Notes from interaction with management of Balalji amines during/after AGM.( there may be few mistakes from my side while noting down the points)

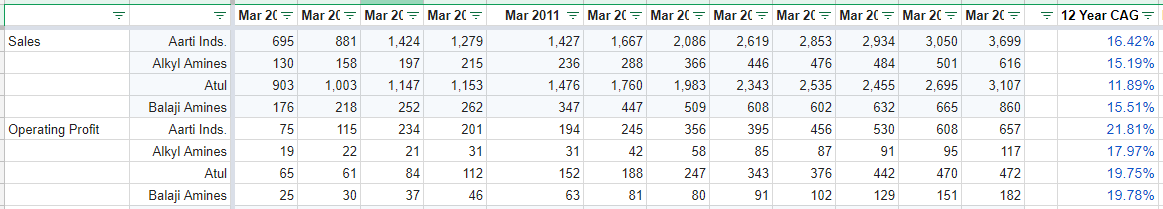

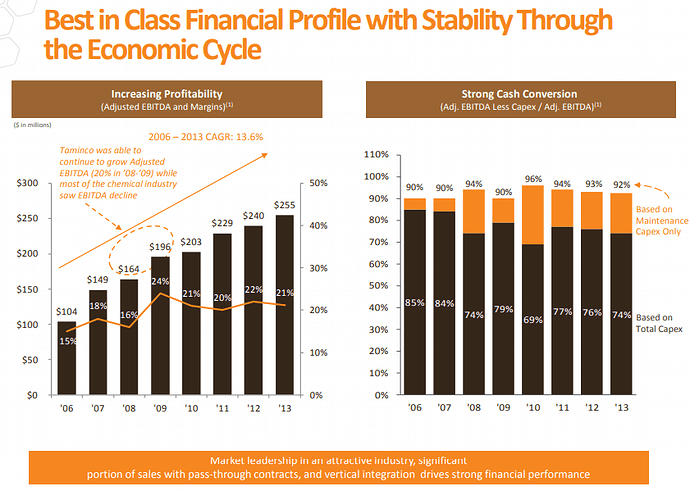

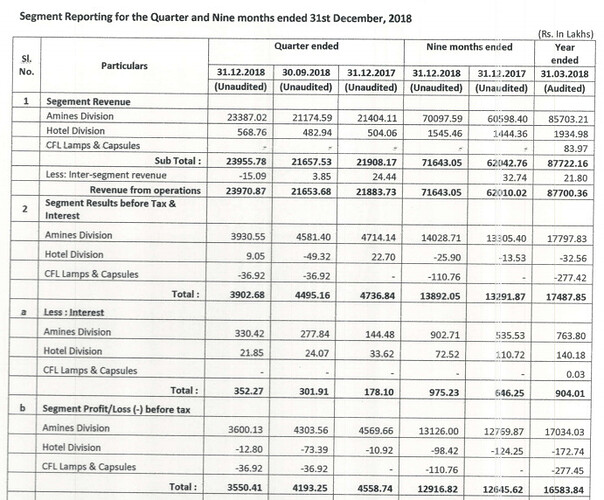

Volume and revenue guidance: 20% volume growth for the year. Revenue we may do more than 1100 cr if everything happens as planned. EBITDA margins will maintain range of 20 to 22% for the year. All raw material hike has been passed on to customers.most of the time it’s passed onto customers quickly without delay.

