Biocon – The Ultimate Biosimilars Play!

Date: March 20 - 2016

Mcap: 9100 crores

What are Biosimilars - A biosimilar (also known as a biologic) is a medical product which is almost an identical copy of an original product that is manufactured by a different company. Unlike generics which are replicas of the original (innovator) product, biosimilars are merely similar in that they tend to exhibit similar attributes in terms of efficacy and safety. They are usually characterized by extremely large and complex molecular structures, and are highly sensitive to changes in manufacturing processes. Biosimilar products are generally derived from a living organism. They can come from many sources, including humans, animals, microorganisms or yeast.

A generic drug on the other hand is a replica of the original innovator drug in terms of dosage, strength, quality and performance characteristics. Furthermore, international laws require generics to have the exact same API (Active pharmaceutical ingredient) as the original branded drug. So a generic is a mere “copy cat” version of the original branded drug.

A major distinguishing feature between a generic & a biosimilar is in their composition, manufacturing process and the research involved to make it. To manufacture a generic, if one were aware of the ingredients & the recipe of how much of each ingredient to add and at what stage any company can replicate / manufacture a generic drug. A biosimilar on the other hand is much more complex, even if one were aware of the recipe and the ingredients that comprise the drug, it is extremely difficult to replicate a biosimilar molecule. In the case of biosimilars, it is not the recipe or the ingredients that can assure replicability, but the process of making it is an art in itself and that is of paramount importance. That is why slight changes in manufacturing processes can result in large variances in the finished product. This needs to be viewed in conjunction with process patent laws in India and around the world as legal protection against competition.

Economics of the industry - Innovator drugs that are patent protected command a huge premium in the market place. This is due to the fact that the process of bringing a new drug to the market in the US on an average takes 8-10 years sometimes even longer. The novel molecule first needs to be invented, developed, investigated, evaluated and finally put through rigorous FDA testing. FDA tests are usually structured in 3 Phases. Phase 1 to prove drug safety on a small sample of participants. It is also used to study safe dosage ranges, side effects if any etc. Phase 2 – The drug or treatment is given to a larger group of people to see if it is effective and to further evaluate its safety. In phase 3 -The drug or treatment is given to large (statistically significant) groups of people to confirm its effectiveness, monitor side effects, and collect information that will allow the drug or treatment to be used safely.

Given the costs and the time involved in conducting such tests, novel drug compounds, once approved command a very steep premium, and are patent protected to ensure minimal competition.

Generics on the other hand do not have to go through this process of testing to prove safety & efficacy. If the molecule of the original drug is replicated and if it is proven that this can be done with repeatability that’s usually good enough for the FDA. Generic companies therefore incur fewer costs in creating generic drugs (only the cost to manufacture, rather than the entire cost of development and testing). When a novel drug goes off patent and generics come into the market, the price of the drug falls on an average by 70% – 90% Given the low cost structure of the generic companies, they still maintain profitability and compete aggressively with each other for market share thereby driving prices further. It is not uncommon for 8- 10 different generic companies to be fighting for market share with each other over the same drug. This is where sales & distribution networks in the US become very important as it helps the new entrant get products to the market quicker than competition and capture market share rapidly. This is how a Lupin went from a 7,000 cr market cap company to 75,000 cr company in a span of 5 years. The same can be said for Sun Pharma.

Biosimilars - Biosimilars in the US (will touch on Biosimilars in Europe in a bit) came about as a result of the Affordable care act. (Obamacare) passed in 2010. It amends the Public Health Service Act (PHS Act) to create an abbreviated licensure pathway for biological products that are demonstrated to be “biosimilar” to or “interchangeable” with an FDA-licensed product. Interchangeable is the key word here and I will address why shortly.

The biologic in this case has to go through the same rigorous phased testing (FDA phase 1,2 & 3) as the original innovator drug had to. This is the reason why, to date, we only have 2 biosimilars in the US, despite the law being passed 6 years ago. As the FDA testing takes an average of 4-5 years depending on patient “recruitability”

Once a biologic is introduced in the market (see Sandoz’s Zarixo biosimilar to Amgen’s Neupogen) the price erosion is minimal (prices usually drop 10 – 20%) and the massive market size is now to be enjoyed between only 2 companies, the original innovator & the biosimlar company. No other competitor can get in easily. Furthermore, the research costs of developing a biosimilar to an already available patented molecule are about 25% - 40% that of what the innovator spends in developing / inventing a brand new molecule. Therefore the biosimilar has a massive cost advantage compared to the innovator drug and can afford to underprice much more aggressively if need be.

So unlike in the case of generic drugs wherein let’s say the innovator drug had a $10 Billion sales / year and once generic competition comes in the total market size drops to less than $1Billion (as evidenced recently with Abilify and many others) and that reduced profit pool is aggressively competed for by 10 different generic manufacturers, in the case of biologics this is not the case.

