They revalued their land

Any reason for it being stagnant amidst the market rally? Is it consolidation/accumulation? Kindly advise

Shouldn’t this revaluation be shown under other comprehensive income?

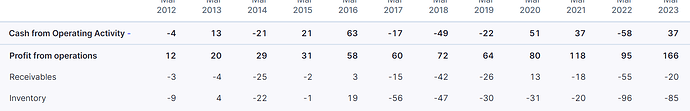

Does anyone know why CLSE has poor Operating Cashflows compared to peers (like KRBL, Dawat)? Do they have any known receivable issues?

I don’t think they have any receivable issues. Operating cash flow seems to be mostly affected by increase in inventory and due to slight increase in receivables.

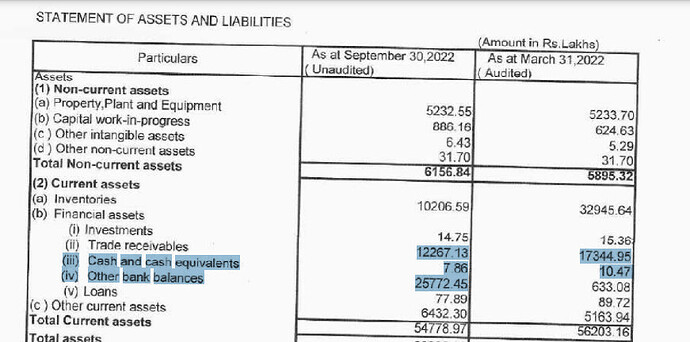

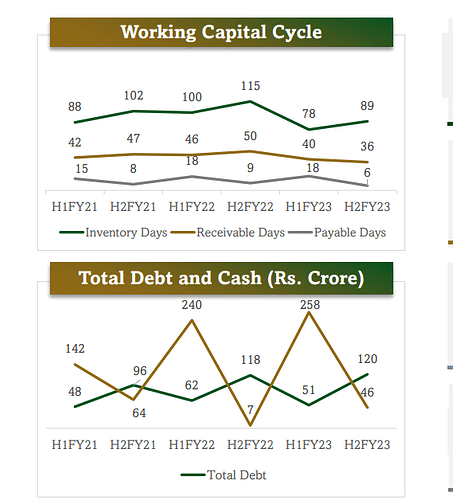

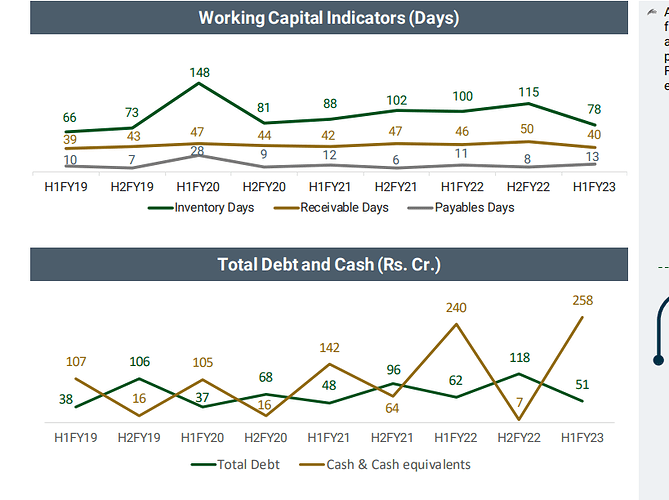

I don’t think its an issue as sales has significantly increased over the years requiring higher inventories. Inventory days is in fact much better than for KRBL ( they age basmati rice). Inventory is usually higher during annual balance sheet date as bulk of the basmati procurement happens in Q3 and Q4. So I think looking into the half year balance sheet will give us a better picture of the inventory. Inventory is getting converted to cash in the Sept balance sheet.

The Unaudited Sept 22 balance sheet shows increase in Other bank balance and corresponding reduction in inventory over March’22.