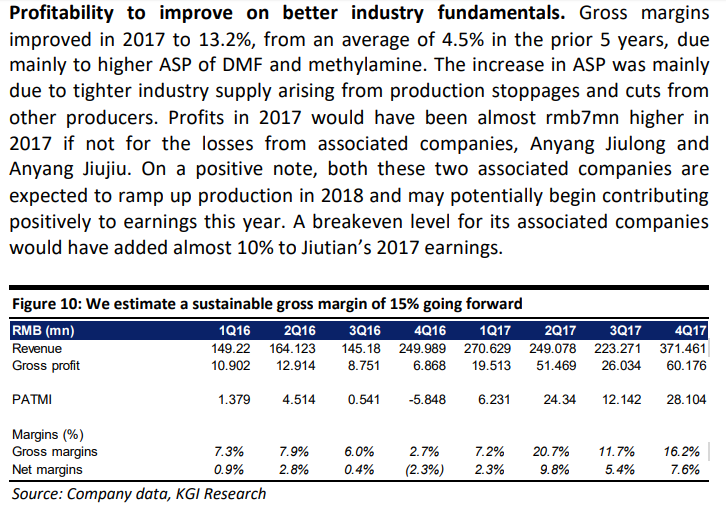

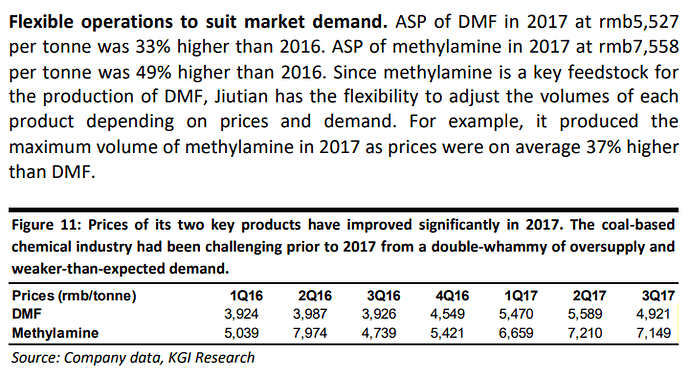

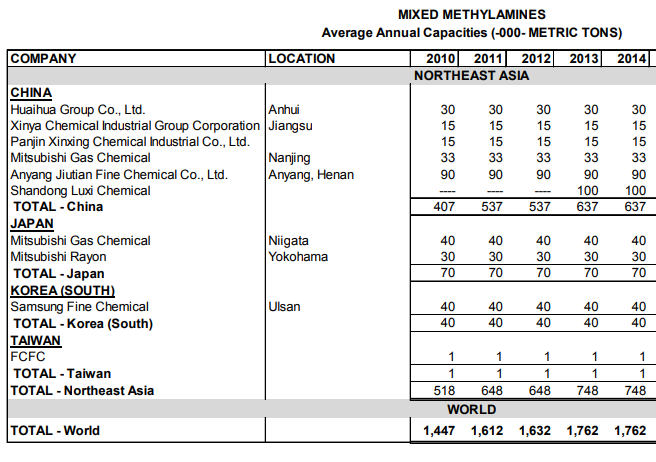

China: Looks like china capacity has come back to some extent. Probably China govt has allowed factories to run after US tariff announcements to make the industries to survive. But they are definitely stricter with environmental pollution issues and govt is punishing the companies not following guidelines.

Long term contracts: We don’t have any long term contracts with MNCs for supply of raw materials( like Aarti industries).we are only few players/monopoly in certain products ,there is no need to look for long term tie ups.

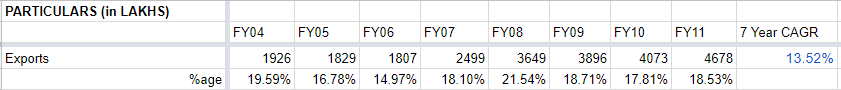

Effect on Rupee depreciation: BAL is net importer. Rupee depreciation is not good for us. Even though exports may be slightly positive.

NOC/Environmental clearance: File is still with state Govt. It will be reviewed by state committee/ CM soon and later will be sent to central govt. Not only Balalji amines, other 4-5 companies in the same industrial area are facing the problem but everything will cleared soon.Even the NOC for Balaji speciality/planned mega project will be done in few months.

