Apologies skipped this one somehow.

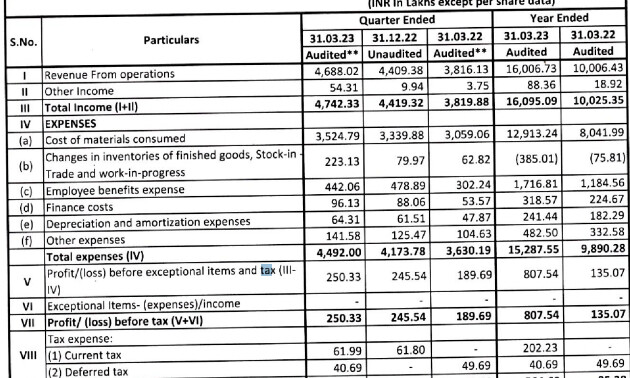

Check tax % once for Mar 2023 Vs Dec 2022 — 25% to 41%

Deferred tax in march 23 and march 22 in the past too.

Apologies skipped this one somehow.

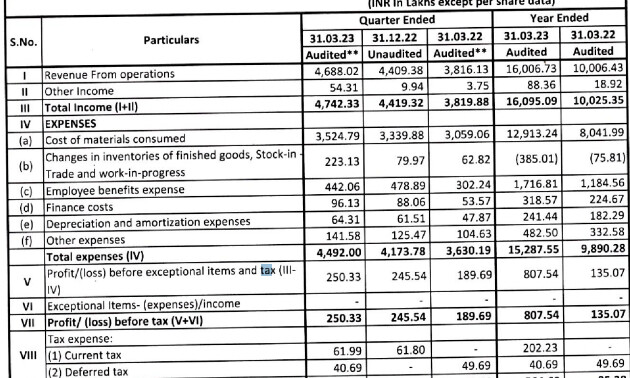

Check tax % once for Mar 2023 Vs Dec 2022 — 25% to 41%

Deferred tax in march 23 and march 22 in the past too.

Hii…

Ca anyone share current outlook on Ikio lighting

Thank you

IKIO is most an integrated player. The market size is quite huge and going by the china + 1 thesis it remains a sector which can pick up considerably well for player like IKIO, Calcom etc.

IKIO is moderately bigger in size vs Calcom. U can study IKIO to check how they are cross selling and ramping up at RV Industry ( one of their recent clients ).

If u think Calcom can do such a thing with Amazon then probably calcom also makes sense. Else IKIO will grow as the sector is in tailwinds.

I have gone through Annual Report - 2023 today, while there are many positives, I would like to focus/emphasize more on the negatives here as the concerns are high as per my understanding.

The debtor days are increasing. It was 30 days (Low Point) in 2019 but increased to 41 in FY20/56 FY21/61 in FY22 and 65 in FY23. While debtors outstanding >6 months are not significant, rising debtor days all say either about competition or something else.

Ratios are at sub-par levels. ROE/ROCE/ROIC are very low to even beat the cost of equity. But as a growing organization, this is less of a concern and hence will require continuous tracking with an increase in revenue and operating leverage.

Note: These are only my negative pointers and there are many positives for the company as well. The first is Good Management and then Improving Product Expansion and Innovation. I would like if someone could point out the issues and highlight the counter for better insights.

Invested, but not a substantial amount.

Regards,

Mukul Jain

Teahwa Techno JV is a reflection that they do some global standards which is meeting already and this could lead to other JVs in the future too. As World moves away from china.

Good observations.

Even with these few -ve things, i feel that there is a good opportunity for the company to have decent growth in coming few years from BLDC fan & EV chargers.

They might be late entrants in the Smart meters category to gain market share but this wil l also push the revenue slightly in addition to the above fast growing products.

Completely agree, apart from pointing out the negatives there are many positives as well:

Not only new products like BLDC & Smart Meters, but the electronics space also has too many lists of products that could be made by the same company. There could be an exciting list of products to come in the future. The only concern that could turn out to be positive going ahead is that they start more and more raw materials sourced indigenously or manufactured. Yes, all cost structures and many more things are to be considered but dependence on imports will surely not be a good option in the long run.

Regards,

Invested

Can someone explain why there’s approximately a 45% drop in year-over-year revenue? I failed to find the reason.

Posting on this thread after a very long time.

Calcom has achieved 87% YoY growth in Q1FY25, confident to clock INR 200 crore sales in FY25. vis a vis 25% growth.

Got an approval for a solar street prototype and production will commence in this quarter or Q3 beginning.

Looking ahead, company is excited to announce their foray into Outdoor Lighting Segment starting in the 3rd quarter of this financial year.

Calcom has approved for fund raising of ₹ 50 cr . Looking on its size, significant Capacity expansion is on the way…

LED price has collapsed . None of company in this sector has reported good number due to price erosion be it IKIO or Focus . So I don’t see any trigger for now . what are your thoughts @Gautam_Chopra @Mukul_Jain

Yes, LED prices haven’t helped. I guess most of the old investors have moved on to interesting RR ideas.

Yes you are correct. LED Price erosion is an issue since past 5 quarters for Calcom and whole segment. It has made waiting longer for sales number to show meaningful growth. As far as there is good volume growth and investments in backward integration bearing fruits (Better EBITDA%), i would like to wait patiently.

Also, new initiatives like PLI Scheme Investments and New Product Announcement are good enough for me to hang on longer. I have hawk eye on “Cash Flows” as there has been too much of capital raise and good amount is blocked in receivables and Working Capital.

Regards,

Mukul Jain

Invested and Biased

I am hopeful that Calcom would do wonder like other OEM…Dixon which also works on very low margin in other field.

With Calcom, please keep low expectations. Although the company is quite old and I know them from last 20 years,since the time they were making CRT televisions but the intent and drive is lacking. It would be great to see them do well but as an investor, please do not go overboard and manage risk with position size. They can never be the next DIXON, because Dixon has the first mover advantage and deep pockets of the erstwhile WESTON TV group.