Anyone wanting to compete with a biosimilar has to create a biosimilar through a different (novel)manufacturing process due to process patents, they also have to go through 4-5 years of FDA testing, incur all the costs of doing the same file an application with the FDA and then come to market. The overall time involved (7 years approx.) and high upfront costs with the hope of capturing some amount of market share discourages most competitors thereby resulting in a larger profit pool (less price erosion) competed for by just 2 players (the innovator & the biosimilar company).

To sweeten the deal further, all governments, those in Europe that have a single payer system and the US which has an insurance model are determined to drive prices lower. The affordable care act (Obamacare) further permits Pharmacy benefit managers (PBMs) to fill prescriptions with “interchangeable” products if the said product is cheaper than the original. Basically the insurance company wants to save money, and so has the legal right to tell the patient that we can give you what your doctor prescribed, but then you’ll have to pay for it as it won’t be covered by insurance (and this is an innovative branded drug) so super expensive, or we can give you an interchangeable replica, that you only have to pay the co pay for and is completely covered by your insurance. This helps steal market share away from the innovator drug rapidly & reduces sales, marketing & distribution costs. In the entire healthcare system in America, so far focus has only been on drug companies, doctors and patients, the payers (be it the government in Europe or the Insurance companies in the US) have been largely overlooked. However their bargaining power in this system has grown vastly.

BIOCON – Now that we have a better understanding of the environment that biosimilars are operating in, let’s turn our attention to Biocon.

Before getting into how Biocon fits into this global biosimilars space, a quick look at their extremely mediocre & lackluster financial performance so far.

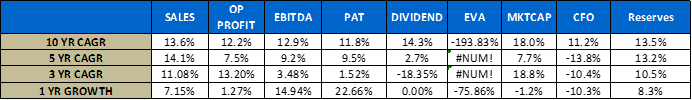

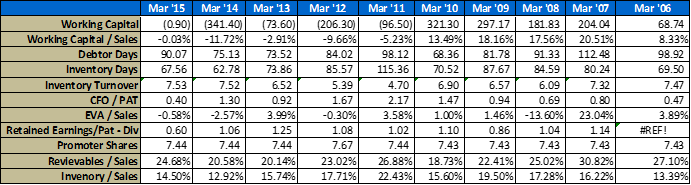

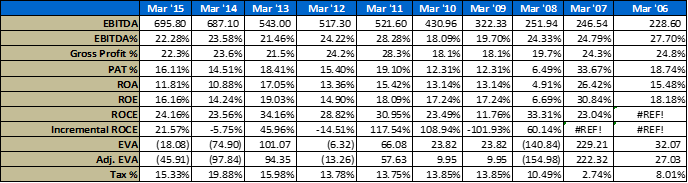

- Growth Parameters

- Return Parameters

- Operational Parameters

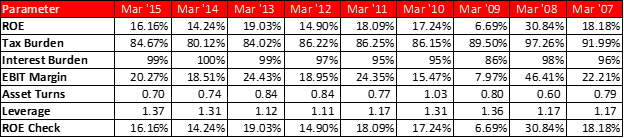

- ROE breakup

A few notes on the above numbers – I have made several adjustments to their financial statements to reflect true economic performance, the usual stuff like capitalizing operating leases if any, adjustments to CFO etc.

For working capital calculation – I have backed out excess cash from the balance sheet in arriving at these numbers. Working cap management is critical for a company with such a long go to market pipeline.

How does Biocon fit in to the Biosimilars space - Clearly the key to understanding Biocon is not in their historical numbers. So while a Lupin went from a 4,000 ish cr market cap company to 75,000 in the past 10 years & a Sun Pharma from a 15,000 cr company to a 2 lakh crore company what on earth were the people in Biocon doing? They barely doubled in size from a 4,500 cr company to a 9,000 cr company in 10 years!!

