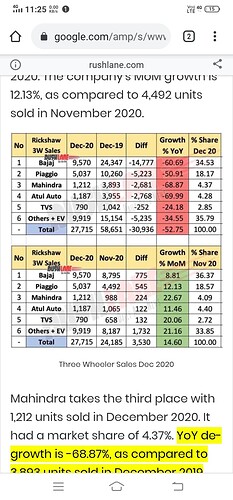

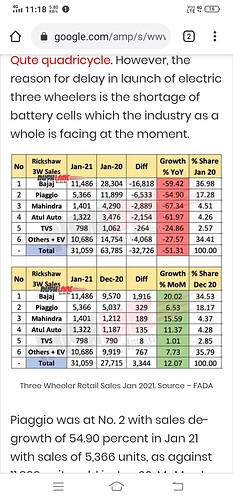

From Nov20 to Jan21 industry growing fast and Atul Auto little less on MoM basis. I think MoM will be better to understand recovery in 3W than yoy. Also in Jan 21ind growth lesser than Dec 20 on mom basis, it means again growth slowed after festival and pentup demand.

Atul auto mkt share Nov 20-4.40, dec 20-4.28 jan 21-4.26 percentage wise.

Good Initiative.

Does anyone has an idea, what is the company doing on EV segment. I am sure, there would be time, when all the vehicles would be EV & commercial vehicles would also be the same.

Disc : Invested

some food for thought - https://twitter.com/Dhruvapandey/status/1397407933609086980?s=20

See this post, esp. point no.4 in this: Atul Auto Limited - #558 by Chandragupta

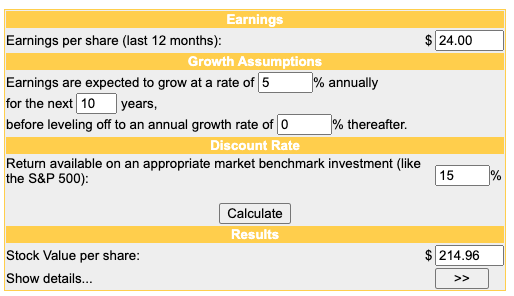

I see there are two issues currently on investors mind -

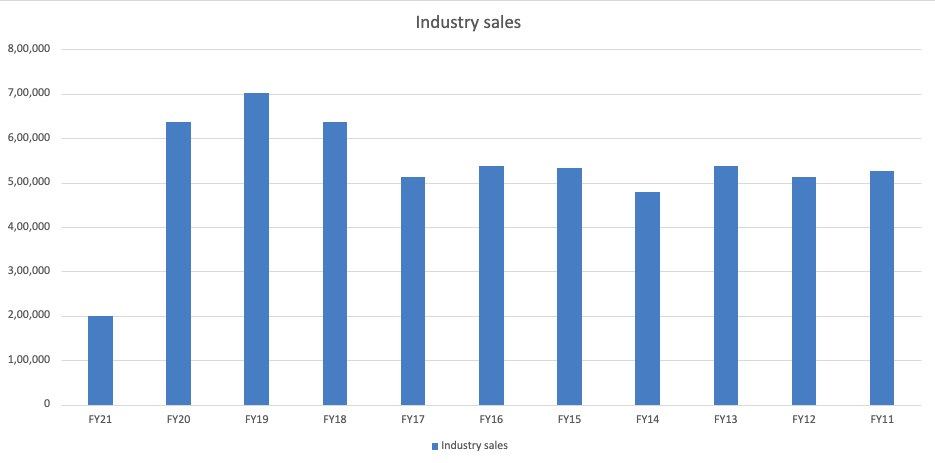

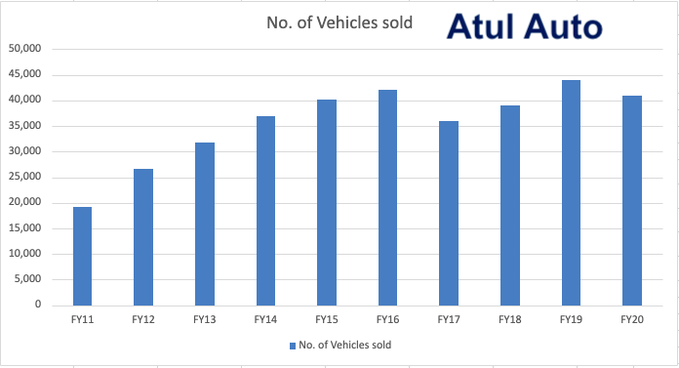

a) Management failed to live up to for FY16 growth expectations ( They were growing very fast till FY16 then it stagnated )

---- Currently that expectation is not priced into the stock anyways if they able to get to FY20 earnings & grow 5% CARG for next 10 yrs & 0 terminal growth then also stock is trading cheap as per DFC.