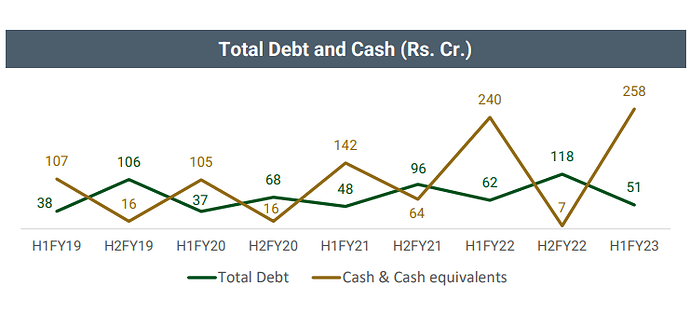

This chart shows the company’s fluctuation in cash equivalents every half year.

Source: Investor presentation Q323

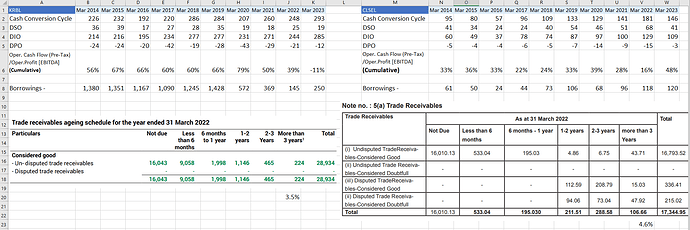

Here are my observations after comparing numbers of KRBL and CLSEL.

- Business is WC intensive, particularly on the inventory front.

- Cumulative operating cash flows (Pre-Tax)/operating profit ratio of KRBL is 2x to that of CLSEL’s.

- Unlike CLSEL,

- KRBL writes-off its impaired credit and does not keep any disputed receivables in the aging schedule.

- KRBL products have a pull among customers, inference from the trend of falling DSO.

- KRBL gets better credit terms from its suppliers, inference from DPO.

CLSEL’s accounting for AR, and business terms to customers as well as suppliers are more liberal, resulting in weaker operating CFs.

Is there any reason, that despite huge shortage of Basmati being reported in USA and Europe, Chaman doesn’t seem to find any traction ?

Will the high demand of Basmati (triggered by export ban of non basmati rice) not yeild to better margins for Chaman ? Company seems to carry decent inventory as evident from March Qtr results.

Any insights from rice experts will be appreciated.

Hello Folks,

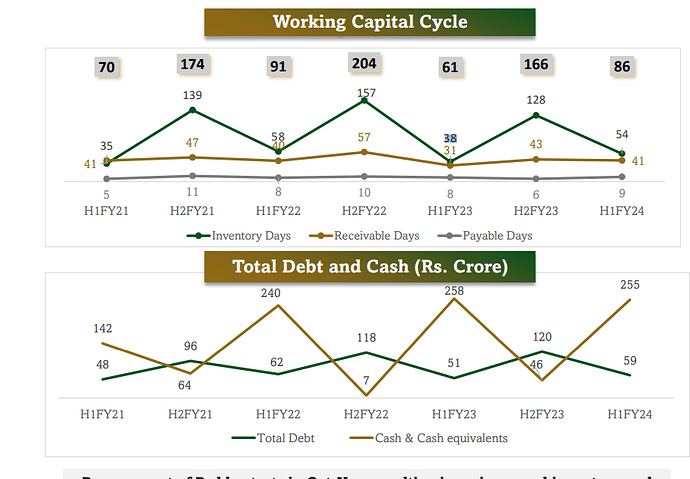

Can someone please explain to me the reason why are the numbers of the inventory days are different of the same half in the below pictures.

The pics are Taken from Chaman Lal Setia Investor Presentations of different quarters

I am studying about the company recently and have been amazed by the managements way of doing Business.

Also I have come across a great site to track basmati export Volumes and Realisations. I did not see anyone mentioning this in the above posts.

Qty Exported in the Month of October by India

Qty - 300,669 MT

Value in Cr - 3067.51

Avg Realisations - 102/kg

Val. $mn - 368.52

I have learned a lot from this thread and Valuepickr.

Disc- Taken a tracking position recently.

Chamanlal has been reporting very good nos. I am including notes from their last couple of calls below.