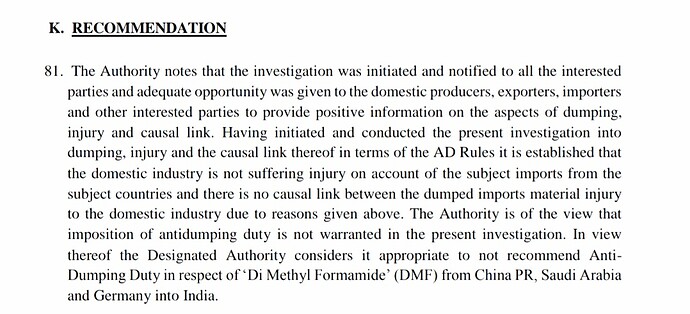

Anti -Dumping duty on DMF: We should have got it two weeks after final hearing. Everything has been done. Due to ongoing auditing by WTO, the process has been delayed. Definitely anti dumping duty will come at what % is we have to see. We are following it closely.

(Even though management has been repeatedly the same thing about NOC and antidumping duty, I felt there are honest efforts from company to solve these issues)

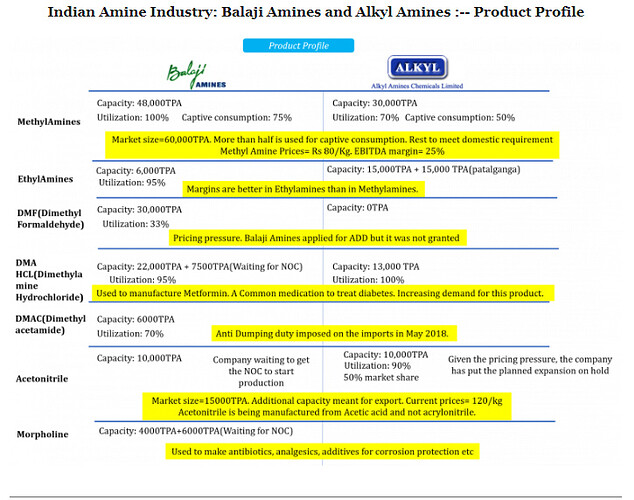

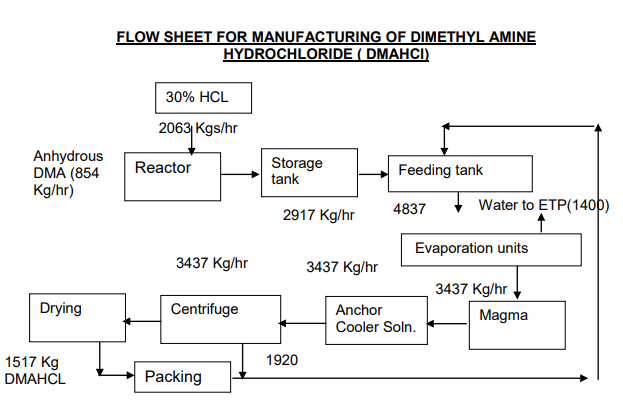

PRODUCTS:

