With Q3 results in, 1200 Cr topline seems like a stretch now. Sure company sold some of the assets, but it’s not even half way there after 3 quarters. Waiting for management commentary.

Quick update if anyone is interested - All the results are out. Its been a mixed bag with VBL, PML, Apar with spectacular numbers, Esab with great set, Honda good margin expansion possibly due to localisation but flat topline, Pricol flat apparently due to supply constraints and Vimta flat with delay in rampup of samples at JNPT lab, Techno poor, again due to supply constraints and Dynemic possibly into its last quarter of poor numbers.

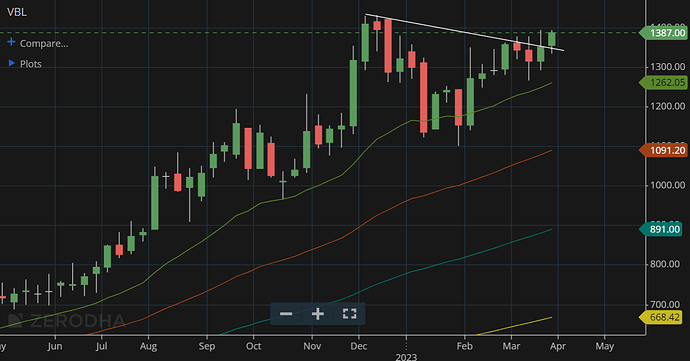

The charts too reflect the mood with VBL, PML, Apar trading strongly above result week. Esab pulling out but faces very stiff resistance at 4200. Pricol and Techno doing OK post flat numbers. Dynemic and Honda have to form a long base around 250-300 levels and 2000-2200 level (and fill 1800-2000 gap) respectively for any credibility to runups.

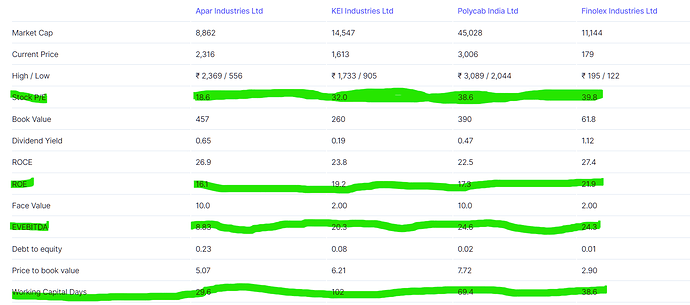

This is clearly playing out (There’s a nice book called ‘The Grid’ - summarized here which is a good read on the sector). However, unlike my earlier assumption that everybody will benefit, it has been a mixed bag and the winners are now standing out clearly. Players who are exporting are at a distinct advantage vs those that don’t. Also non-commodity busisses with strong govt. spending. (Cummins, Thermax, Apar, transformer guys, cables guys, turbines guys done well while Skipper, Savita oil, Hitachi energy havent done well)

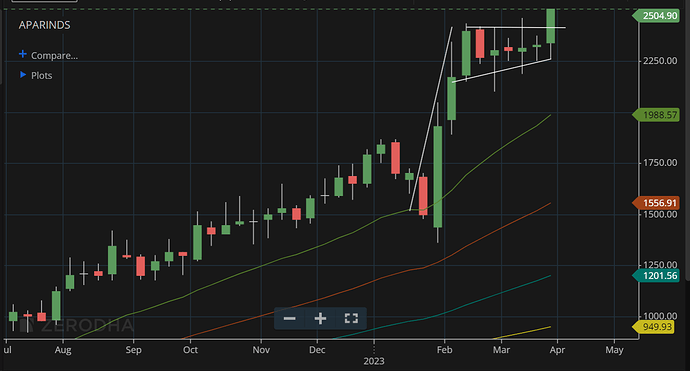

Apar Inds, Weekly - The runup here since Q3 numbers has been something else. It has strongly broken out of that trendline (in my last post) last week.

Pre-results it had broken down post Savita oil’s dismal show - because market continues to remember this as a transformer oils business when it is no more just. The impact due to oils business was a mere 30 Cr (in the past this may have been huge)

There’s a lot of detail on the business in the call with Antique and call with Nuvama . In short, the tailwinds are very, very strong and company is talking about sustaining this for few years due to power capex around the world. The margins abroad are bigger and demand for quality products it produces as well higher. In India products are made to cost since you don’t have to please the EPC players but abroad its the lifecycle cost and not product cost alone that’s under consideration

Valuation differential vs Polycab and Kei is big and its trading less than what the cables business alone will be worth today when compared with these. No one will be surprised if this trades 2x sales with 18-19% RoE which would be a 3x from here.

In terms of technology as well, Apar appears well ahead being able to supply to developed markets in US, Europe and Australia - be it conductors or cables or its own premium products in elastomeric cables used in renewables (approved by Siemens, Gamesa and every major wind power supplier), OPGW where conductors used by railways or powergrid are also used to transfer data, electron-beam cross-linked cables, covered conductors to prevent electrocution of animals and preventing forest fires etc. Any bridging of this valuation gap might bring reasonably good returns.

