Sir why prefer to exit from Manappuram?

Please don’t call me sir. I bought between 103-105 on the day the news broke out about the ED action. The price has reverted back and I have better ideas at the moment. This of course has no bearing to anyone else who has a different horizon/investment thesis.

Some pointers on my high allocation ideas, and those I’m currently evaluating.

-

My model is for Satin is that they’ll do around 250 Cr. of PAT in FY24. This would make FY24 book value 225. If the industry structure remains robust for a few more quarters, Satin too should re-rate. Depending on how this plays out, from 1-1.5x FY24 book, upside ranges from 32 - 100%.

-

Man Industries has guided for 300 Cr. of EBITDA in FY24 on the back of a strong order book, volumes from new capacities, and additional volumes coming through at the end of FY24. If they grow conservatively at 20% and manage to reach double digit margins, they could do around 270 Cr. of EBITDA. They’re virtually debt free, and will receive around 150 Cr. of cash for land that they’re trying to monetise. If this happens, FY24 EV/EBITDA is around 2.6-3 before taking into account any spend on stainless steel pipes.

-

Market is pricing in a recovery for Coastal Corp. They claim to have sold out their capacities in their new plant to Japan and South Korea, thereby avoiding competition from Ecuador incrementally. A reversion on US shrimp inventories, and a really cheap ethanol plant are additional optionalities for Coastal. I’ve shared some reading material on the former here:

-

Sudarshan has put up an immense amount of capacities in the last few years, possibly at the worst time in the cycle. Margins look to be recovering, and they should start reporting volume growth too. I’m going to be quite patient here, and possibly pick up other peers once the sector as a whole starts to recover.

-

Solara has been battered for a year now, and is trading at really cheap valuations. If they manage to scale up their new plant - and with some luck, have the USFDA issues sorted out soon - margins should start to recover. Management has guided for reversion in margins in the second half of FY24. At this price, any improvement in the business could lead to a quick rally.

For the majority of my portfolio, I am not looking for multibaggers or huge winners. I have found having a broader view on sectors and companies more rewarding, and this helps me find mispricings.

This is not financial advice, I am often wrong. Please do your own due dilligence.

Hii…

Can we expect better nos from Sudarshan chemical after Atul ?

Thank you

Why did you exit from Transpek?

Hi Chins, been a while since we heard from you. Any updates on your portfolio?

Hi @Chins I saw you posted about shrimps on Twitter and since you have researched this sector, how do you see Kings Infra Ventures Ltd? (Kings Infra Ventures Ltd financial results and price chart - Screener)

My 3 +ives - 1) Healthy growth in sales & PAT and massive plans for expansion/JV into US, Japan,China (though small) 2) NCD allotment; 3) They have some new species with better yield and fewer health issues

3-ves 1) Not sure of management; 2) Too much diversification on a small base into retail activity, IT, etc. 3) PE at 50.4 & Price to book at 9.9

(I am just a newbie just learning the ropes.)

There are several new developments in my investment journey that I’d like to share.

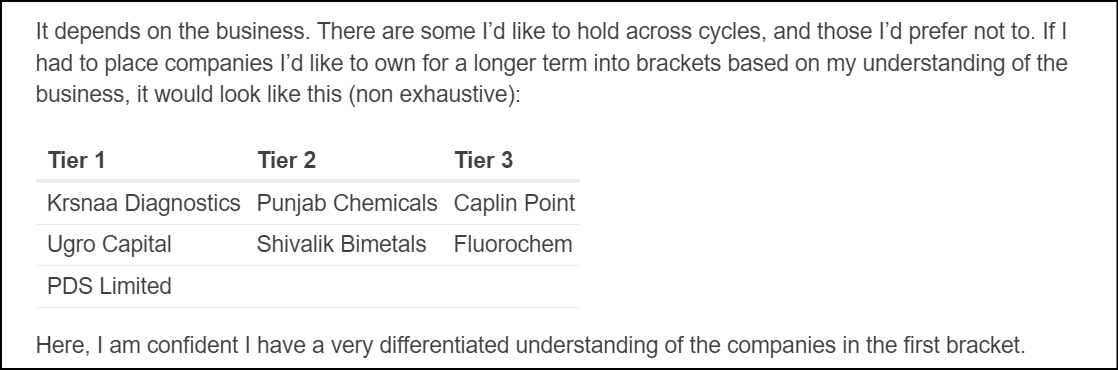

Six months ago, I classified my understanding of my top holdings in different brackets, according to my confidence in having differentiated insights:

Since then, I have implemented a completely new framework while working on a company.

I now speak to suppliers, clients and distributors of all of the companies I am evaluating. The goal here is not to look for UPSI, but to understand the nuances of operations from several different stakeholders. This has many advantages:

-

I have a better understanding of where we are in a given cycle, the major drivers, and the industry dynamics over the last X years.

-

I have a better understanding of the competitive positioning of all the companies within this space, the differences in each one’s model, and the (relative) truth on the ground.

-

I have a better understanding of the life cycle of several products that were introduced, feedback on middle management, and the real drivers of things that have promoted or stifled growth.

-

It now takes far lesser time to get the hang of a new industry or sector. A complicated story like PDS took two years to unravel, I’m now able to get to that kind of understanding within 2-3 months.

As an example of what this entails, please see the post below, where I shared the notes of my conversation with one of India’s largest public sector banks.