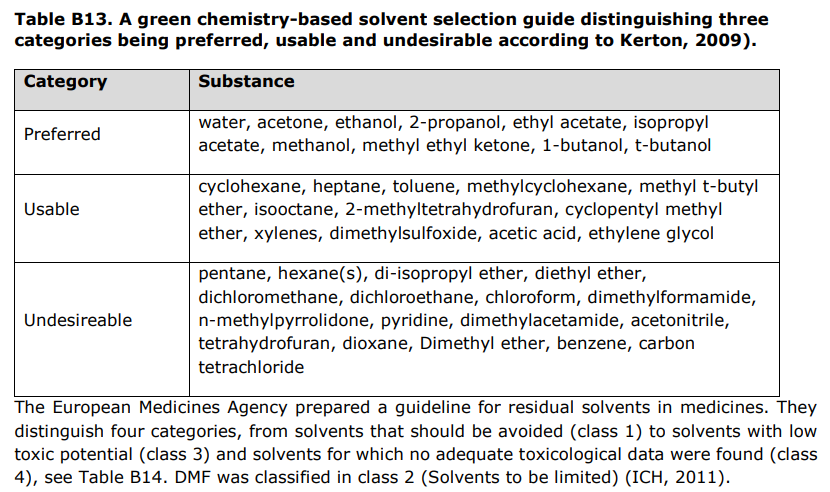

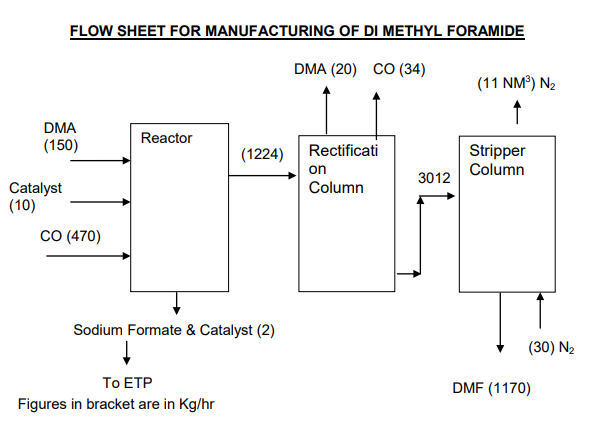

DMF: Present utilisation of DMF capacity is around 30% only(10 to 12k tons) against total installed capacity of 30,000 tons.After antidumping duty we will be able to reach 15 to 20k tons and revenue potential may be 100 cr. presently selling at 85 Rs now compared to 90 Rs few months back. We decided to compete with china imports to some extent till antidumping duty comes.India total consumption of dmf is 46,000 tons /yr.

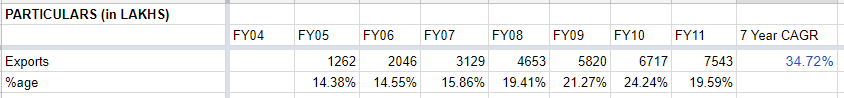

Morpholine: total capacity with expansion is 10,000 tons. present price 150 -160 Rs.Majority we are exporting. We will able to sell 6 to 7k tons with possible revenue of 100 cr. Demand is bit sluggish now. china slow started producing it again.When china production was low price was 200 Rs/kg. We use to export to china itself…600 tons/700 tons per month. we are one among three producer in world.

Acetonitrile: our capacity 9,000 tons…if we add some equipments, we can go up to 18k tons with presently installed reactor. we have not increased the production as price is very volatile. Its around 140 Rs now from high of 200 Rs.It varies a lot with acrylonitrile production in which it is produced as byproduct. When Acrylonitrile plants shuts down acetonitrile prices will shoot up. Its very difficult to guess the acetonitrile price and market. Our competitor(alkyl amines) also may not increasing the capacity as planned due to volatility associated with price.We are trying to get lab grade/ultrapure grade which is almost double the price and gives good margins. Lab grade acetonitrile price is 250 to 300 rs per kg. Mainly used in laboratories/pharma…etc.