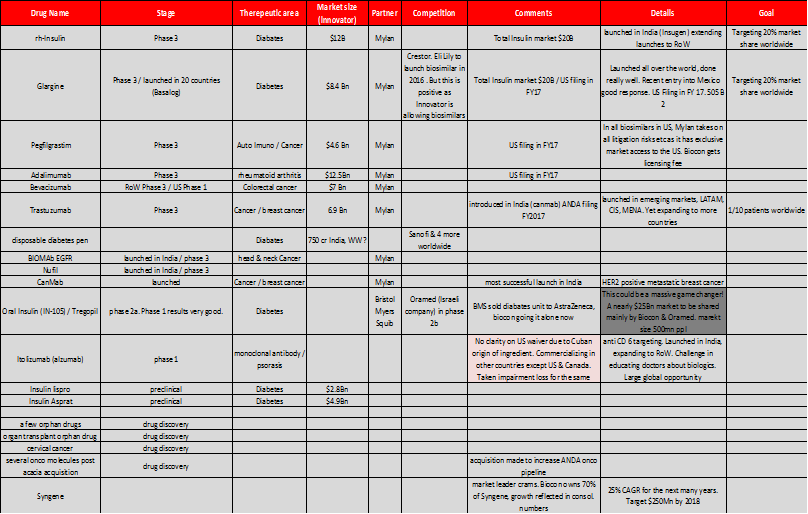

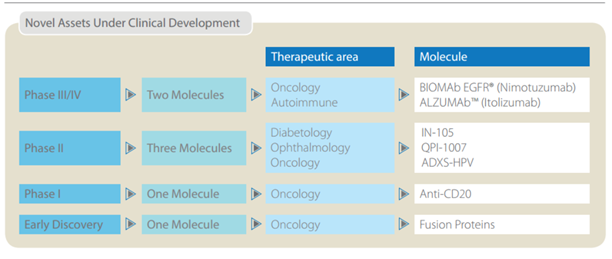

So here’s what they were doing – they decided not to play the “me too” copy cat, generic game that all the other Indian pharma companies were playing, and instead invested heavily in R&D and product development to come up with products with orbit changing potential. Things that were never attempted before, like oral insulin etc. So here is a quick snapshot of what they were doing in the past 10 years, and the pipeline that their R&D investments have helped build.

Source: U.S. Market size data obtained from an Axis securities research report.

Notes on the pipeline –

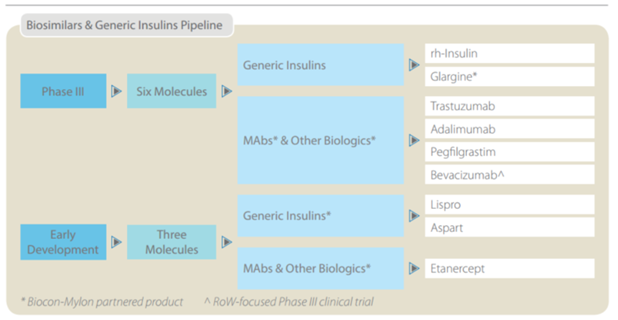

Anti-Diabetic (Insulin) – Insulin in all its forms is a massive market $50 Billion worldwide, $ 22 Billion in the US alone as per INS. Despite the fact that human Insulin was first discovered and patented in the 1920s, there is still NO generic insulin available in the US (Source – New England journal Medicine – March 2015) All diabetics in the US face extremely steep costs (an average of $13,700 / year – out of pocket, so not including what the insurance companies pay) to get their insulin fix. How have drug companies managed this so far? By “ever greening” their patents. By making incremental improvements successively to date. Biocon (as evidenced in a TOI report March – 18 – 2016) is all set to disrupt this. While the newspaper article talks of the impending RH Insulin filing in the US with a Mexican partner, Biocon is set to file the ANDA for Glargine in the next few months along with Mylan Pharmaceuticals as a partner. Glargine has been launched in India (Basalog) & 20 other countries, and the roll out process to more countries is underway, including the regulated market of Europe. This drug has successfully completed all phases of FDA testing, has built a massive dossier of data from patients in 20 countries that it has launched the product in. Launches in all these countries has shown the drug to be safe & effective. They are expected to launch in the US during the end of calendar year 2017 (given the time taken between filing an ANDA & receiving FDA approval) This alone could tipple or quadruple their total revenues (not unlike what Torrent and Alembic pharma experienced post launch of Abilify) Unlike Torrent and Alembic though, there is no other generic insulin brand in the US, the competition space comprises 4 innovator companies, J&J, Bristol Myers Squib & 2 others. The combined market size for the above two molecules (Rh Insulin & Glargine) is $20 Billion in the US.

Oral Insulin (IN – 105 / Tregopil) – There are currently no oral forms of insulin available anywhere in the world! This is an additional $25 Billion market with just 2 companies in the race. Oramed of Israel which is currently a step ahead with its product being in FDA Phase 2b testing & Biocon with IN 105 in phase 2a testing. The safety and efficacy data of the Phase 1 tests are “encouraging” per management, so I would take this with a grain of salt, as it still has a long way of testing before it. The key point to note here is that, if successful, they will be patent protected and no other company can compete and it would take a potential competitor 6-7 years just to come to market given development, testing time etc.

Biosimilars – Biocon is going to file 4 ANDAs in the next few months CY 2016 / FY 2017. These 4 drugs to be launched represent a total market size of $ 30 Billion totally. Pegfilgrastim (a drug to boost immunity post chemotherapy - $4.6 Billion market size), Adalimumab (rheumatoid arthritis - $12.5 Billion market size), Trastuzumab (a.k.a. Canmab in India - Breast cancer - $6.9 Billion market size) & as mentioned before Glargine (Diabetes - $8.4 Billion) Apart from this they have a portfolio of products representing a massive market size in the Billions of USD which are in final stages of testing (FDA – phase 3).

