We have all seen various posts on different social media platforms about how the Indian economy will soon become a consumption economy. While this is true due to our increasing population and more disposable income we should not forget the main drivers behind this. Data from World bank suggests that 64% population lives outside urban cities and many reports from reputable agencies suggest that the next wave of growth would be outside urban India.

When I first read about this I was shocked but excited about India’s potential and I started my journey by finding stocks that would benefit the most.

Before talking about this stock a quick disclaimer that this is not a buy or sell recommendation and I hold < 3% of my portfolio in this stock.

The company we will be talking about is Cantabil Retail India Ltd

Cantabil was incorporated in 1989 as a garment manufacturer and pivoted into the retail business in 2000.

The Company is into men’s wear (86% of revenues)- These include your formals, semi formals, Casuals, Ultra casuals etc

Women’s wear (9% of revenue) - These include kurtis, leggins, tops and other items

Kids wear (2% revenues)- Shirts,dresses etc

Accessories (3% revenues)- belts,socks,ties etc

The company has established a 1.5 lakh sq.ft. state of an art manufacturing facility in Bahadurgarh, Haryana with a capacity to produce 10 Lakh garment pcs. equipped with best brand machines from JUKI, Durkopp, Brother, Ngai Shing, Kansai, Pfaff, Maier, Siruba, Sako and latest finishing equipment using hot and cold steam foam finishers from Veit and Macpi.

Asset Light Model

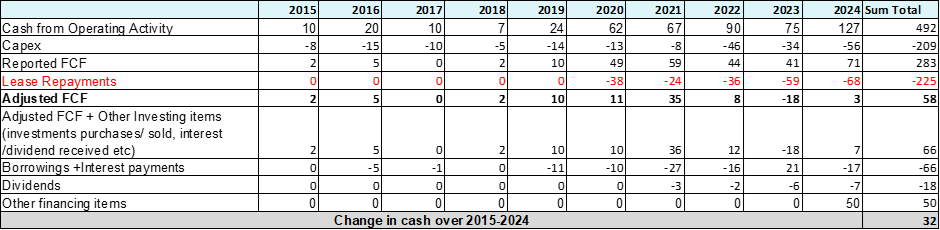

The company operates with an asset-light model wherein only about 1/3rd of the apparel are manufactured in-house at its fully integrated facility in Bahadurgarh. And sources another 1/3rd of its requirements from dedicated job workers and the balance ~1/3rd is purchased on a FOB basis directly from manufacturers

Distribution Network

The company sells its products under its brand Cantabil, Kenaston, Crozo, and Lil Potatoes.

Online Presence

The company has products listed on top Indian marketplaces like Amazon,Flipkart,Myntra and Tata Cliq to name few.

However sales from online channel currently contribute to only 3% and the company expects it to raise by 5%

Number of showrooms

As of 31st July 2023 the company currently has 469 stores and plans to open atleast 60 to 70 showrooms every year.

