To all the valuepickr members I have one question

Why bharat rasayan has a low p/e multiple as campared to astec . Although , studying both the companies i find Bharat rasayan quite interesting .

Can anyone comment ?

P/E alone can not be a basis of investment decision. need to look at growth, cash flows( which really tells if profits are true), ROCE/ROE , corporate governance etc.

Mr Market decides the P/E. Put your thesis comparing both companies considering above.

if you have gone through threads of both companies completely you should able to decide.

Anyone has update on AGM proceedings ?

Thanks for sharing.

Regards,

Kshitij

Few important points:

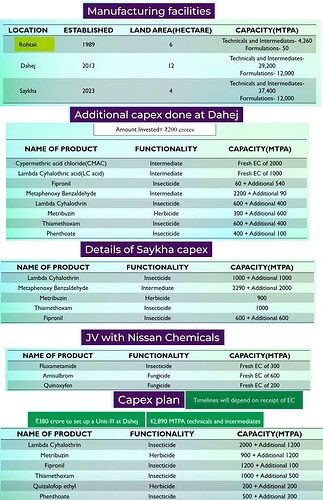

- BRL has JV company with Nissan Chemical Ltd Japan. The company named as Nissan Bharat Rasayan Pvt Ltd (NBRL) has started its manufacturing operations from February 2023 at its very modern and automated facility at Sayakha, Gujarat. Major focus of this unit will be manufacturing of patented molecules for global requirement.

- Bharat has expanded its production capacity both at Mokhra-Haryana and Dahej Gujarat manufacturing plant. We have also finalized a new greenfield manufacturing unit-3 at Dahej Gujarat which will start commercial production by end of 2024 as part of our further backward integration strategy along with focus on contract manufacturing for our MNC and Japanese partners.

We also started formulation production in our second state-of-art greenfield facility at Panoli Gujarat spread across 8 acres to cater increasing demand for packed (P2P – pack to pack) formulation products by both domestic and global customers. Some of the new formulations which we can formulate include OD, ME, SC, WDG, WG, SE, ULV, SL apart from normal generic products.

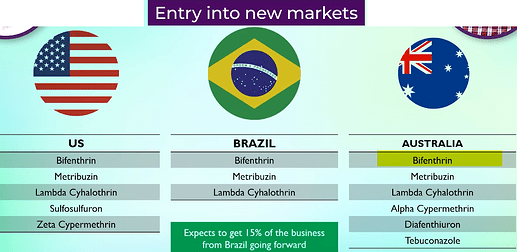

New products which were launched by us in last couple of years includes: Penoxsulam, Tolfenpyrad, Pymetrozine, and Zeta Cypermethrin apart from some patented intermediates and technical as part of CRAMP business - Bharat Rasayan Ltd. (BRL), one constituent company of Bharat Group, invested in global registrations (particularly in restricted market) as a part of long-term strategy and we were able to get registration of Bifenthrin, Metribuzin and Lambda Cyhalothrin in Brazil market and also got EPA registration in US market for Bifenthrin, Metribuzin, Lambda cyhalothrin, Sulfosulfuron and Zeta Cypermethrin.

Disc: Invested for over 5 years

Nissan_Presentation_Dec22_Results.pdf (1.8 MB)

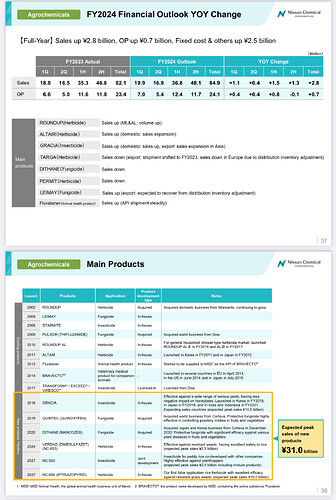

The above presentation published post December 2022 results by Nissan has some relevant information on Bharat-Nissan JV (Refer Slide 32-40)

-

Nissan-BRL JV is likely to start commercial production in Q4 FY 23 (Indian FY 23) and the JV will manufacture AI for patented products like GRACIA, LEIMAY, QUINTEC etc for exporting to Nissan

-

Total Plant will cost around 500-550 Crore (including working capital and IDC) and total debt will be funded by Nissan chemicals (hence we assume cost of debt will be lower) Total equity investment will be around 140-150 Crore.