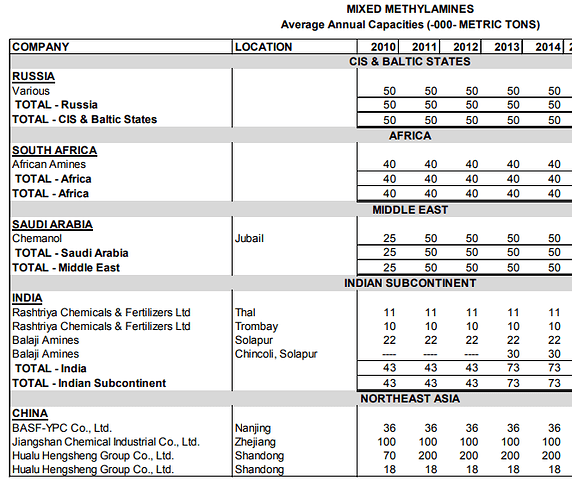

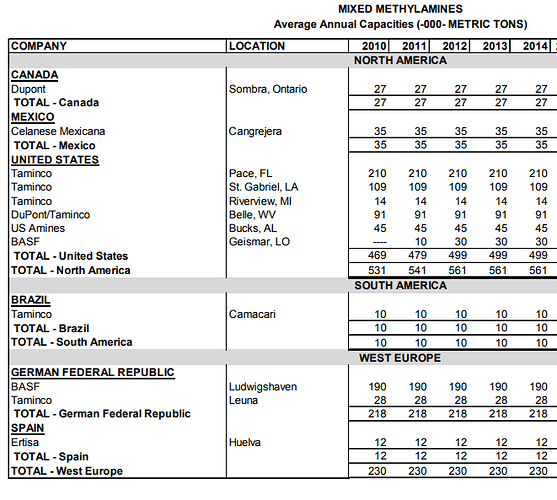

Methylamines: present selling price at Rs.180. We have not seen competition or pricing pressure from competitor alkyl amines.China is not competitor when it comes to methylamine as such. China is having problem in exporting them…they have get separate license for the same and apply six months prior.

_DMAC:_6,000 tons installed capacity. After antidumping duty price increased to 110 rs/kg…presently at 100 rs/kg. Presently we are using around 70% of installed capacity.

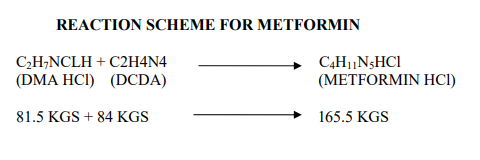

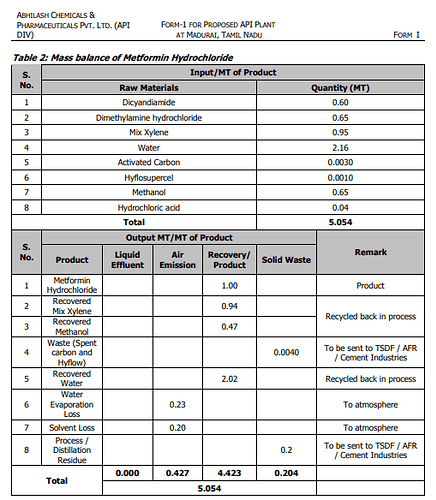

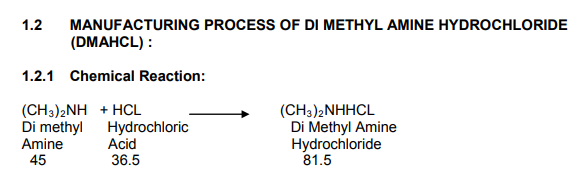

DMA HCL: Presently not using the expanded capacity. Earlier capacity(26,000 tons) is enough for present demand.

PVPK: regulatory requirement is high for use in pharma companies.difficult to convince pharma companies to use this instead of importing at higher price.

NMP: capacity:16,000 tons…utilising 9,000 tons…in india we are selling 5 to 6k tons …rest is exports…present price Rs.150 reduced from high of Rs.180.