Lets talk about the business now

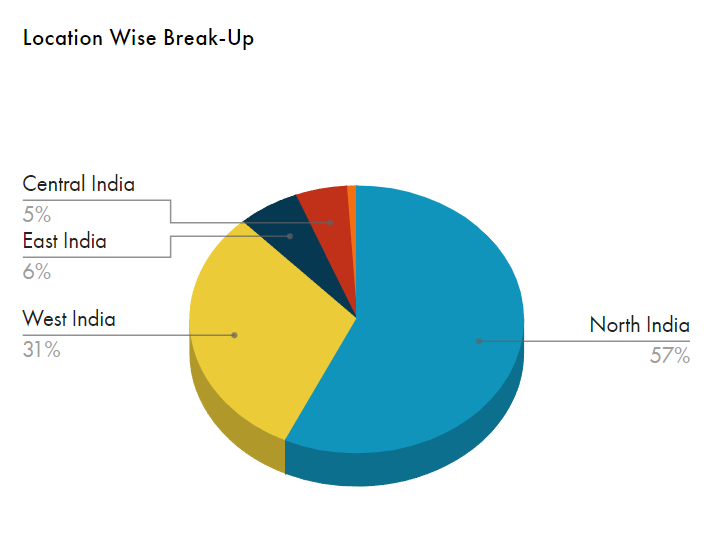

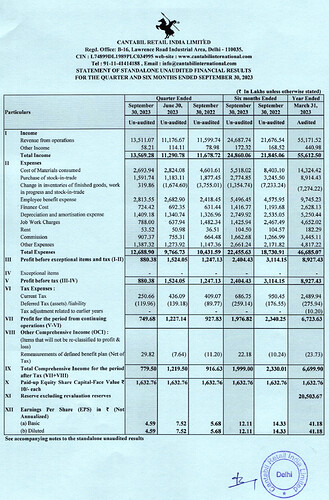

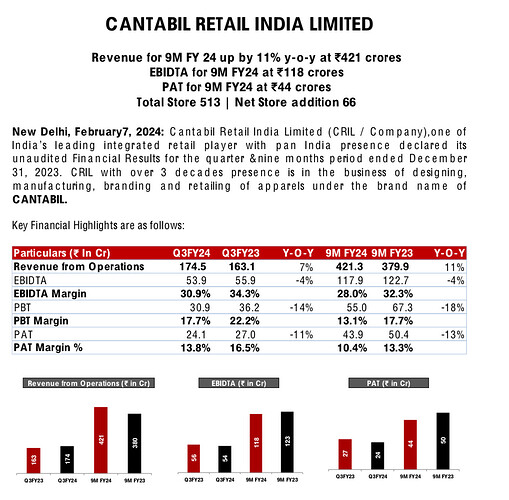

Company expects an average revenue of 1.2 crore per store and expects the revenue to increase by 10 to 15% every year. Company currently receives majority of its revenue’s from North India.

