Before we go any further, let’s take a closer look at BASF India’s business and future prospects.

(Taken from Annual Report 2021)

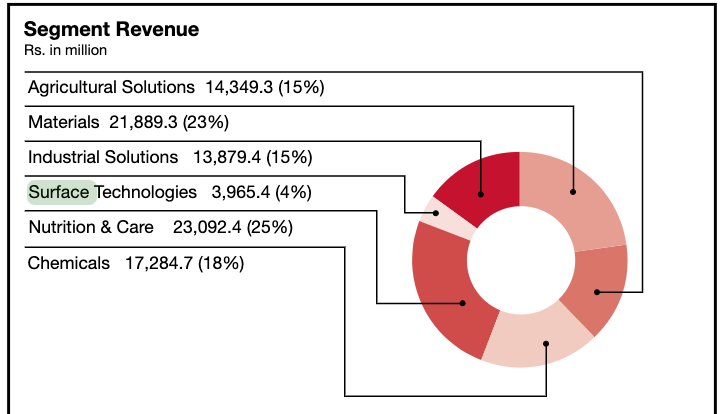

Product from BASF falls into

- Agricultural solutions (15%) - The Agricultural Solutions segment consists of the Crop Protection division. Agricultural Solution is seasonal in nature

- Chemicals(18%) - The Chemicals segment consists of the Petrochemicals and Intermediates divisions

- Materials(23%) - The Materials segment comprises Performance Materials divisions, the Monomers divisions and Polyamides business of BPPIPL merged with the Company

- Industrial solutions(15%) - The Industrial Solutions segment consists of the Dispersions & Pigments divisions and Performance Chemicals divisions

- Surface technologies (4%)- The Surface Technologies segment comprises of the Catalysts and Coatings divisions (earlier Construction Chemicals also used to be part of this business, but they sold in July 2020 for 595 crores)

- Nutrition and care(25%) - The Nutrition & Care segment consists of the Care Chemicals and Nutrition & Health divisions

- Others(1%) – Others includes activities that are not allocated to any of the continued operating divisions. These includes remaining activities after divestiture of leather and textile chemicals business, paper wet-end and

water chemicals business, technical and service charges other than those specifically identifiable to above segments.

As we can see from the above business section, company’s business is not completely reliant on one segment, which offers longevity to the company. “Market generally gives high value to the longevity ”