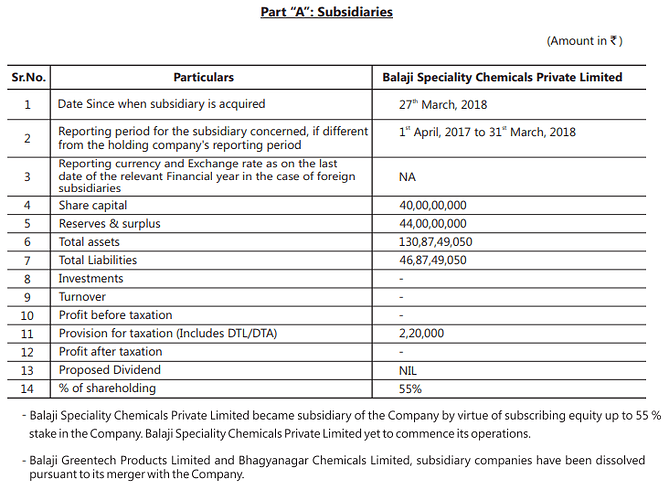

Balaji speciality chemicals: R&D and product work was going on from 2 years. Started construction 9 months back only. Work is progressing as planned. Will start operation from October. This year BSC will do 100 cr of revenue. In fy 2020 BSC will acheive revenue of more than 400 cr business from the three products. This is conservative estimate at present prices BSC may do 100 cr more than estimate. All three products (EDA,PIPERAZINE & DETA) we are sole producers in India.BSC will get all the support from BAL in terms of distributors/sales team and overheads. The additional expenses are going to be less.

EDA: India is importing 39,000 tons/yr. Its demand by end users is also expanding at 20-25% per year.Expecting its demand to be doubled in few years.This is very important product for us. Technically also difficult. All the MNCs are keeping eye on us to see whether we are going to be successful or not. Installed reactor of 150 tons capacity already,catalyst need to added. Our capacity will be 22,000 tons. Present price is Rs.180-175 expected to reduce slightly.Raw material for the same is monoethanolamine and ammonia at full capacity we will do 500 crs.

Piperazine:10k tons is imported…our capacity will be 5k tons.

_DETA:_2-3 k tons capacity.

BSC also we have applied for Mega project status to get benefit of low power cost and tax refund benefits.

Receivables: Increased to 175Cr as sales also have gone up. Will maintain 70 to 75 days of receivables. Most of our customers will pay as scheduled.If somebody is not paying ontime, additional cost will be added to them. All major pharma/agrochemical players are our customers. Sometimes they pay us in advance.

Raw materials scenario:

Payment deal for oil import from Iran is yet be finalised by Govt. If it’s not going to happen whole industry will face problem with methanol price. Present methanol price is around Rs.30-31. Iran deal will bring the price down.We have passed on the price increase to customers.

Ammonia price around 28 Rs…

Acetic acid price has increased to 65 rs but we have good inventory at the low price of 55 Rs.

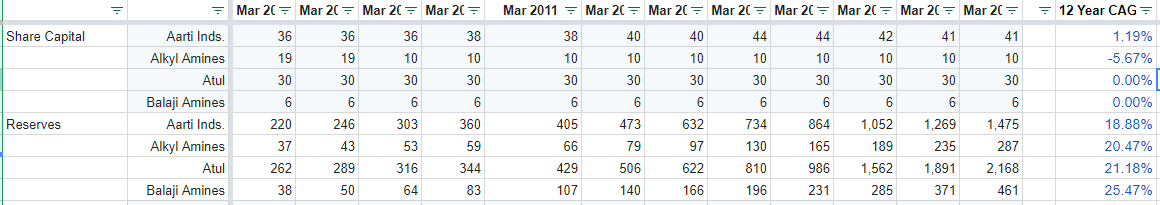

For MEGA project by 2021: we have to raise debt of around 150 cr.same amount of money will generate from internal accruals as well. No equity dilution will be done. Infirst phase we are going to produce methylamines,ethylamines and MEPA. around 300 cr investment is required.

IPA is in second phase…

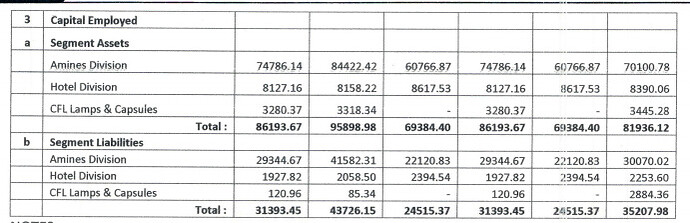

_Cash:_Presently we have around 60-70 cr cash…by next year will be in better position. BAL term loan is almost Nil.(3 cr)?

Hotel : No plan to monetize it presently.its Valued at 150 cr presently and in cash profit now. Loan of around 10 cr will be cleared by next year.

Applied for project in planned pharma city at Hyderabad for 100 acres land.