Hi Everyone,

( It’s my first post here, I am new to this field and have been learning for last 6-7 months in my spare time. So apology for any mistakes )

Symbol/Ticker: 531112

1. Business Overview

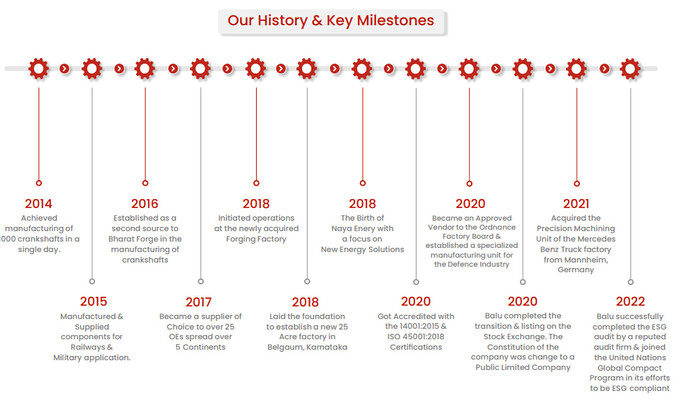

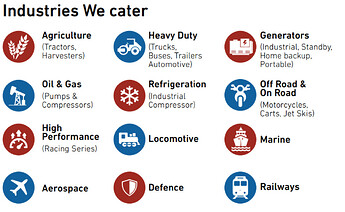

Balu Forge Industries Ltd (BFIL) was founded in 1989 as a precision-engineering company, specializing in the manufacturing of crankshafts and forged components for sectors ranging from automotive to agriculture. Over the last few years, the company has taken strategic strides to diversify its portfolio, venturing into defense, aerospace, and new energy vehicles (NEVs). The company’s fully integrated forging and machining production capabilities allow it to produce a wide range of products, from 1 kg to 1000 kg components, catering to an international market that spans 80+ countries.

This transition positions Balu Forge at the intersection of traditional industries, like agriculture and automotive, and emerging sectors, such as defense and electric mobility, providing a unique growth narrative.

2. Leadership

The company is led by Trimaan Chandock, who serves as the Whole-Time Director. Chandock has been instrumental in Balu Forge’s strategic pivot from a traditional automotive components manufacturer to a multi-sector player. His focus on aligning the company with India’s push for Atmanirbhar Bharat has led BFIL into new and promising territories, such as defense and aerospace. The leadership team has also emphasized operational efficiency, highlighting plans to expand production while maintaining a disciplined approach to capital spending.

3. Business Model

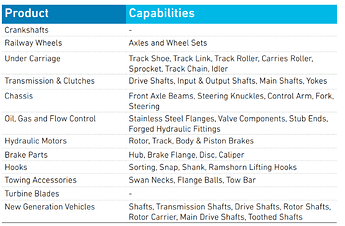

Balu Forge operates a business model centered on high precision engineering, supplying a wide array of industries including automotive, agriculture, power generation, and now expanding into defense and aerospace. The company’s key products include crankshafts, which make up 100% of the company’s product portfolio, but it has started to diversify with new offerings for new energy vehicles (NEVs) and defense components.

-

Geographic Reach: Balu Forge exports 90% of its products to international markets, with Europe (45%) representing the largest regional share, followed by MENA (20%) and America (20%)

-

Customer Segments: The agriculture sector remains the company’s largest customer segment, accounting for 55% of revenues, followed by power generation (15%) and defense (5%)

4. Financial Overview

Revenue Growth:

- FY23: The company achieved revenue of ₹33,928.48 lakhs, a 15.2% increase from the previous year

- FY24: The revenue continued to rise significantly, reaching ₹560 Cr, driven by the company’s diversified product offerings and the entry into high-margin sectors like defense

EBITDA Margins:

- Margins improved from 15.5% in FY22 to 18.4% in FY23, and the company projects them to stabilize at 23-24% in FY25, reflecting improved operational efficiencies

Debt and Capital Structure:

- BFIL maintains a low debt-to-equity ratio of 0.26, demonstrating careful debt management. However, the company’s recent fundraising efforts to secure ₹496.80 Cr through equity shares and warrants will likely lead to short-term dilution for existing shareholders

Profitability grew by 30.4% in FY23, and is projected to further improve as the company expands its product line and clientele in defense and aerospace sectors.

