CL Educate

April 02, 2023

Overview

Incorporated in 1996 by IIT-IIM alumni Mr Satya Narayanan V and Mr Gautam Puri, CL educate started with providing quality guidance and education for the test prep segment. Initially, it was a known name in the CAT coaching segment. But overtime, the company diversified into other segments for test preparation.

The company has relied on inorganic expansion with the acquisition of KITS, compassbox and paragon classes to expand into K-12 segment. These acquisitions were made between 2000-05 time period. In 2006, the company even opened its first school “Indus World School” which was shut down. The company had to write off certain outstandings to the tune of 15 cr

However, the company wanted to foray into the vocational training segment and hence acquired Kestone Marketing in 2008.

With all these trial and errors, the company finally settled onto asset light model where it lends the brand name and operational frameworks to franchisees who in turn operate the centers for test prep. In addition, Kestone could not fulfill the vocational education purpose. However it grew on its own in Martech (providing B2B marketing, digital marketing and experiential services) to contribute 35%-40% of the topline.

Business

The company operates in primarily the following sectors: Edtech & Martech

Edtech

In India, Edtech is primarily divided into 4 segments:

- Test Prep

- Online Certification

- Upskilling

- K-12 Segment

Here CL Educate, after facing several trial & errors, is focussing purely on test prep segment. Their edtech business is divided into 3 categories:

- Test Preparation

- Platform Monetization

- Content Monetization

Test Preparation

CL offers test preparation content and coaching for the following

- Aptitude products for entrance exams like – CAT, CLAT, AILET, GRE, GMAT, Bank, SSC etc

- Knowledge Products for entrance exams like – JEE, NEET, GATE, AIIMS, CUET etc

Company operates around ~200 centers of which 25 are own centers while 175 are franchisee partners. The company is planning to ramp this up to 500. Additional 300 would come via franchisee route only.

Platform Monetization

Under its Platform Monetization, it offers various educational institutions an array of its products such as:

- Integrated solutions to educational institutions & universities across India

- Student Recruitment Services

- Research & Incubation Services

This helps universities in the following:

- Attract smart students

- Improved Research Output & Publishing

- Seed Funding and CSR projects

- Attract research funds from Govt. & Industry

Content Monetization

CL under the brand name GK Publications distributes titles under 3 categories:

- Technical (comprising titles for GATE, technical vacancies in Central Public Works Department, etc.)

- Non-technical (comprising titles for CAT, Bank/SSC examinations, Civil Services examination, CUET etc.)

- School Business (comprising titles relevant for students preparing for their Board exams)

The company believes in the phygital (physical+digital) approach even after the advent of edtech for test prep segment where:

- Expansion takes place via an asset light model of franchisee

- Company’s in-house SAAS tools are used by students at home for taking test or revision

Also the company had taken baby steps towards CUET 2 years ago and hence the announcement and its concrete plan given by the government, CL had the head start to acquire students

Martech

For the MarTech segment, the company offers the following services to corporates:

- B2B Marketing

- Experiential Marketing

B2B Marketing

These are standard services offered by any digital marketing agency. Here CL educate offers Lead generation, creative designing, content creation, website designing and digital marketing services

Experiential Marketing

Here the company takes charge of the events (physical or digital) which are conducted by corporates. Kestone takes care of everything from booking the venue to marketing to setups.

In this regard, the company has launched its platform “VOSMOS” where the company will plan to integrate metaverse with virtual events (Source: Link). The company has been the pioneer in using web 3 and has been a key player in providing virtual event experience with metaverse

Corporate Structure

Prior to merger in March 2022, CL Educate used to have 5 WOS (wholly owned subsidiaries):

- CL Education and Infrastructure

- CL Media

- GK Publications

- Kestone

- Accendere Knowledge Management Services

All these companies were merged with the parent (CL Educate). Hence the related party revenues have been considerably decreased along with loans provided. Besides this, CL Educate owns ~9.5% stake in Threesixtyone Degree Minds Consulting Private Limited. This company provides educational solutions to universities and corporates