-

As per slide 33, GRACIA, they expect it to reach sales of 600 crore plus from current levels (though absolute value not mentioned). Most of the molecules have been growing at good rate (90-100%)

-

Nissan is manufacturing newly launched molecules like GRACIA and QUINTEC (launched in 2018 and 2019) and not mature products thus the runway for growth will be high given that these molecules will be early in their lifecycle.

-

Nissan is targeting peak sales of close to 2000 Crores over time (AI for many of them may be manufactured in JV)

-

According to Nissan’s projections, JV’s contribution to Nissan at OP level is likely to be 60 Crore in FY 24 and 150 Crore in FY 25. BRL thus will see sharp increase in contribution from JV in FY 25.

-

Over and above that BRL will make intermediates for many of the AI for patented molecules and benefit of which will accrue in standalone entity

Overall, post couple of years of breather BRL seems to be at interesting juncture where growth journey can resume.

Disclosure: Invested with decent allocation from much lower levels.

Any other updates on Bharat Rasayan ? When are tailwinds expected to be back in co and sector ? Is competition from china increasing ?

A very detailed coverage of Bharat Rasayan

Some of the interesting snippets from the above presentation:

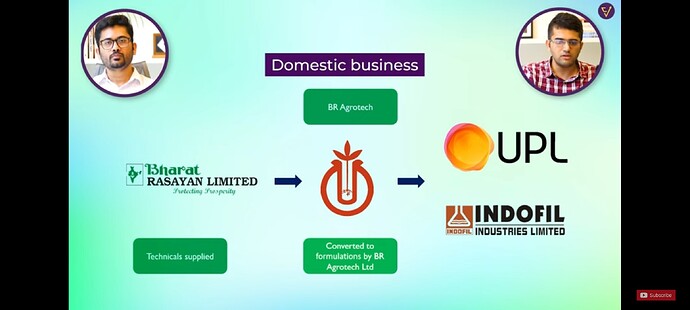

Domestic Business Flow

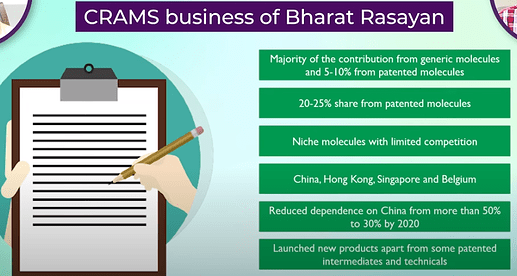

MNC Customers & CRAMS Business Flow

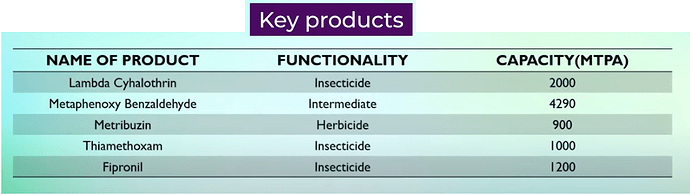

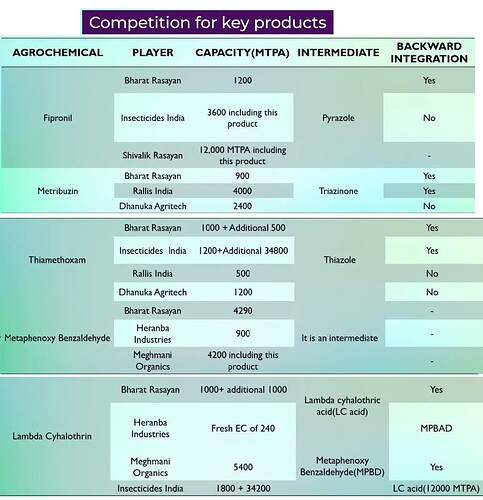

Key Products

Manufacturing Facilities and Capex Plans

Product Registrations

Any notes available from FY23 AGM that happened yesterday ? (13/09/2023)

Nissan Bharat Rasayan has started commercial supply of the active ingredient of the fungicide “LEIMAY®”. Nissan Chemical will manufacture LEIMAY® formulated products containing the technical grade supplied by NBR. And the Saykha plant has a plan to sell and ship a technical grade of active ingredient of GRACIA® also.