Strengths:

- Revenue Growth Consistency: Sustained growth in revenue and profitability across FY22, FY23, and FY24, even during global uncertainty, indicates robust demand for Balu Forge’s precision-engineered components

- Diversified Product Portfolio: The company’s move into defense, aerospace, and new energy vehicle (NEV) components ensures that it is well-positioned for the future

Weaknesses & Risks:

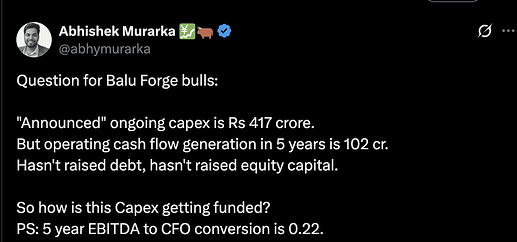

- Capital Efficiency: High capital block (₹15 Cr) relative to sales raises questions about capital allocation efficiency, especially when compared to peers.

- Currency Risk: With 90% of revenue from international markets, Balu Forge is exposed to exchange rate volatility.

5. Recent Developments and Strategic Initiatives

-

Expansion into Defense and Aerospace: The company is positioning itself as a player in the defense and aerospace sectors, expanding its capacity with the Mercedes-Benz machining unit acquisition, which increases its output from 18,000 TPA to 32,000 TPA. The strategic move aligns with India’s self-reliance initiatives under the Make in India program.

-

Fundraising for Growth: BFIL plans to raise ₹496.80 Cr to bolster its R&D capabilities and expand into high-precision defense and aerospace manufacturing. A significant portion of the funds will also be used to procure Solid Wheel Rolling Machinery, enhancing its product portfolio to serve the global rail industry

6. Sectoral Insights

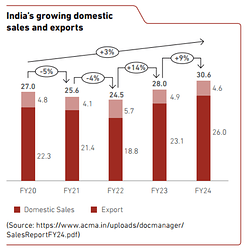

Automotive Industry:

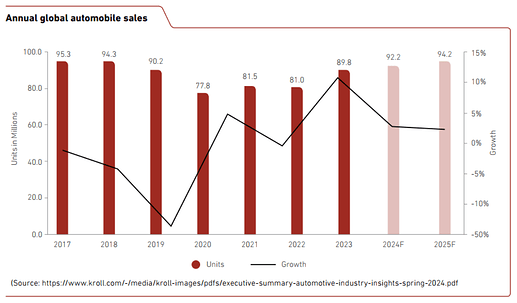

- The global shift towards electric vehicles (EVs) presents a challenge for BFIL’s traditional revenue source—crankshaft production. However, the company’s proactive approach in developing components for new energy vehicles (NEVs) positions it well to capitalize on this evolving sector.

Industry Outlook: The Indian automotive industry is expected to grow at a CAGR of 8-10%, driven by increasing demand for commercial vehicles, particularly in agriculture, where Balu Forge has a 55% market share

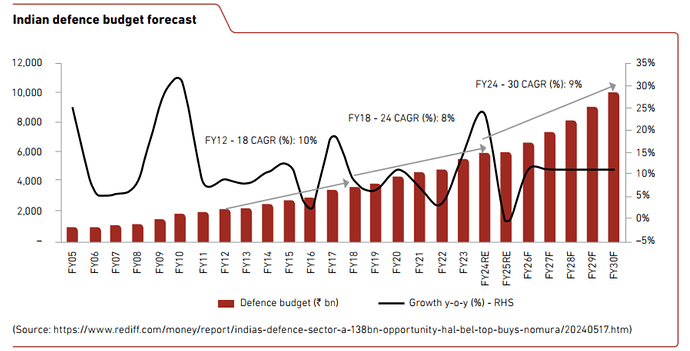

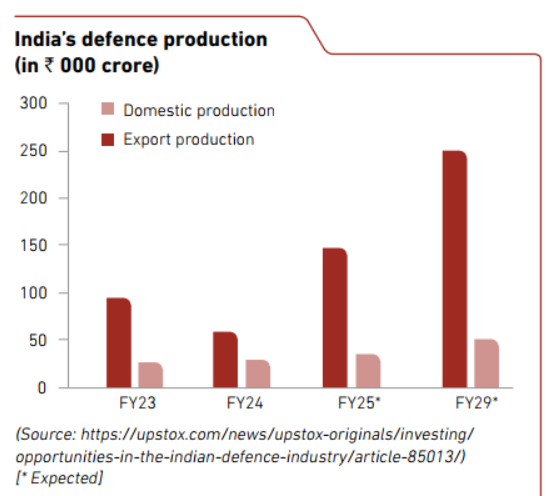

Defense and Aerospace:

- Balu Forge’s expansion into defense and aerospace aligns with global trends, with defense spending expected to grow at a CAGR of 3-5% over the next decade. The company has secured several Transfer of Technology (ToT) agreements and plans to manufacture railway wheels for the global market

Competitive Position: Their strategic investments in Direct Drive Screw Press Lines and aerospace components allow them to penetrate the defense and aerospace sectors, projected to grow at 3-5% CAGR globally

7. Growth Prospects & Capacity Expansion

Revenue Projections:

-

The management has projected 40-45% revenue growth for FY25, driven by new contracts in defense and railway sectors and increased capacity from its Mercedes-Benz machining unit

-

Expansion into new sectors like defense will likely drive medium-term growth, while diversification into new energy vehicles will help safeguard against automotive sector volatility

Capacity Expansion:

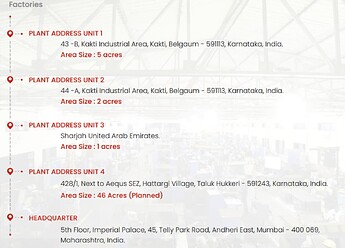

- The acquisition of the Mercedes Benz machining unit and expansion of capacity from 18,000 TPA to 32,000 TPA reflects the company’s aggressive push towards scaling

- Additionally, Balu Forge’s investment in a 52,000 square meter facility in Karnataka will further boost their production capabilities across defense, aerospace, and traditional automotive components

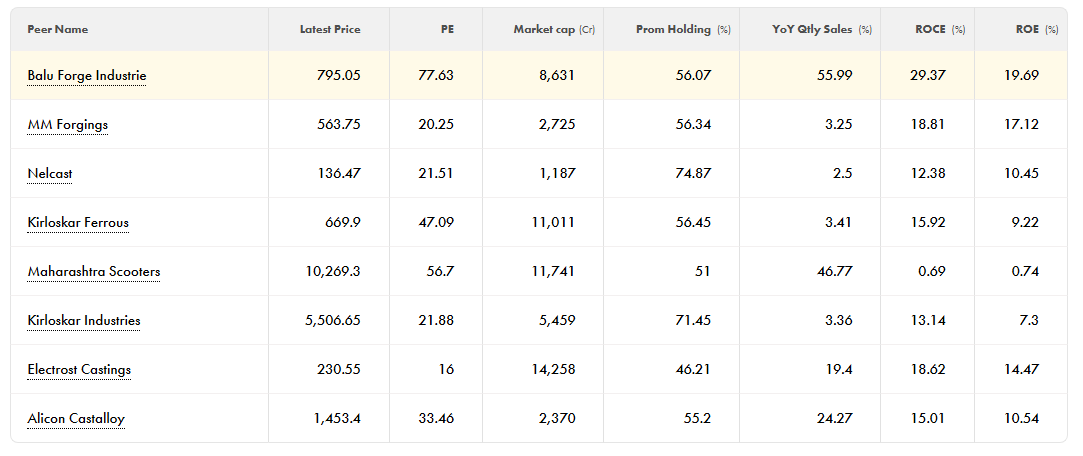

8. Competitive Landscape and Risks

Peer Comparison:

- While BFIL is smaller than some of its peers, such as Bharat Forge, its specialization in precision engineering and focus on NEV components provide it with a competitive advantage. But peers high capital intensity, puts them at a disadvantage

Key Risks:

- Capital Inefficiency: Despite aggressive growth plans, BFIL’s relatively high capital block (₹15 Cr) compared to revenue raises concerns about its ability to deploy capital efficiently.