FY24Q2

- Realizations increased from 85 in Q1 to 90/kg in Q1, export volumes increased by 14% QoQ (export sales growth of 20% vs 4.5% decline in domestic sales)

- 35k tons in Q2, EBITDA: Rs. 10/kg (which is very high according to management)

- Focus is now on increasing domestic sales, especially with MEP problems

- The shipments of parboiled rice were impacted in September

- APAC region contributed 40%, Middle East 40% and America & Europe contributed 20%

- Israel exports are intact and hasn’t seen any pressure

- Crop is 15% higher than last year. Have procured 10,000 tonnes of pesticides free rice

- Expect Q3 to be more favorable because company have procured rice at lower level which will lead to increased profitability

- 50% of the total procurement is already done and procurement has happened at favorable prices

- If basmati minimum export prices had stayed at $1200/tonne, there would have been severe impact, but because of reduction in MEP to $850/tonne there are no problems currently

FY24Q3

- Export realizations increased from 90/kg in Q1 to 93/kg in Q3, export volumes increased by 10% YOY and 37% QoQ (export sales growth of 16% vs 13.2% decline in domestic sales). Are opportunistic about selling between domestic vs exports

- 39k tons in Q3, EBITDA: Rs. 13/kg

- Branded sales (Maharani, Mithas and Begum) comprised 12% of 9MFY24 sales

- Value-added segment (Diabetes, Brown Rice) grew by 167% YoY during 9MFY24

- Have started advertising on e-commerce websites

- Procurement prices are 25-30% higher this year

- Basmati prices are decreasing, however their inventory is mapped to sales

- EBITDA margin guidance: 11-14%

- Small packing sales (<=5kg): 35% of sales

- Inventory Dec 2024: 626 cr. (Have more orders than inventory)

- Make quotation on FOB prices, make shipments on CIB basis

- Yemen, Israel are currently impacted

- Deals with House of Spices in USA

- Will use cashflows generated to grow business by investing more in working capital

- Will target export of other commodities like Peanuts, sesame seeds, haldi, etc. from Gandhidham unit

Disclosure: Invested (position size here, no transactions in last-30 days)

Could it be that we are near the peak of the basmati prices ?

Waiting to see the Feburary price of WPI basmati rice.

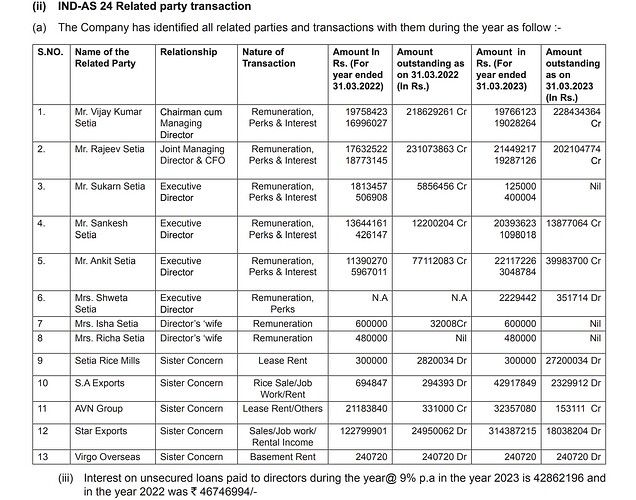

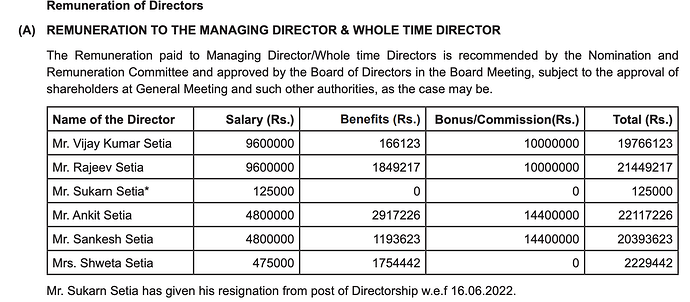

I was going through FY23 Annual report and came across a related party and saw two entries for amount FY23

- First one matches exactly with Compenstation. What does the second entry refer to?

- Why are they taking loan from Promoters at 9% ? Isn’t that too high rate of interest given that they are a sizeable business now and getting short term from HDFC ?

Both snapshots are taken from Annual Report FY23

These are “unsecured” loans. Unsecured loans at 9% is fairly competitive rate…

Further, with the asset light model they have, they have sudden requirements of funds for a short period of time (depending on orders inflow/raw material availability), and that’s where these funds come in handy …

Anyway promoter putting his own funds on unsecured terms at a fairly competitive rates is a positive.