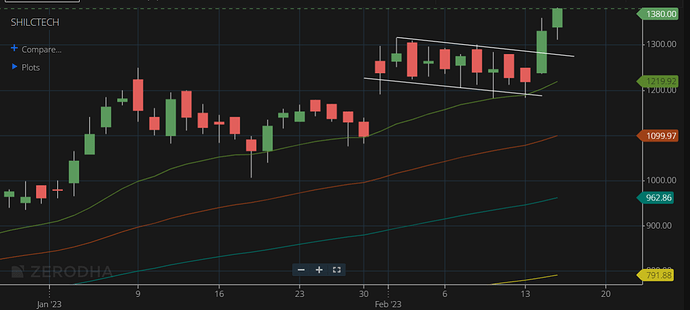

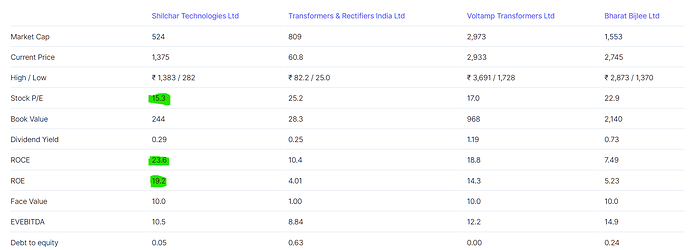

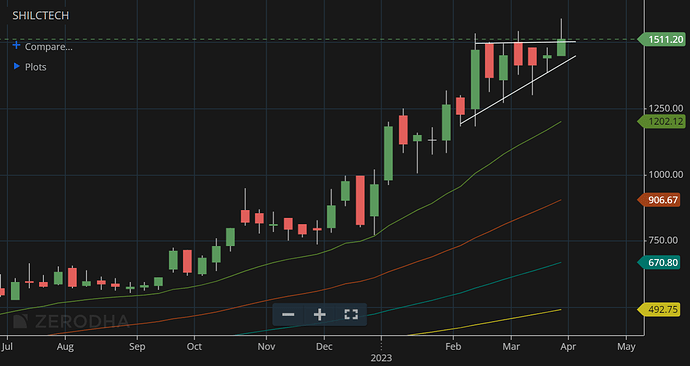

Shilchar, Monthly - While looking for transformer companies to play the same theme above, I was confused between Voltamp, TRIL, Shilchar and Bharat Bijlee. While all of them make distrbution transformers, Shilchar has highest exports among the lot and better return ratios. It doesn’t have working capital issues since its business with govt. here is less. (There’s an acute transformer shortage as well. Lead time is almost 1 year)

Daily - Post Q3 numbers there was a gapup and a sideways channel consolidation above the gap and a breakout since then.

Q3 numbers were the best of the lot as well and valuation the cheapest too and felt a nobrainer. It is still trading cheap despite the runup.

Disc: Have positions in all mentioned. No recent transactions in VBL, PML, Dynemic, Honda (last two are small positions to be scaled). Increased Apar and Shilchar. Reduced Vimta but contemplating increasing at these valuations around 300. Reducing Esab, Techno, Pricol - Nothing strongly against but as a trader, have to make sure money is riding on best bets. Not an advisor and very much a novice. Writing to clear things to myself.

An Update here on stocks posted:-

Booked out of both USHA M and Bharat Wires sometime back. Found cheaper stocks in existing PF.

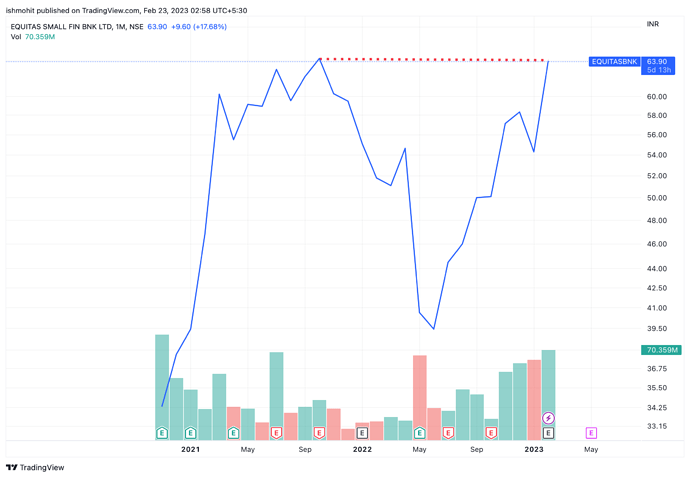

EQUITAS Sfb reported 60%+ PAT growth and Guiding for 25%+ AUM Growth going forward. Used proceeds from USHA M and Bharat Wires to top up both EQUITAS and South Indian Bank.

Equitas Chart:-

ADX has gone above 25x, and stock has just hit a fresh 52 week high. Quarterly run rate of PAT (assuming no growth) can lead to 680-700+ crore PAT next year. My most bullish estimate is 800-850 crores next year, given credit costs are falling to 1% as guided in the concall.

SIB:- Ex of Securitiy receipt provisions (mandated by RBI). Reported 306 crores PAT this Q vs Loss of 50 crores in Q3FY22.

Varun Beverages: Status quo and some addition when stock fell to 1100s.

No changes in Arman.

Disclaimer: no reco to buy or sell. Have positions in ARMAN, Equitas, VBL, SIB.

Good insights on Apar on both the links you pasted. Just a small correction, You have used Finolex ind instead of finolex cables. Fin cables is also under valued due to mgmt fight

@phreakv6 Great insights on the power sector. Kindly also share your view on Smart Meter National Programme (SMNP ) under RDSS scheme and Company like Genus Power & HPL

My bad. Thanks for pointing it out.