- Currency Exposure: With 90% of its revenue coming from international markets, the company is exposed to currency fluctuations and global economic conditions, especially in Europe

- Dilution Risk: The ₹496.80 Cr fundraising, while necessary for growth, presents a short-term risk of earnings dilution

- Transparency Issues: While Balu Forge’s management has been transparent about their expansion plans, concerns about capital efficiency have been raised by market observers

9. Management Discussion & Analysis (MD&A)

FY23-FY24 Insights:

- Balu Forge has shown consistent revenue and profitability growth. The company’s EBITDA margins improved from 15.5% in FY22 to 23-24% expected by FY25, reflecting operational improvements driven by capacity expansions and cost control

- Strategic Focus: The management’s shift toward defense, aerospace, and NEV components is in line with industry trends, and the company expects these sectors to drive future growth

10. Conference Call and Management Analysis

-

Sentiment: Management remains confident in the 40-45% revenue growth for FY25, attributing this to customer additions in defense and railways

-

Operational Focus: Management highlighted operational efficiency gains from the new Mercedes-Benz machining unit, which will start contributing to revenue in Q2 FY25

-

Commitment to Expansion: The leadership emphasized their intent to raise capital for defense and aerospace, ensuring long-term growth

-

The management has continued to emphasize its strategy of diversification, focusing on growth in new energy vehicle (NEV) components, defense, and aerospace. This diversification ensures they are not solely dependent on the automotive sector, which is experiencing a shift to electric vehicles (EVs)

11. Credit Ratings Overview

- Stable Ratings: The company’s low debt-to-equity ratio and strong EBITDA growth have ensured a stable outlook from credit rating agencies

- Upcoming Fundraising

12. Conclusion: Long-Term Investment Outlook

Investment Thesis:

Balu Forge Industries offers a compelling growth narrative, especially for long-term investors seeking exposure to precision engineering, defense, and new energy sectors. The company’s strong revenue growth projections for FY25, coupled with its diversification strategy, make it an attractive investment. However, investors should be mindful of the company’s high capital block, potential equity dilution, and exposure to global economic risks.

In the long term, Balu Forge’s positioning in high-growth sectors like defense and aerospace provides a buffer against cyclical downturns in traditional industries, such as automotive.

** Year-on-Year Comparisons**

Revenue:

- FY22 Revenue: ₹29,460.54 lakhs

- FY23 Revenue: ₹33,928.48 lakhs

- FY24 Revenue: ₹560 Cr

EBITDA Margins:

- FY22: 15.5%

- FY23: 18.4%(Annual Report 2023)

- FY24 Projection 23-24%

Capacity Expansion:

- FY22: 18,000 TPA

- FY25: 32,000 TPA after the Mercedes-Benz unit acquisition

Positives

- Strong Growth Prospects: With 40-45% projected revenue growth, BFIL is on track for long-term expansion, driven by its entry into defense, aerospace, and new energy sectors

- Improved Profitability: EBITDA margins are projected to remain healthy at 23-24%, showcasing operational efficiency

- Strategic Positioning: Their investment in defense and aerospace is aligned with India’s national priorities under Atmanirbhar Bharat, making them a key player in defense self-reliance initiatives

Risks:

- Capital Inefficiency: The relatively high capital block compared to sales (₹15 Cr vs ₹560 Cr) raises concerns about capital efficiency

- Currency and Geopolitical Risks: With 90% of revenue derived from exports, Balu Forge is vulnerable to currency fluctuations and geopolitical uncertainties, particularly in Europe

- Equity Dilution: The planned ₹496.80 Cr fundraising could dilute earnings per share (EPS) in the short term

Bonus:

Chart:

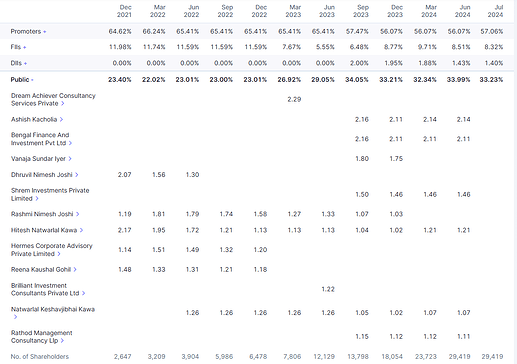

Institutional Investors:

DII: Ashish Kacholia

FII: Sixteenth Street Asian Gems Fund

Related ValuePickr Links:

Disclosure: Not yet invested, but monitoring closely.

Other Links:

https://x.com/mukesh634/status/1791153051660882095

https://x.com/ConcallSummary/status/1810851235806822675