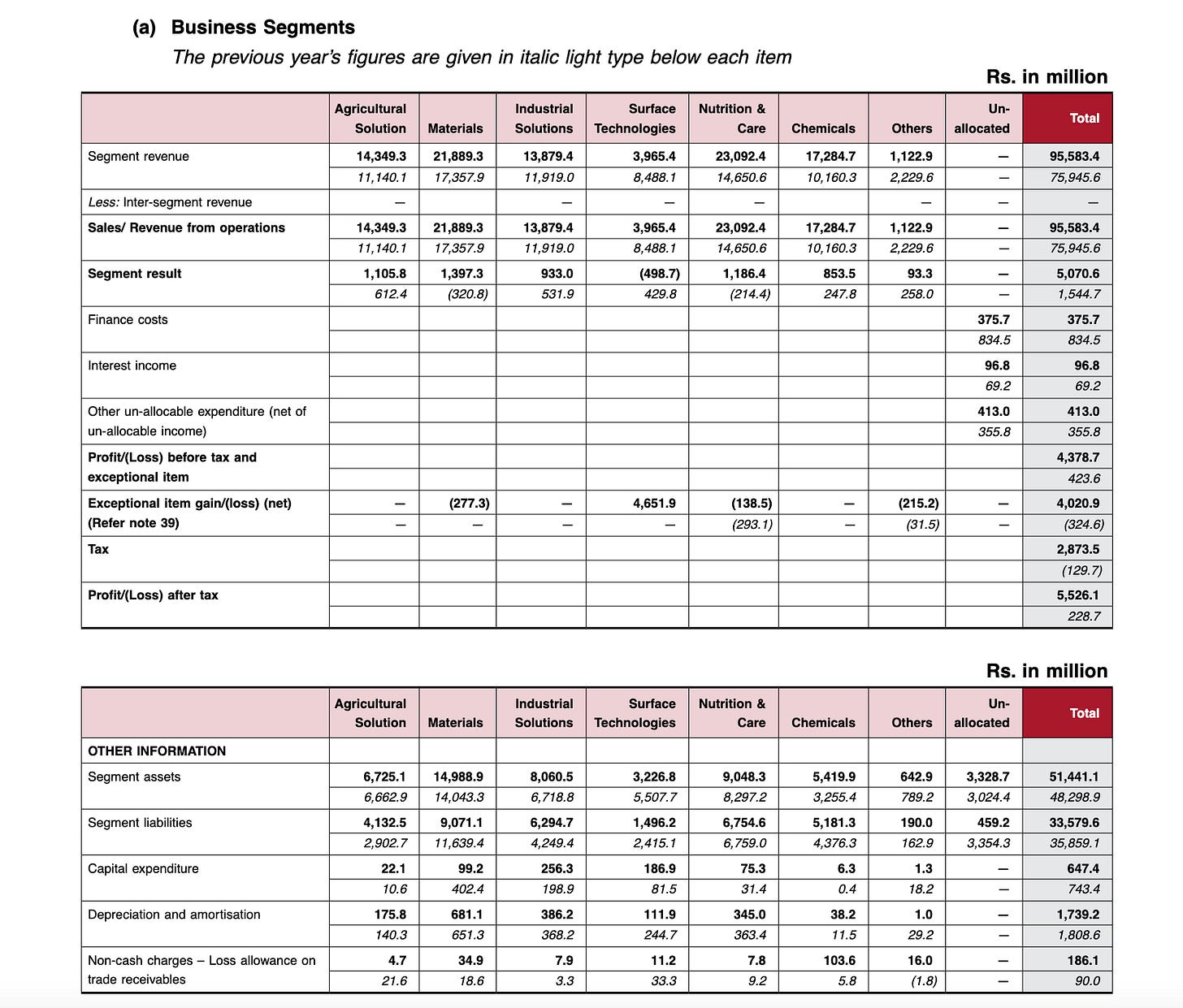

Detailed revenue and profit from each segment

Except “Surface Technology business“ all other business looks profitable but we should not be more worry about it as it is just 4% of overall business, this is what management has to say about Surface Technologies

“The Surface Technologies segment of your Company comprising of the Catalysts, Coatings & Construction Chemicals businesses registered lower sales due to the impact of lockdown followed by sluggish demand. Although the margins of the Coatings Solutions business were impacted, the gross margins improved from lower input prices. The Catalysts business registered higher merchandise volumes, but its margins were impacted due to lower price realisation as compared to the input costs. As a part of BASF’s global portfolio optimization, the Construction Chemicals business of the Company was transferred to Master Builders Solutions India Pvt Ltd on 1st July 2020.”

Key things to watch out for :

- The agriculture business is reliant on a good monsoon and fungicide performance, we must factor this into the while doing valuation of BASF India.

- We must also consider the fact that all business segments are dependent on crude oil and other raw materials, and with the current level of inflation, margins may be impacted.

- The material business is dependent on automotive sector and currently automotive sector is in downturn.

- The Industrial Product segment will play a key role in emerging businesses like 5G and e-mobility connected infrastructure.

- I don’t see any major threat to any of their business segment in future.