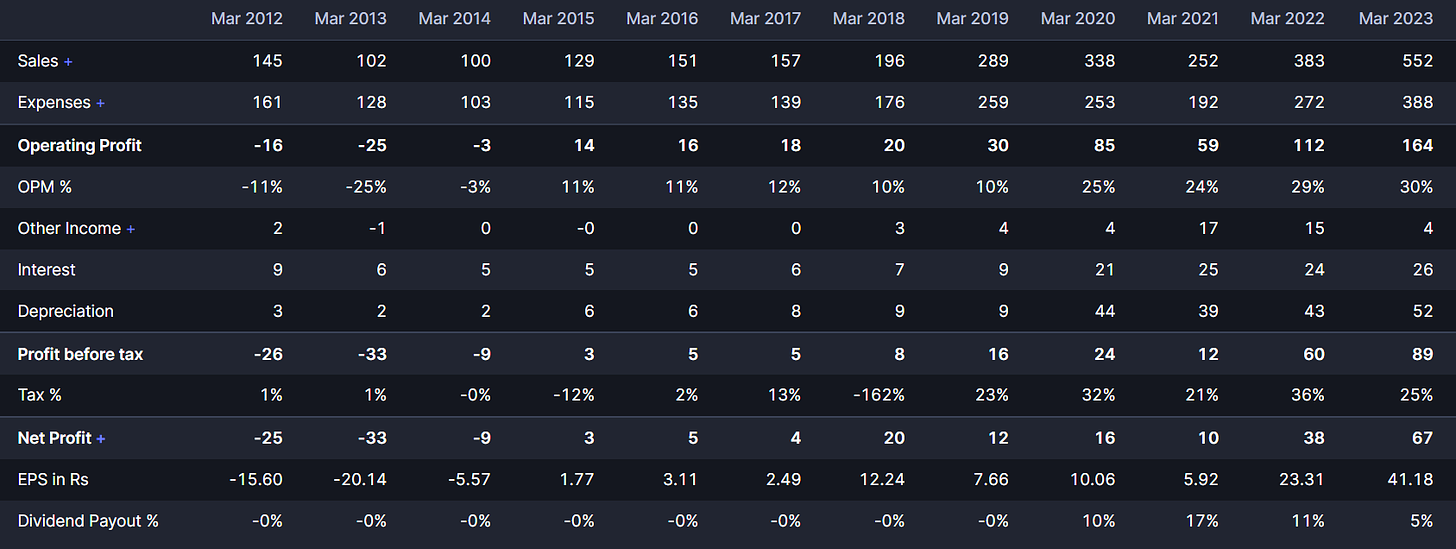

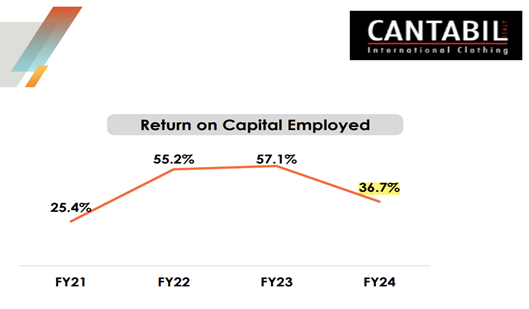

Company is constantly increasing revenue and is opening 8 to 10 stores every month. This can be seen in the increasing revenue of the company. Company also has a strong moat with close to 30% margins expected this year. Competitors like Aditya Birla fashion can hardly maintain 10% margins despite having a strong brand value in Urban India.

Strengths

- Consistent and higher margins compared to competitors

- 18% CAGR growth in sales on a 10 yearly basis

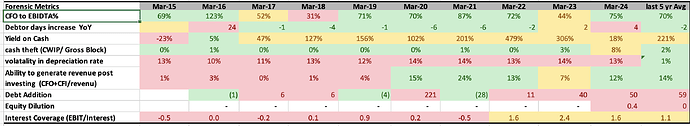

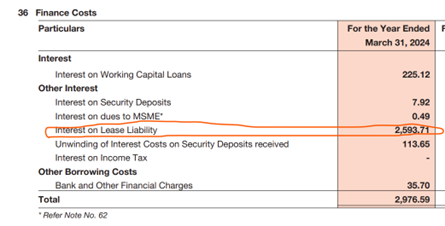

- Company is debt free and the debt shown in balance sheet is not debt but actually lease liabilities which have been shown according to IndAs 116.

- Company operates on 70:30 model and due to this the company enjoys benefits of franchising as well as self owned stores.

- Company has asset light model at place. It manufactures 1/3rd of the inventory in-house, 1/3rd from dedicated fabricators and the rest on Free on board basis.

- Promoters have a vast experience in the textile industry and the company is currently run by young managers

Risk

- Higher working capital management because new stores tend to take some time to pick up. Company usually has to stock up inventory which hurts the working capital of the company. Inventory days are currently at 498 days which is high compared to peers.

- Focused on men’s wear - Company currently has majority of its revenue from men’s wear and it is difficult to add a premium on men’s wear which forces the company to sell at a discount or usually has to offer discounts like buy 2 get 2 free and such other offers.

- Intense competition - Company currently faces competition from not only foreign brands but also Indian brands. Regional brands understand consumers well and are usually quick on customer service. With the rise in D2C market and growing demand of buying clothes online will hurt the company in the long run if they wont pivot on time.

- Changing fashion trends and rise in disposable income - Company currently operates in the mid premium segment and with growing disposable income and rise of aspirational brands the company faces challenge in marketing.