Over the last six months, I have spoken to 2-3 industry veterans / managements a week, and I am happy to say that the number of companies I am confident of having differentiated insights on has grown from 3 (in the above image) to now over 25.

This framework is nothing new, or groundbreaking - indeed many of the top funds in the country (and some senior members of the forum) have been doing this for a long long time. I have tried to exponentially increase the number of different data points that help validate or invalidate an investment candidate, in order to raise the probability of being right.

I have implemented this framework in the family portfolio. I have sold out of all of the legacy holdings, inlcuding TCS and Infosys that have been held for 20+ years. We will be formally incorporating as a family office some time in 2024:

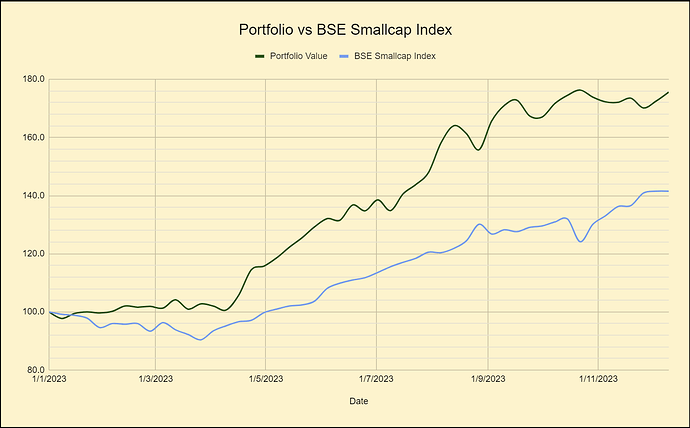

The portfolio shared throughout this thread has been my own portfolio. This year, it has generated ~80%. I am sure everyone has done well in this market.

Going forward, I will be sharing the family portfolio. While I want to be transparent with my purchases, my framework involves a lot of churn, and thus will share what I think are longer term investments, and not opportunistic bets.

I will also try to share a summary of my industry scuttlebutt with a lag of a few weeks, or maybe something like a monthly post. I don’t plan on monetising these insights.

Have enjoyed working with @nirvana_laha who has become my biggest collaborator this year. Thanks to Harsh, Yash, Bharani, Ayush, Sahil, Malhar, Vineet, Ankit, and all the others for working on many many ideas with me.

In the last week, I have taken a 6% position in Dollar Industries.

I had a discussion with a former employee at Rupa, and my goal was to better understand the innerwear cycle, where we are right now, and a channel check of the current demand. In this conversation, he spoke about Dollar Industries unprompted, and proceeded to explain in the next hour why Dollar has the most differentiated model within the economy innerwear segment.

Prior to this call, I was of the opinion that the chaddi companies were all the same, there was not much differentiating them, and the play is largely mean reversion in the cycle. I now am of the opinion that we’ve stumbled upon a story whose gravity is only visible through scuttlebutt.

I think Dollar therefore is a perfect candidate for a long term position in my portfolio, with the one risk of being a year or two early to the story. It fits my bill of being in an out of favour sector, and the thesis is not very transparent unless one is looking closely. Indeed without this coming from a competitor’s mouth, I may not have paid as close attention.

I have shared my thesis of Dollar Industries on the company thread below.

While I had not thought as deeply on the structural shift in Dollar as you have, I have also been watching the progress on the Project Lakshya efforts. I had initially built up a position in Rupa before deciding to invest in Dollar. Over the last quarter or two, I have turned more confident about Dollar.

That said, I have two concerns here - 1) There is still no signs of consumption recovery in the segments that these companies primarily focus on (maybe the elections will lead to a short-term bump up) 2) Competitive intensity seems to be increasing with a number of new-age D2C brands coming up. Examples include XYXX, Clovia, DaMENSCH etc. Unsure about their business models (as with most D2C startups), but so long as they are around, they could impact the sales of the traditional brands like Dollar, Rupa etc.

These two key concerns are holding me from increasing allocations much more now. Appreciate your thoughts here.

Hi @Chins,

What do you feel about the results of Kanchi Kapooram & Mangalam Organics ?The results didn’t show much of margin improvement as well as revenue improvement. Do you think the camphor cycle will play up looking at the shortage ?

Hi Chin,

How are you? Hope all is well. ![]()

Wanted to know if you are still holding Valiant Organics.

Thank you very much for sharing your knoledge.

In the last two camphor cycles, prices of camphor usually followed prices of gum turpentine - a strong year for gum turpentine has lead to inventory gains for camphor companies.

Right now, people like Oriental have spoken about more camphor supply that has come in. After speaking to a couple of unlisted players in camphor, it looked like supply and demand for camphor in the country was balanced despite the new supply coming in.

My understanding is that the major demand season for camphor happens in the festive seasons of Q2 / Q3. Right now, the RM prices have run up, but camphor prices are soft because we’re not in this window. My plan is to wait and see if prices pick up in September / October.

The clearest way to play this cycle is Privi. They have long term contracts for both RM and FG. So they’re buying RM at much lower prices right now despite the shortage, but consequently, their FG prices are also lower than the spot market. However, a quarter of their sales are in the spot market where they should make a killing. This said, Privi is the most expensive in the space.

Hi Satyajit, I don’t own Valiant.

Do you like Oriental Aromatics given your study in this space?

buddy what’s your thesis on TF? have you concluded, planning to enter but not getting more info online, may be due to microcap.

Appreciate if you can share your thoughts or any latest info if any., thanks