I don’t know about the specific countours and outlay of the SMNP policy to comment on it. I do have a rough idea of why its inevitable though. The grid, the generation (stable) and consumption (filled with peaks and troughs) could still be balanced as we had put up excess capacities and the peaks and troughs, though having large variance, was still very much predictable.

With renewables, generation isn’t as stable as a coal-based power plant. There’s a lot of variance based on vagaries of wind and clouds. Consumption variance is trending up as well as large appliances like EVs and fast chargers will need to draw lot more from the grid and this might be a much bigger headache than the current headache which is air-conditioners. To smoothen the peaks, some sort of transparent to consumer real-time pricing also is inevitable from the current pricing based on slabs of consumption which will also need smart meters. Our attitude towards blackouts/brownouts and load-shedding has changed tremendously as well. We now see it as a big failure.

So our grid has to evolve from this non-living thing it is today to a living, breathing thing with senses gathering lot of inputs - on generation, distribution and consumption in real-time. This doesn’t just mean smart-meters (consumption) but also smarter grids that measure what’s happening real-time at various points.

When and how it happens and who benefits I am not completely sure. I have not yet studied Genus Power and HPL but they do look interesting. I however have a bet on PML in this space and metering components is their forte. They also make hall-effect sensor based clamp-on components that might make it easy to measure what’s happening on a cable with reasonable accuracy for such purposes. (Recently IGL has also announced a gas meter manufacturing plant which could also benefit PML). Lets see how it plays out

Nifty, Monthly - Although it looks like things are all bleak with no respite, I feel Nifty is in a bullish flag formation in the long-term. Should take support on the 20-month MA, if it doesn’t or bounces and corrects in a month or two, it could take support on the lower trendline around 16500 levels and move from there. If it works, second half of this year could see a run towards 19k

Fundamentals as well point to it, although inflation hasn’t eased yet, its only a matter of time.

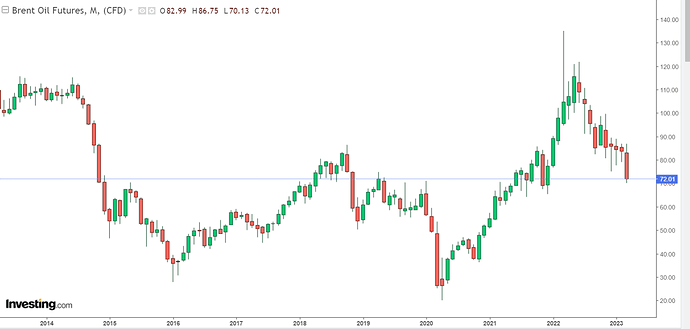

Brent, monthly

Brent peaked in May '22 at $120 levels. What got me back into the market was crude breaking the $100 barrier in first week of July '22. Since then, lower base months have kept inflation high. Brent is without a doubt a large contributor to inflation though the stickiness of it has other contributors like insane wage growth seen last year and sentiment. The differential YoY in absolute dollar terms is going to be high from this month onward, where Mar '22 Brent was $110 levels whereas we are averaging below $80 in current month. The differential, clubbed with poor sentiment, should tame inflation

From doing too little in '21 saying inflation is transitory, its quite possible the fed has done a bit too much this time to compensate. With the financial stability in the US in question, its highly likely fed will ease on the hikes citing lower inflation 2-3 months from now.

Disc: Staying invested

@phreakv6, your views on Kirloskar Electric please. The 1st post in the KECL thread gives a good intro. @

Company into Electrical equipments. AC/DC generators, transformers, switch gears.

Went south after acquiring Lloyd Dyna GmbH @ steep valuation in 2008. Has a footprint in Europe along with Engg. know how. May turnout to be a blessing now.

Land bank is liquidated to payoff debt, which is already down from peak levels of 300 crores to 132 crores now.

Revenue Break-up

Power Generator & Distribution- 183 crore

Rotating Machines - 129 crores

Total - 334 crores

Manufacturers of EV motors appears to be an optionality.

Debt equity ratio 1.42. I guess that’s also thanks to revaluation of land sometime back. Net worth otherwise completely eroded.

Operating Profit for the 1st time in 10 years.

Looks like possible turnaround.

Main reasons for buying don’t hold true anymore in South Indian Bank’s case.

Main bet was on the MD staying and turning this around.

Disc: For kosher reasons mentioning my exit thesis as the guy on the top is the main reason for investing in a bank. Be flexible enough to change when facts change, that’s the key learning everyone can take from this. Not a reco to buy or sell, take independent decisions.

After a long time seeing lot of bullish breakouts in the businesses I have positions in, most of which have had a strong week, month and FY

VBL, Weekly - Showing strength trading above 1350 levels and just 2% lower than ATH. Can gather steam above 1420

Apar, Weekly - Ran up post results and consolidated for 2 months and strong breakout on the weekly from a flag formation.

