Sorry for the late response. I think my expectation is just that - an expectation that I will be very happy to beat. It makes sure that I don’t take dumb risks having very high return expectations. That doesn’t mean that I will cash out on reaching expectations. I will continue to do my best and let luck do its bit. In the past though, I have taken ridiculous cash calls though my exposure to equities was < 50% in early days (in mid '18, Mar '20 and in Oct '21). I somehow don’t find myself willing to do the same these days. Maybe it is my maturing as an investor over this period of time or its something more natural than that.

I think during this period my circumstances have changed considerably as well and the marginal utility of money has reduced by a lot. I have noticed that having a deterministic income - where you are paid by the hour like a consultant or by month, like a salary as an employee messes up with your ability to take probabilistic risks. You start comparing what you gain or lose notionally in an hour or day on volatile days with what you make in a month or year on the job.

The other thing that is deterministic in our lives is expenses - this again is easy for us to compare with drawdown. Maybe a day’s drawdown is the equivalent of a year’s expense and it changes behavior - I think somewhere I have gone over all these hurdles in the past between '18 and '21 and that has molded me into who I am today. My ability to take drawdowns has improved considerably which makes me stay put in the market. I think this only keeps going up with time. I can sort of relate to people talking about taking several 50% drawdowns in their long career. It comes with an ability to stomach volatility due to negiligible marginal utility of money (and also an inability to sell that comes with size) and being answeable to no one but yourself.

Since marginal utility of money is a very personal concept, ability to stomach drawdowns is going to vary a lot in the population. The people who have made it get to appear on TV or write books and so tend to advice on what feels right to them then. On a smaller pf though, they would have churned and been sensitive to drawdowns as us - so I feel staying put vs cashing out is a very personal decision and we shouldn’t go by what anyone else is doing, irrespective of our respect for them.

Since then the pf recovered its past highs and made fresh highs. It very well could have meandered sideways or crashed but the decision to stay put was the right one, given what we knew at that time. I believe for a small portfolio, there will always be opportunities for someone willing to put in the fundamental work keeping technicals aside. Narrowing markets are especially wonderful as you dont have to fight for value to be recognized. We also need to put in considerable fundamental work or we will end up looking at headline indices and be misguided or end up setting up stops that invariably get taken out.

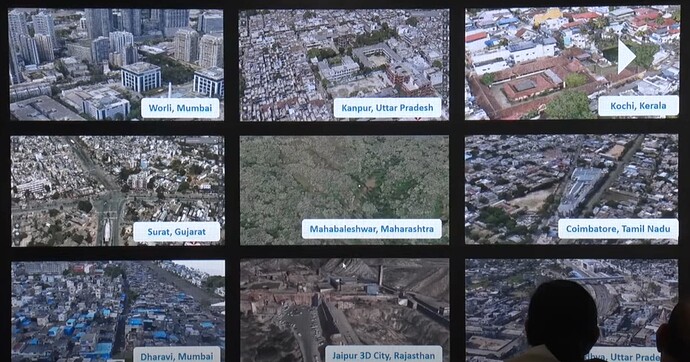

Genesys, Weekly - A breakout from 2+ yr resistance and a re-test that is underway in current week. This is a fundamental pick for me more than technical. Please do check out the geospatial sector thread.

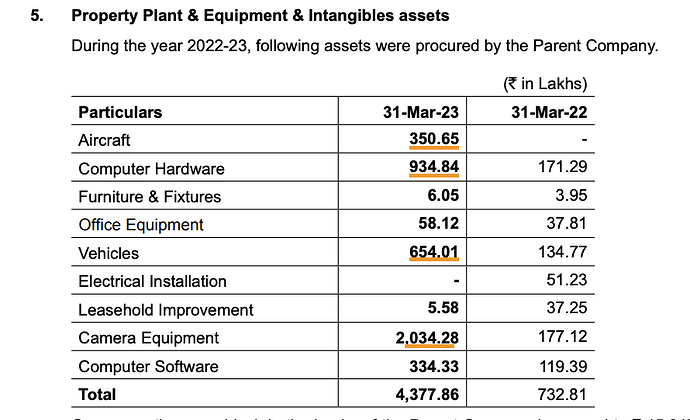

Short thesis is that this sector is still very nascent and growing very fast. The govt. is subsidising map building in these digital twin projects but the digital twin assets reside in Genesys books. The company raised capital from some marquee names and built the equipment required for the project work.

They now have around 57 Cr of intangibles which is the digital twin assets on the books.

These assets can be utilised with other clients across sectors in banking and insurance, power, telecom etc. The company projects for 1000-1500 Cr revenues with a 25-30% margin in 3 yrs. The current order book must be north of 500 Cr going by what the company has won in the last 6 months. As they do more of monetising the data assets, the margins should trend up as this will be more like a product company at that point than a project company it is at this point.