Key risks:

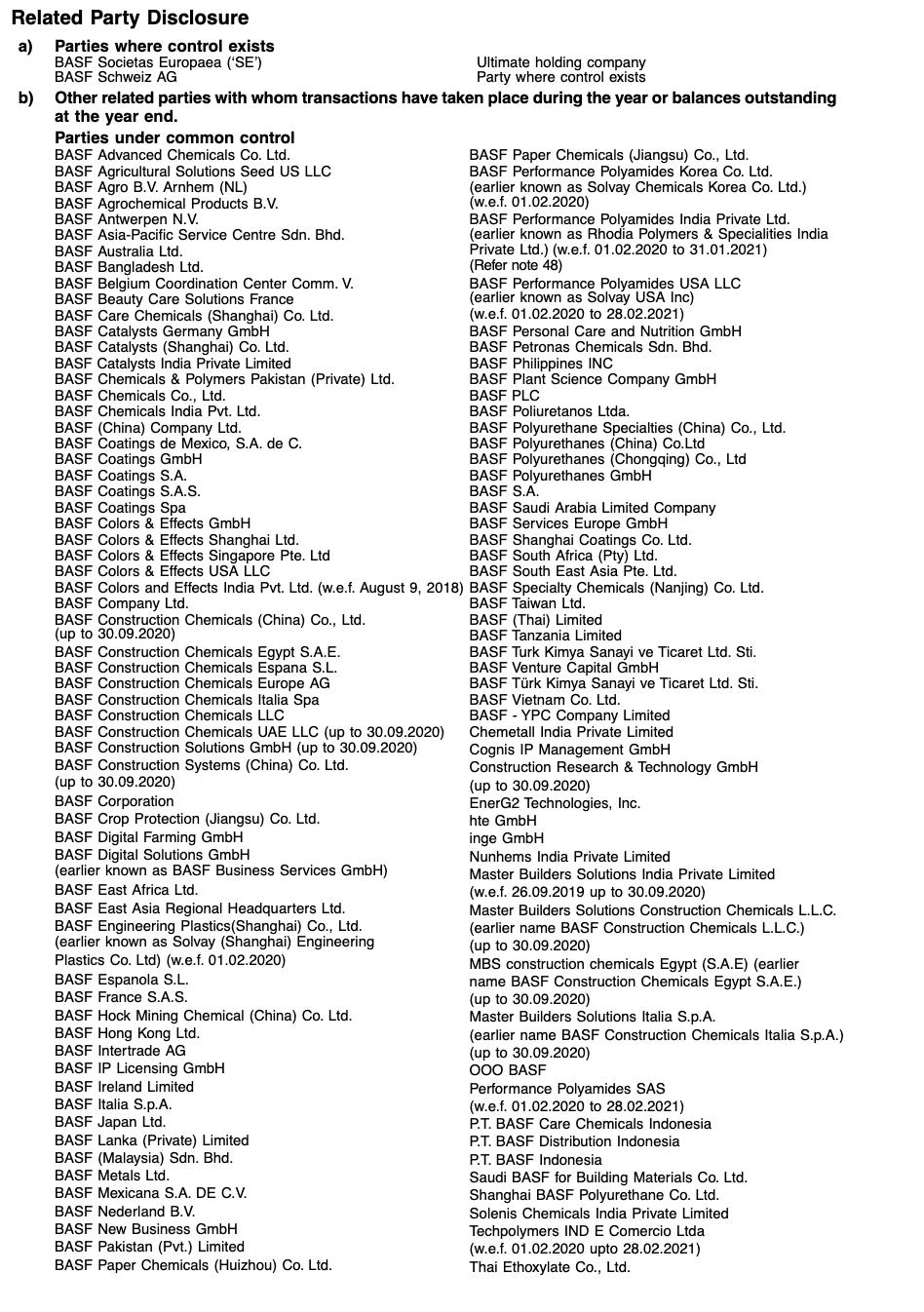

- Foreign currency risk : Ofcourse this risk will be there with every company who does import and export from other countries.

- You need to keep your eyes and ears open when you have so much of related party transaction

- Business risk we already discussed - Monsoon dependency , key material price, automotive sector down cycle etc

- With chemical enterprises, there is always the possibility of improper chemical handling.

Crisil Report in case you want to go through strength and weakness of business

Now that we have fair amount of Idea about the BASF India’s. Let’s deep dive into the numbers

- InterestCompany was paying 148 crore as interest in 16-17 from 148 crore company now paying only 24 crore. In my opinion that’s a big positive for any company

- SalesA tremendous sales growth of 12% CAGR in 10 years, so thumbs up to the management being into the cyclical business, sales always moved into upward trajectory.

