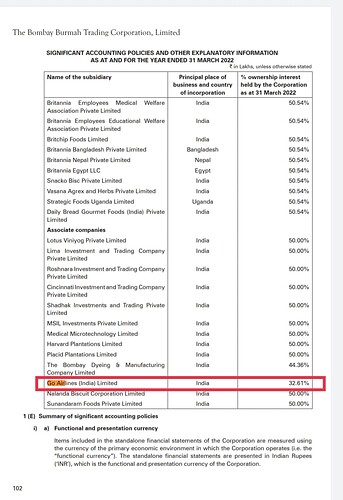

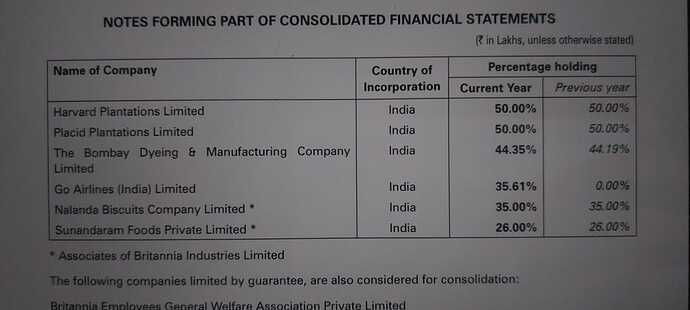

Could you please tell me how their stake in Go Air is 40% as their latest Annual Report states it to be 32.5%

Here data say 35.61% … and I remember I read somewhere about 40% around holding… I am not 100% sure now . But as you said they hold 32% for sure

This is from which document?

Hello To Value Pickr Forum and all the esteemed members who are contributing so much to the site and we really get a great knowledge and our scope of thinking really becomes wide.

So now Coming onto This Share BBTC, I have been holding this for quite a time now but this share is not been able to move and the opportunity costs right now are very good in the market so i am concerned about why the company not being direct holding company and through a route of many different companies, so is this a issue if there is any dispute as we know the britania is king and there wont be much trouble there but the future of BBTC (although having so much under their hood) is uncertain. Would really love someone if there is any thesis on this as it would make investors go for this holding company available at such discount.

Disclosure : Very Small Amount Invested

I am holding BBTC at higher price and in loss

And I like to mention few things here

1.BBTC hold 50.55% indirectly holds Britannia

2. Bombay dyeing 44%

3. Go air 36-40%

12000 acre of tea and coffee estates

Dental and auto components manufacturing

Horticulture

Why company is in discount

-

Dividend received by Britannia is not disbursed among shareholders instead they are re-invested into loss making business like tea and go air

Which company is not going to show any earning growth -

Britannia is not moving anywhere since 2018

-

Issue with promoters in Bombay dyeing issue

-

Halt in Go air ipo

Why company should go up in future

- Definitely positive in Britannia business

- Coffee and tea business growth

- Go air ipo

- Bombay dyeing demerger if it happens

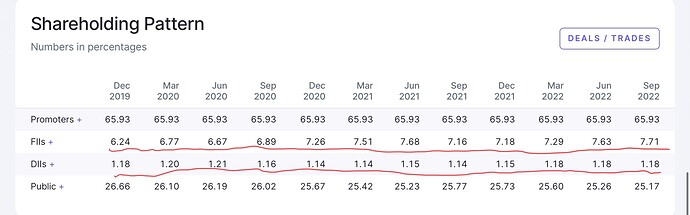

Look at above two images

- Pattern is same as before where accumulation was being done for years

- FII DII or Promoters still staying strong but price falling down means they are accumulating for lower prices

- Majority shares hold by strong hands so it is highly operated stock

BBTC Now hold 24% holding National Peroxide

Bombay Burmah posted highest profit of 618 crores in q3

PBT at 836 crores vs 316 crores

Net Profit 618 crores vs 179 crores

it’s trading at almost 89% discount to its holding in britannia. bombay burmah mcap 6439cr. Britannia mcap 111258 cr. bombay burmah holds 55851cr in britannia.

britannia to report strong q4 with raw materials prices expected to go down. with go first airline expected to improve performance under varun berry leadership, engine delivery improving and strong advance booking go first expected to bounce back .

so can expect stronger finish to q4 too

@edwardlobo, I have a doubt. If dividend is the only factor that decide the value of this stock, then why it has gone up 8 times in the past 9 yrs ?

BBTC sold its coffee estates at 295 crores

April 4 Britannia will announce dividend

BBTC will receive around 500-1000 crores in next 1 month

All the money it receives will get wasted in Gofirst airlines…!!

Go airlines has not paid lease rentals for 10 planes from past 2 month … all the money received will move here

There’s a reason holdcos get discounted. They have the worst capital allocation strategy. Throwing good money after bad money.

Britannia announced dividend of 72 per share which means BBTC will get 860 crore around and coffee estate sale at 295 crore

1000 crore cash will now go to Go airline ![]()

Wadia is planning to exit from Go airline business or stake sell … Great news for BBTC and Britannia

BBTC hold 30% stake

Wadia group is loosing huge money in aviation its a good decision if it happens

Bombay burmah sold all its land and assets in Tanzania Tea estates for 12 lakh USD

Last month sold all Coffee estates

Now left with Indian Tea estates that too lease will end in 2027

One overhang done.

End of Go airline … Great news for group companies. Britannia and BBTC

BBTC management directly clicked delete button to loose its all loss making businesses coffee , tea estates and now Go airline

So finally what business they will be having? Just to remain holding company of Britannia at the end?

Auto ancillary, Dental products,horticulture all 3 are profitable

Holding company of Britannia , Bombay dyeing , national peroxide. Bombay dyeing has Bombay realty so 1:1 demerger will help BBTC

Management is clearly not aligned to unlock shareholder value. I would not waste my time here holding onto this unless we know there is an activist shareholder pushing the agenda to unlock shareholder value