Basic assumption is post opening up in year or two sales will jump back to Fy20.

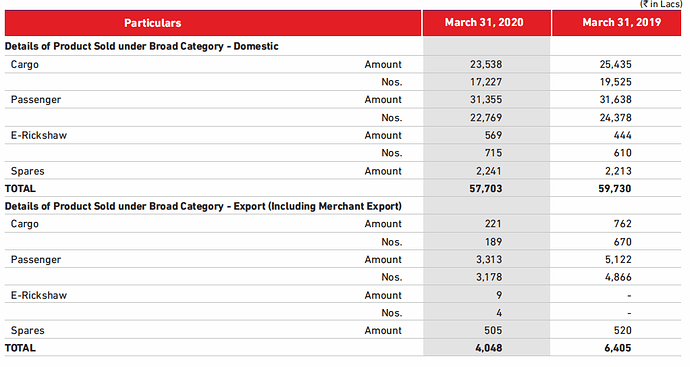

Domestic sales - Have not grown in meaningful way anyways post 2016 - most of the growth came due to low value sales of E- rickshaw ( which are getting sold 12000 per month - significant number ) , In which now organized players like Atul are venturing into -

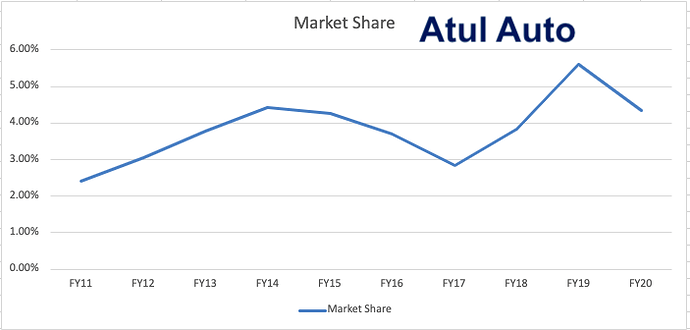

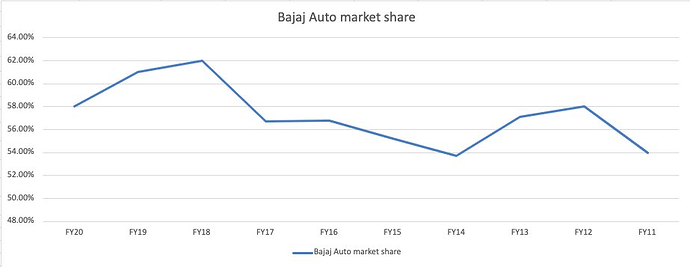

Market share Atul Vs Bajaj Auto - ( I don’t see any alarming situation here, both have been maintaining their marketshare )

E- rickshaw is already Rs12,000 cr market.

Growing rapidly, This should be looked as opportunity as its adding numbers to the industry not cannibalising it (mostly cannibalising cycle rickshaw for short distances) . I see people seeing it as negative for the industry.

A lot to gain for organized market, will accelerate once gov regulate it for safety standards, battery standards etc.

I don’t see any structural reason to believe the Three-Wheeler Auto industry will die 10 years form now. Infact its the only industry driving EV adoption in the country , 80% of EV sold are three-wheelers due to Very good economics offered by E-Rickshaws.

Also, I did little comparison between Atul Vs Competition - I don’t see they are anywhere inferior from cost , quality point of view.

There are bunch of youtube videos on folks comparing and comment sections , there are other websites where you can read reviews i didn’t find anything alarming or -ve from the product point of view.

b) Khusbhu finance blowing up –

Currently stocks is priced such a way that khushbu finance will blow up altogether as even if i consider 20% NPA on the book of Rs 160 Cr then also they have to provide the provisions for Rs 32 Cr /-

Which is nothing for a Atul Ltd which does Rs 50 Cr profit during normal times. As far as Covid contingencies are concerned RBI has allowed lot of relaxations in terms of recognitions and re-structuring, they should be able to tide over it.

Would love to understand others views here too, why they think its not trading cheap.

Sir I am from gujarat and here I am not able to see any e rickshaw, cng rickshaw of Atul, there are many cng rickshaws but most of them are Bajaj

Hi Chintri , I agree with you…Its very evident only 4% of the three-wheelers sold in India are of Atul and 60% of the of the three-wheelers are of Bajaj.