Shilchar, Weekly - Similar consolidation and a breakout but with a retracement on the daily. Made an ATH last week and trading just 2% under it

PML, Weekly - Strong breakout last week with a good follow-up trading above it and closing at ATH

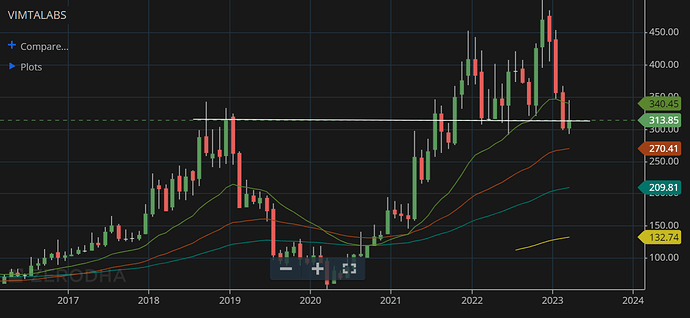

Vimta, Monthly - Not as strong as the rest and fell drastically post results and has consolidated around 300 levels which is also a strong support. Will be back in the game if it closes above 350 levels, above the 20 WMA to resume uptrend. Fundamentally, I dont think much has changed here though the ramp-up in volumes in the JNPT lab didn’t happen last quarter. Its probably just a matter of time. Current levels offer a lot of margin of safety

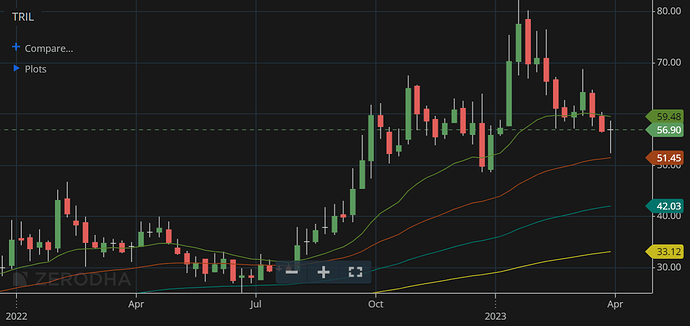

TRIL, Weekly - Showing decent strength in the 55-60 value zone which also happens to be the 20 WMA. Had a strong breakout in Jan but retraced almost everything to trade back in the same zone. The ICICI report has good details on the business

Earnings on an uptrend and so is the orderbook. It is my distant second pick in the transformer pack after Shilchar. The sector is on a strong uptrend both in domestic and exports. TRIL has a strong domestic presence and the company is making earnest efforts to crack the exports markets outside of Middle-east, Africa and Russia where it currently seems to have presence. Capacity utilisation currently around 65-70% levels like Shilchar and operating leverage could kick-in in both going forward with the sector itself being in strong uptrend

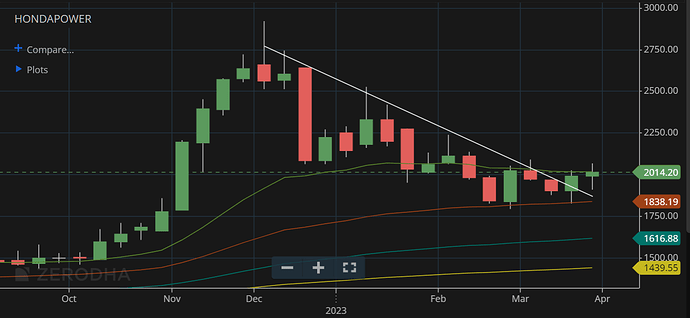

Honda Power, Weekly - Filled the gap and is consolidating around 2000 levels. A strong breakout will confirm resumption of uptrend

Disc: Have positions in all. No recent transactions in VBL, Shilchar, Apar and PML. Increased Vimta, Honda and have built positions in TRIL around 60 levels

Prima Plastics giving breakout after more than an year long consolidation.

Digging deep, it can be seen that prima’s EPS is inversely related to crude prices. So in a scenario where crude prices sustains below 90-100$, we can see it reclaim its previous price peaks. Last two quarter combined EPS was 9 Rs. Expecting good results in March qtr too.

Caution: Low market cap, Low float available, may not be suitable for all.

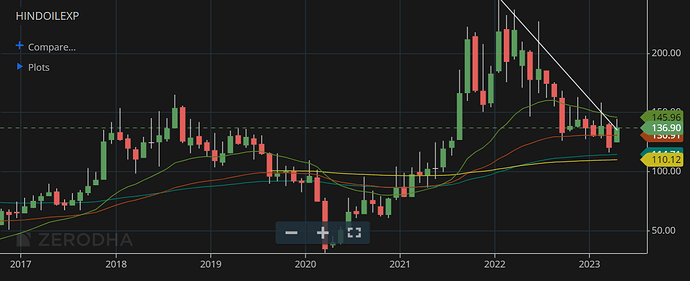

HOEC, Monthly - Beaten down and resting on the tops made in 2018. Technically there’s not much more to lose from here, perhaps another 10% downside at most. 132 is strong support (200 WMA). The downward trendline should get broken out of in the near future with support from fundamentals

B-80 might finally be online with the repairs completed. They now seem to be testing for 15 mmscfd of gas which is the full potential of the well (10-12 mmscfd would be sold and rest for internal consumption). However, there’s no confirmation on the Oil production (still under review). I think the probability of things going right this time is very high. Market still seems to be giving it a zero probability. Unfortunately, things have gone wrong one too many times that market might believe its all fine only when numbers hit the PnL and cash flows and debt is reduced and so on. At these levels, there’s perhaps nothing to lose.

So what is to gain?

B-80 when fully online could produce 4000-5000 boepd of oil and 12 mmscfd of gas. They may start with 2000 boepd and ramp up to 4000 boepd.

Topline from D1 oil well - At 4000 boepd, and $80 per barrel, for 365 days at Rs.83/USD gives 969 Cr (4000x80x365x83).

