impacted due to Crude ? - YouTube for good analysis of how much would the increase in crude oil affect which company.

Clean Science has gross margins of around 70%. Even if raw material prices increase by 50%, hit on gross margins would be 15% and that is assuming, CSTL doesn’t pass on anything to the customer.

If i recall correctly, CSTL has inked new customer contracts in December which allow for faster price pass throughs. In all likelihood, CSTL should benefit since if it passes on the price rise fully, its gross margins will only expand.

Please check last Quarter concall, Management has mentioned that,

- Despite of very steep increases, we have been able to marginally pass on price increase to

customers because we were contracted until December and the new contract which will start from

January has seen further price improvements. - Going forward, Clean science is not quoting anyone on CIF basis, meaning we are only quoting ex-factory. So, now all prices are only on ex-works basis and whatever is the actual freight will be accounted to freight. Hence, all customers will pay factory price for chemical and freight charge is paid separately. Hence that one hurdle is out, and we have been able to increase prices between 10% to 25% amongst the different products we have."

- So, I’m very hopeful that the margins should recover back and the raw material prices should again come down to between 30% and 32%, which is currently 36% and their price hike will reflect in Q4 result onwards."

Disc: Completely exited last month

Clean Science incorporated a new subsidiary

The new Wholly Owned Subsidiary ("WOS’) will be formed under the name “Clean Fino-Chcm Limited”, or any other name as may be approved by Ministry of Corporate Affairs.

Total lnvestment in the proposed WOS would be upto Rs.200 Crores which will be made in tranches.

The proposed WOS company to be incorporated in India shall carry out the business ol manufacturing Speciality Chemicals.

Nirmal Bang initiated coverage

Quarterly Results

Standalone Figures in Rs. Crores / View Consolidated

| Jun 2020 | Sep 2020 | Dec 2020 | Mar 2021 | Jun 2021 | Sep 2021 | Dec 2021 | Mar 2022 | |

|---|---|---|---|---|---|---|---|---|

| Sales + | 113 | 140 | 125 | 134 | 146 | 153 | 181 | 205 |

| Expenses + | 57 | 70 | 63 | 64 | 75 | 84 | 105 | 121 |

| Operating Profit | 56 | 70 | 63 | 70 | 71 | 69 | 76 | 84 |

| OPM % | 50% | 50% | 50% | 52% | 49% | 45% | 42% | 41% |

| Other Income + | 5 | 8 | 7 | 6 | 7 | 9 | 7 | 7 |

| Interest | -0 | -0 | 0 | -0 | 0 | 0 | -0 | 0 |

| Depreciation | 4 | 4 | 5 | 4 | 6 | 6 | 6 | 7 |

| Profit before tax | 57 | 74 | 65 | 71 | 72 | 71 | 78 | 84 |

| Tax % | 27% | 26% | 24% | 26% | 24% | 25% | 25% | 26% |

| Net Profit | 42 | 54 | 49 | 53 | 55 | 54 | 58 | 62 |

| EPS in Rs | 315.73 | 408.75 | 369.51 | 5.00 | 5.14 | 5.04 | 5.46 | 5.88 |

Disc: On my watchlist, waiting for a significantly lower valuation to invest

Some highlights from Concall:

- Most of the revenue growth is volume growth.

- Unable to pass whole input price increase. Focusing on wallet share gains.

- Added 2 new products p-BQ and TBHQ. Expanded BHA capacity by 50%.

- New products have lower margins to start off. Lower efficiency initially and discount to customers

- Try to look at products where there are no manufacturers in India and country is dependent on China. P-BQ is one such product. p-BQ capacity is 40-50 tons per month which is sold out. Doubling capacity to 80-90 tons. Import is 1200 ton PA.

- Capacity expansion of 50% is completely booked.

- Supply chain issues and logistics constraints helping the local player vs imports

- In products where market share is very high, clean science is the major price driver.

- Last year raw material cost went down significantly thus boosting gross margins. Those GMs are not sustainable.

In terms of raw material cost Management was highlighting about FY21 and not FY22. During FY21 they had good margins which was not the case for FY22 and will not be for future years.

Yes, FY 2021 was an exceptional year for raw material prices. Current GM of ~ 65-70% could be sustainable in future