I can understand base rate is against you and me seeing a Atul Vs Bajaj but they generate 30% of revenue from Gujarat meaning they must be selling around 15000, 3 - wheelers in Gujarat per annum , Total three- wheeler sold in Gujarat annually is around 70K meaning, 1 in 5 three wheeler must be of Atul.

Atul has recently introduced CNG and E - Rickshaw and Atul derives significant part of its revenue from Cargo.

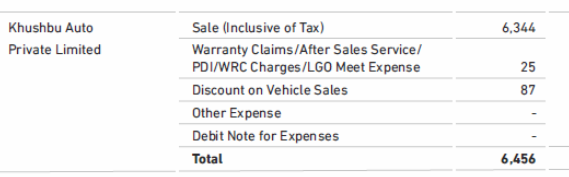

Related party - I was looking at the FY20 AR and there seems to be a related party called Khusbhu Auto Private limited (NOT the NBFC arm Khusbhu Auto Finance). There are sales of Rs64cr in FY20 which is ~10% of Atul’s FY20 sales

On the website the company is listed as dealer of Atul Auto in Ahemdabad. On Zauba the CIN of Khusbhu Auto and Khusbhu Auto Finance are different so seems like 10% of sales of Atul are to a related party dealer?

Can someone shed some light on this? I have attached images of both the dealer details and related party from AR

Both the companies, Khusbu Auto Finance Ltd & Khusbu Auto Pvt Ltd are part of Atul Auto Ltd itself.

The directors in both the companies are also mentioned as promoters in Atul Auto Ltd.

What’s the impact of this on Atul Auto?

Intrsting indeed. A quick research gave these insights

-

Atul as of now just has E-Rickshaws in EV. The cost is around 1 lakh for e-rick. I am not sure, but I think the subsidy here would be for two-wheeler. Rest would be how e-rick is covered in it.

https://atulauto.co.in/product-details.aspx?cid=4&pid=27 -

None of their 3 wheelers are yet operated on EV.

Disc : Invested.

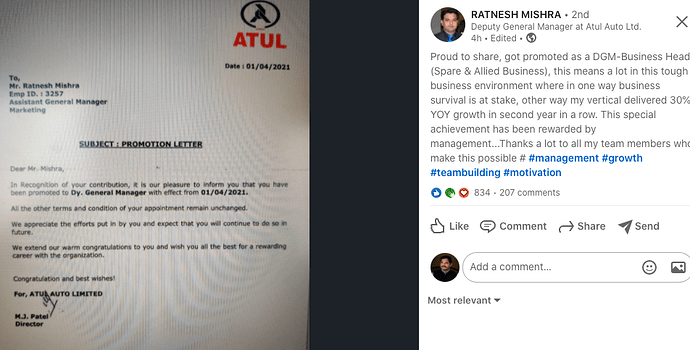

Well I think, Linkedin gives me more info, then Google.

Again, one of the employee is rewarded for a promotion & he shows it off on Social Media.

We as an Investor get real insight.

The spare & Allied business had a 30% YOY growth that too in a difficult year, specially when the whole business has shown huge de growth & loss. I think, there is still grt things happening with in the organisation.

Disc : Invested & am sure, am biased.

Thanks for sharing this useful data point, here is how spare sales has looked in the past.

| Year | Spares revenue (cr.) |

|---|---|

| FY14 | 11.36 |

| FY15 | 13.15 |

| FY16 | 15.58 |

| FY17 | 15.40 |

| FY18 | 21.61 |

| FY19 | 27.34 |

| FY20 | 27.46 |

What all products do they sell under Spare & Allied business ?

Here are my notes from their AR21

- After the launch of Elite - Electrical range of vehicles, we are looking at L5 engines which will further help mark greater profits for our customers

- Company has launched its new range of Alternate Fuel 3W Atul Rik starting with the selected markets which is considered as best in class in terms of comfort and economy in 0.35 ton passenger segment

- Plan to develop Lithium ion Battery Packs from its Wholly Owned Subsidiary. All together new model with upgraded features is under development to be powered with Lithium-ion Battery

- More than 90% of 3-wheeler sales are financed by institutions and availability of credit credit was a major impediment in growth

- Average sales realization per vehicle increased by 22% to 1,63,506 on account of price hike due to introduction of BS VI vehicles