- OPMThis is where we should be careful, margin fluctates between 2 to 7%, as we can see by the numbers company has hard time in passing the cost. ROE and ROIC goes down if there is a dip in OPM. Not necessarily but I can see a pattern in OMP - margin drops to 2-3% after every 2 years.

- Receivables days

Receivables days are within limit approx 2 months so no concern here.

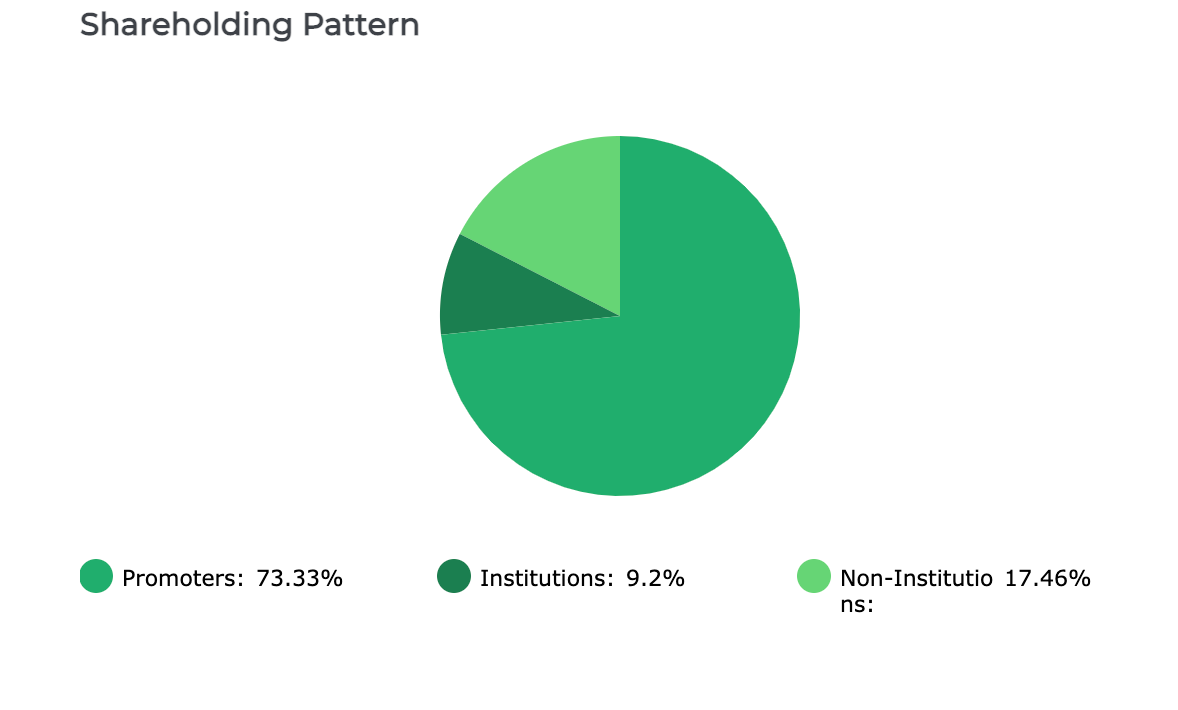

- Promoter shareholding is around 73% - Another tick

pic taken from moneyworks4me

- Cash flow from operating activity for 10 years period is around 2204 crore and total profit after tax is around 1135 so I do not see any problem here. Problem is when CFO is not 70-80% of total Net Profit.

- Debt to Cash Flow is 0.3 years which means company’s 3 month cash flow can take care of all the debt.

On face, numbers looks decent and Balance sheet looks strong.