Topline from D2 gas well - 12 mmscfd at 22.2% of brent ($17.76/mmbtu), for 365 dats at Rs.83/USD gives 670 Cr (12x1037x17.76x365x83)

Of this though 45% of Oil and 33% Gas topline goes to govt as revenue share and royalty. Add to that about $15/barrel as operational cost.

Post costs, B-80 should have operational income of

Oil - 969 Cr - Govt take of 436 Cr (0.45x969) - Expenses of 182 Cr(15x4000x365x83) = 350 Cr

Gas - 670 Cr - Govt take of 221 Cr (0.33x670) = 441 Cr

So total B-80 cash flow could be 790 Cr. Of this HOEC ownership is 60% (its a JV with Adbhoot estates that owns 40% interest in b-80), so total cash flow to HOEC will be 60% of 790 Cr which works out to 474 Cr. Add to this another 100 Cr or so for the MOPU which HOEC owns and so the expense will get added back.

There are of course lot more variables than this simple calculation but this is the best case scenario (not considering super best case scenario of 5000 boepd) under the circumstances since this company has had a cursed recent few years.

How long can this 400-500 Cr free cash flow sustain? According to management estimates they have a P-90, P-50 and P-10 estimate of 7 yrs, 10 yrs and 20 yrs respectively. So it might be conservative to consider this cash flow going for 7 yrs. Discounted conservatively at 15%, it should add up roughly to somewhere around current market cap, so ideally this is at least a 2x opportunity once the field starts producing. So far it was a 0 or 1 event. It still remains a 0 or 1 event until the oil production is confirmed but we are definitely closer to 1 than to 0 now than in the past, or so it seems.

Glossary: ![]()

- boepd - barrel of oil or equivalent per day

- mmscfd - million standard cubic feet per day

- mmbtu - 1 mmscfd = 1037 mmbtu/day

Risks:

- Oil production could be lower than 4000 boepd

- There might still be many a slip as it has been in the past few quarters

- Oil prices may crash over the period in consideration

Disc: I have had two trades here that did no work out, so perhaps this is likely a revenge trade. I have positions around 135. Not an expert in equities or oil & gas, so very likely there are lot of errors and assumptions which are downright stupid. Please do your due diligence.

KPT Industries, Daily - Breaking out of a consolidation on the daily. The big runup that caused this consolidation were last quarter results.

Monthly chart as well shows a nice consolidation and breakout '18-'21 around 100 levels and '21-'22 around 200 levels.

Currently trading at around 300+. Fundamentally, the business is into making power tools and blowers and seems to have been around doing the same. Around 2019 or so, they seem to have designed their own EV garbage collection cart. There hasn’t been much traction on this until last two quarters.

They have had a revenue of 5.12 Cr out of total topline of 37.36 Cr in Q2 (14%) which has grown to 13.27 Cr out of total topline of 44.55 Cr which is almost 30% topline contribution from their EV

The bottomline as well is healthy at 2.89 Cr from this revenue at a margin of almost 22%. There’s a healthy expansion of margins as well as compared to last quarter on their EV sales (8% last quarter), probably from operating leverage.

It is however not clear about the sustainability of numbers. If the Capital Employed numbers are anything to go by, assuming most of the increase is inventory, there’s a good correlation between CE and EV sales - 6.23 Cr CE lead to 5.12 Cr sales and 14.93 Cr to 13.27 Cr sales (closing vs subsequent quarter sales). This is of course very crude way of extrapolating but if right, the CE of 25.11 Cr should mean that the numbers could sustain or be even better.

The valuation is cheap at 12x TTM earnings and if numbers are sustainable it is definitely cheap. The return ratios are good as well at around 17%. The entire business is just around 100 Cr which isn’t bad for a business manufacturing precision power tools, engineering products and a home-grown EV. There was some info available on linkedin which shows their power tools manufacturing facility. There’s also a corporate film from 5 yrs back, so the business seems legit but this is no scuttlebutt. I felt at 100 Cr valuation with good sales, mainly from EVs, this was at least worth a look.

Disc: Have positions around 300-310 levels. Not sure of legitimacy or sustenance since very little is known about the business. Please do your due diligence.