Syngene – Syngene a Biocon subsidiary (70% owned by Biocon) is the market leader in CRAMS. No Indian company comes close to Syngene in this space. It is estimated that nearly $100 Billion dollars of non core pharmacy R&D can be outsourced. Innovator companies (read Amgen, BMS etc) are facing increasing pressure to cut costs in the R&D phase and to outsource most of the “non core” research work to third parties. Syngene currently hosts dedicated centers for Bristol Myers Squib & Abott currently and is the partner of choice for all global biotech companies, due to proven competence, quality & cost competitiveness. Management expects Syngene’s revenue to be $ 250 Million by 2018. Current sales are $130 Million. Syngene being a subsidiary of Biocon commands a market capitalization of 8,100 crores, just 1,000 crores less than Biocon itself!

I think I’ve gone on for way too long about their products, their prospects & their pipeline, I am not going to further build upon the above list even though there is a lot more under the Biocon hood such as their foray into specialty APIs and FDs with 25 ANDAs expected in the next few years, the organic 15% growth of their existing product portfolio etc.

Regulatory compliance record – In the past 10 year, from 2006 – 2015 Biocon has had a grand total of 6 FDA 483 s, 3 of which were prior to 2009. This is the best company in India in terms of FDA compliance when stacked up against anybody else, a Sun, Lupin, even a Mylan in the US has had more 483’s than Biocon in India. Also being B2B since it is in partnership with Novartis, Mylan and many others, client inspections are frequent.

Management Integrity & Accounting Standards – All I can say is that I have no reason to doubt or second guess the integrity of Kiran Mazumdar Shaw & the top management team. A cursory glance at the composition of their board of directors is enough to be assure one of the same. Nil related party transactions, extremely conservative accounting practices (ex: impairing all the R&D costs of Itolizumab, due to Cuban origin of the drug and no clarity on US market entry etc.)

Bearish Viewpoints – Investment Risks & Mitigations.

-

They will not get FDA approval for any of their biosimilars or other drugs. All of these lofty dreams of massive market size in the US etc. will never materialize & will remain a pipe dreams.

Europe is far ahead of the US in biosimilars and is very embracing of the same given the single payer medical system. They want to drive costs down and currently have 60ish biosimilars in the market already. The process for approval in EU is also simpler than in the US. So Europe in which Biocon is expanding and in some cases already has approvals in place is a good counterbalance. Furthermore, the 4 biosimilars that Biocon plans to file ANDAs for, are currently being used in 20 countries including India. The track record of these drugs shows them to be safe & effective and have helped millions of patients worldwide. So it’s a little farfetched to think not even one of these drugs will get FDA approval. Again the market size is huge in the Billion of $ ($30 Billion for these 4 drugs alone) So even if they get 5 or 10% of what the total market size is (conservative assumption as there is no other competition apart from the innovator) their annual sales will surpass Sun Pharma’s in 2019-2020. Plus there’s Syngene (70% owned by Biocon). Additionally management guides to double revenues to $ 1 Billion in calendar 2018. Kiran Shaw says that there might be positive surprises on achieving this goal. -

FDA compliance issues – Their track record to date talks for itself. Geographical diversification (ex: Malaysia) further helps in this regard.

-

Valuation – Current Market cap 9,183 crores (Syngene (70% owned by Biocon) 8,100 crores market cap! I know there is a holding company discount but this is ridiculous! Valuing the entire Biocon pipeline for a measly 1,000 crores) 9 month FY 16 Net Profit is 586 cr with a full year FY 16 earnings expected at 700 crores. This translate to a P/E of 13.1 if we back out one time Syngene gains it works out to a P/E of 17.5. I am personally not a fan of P/E as it hides more than it reveals, I usually prefer an EVA method. The larger point however is that Biocon cannot and should not be evaluated on trailing earnings or any other such variant of historical performance based valuations. The market is forward looking, and should be evaluated based on probabilistic future prospects as opposed to historical earnings that are not going to be too relevant going forward.

Conclusion – Biocon is the classic mid cap company one can hope for, sector leader in their domain with a wide moat (patent protection) and an extremely vast runway / opportunity size to expand into! While it true that Biocon has gone nowhere for the past 10 years whereas all the pharma companies have raced far ahead of them, given their pipeline and the inflection point that Biocon finds itself in currently, this might be a classic example of the tortoise out pacing the hare to the finish line!

Disc: i have no position in Biocon at the moment, however I am actively tracking the company & awaiting FDA approvals, before I buy! Please assume that I am biased and please do not take my report at face value, do your own research about the same!