Care Rating 27th Dec '23:

Integrated operations offering diversified product mix.: BRL has a leading market position in many technical and intermediate products, including Lambda Cyhalothrin Technical, Metaphenoxy Benzaldehyde, Metribuzine Technical, Thiamethoxam (Insecticides) and Fipronil (Insecticides) among others and further added new products in past year, namely, Fluxametamide, Tolfenpyrad Technical, Diuron Technical, etc., which contributed around sales of ₹102.05 crore in FY23 and ₹98.88 crore in H1FY24. Though there is a product concentration risk as the top 10 products of BRL accounts for around 81.13% of the total sales of BRL in FY23 (PY: around 79.08%) and around 66% of total sales in H1FY24 (PY: around 81%). Technical accounted for 79.94% of the total sales in FY23 (PY: 78.12%), intermediates accounted for 17.78% (PY: 18.98%), and formulation accounted for 1.22% (PY: 2.09%). The group derives cost advantage from the integrated operations through lower dependence on imports of technical, which is the key input for manufacturing of formulations.

Long standing relationship with reputed customer base : The company supplies its products in both locally as well as overseas locations and has a long-standing relationship with reputed

customers, including NISSEI Corporation, Syngenta Crop, Biostadt India, Sumitomo Chemical Company among others. However, BRL is exposed to moderate client concentration risk, as its top 10 customers accounted for ₹793.84 crore in FY23 (around 63.41% of total operating income [TOI]) as compared with ₹722.79 crore in FY22 (around 54.97% of TOI). BRL also has long established association with many reputed Japanese players and has a 30:70 joint venture (JV) with Nissan Chemical Corporation (NCC), which started commercial production from March 2023 and has reported total income of ₹69.90 crore in H1FY24 with PBILDT margin of around 37%.

Comfortable financial risk profile The capital structure of the company remains strong marked by zero long-term debt and healthy net worth base of ₹901.19 crore as on March 31, 2023 (PY: ₹771.61 crore) while the total debt of the company reduced substantially to ₹36.84 crore from ₹179.93 crore as on March 31, 2022. The overall gearing stood comfortable at 0.04x as on March 31, 2023 (PY: 0.23x) and other debt coverage indicators were also healthy including total debt to gross cash accruals (GCA) and interest coverage ratio of 0.24x (PY: 0.89x) and 38.81x (PY: 40.99x), respectively.

Nissan projects a healthy outlook for F24 from the new products. Augurs well for the Nissan Bharat Rasayan JV

Link: https://www.nissanchem.co.jp/eng/ir_info/library/pdf/AM/am2024_03.pdf

The Nissan Bharat Rasayan (NBR) JV continues to see uptick in demand from growing products like GRACIA

Nissan Conf Call Transcript: https://www.nissanchem.co.jp/eng/ir_info/library/pdf/AM/am2024_06qa.pdf (Refer Pg 27)