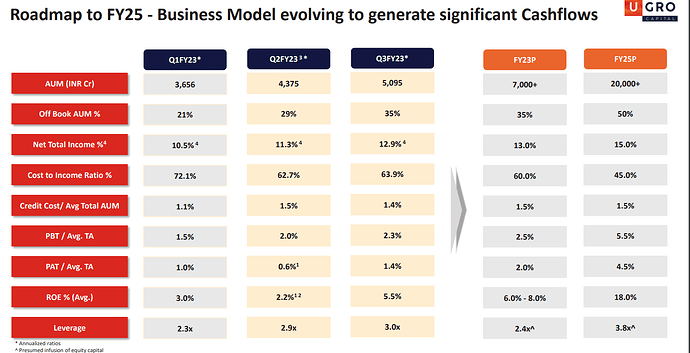

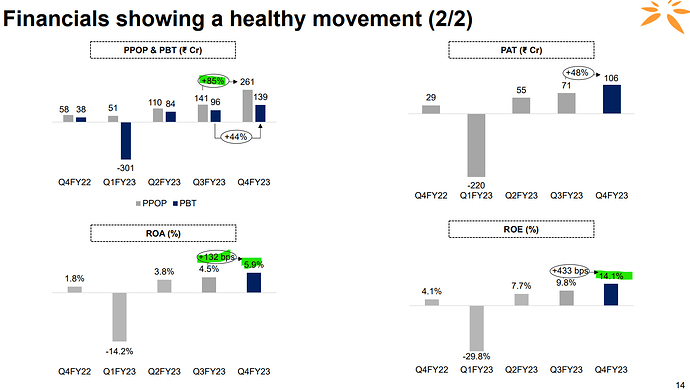

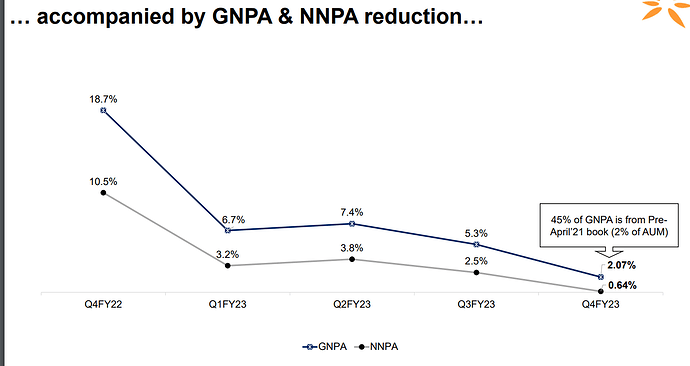

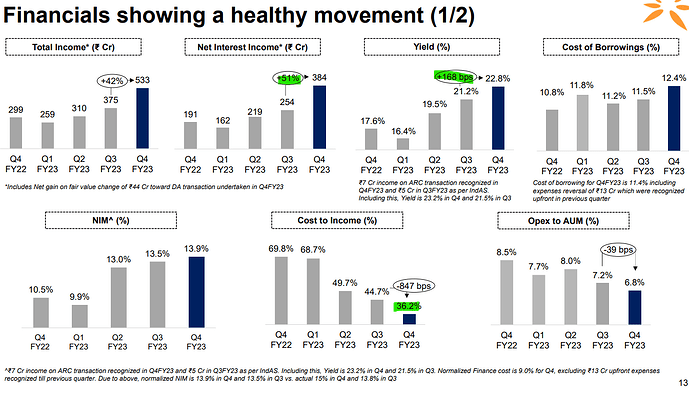

Ugro, Monthly - Trading outside of ~2 yrs downward trendline. There’s a nice narrowing consolidation in a symmetric triangle.

The business is very well covered in its own thread and deserves a read top to bottom as pretty much every aspect of the company from its formation, capital structure, vision, promoter background (his religare group CEO role also discussed in the thread) and co-lending model are discussed in great detail. I learnt pretty much everything I know from the thread and the resources in it along with the PPT and dhruva’s blog on ugro and incessantly pestering @nirvana_laha who understands the business better

Some bits I think worth a look at from @Chins post. It is interesting that you can lend lower than your cost of borrowing and still make good return on the 80% of the off-balance sheet book transferred to the bank (in Ugro’s case SBI or Bank of Baroda).

This model appears to be good for all stakeholders from the customer, Ugro and the co-lending bank (SBI or BoB) as customer is able to avail a loan which otherwise would have been difficult, Ugro earns a fees outside of its book for the reach and the bank can fulfill its priority sector lending obligations if any.

The question I tried to answer over the last few days is if there’s a moral hazard. Since the underwriting standards are agreed with the bank, and the Ugro is board-driven, odds are low. Still co-lending with a ICICI will be very different from a SBI in terms of agreed underwriting standards I would presume.

The company seems to be doing well in terms of the targets for co-lending book and AUM. As of Apr, off-book portfolio is already 40% and is expected to be 50% by FY25.

The thesis is fairly simple then that the RoE should trend up in the next two years exponentially towards 18% levels as all the hard work done by the business in the last 2-3 years is at its payoff period. The valuation today doesn’t factor it and I believe book value can get to 2000 Cr in 2-3 years (currently at 1350 Cr) and being a mature business by then with lot of expertise in underwriting in 8 sectors and its sub-sectors could trade at 2.5x book or at about 5000 Cr market cap, implying there’s a chance to make 2-3x here in ~2 years.

Risks:

- Underwriting hasn’t seen cycles and is an unknown

- Co-lending partner banks like SBI/BoB may not have very sound underwriting principles

- Unsure of the length of co-lending partnerships. Any closure and non-renewal can put the AUM targets and growth at risk (Long as NPAs in co-lending is lower than SBI/BoB’s I dont see why they shouldn’t renew)

- Cost-to-income is high but as per management guidance should trend down from here as most of it is front-loaded

- DBZ has completed exited and their exit kept the price under pressure for 1.5 yrs. Any other PE exiting will be a risk

- Market may not see past promoter’s past at Religare even if evidence points to the contrary. These perceptions though change with price

Spandana, Monthly - Sideways consolidation for 8 months and this month could be the breakout month. On the weekly it has already closed at its highest since Sept '21.

Fundamentally a similar play as Ugro - the business has been undergoing a change under new management and most metrics are trending up since they took over. Unlike Ugro where good RoE is in the near future, here its already underway with recent quarter RoE at 14% and it should trend higher from here.

The quality of the book hasn’t been better

Cost-to-income trending lower, NIMs trending up, yield trending up (management guiding for 25%). Pretty much everything going right and seems to be in a goldilocks scenario here.