Sharda Motors, Weekly - This slow coach which went nowhere for few months has finally woken up. It continues to remain very cheap with 650 Cr cash on the books. There’s a buyback which is announced. I would expect dividend payout to be healthy as well along with the buyback and they are on the lookout for an acquisition as well. All this alongside growth driven by volumes and value in the exhaust business. While most businesses are busy doing dilutions, here’s one doing buybacks. Considering the cheapness of the stock, this is perfect use of the capital. It deserves to trade much higher

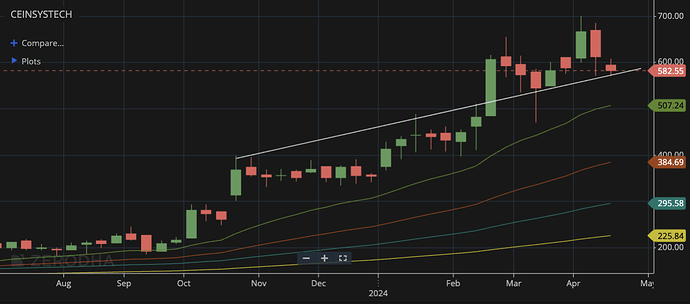

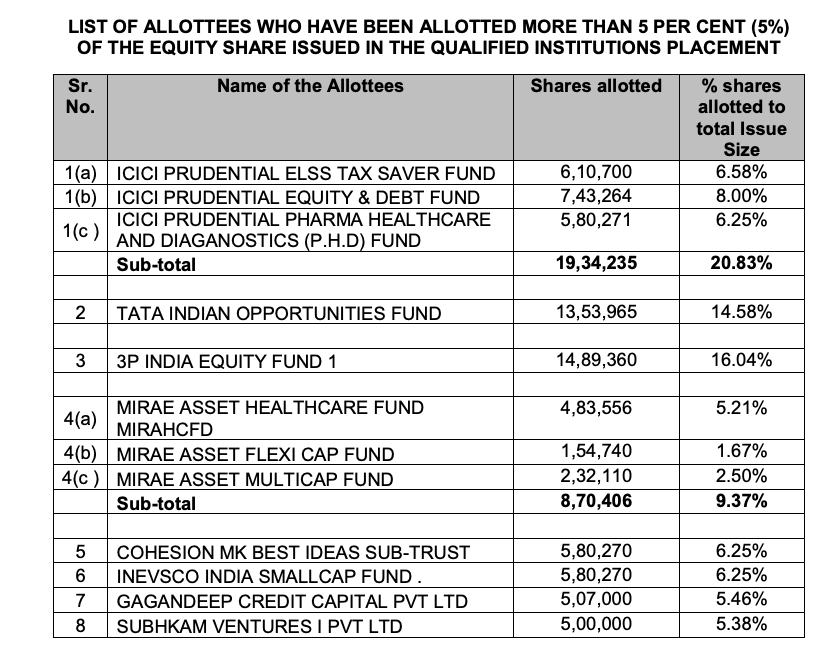

Ceinsys, Weekly - The geospatial sector thread above covers ceinsys as well. Please do have a look. Here too the opportunities are huge as mentioned few times in this thread. Ceinsys has announced a massive QIP+Pref of 240 Cr with promoter participation for ~90 Cr or so at 560/share. This should act as bottom for the share. How the capital will be utilised will drive future value. There are enough and more opportunities in this sector and company has very good order book.

Wockhardt, Weekly - This a medium-term play and is playing out really well so far. Nothing new since last update on the Wockhardt thread except that they have succesfully managed to raise money through QIP - this was a major hurdle to progress in the phase-3 trials for WCK 5222. Very glad that this is now sorted. QIP price of 520 means current levels should hold as it consolidates to take out 620+ levels in the coming weeks

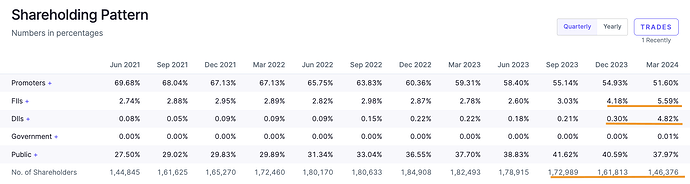

What’s also nice is that marquee investors from Prashant Jain, Madhu Kela, Nimesh Shah’s funds have taken allotment in the QIP.

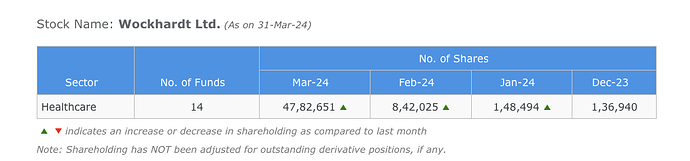

The institutional holding has now gone up considerably since Dec - both FII and DII, even as retail has shed positions considerably.

Shaily, Weekly - Had taken out previous highs when it was trading above 500 levels. Now it is looking to take out the long-term resistance trendline. Fundamentals discussed few posts above.

Disc: Invested as disclosed before. No recent transactions except in Genesys. Not qualified to advise. Just writing what I do from time to time as clarity for myself as writing helps my thinking