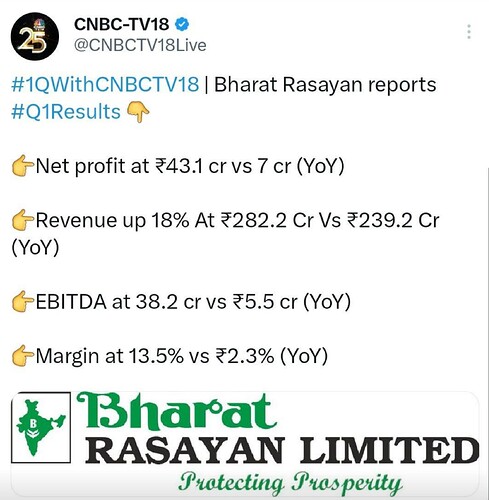

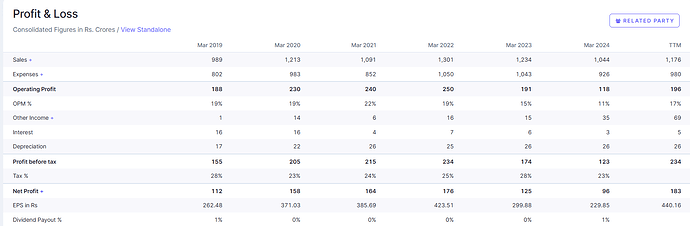

Company posts Lifetime High Trailing twelve months earnings led by strong standalone performance and strong JV performance

Yes, very good performance from BRL given the sad situation the whole agrochem industry has been in. Challenging times like these differentiate good management teams

It seems one of the brokerage firms organised a plant visit for investors yesterday. If anyone has more insights from the same, pls do share.

Looking at the resulting surge in stock price today, it seems like the investors broadly liked what they saw.

“expects a more constructive, volume-led agchem cycle in 2026, which could support stronger asset utilisation and operating leverage-driven margin tailwinds, contrasting with the twin challenges of shaky demand and weak pricing that have defined FY25.”

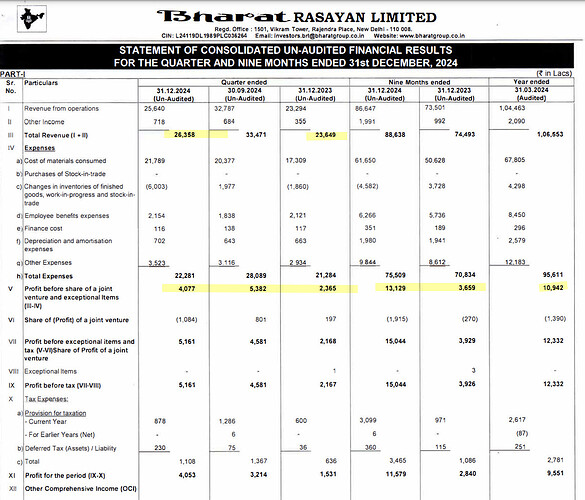

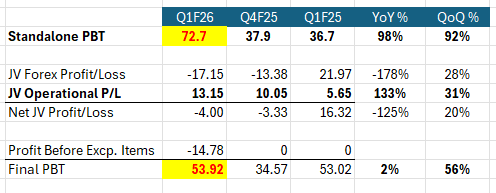

Great set of standalone numbers spoiled by one time expenses (Environmental Damage Comp.) and continued Forex losses (in the Nissan BR JV - what on earth is going on here ???)

Environmental Damage Compensation

Exceptional Items: The Company recognized ~₹14.78 crore under Exceptional Items during this quarter towards Environmental Damage Compensation (EDC) and others related to the Dahej Plant fire incident that occurred on 17 May 2022, in accordance with the directive issued by the Hon’ble National Green Tribunal (NGT). The amount was paid under protest. As the matter is currently under litigation, the Management has opted to treat the payment as a revenue expense, under the head “Exceptional Items”. The matter remains sub judice, with an appeal presently pending before the Hon’ble Supreme Court of India. The Company is actively pursuing all available legal remedies to safeguard the interests of its shareholders.

Results from JV:

Joint Venture Performance: The Company’s Joint Venture, Mis Nissan Bharat Rasayan Private Limited, which is accounted for using the equity method under Ind AS, reported total revenue of ₹58.56 crore and a loss after tax of ₹13.33 crore for the quarter ended 30 June 2025. The loss after tax includes a foreign exchange loss of ₹17.15 crore. In comparison, the corresponding quarter of the previous year (June 2024) had recorded a foreign exchange gain of ₹21.97 crore. The Company’s share of the Joint Venture’s net loss, amounting to ₹4.00 crore, has been recognized in the consolidated Statement of Profit and Loss.