Unlike Ugro most things are already in place here for a re-rating of the P/B. I believe book value should grow to 3600 by FY24 end and a 2.5x P/B can make this trade at 2x current valuations. These are simplistic estimates to get a rough idea of the upside. Risks here are the usual MFI political risk and the underwriting risk but the valuation offers a lot of comfort for the bet.

These bets I think are fairly similar to the IDFC First bet. The rate cycle I think should favour this sector going forward. Hoping for the best.

Disc: This is not a sector I have any expertise in so these bets are a way for me to get out of my comfort zone and explore. My thesis could be completely flawed, so please do your own research. I have positions in Ugro from 175-195 levels and in Spandana around 630-640 levels - both taken this week

Seems bulls will be in control given the subsequent Price volume action and finally fundamentals have improved

Q4 results:- ROA Above 2% for second Q in a row. Banks usually trade at 3x PB minimum, when they hit 2%+ ROA.

-Asset quality ends up improving. GNPA at 2.6% vs 3.4% QOQ. NNPA at 1.14% vs 2.37% YOY.

-PAT at 190 crores, 59% YOY and 12% QOQ growth.

-Restructured book down to 1%.

-ROA crosses 2.2% for second Quarter in a row.

-Net worth at 5100 crores (Book value)

Lets see. ROA inched up…(check original post).

Disc: no reco to buy or sell. Study the businesses and then technicals for medium to long term investors…

PAT doubled YOY

Maruti suzuki looks to be forming inverted head and shoulder pattern on the monthly chart… Can someone here clarify my doubt… Can we consider this as inv HnS as the stock is in uptrend?

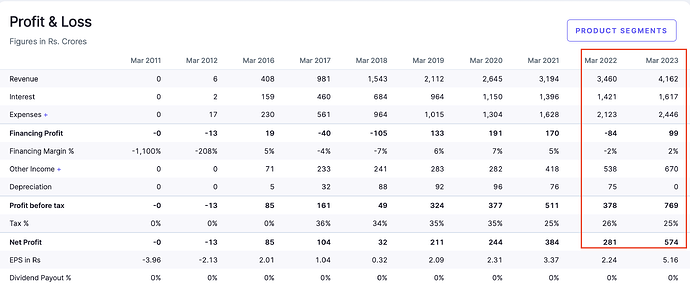

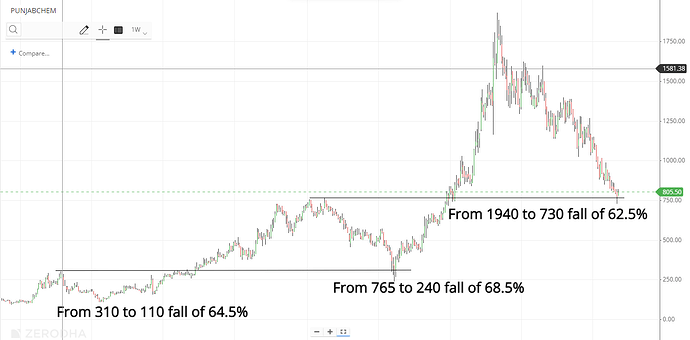

Punjab Chemicals & Crop Protection Ltd

I have tried to see the 3 big fall in Punjab chemical and found few things in common.

-

All the three fall are between 60% to 70% with an average of 65%.

-

During the coivd fall it took support near the all time high of 2015 and the current share price is close to the all time high of 2019.

-

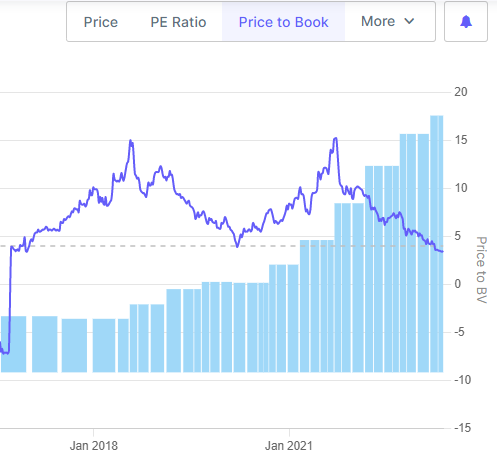

The current P/B is now below the all time low during covid. It is also below the 10yrs median of 6.3 and 5yrs of 7.8. Current P/B is 3.5

-

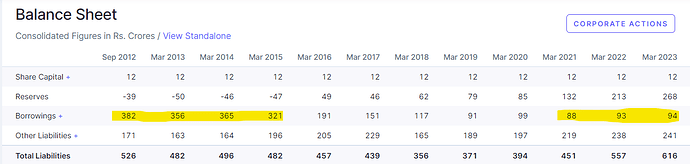

Over the years debt has been reduced substantially

-

The company is planning to do sales of 1500cr by FY25 with margins of 14% to 15%. The current sales is 1000cr and margins are 12%.

-

This company generally has an Asset turnover ratio of 4 to 5times and they are doing a capex of 150cr . So this is where they are planning to get the incremental sales.