Financial Highlights

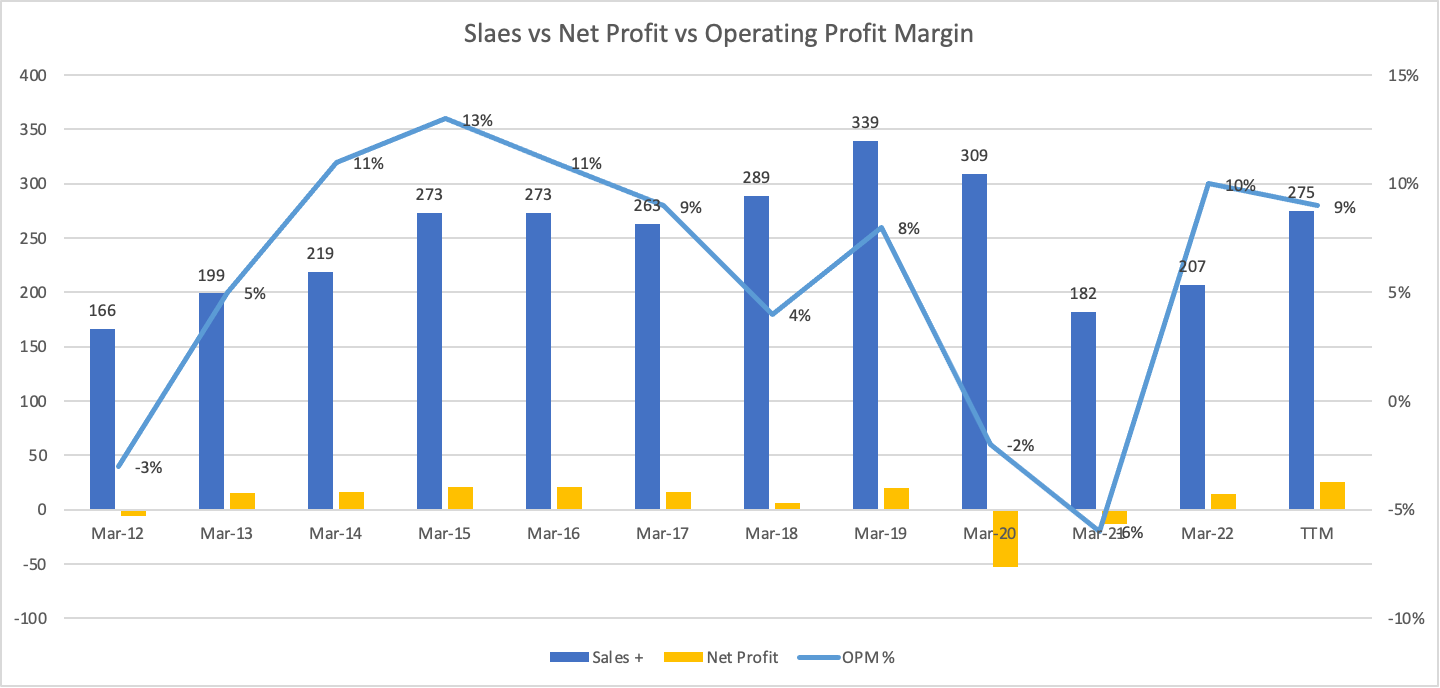

Here is the highlight of Sales, Net Profits and Operating Profit Margins:

Some points to note:

-

Negative net profits to the tune of -53 cr occurred in Mar 20 due to one time write off

-

There was no impact on operational cash flow

-

During 2017-18, the company sold its K-12 related business to B&S Strategy Services Pvt. Ltd in a cash plus stock deal. As a result, one of the subsidiaries of the company, namely, CLEIS (Career Launcher Education Infrastructure & Services) Ltd. received a 44.18% stake in B&S Strategy Services Pvt. Ltd. This has been written off on account of school closure due to Covid

-

On the other hand, Mar 21 had the negative profits of -13 cr majorly on account of covid lockdowns

It takes 80-90 days for their cash to be converted. ROCE is muted at ~12%-13% in a stable state.

The biggest expense line items are Franchisee expenses and Project Expenses. These are the share of revenues given to franchisees

However, the company plans to take it to 16%-17% in the steady state on account of expansion via asset light model and returning excess cash to shareholders

Key Strengths aka Moats

-

No reliance on star teachers and hence making the organization star teacher dependant

-

Dependent on systems driven, process driven and take youngsters and groom them into becoming effective leaders,

-

Local entrepreneurs for franchisee have skin in the game and hence always hunt for youngsters who can be groomed to become star teachers

-

Diversified and integrated education products, services, content and infrastructure provider, with pan- India presence and a focus on knowledge-creation;

-

Asset-light, technology-enabled business model;

-

Strong brand equity; leader in MBA prep with 10%+ market share

-

Track record of successful inorganic expansion due to better human capital management

Valuation

The current valuation of the company is 279 cr. The total sales is for 275 cr with net profit 25 cr. Cash sitting on the Balance sheet is 94 cr with 4 cr of debt. Enterprise value comes out to be 180 cr

- In a steady state, for eg., they used to have 151 centers with 273 cr of revenue in 2016 with 53% coming from test prep. This comes out to be 95 lakhs per center

- In this steady state, with 500 centers, the topline comes out to be 475 crore

- With the Martech growth assumed at 20% (the past has been 40%), the current revenues of 120 cr translates to 207 cr in 2025.

- Translates to 475+207 cr in sales = 682 cr in sales

- EBITDA at 10% means 68 cr in EBITDA. Assuming the current EV/EBITDA multiple at 7.2, EV comes out to be 480 cr

- Adding 100 cr of cash makes 580 cr of MCap

Let’s see how this plays out