I think Prof Bakshi didn’t say anything wrong, He just pointed out the obvious that some of the revenue is gone forever due to some companies defaulted which were AAA rated.

Does it means there will not be any new addition in future ?

No.

He is not also thinking in Bayesian way, Giving more weight-age to few defaults over the over all track record of the company.

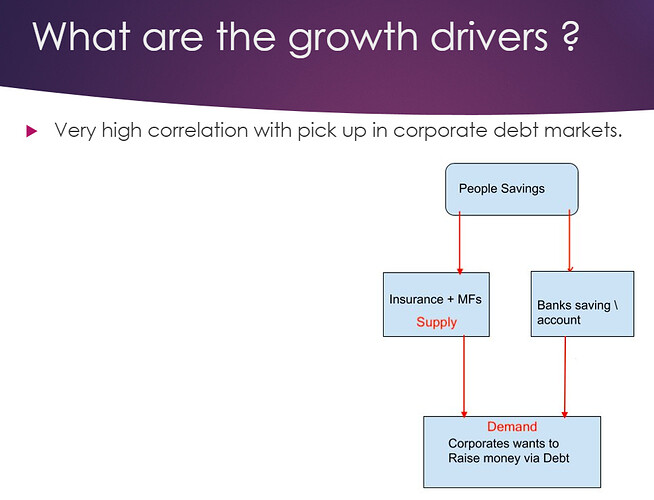

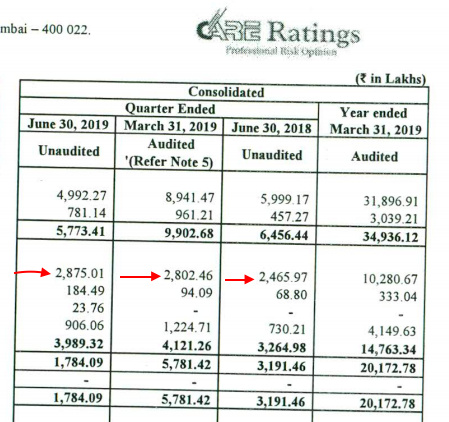

Net profit became half not because they lost revenue from DHFL & IL&FS and select few as they rate 1000’s of companies, its gone because the demand for debt is vanished from the economy ( Shown below - Demand driver )

Here flow to MFs Debt fund is -ve, Corporates not raising any Debt. either through BLR or Bond markets. Basically incremental demand is 0 in the market today ( not a forever phenomenon)

Does it means the Demand will never come back ? The answer is NO.

Now you may argue there is a certain part of the revenue which is recurring what happened to that? Like the instruments CARE rated in past has to be update YoY and those institutions pay YoY.

For this CARE clarifies the Cash has not come yet, The companies are delaying fee. Yes there are some ( very few) defaulted, won’t come into recurring revenue but there are many in stress and probably waiting it out to get themselves rated as nobody wants to get themselves rated in this economic scenario where their receivables are stuck with other ( but are good) , they might be waiting for them to become normal. ( if you go check ground conditions in SMEs everyone is saying Payment lene baad mein aana, Dhanda ruka hua h)

I would argue this is a Pause not Reset for CARE ratings.

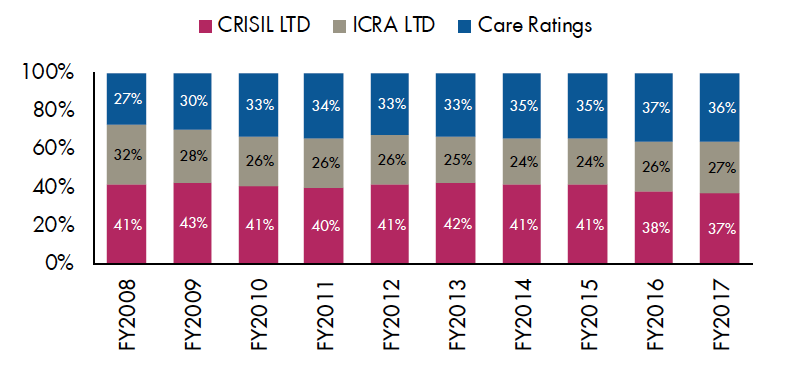

Secondly, Earning call some analysts asked how come you your competitors are doing okay and you are doing bad? That means you are losing market share and she was pointing towards CRISIL.