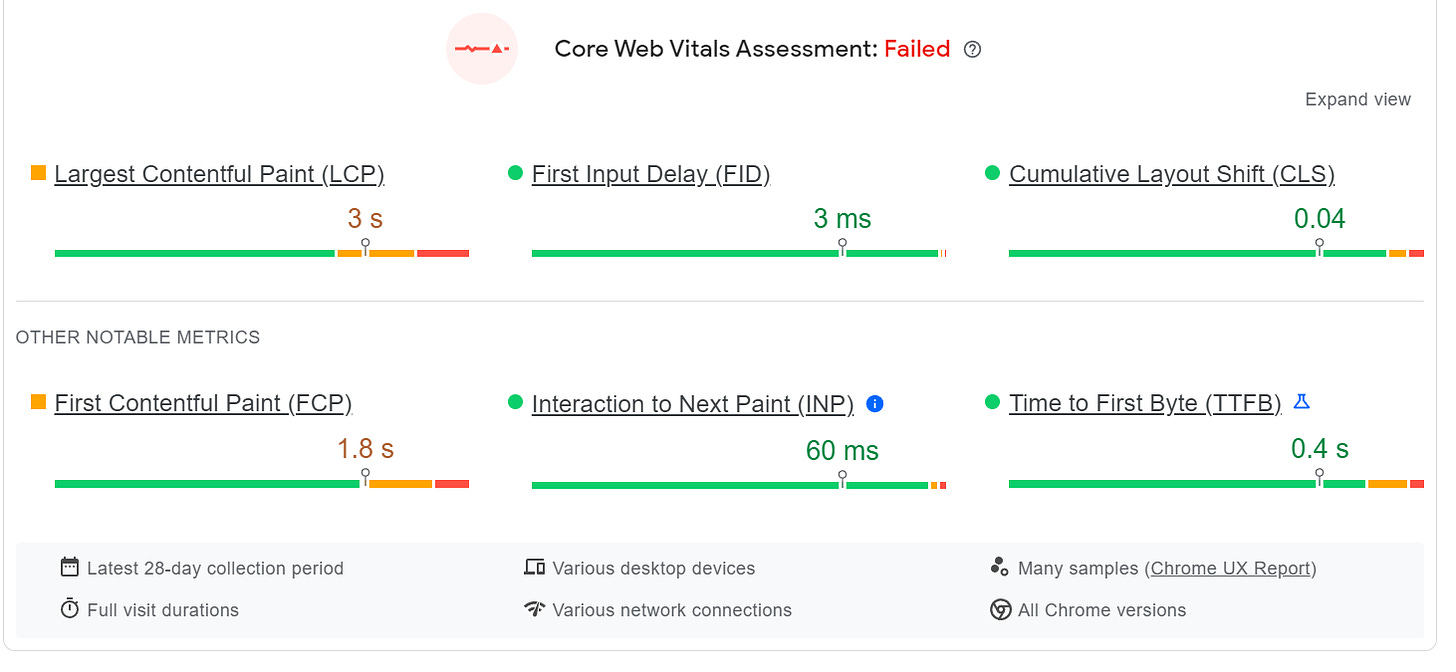

- Slow website - While online sales from website are currently low the company needs to focus on the core website and make it more attractive and simple to use. A new global study from website optimization company Eggplant found that just under three quarters (73%) of consumers will move to a rival site if the website they are on is too slow to load.

These metrics would be too trivial for you but when analyzing a business every minute detail matters and these details could prove to be big when investing for long term.

Management analysis

Company is currently managed by Vijay Bansal who founded the business and is responsible for growth in early years. Mr Vijay bansal drew a salary of 1.5 crore in financial year 2022. ( Pg 65 Annual Report FY 22)

Deepak Bansal - Son of Vijay bansal and graduate in mathematics from Delhi University. Responsible for expansion in retail markets and finding newer opportunities. Mr Deepak Bansal also drew a salary of 1.5 crore in financial year 2022. Deepak Bansal also holds about 10% stake in kwality pharma which manufactures and exports pharmaceutical formulations in liquid orals, dry syrups, tablets, capsules, sterile powder for injections, small volume injectables, ointments, external preparations and oral rehydration solution (ORS). The company currently has a market cap of around 400 crore.

Basant Goyal - Whole time director and pursued bachelors in business from Shaheed Sukhdev College Of Business Studies. Mr Basant Goyal drew a salary of 24 lakh in financial year 2022.

Megha Bansal - Wife of Mr Deepak Bansal has been appointed as deputy manager of finance and is entitled to gross remuneration of 2 lakh per month. She holds about 2.5% stake in F Mec Investments & Financial Services Ltd which has a market cap of around 15 cr.

Company currently employs more than 2200 people and the average remuneration of an employee not on managerial level is 18577 and on managerial level is around 6,85,000.

Related party transactions seem to be less and are controlled with not much significant impact seen however the company needs to hire employees who excel in digital marketing so as to increase sales in online channels.

In conclusion the company seems to grow at 18% cagr and is expected to open huge number of stores in the coming years. However sustaining demand and increasing market share remains a challenge for the company.