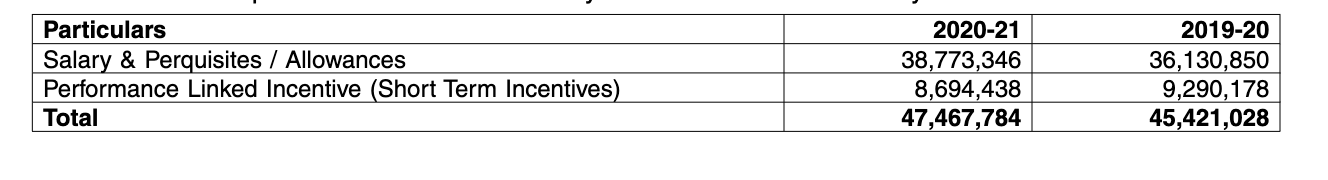

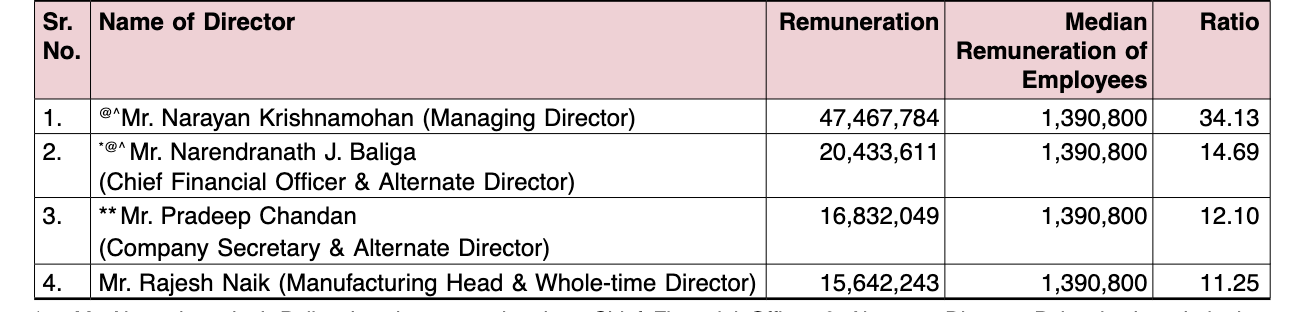

Remuneration paid to Managing Director Mr. Narayan Krishnamoha is approx 4.7 crore during that period companies profit after tax was in 2019 - 72 crore and 2020 it was around 10 crore, so I am bit disappointed here(This I am thinking while wearing the hat of a shareholder), when company is not making money MD and top management can take little bit of hit in their salary and any increament on salary is unwarrented.

What CRISIL has to say about Liquidity

Liquidity: Superior

CRISIL Ratings expects cash accrual of around Rs 440 crore for fiscal 2022. Cash balances stood at Rs 173 crore on March 31, 2021 and working capital lines around Rs 800.6 crore remain mostly unutilised. These, along with cash accrual, should suffice to cover the yearly debt obligation of Rs 152 crore in fiscal 2022. Liquidity is also aided by strong financial support extended by the parent; this was reiterated in fiscal 2019, with the parent refinancing ECBs to an extent of USD 20 million with a longer tenure loan.

So it is a big positive Parent company of BASF India i.e BASF gives apart from technical, financial support as well.

Capex : I didn’t find any thing on capex except that they have planned expansions for the Dahej and Mangalore plants, please do let me know if you have the details about their expansion plan or from where the growth will come in coming years.

Now let’s come to the main part of the blog Valaution

“Value lies in the eyes of the beholder”

But based on my models if i have to hold BASF for 3-4 years and I assume 12% growth and 5% Operating margin Rs 2000- 2200 will be the price where you might not loose money, not sure about making. If company grows with 12% CAGR basis along with 7-8% operating margin than in 3-4 years it can be a potential 2-3x

You can see the share price of the stock moves in sink with operating margin, generally this type of stock one should buy at bottom of cycle, at present it doesn’t look that we are at bottom of operating margin, One should wait for the downcycle to make money in this kind of stocks.

pic taken from screener

Note: This is not a recommendation please do consult your advisor, while writing this blog I don’t hold BASF India but in future i can buy, sell, hold without any prior intimation. Please do you due diligence and treat this blog only a starting point of your research.