- KAFL:

o Disbursed loan of 64.47 cr. to 2’798 customers (2.3 lakhs/customer). AUM grew by 4.1% to 152.93 cr. (vs 146.86 cr. in FY20). Revenue grew by 3.5% to 33.80 cr. (vs 32.65 cr. in FY20). PBT increased by 60.4% to 7.01 cr. (vs 4.37 cr. in FY20). And PAT increased by 65.31% to 5.29 cr. (vs 3.20 cr. in FY20)

o Has presence in Gujarat, Haryana, Andhra Pradesh, Madhya Pradesh, Punjab, Uttar Pradesh, Kerala and Karnataka through Direct Branch Operations and Income Distribution Partners (IDPs)

o 29.54 cr. will be invested in KAFL in the form of Participative Preference Shares within due course of time to increase the capital base of KAFL - Atul Green Automotive Private Limited: Invested 44 lakhs (taking share capital to 45 lakhs from 1 lakh in FY18)

- Atul Greentech Private Limited: Invested 5 cr. to meet CAPEX requirements including employee remuneration and pre-business operation expenses (taking share capital to 5 cr. from 1 lakh in FY20)

- Term loan: Has been sanctioned a term loan of 90 cr. from EXIM Bank, for part financing the green field project at Bhayla (Ahmedabad) from which the company has utilized 15 cr. as on March 31, 2021. Total CAPEX incurred in Bhayla was 39.57 cr. in FY21

- Average decrease made in salaries of employees other than the managerial personnel was 16.19% whereas there was a decrease of 46.24% in the managerial remuneration as the Executive Directors have voluntarily forgone their fifty percent remuneration in June 01- 30, 2021 considering the COVID-19 pandemic

- Contractual employee: 335, Permanent: 809

Below are the detailed business metrics over the last 15 years.

| In crores | FY07 | FY08 | FY09 | FY10 | FY11 | FY12 | FY13 | FY14 | FY15 | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net sales | 121.77 | 80.39 | 116.81 | 119.85 | 201.59 | 298.29 | 362.86 | 429.25 | 490.07 | 528.00 | 472.19 | 551.22 | 661.35 | 617.51 | 290.27 |

| Raw material cost | 91.60 | 156.20 | 241.86 | 283.15 | 330.39 | 372.20 | 384.87 | 346.15 | 402.20 | 494.97 | 443.13 | 239.19 | |||

| Employee cost | 7.03 | 10.54 | 16.48 | 21.01 | 27.36 | 30.30 | 34.91 | 39.04 | 40.13 | 47.68 | 54.55 | 37.74 | |||

| EBITDA | 8.75 | 6.86 | 5.69 | 14.20 | 20.06 | 28.14 | 42.06 | 48.31 | 57.61 | 71.52 | 59.86 | 75.12 | 88.35 | 74.46 | -5.76 |

| Depreciation | 1.95 | 2.29 | 2.46 | 3.87 | 4.25 | 4.26 | 4.44 | 5.21 | 5.60 | 5.29 | 5.28 | 5.26 | 5.54 | 6.40 | 6.56 |

| Exceptional items | - | - | 0.23 | - | - | 0.13 | - | - | 1.65 | - | - | - | - | - | - |

| Interest | 2.78 | 1.71 | 0.76 | 0.40 | 0.35 | 0.59 | 0.78 | 0.58 | 0.42 | 0.86 | 1.03 | 0.88 | |||

| PBT | 7.15 | 14.06 | 23.24 | 37.22 | 42.75 | 59.25 | 71.53 | 56.52 | 69.43 | 81.95 | 67.03 | -13.20 | |||

| Tax | 2.61 | 4.64 | 8.40 | 11.30 | 12.95 | 19.20 | 24.35 | 19.20 | 23.24 | 28.83 | 14.64 | -3.00 | |||

| Cash tax | 1.22 | 4.94 | 6.96 | 12.19 | 13.37 | 16.47 | 25.36 | 19.53 | 23.20 | 27.10 | 19.40 | 0.29 | |||

| PAT | 3.15 | 1.27 | 0.46 | 4.54 | 9.42 | 15.59 | 25.92 | 29.79 | 40.57 | 47.40 | 37.32 | 46.19 | 53.12 | 52.39 | -10.20 |

| Dividend | 0.54 | 0.29 | 0.29 | 1.17 | 2.34 | 3.66 | 6.58 | 8.23 | 10.98 | 11.51 | 11.51 | 9.33 | 11.52 | 6.03 | - |

| Dividend tax | 0.38 | 0.59 | 1.12 | 1.40 | 2.22 | 2.35 | 2.35 | 1.90 | 2.37 | 1.24 | - | ||||