This company has been covered very deeply by harsh Sir. There are good 1hrs videos on youtube in VP EUROPE channel which covers this company

Overall looks like the downside is less and the entire agrochemical space is going through the downcycle. Things are expected to pick up form Q1,Q2 FY24

Invested at around 780 levels

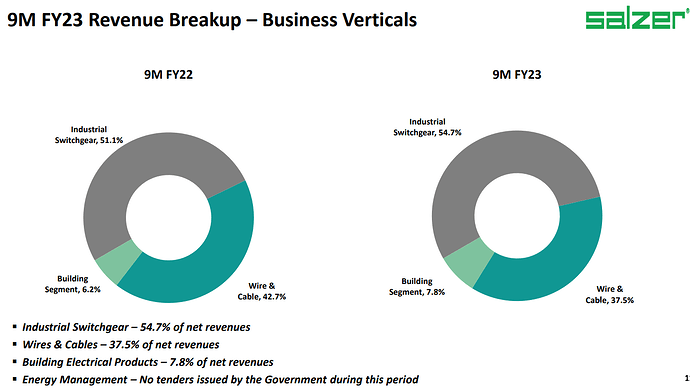

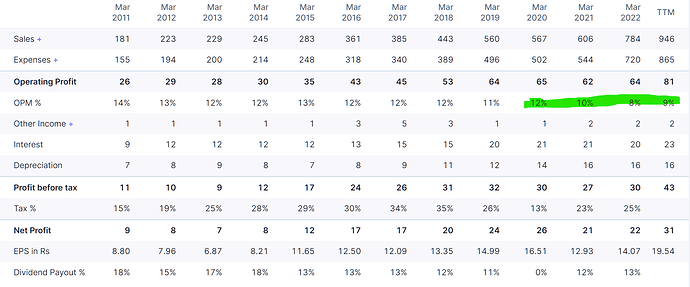

Salzer, Monthly - Made an ATH today. The previous peak was 332 made in July '15 (not in chart). Has had a bit of congestion around 300 levels last few months and it has been resistance since start of the year but looks like we might be getting a move on

The company makes switchgears (rotary switches, wire harness, toroidal transformers, mpcbs etc), building electrical products (MCBs, modular switches) and also copper products (wires and cables).

The switchgears and building segments is doing well while the wires and cables are being a drag (10% decline YoY)

The wires and cables are also being a drag on the margins of the company as this is a commodity business and it has caused the margins to dip quite a bit of late.

This is however changing and margins as guided by the management should be back to 11% level in a quarter or two at most. Good part is exports are increasing in contribution from 22% to 28% levels YoY for last quarter. Most of the good performance is masked by the drag caused by the wires and cables business which is marred by high inflation and suppressed agri demand and also copper price fluctuations.

So that takes care of the base business performance.

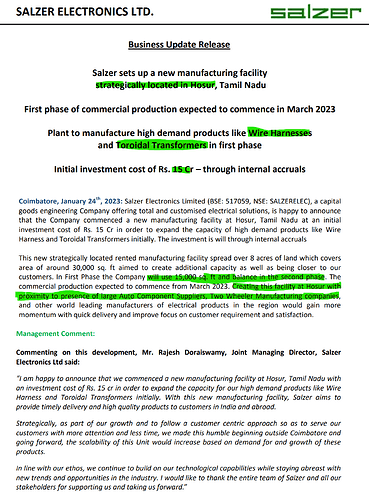

The company is also expanding its wire harnesses and toroidal transformers used in 2W EVs. The proximity to two-wheeler companies here could mean that they are setting this up to supply to Ola and Ather (management hasn’t confirmed though in the call so it is solely my assumption)

This should be the growth kicker from Q1 FY24 (current quarter if it has commenced production as planned). It is also interesting that this company with 5 manufacturing facilities in Coimbatore is for the first time getting out of its comfort zone into another town, signaling its ambitions.

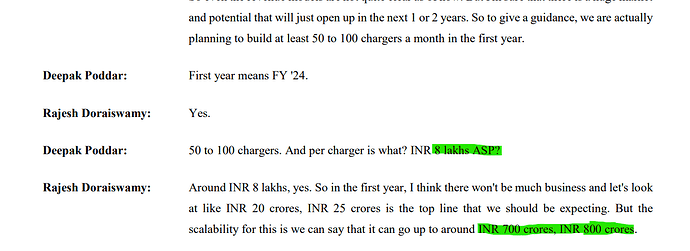

The ambitions are also visible in its JV with Kostad GmbH (26% interest with option to inc it to 50%)

The product is in prototype stage and they are looking to localize as much as possible. But the risk here is that there’s no clear model on how EV fast charging networks are going to be setup here. So I see this more as an optionality while the base business growth and recovery in margins, along with the under-valuation supports the price in the near term.

Unfortunately I was researching the idea when P/E was 13 but actually bought when P/E was 15 and today it already at 17. Re-rating was part of the thesis but it has hit a ATH today so its already underway. I feel Q4 and Q1 numbers should give a direction on the recovery in margins and incremental growth. Commercialisation and clear direction on the fast chargers could be the optionality

Disc: Have positions between 300-310. I am not a registed RIA and just a novice sharing what I find interesting. Please do your own research

Which plays more important role when you are taking a position, a strong chart or a turnaround or movement in the business, what is your average holding period assuming these are not part of a long term PF, and what is your exit criteria, a sign of chart weakening or based on fundamentals or the combination of both?

And is this technofunda approach alone your participation in the market now, or this is supplementary for an long term PF, and if it is, does this seem more lucrative than having a long term PF, the XIRR is more than the CAGR, including the stop losses, if any?

I am leaning towards and learning about short term opportunities than long term ones despite having a longer outlook, so asking such and many questions. Hope you don’t mind.