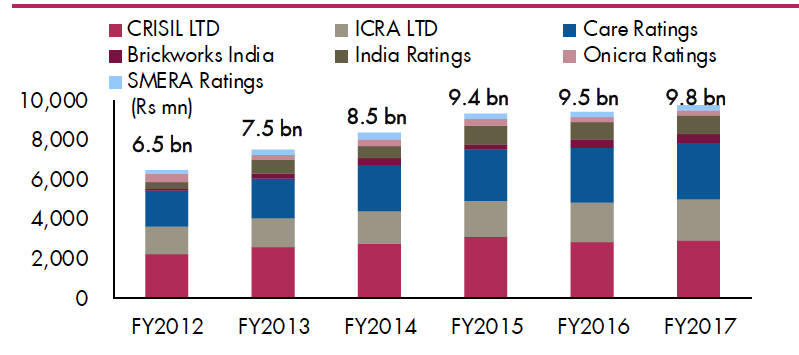

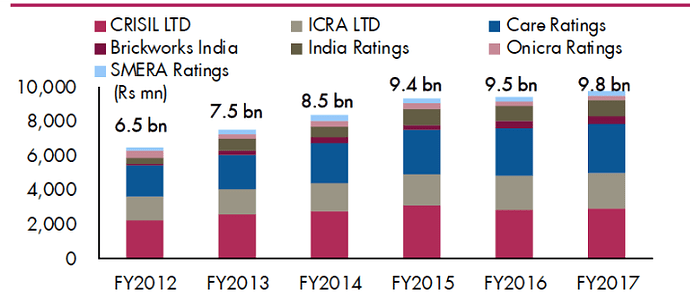

CRISIL - Does 30% revenue from Ratings and if they would have reported their rating segment-wise revenue ( i didn’t check) it must have declined in line with CARE.

Coming back to Prof point they rate Rated " FAKE AAA and its all gone" - Its a right statement in a sense yes maybe 10-15% ( at max ) of the revenue gone forever but that gone for CRISIL and ICRA too, they rated them as well.

No company can do NCD if not rated by at least two rating agencies.

since 1993 of CARE existence many have defaulted overtime and many came up overtime, CARE / ICRA /CRISIL continue to grow their rating books. Its not end of the road.

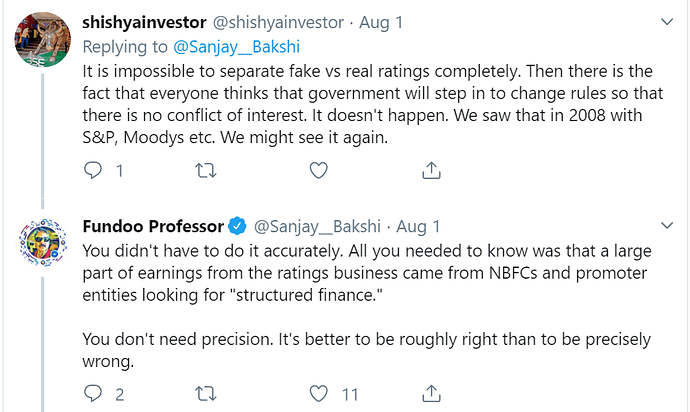

Now, coming back his replay to this stuff by prof -

It sounds more emotional to me than Bayesian to me, because data doesn’t support that.

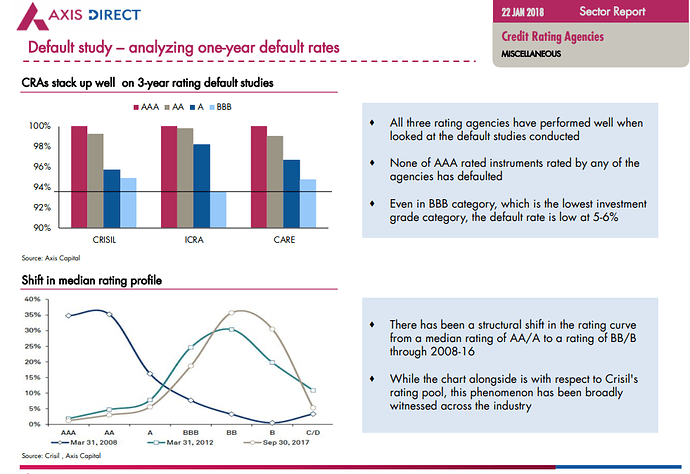

If you look at default study of all previous AAA rated instrument by rating agencies you will realize one IL&FS case is the only miss before that they had 100% track record ( AAA rated never defaulted ).

IL&FS - also if you read rating report they all assumed this company has sovereign guarantee due its PSU promoters, Thats the miss. I think only few like Prof. knew beforehand that what all is FAKE AAA.

Most of mortal like us don’t have crystal ball to know whats going to default in future.

Here is another non- Bayesian type of reply to a good question -

First of all - there is no single NBFC NCD that is rated by CARE alone ( as you need at least two by regulation) .

secondly, If you use think Bayesian way by calculating no. of default vs the number of rated instruments you get not all revenue is phony FAKE AAA revenue. Many instruments they rated AAA, AA etc are doing okay have not defaulted.

CARE has changed the revenue recognition now they are booking only when cash comes in, and Cash is delayed by the companies they rate, most of which are SMEs. i think most of the revenue showed this Q1 is from BLR which used to be about 50% of their total revenue anyway.

This is not doomsday scenario and CARE is not all FAKE – AAA rating agency, their 1993 to 2019 track record doesn’t say that. Util IL&FS none of the AAA rated company defaulted in India.

Whatever happened will force rating agencies to improve and its a good thing.

SEBI did assessment of [

Assessment of Long Term Performance of Credit Rating Agencies

](http://www.sebi.gov.in/sebi_data/attachdocs/1288587929503.pdf)

This is not like the emotional assessment Prof did by writing two tweets, interesting folks here can read it to understand FAKE vs REAL rating debate.

Thanks,

Amit