| Equity share capital | 5.58 | 5.58 | 6.08 | 6.08 | 6.08 | 7.55 | 10.97 | 10.97 | 10.97 | 10.97 | 10.97 | 10.97 | 10.97 | 10.97 | 10.97 |

| Reserves | 20.52 | 21.08 | 24.39 | 27.56 | 34.27 | 48.54 | 63.10 | 83.27 | 109.86 | 143.40 | 169.50 | 208.42 | 247.63 | 292.28 | 282.26 |

| Net worth | 26.10 | 26.67 | 30.48 | 33.65 | 40.36 | 56.09 | 74.07 | 94.47 | 121.07 | 154.60 | 180.70 | 219.39 | 258.60 | 303.25 | 293.23 |

| Gross fixed asset | 40.51 | 50.23 | 57.34 | 59.28 | 63.30 | 61.13 | 68.63 | 83.45 | 146.84 | 149.64 | 152.25 | ||||

| Net fixed asset | 32.32 | 39.80 | 44.78 | 42.82 | 42.65 | 41.54 | 48.07 | 53.33 | 93.36 | 92.10 | 88.77 | ||||

| Market cap | 41.31 | 28.10 | 12.84 | 26.19 | 67.88 | 83.93 | 162.38 | 394.59 | 1’221.25 | 1’139.50 | 1’024.64 | 968.13 | 745.96 | 305.78 | 392.23 |

| CAPEX | 4.03 | 8.47 | 9.60 | 10.57 | 33.59 | 10.79 | 7.91 | 6.85 | 69.83 | 143.47 | 39.57 | ||||

| Outstanding shares | 5’851’520.00 | 7’314’400.00 | 10’971’600.00 | 10’971’600.00 | 21’943’200.00 | 21’943’200.00 | 21’943’200.00 | 21’943’200.00 | 21’943’200.00 | 21’943’200.00 | 21’943’200.00 | ||||

| Low price | 42.55 | 86.00 | 89.95 | 143.15 | 328.35 | 330.00 | 391.00 | 389.30 | 266.95 | 116.80 | 130.85 | ||||

| High price | 159.90 | 155.00 | 226.90 | 379.75 | 834.80 | 635.00 | 567.95 | 512.00 | 466.75 | 372.90 | 203.40 | ||||

| Total shareholders | 1’537.00 | 1’905.00 | 2’833.00 | 3’555.00 | 14’764.00 | 19’007.00 | 21’653.00 | 21’573.00 | 21’108.00 | 21’342.00 | 35’247.00 | ||||

| Disputed taxes | 1.06 | 1.06 | 1.52 | 1.56 | 1.80 | 2.87 | 3.30 | 2.44 | 1.86 | 1.37 | 1.36 | ||||

| CFO | 9.58 | 16.73 | 18.79 | 40.66 | 30.71 | 35.79 | 10.86 | 72.30 | 26.11 | 34.55 | 57.40 | 52.09 | |||

| Director remuneration | 1.79 | 1.41 | 1.74 | 2.17 | 2.51 | 2.88 | 2.95 | 3.21 | 3.76 | 1.98 | |||||

| Auditor remuneration | 0.07 | 0.09 | 0.10 | 0.12 | 0.12 | 0.17 | 0.15 | 0.18 | 0.06 | 0.07 | 0.07 | 0.06 | |||

| Employees | 951.00 | 919.00 | 808.00 | 868.00 | 927.00 | 993.00 | 809.00 | ||||||||

| Median employee salary | 116’808.00 | 142’836.00 | 166’416.00 | 179’712.00 | 192’072.00 | 202’680.00 | 171’089.00 |

Disclosure: Invested (position size here)

Latest management interaction with CNBC Awaaz

- Bhayla plant (Ahmedabad) is commissioned with 60’000 annual capacity, total capacity is now 120’000 (including Rajkot)

- Have the whole product range available (petrol, diesel, CNG, LPG, electric)

- Khusbu finance: AUM of 160 cr. with 70% allocation to 3-wheelers

- Electric vehicle: ~10% of revenues is coming from this section

Disclosure: Invested (position size here)

Atul Auto Limited has announced the sales figures for the month of September 2021. The company has sold 1876 units during September 2021, as against 1633 units during September 2020. The September 2021 sales volume increased 14.88% YoY.

The company has reported sales volume of 6331 units during the period April to September 2021 registering a YoY growth of 11.82%, as against 5662 units during the period April to September 2020.