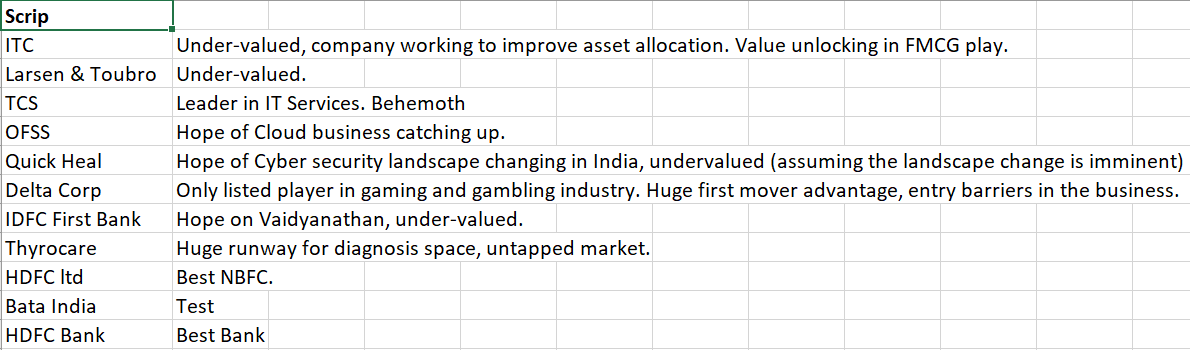

Looking for feedback , top 3 constitute 50% of the portfolio. Feel free to point out if my comments are totally wrong or inaccurate.

First word used for ITC (“undervalued”) has always been there. Until they try something very different, it should be laggard.

Quick Heal is commodity. It doesn’t have potential to be multibagger and consistent return.

When you have HDFC and HDFC bank , there is no need for IDFC… It lacks multibagger quality. Give a look to City Union Bank.

Thyrocare is good but Reliance Diagnostic will disrupt this space.

Rest looks good to me.

Delta is a great buy at current price. With Daman and Land Policy plus growth in online revenue, it is a potential multibagger.

Hi Ashish,

This is a good portfolio but it’s almost completely devoid of any small/midcaps.At best this pf will give you 12-14% kind of CAGR.You can go through the various threads on this forum to pick and choose the good names down the marketcap ladder.

Appreciate the feedback! Will have a look at the banks holding , thanks for throwing light on Reliance Diagnostic.

Thank you for the feedback. Have a few names on radar like Xelpmoc, Naukri .

I was about to tell you about Xelpmoc but your portfolio looked defensive so didn’t take name. Xelpmoc should make a killing in coming times. It is invested in so many startups like fortigo ( backed by Nandan Nelkani ) , mihup and many more. Fortigo alone will do topline of 300cr in FY21.

Disc : invested in Xelpmoc since 66. Have added at 90 and 152 more.

I see the keyword hope in many stocks, back these hopes by number, one can’t be investd more than 10-20% in turn around stories!

I also see under valued, undervalued is also a recipe for disaster in stock market!

Market don’t give value to low quality stocks at the same time I have seen companies enjoying 30-40 + PE for almost a decade!

So irrespective of the stocks, your reasoning is flawed at the least!

Also one don’t write test, they write tracking & then they don’t include that in their portfolio, because it ain’t!

I would advice you to read quality books, listen to esteem investors & their philosophy, learn about fundamental research

Thank you, appreciate your suggestion. Bata is less than 0.25% of my portfolio, I am not even tracking it, probably shouldn’t have mentioned it. Since, i dont intend to add it. Slightly, disagree on the hope bit since markets are forward looking, they run on hope, anticipation, earnings guesstimate. Also, there is already a big debate on growth investing thvs value investing. Some say growth is component of value, so yes some might sustain higher PEs for decades. And finally no one knows what Mr. Market is upto. Happy investing

Go easy buddy !! Your tone isn’t appropriate. He is asking for help. In market everyone learns gradually and learning never ends. Noone can tell exactly what will happen with market or a company in future. Even promoters don’t know what they are capable of. Aditya Puri wasn’t sure he would make HDFC this big. Respect others views.

@ashishp2010 I do beg forgiveness for being rude

Even I maybe wrong. But how I see those biggies invest is they keep the least to probability!

So in turn these hopeful stocks require more time & effort, you need to monitor them more aggressively, which goes against the capacity of individual investors, you would then eventually have to hire analysts to do your work!

Do read the thread on coffee can investing & learn as much you can from the best people in this community

Np bro. I will definitely read that up, however tend to lean more on Ben Graham/chandrakant sampat (although it is widely believed thats a thing of the past) more than Saurabh Mukherjea :). But yeah, completely take your point on the effort and time needed and hence not being a viable approach. Cheers!

Hi Ashish,

Thanks for sharing your stock selection and articulation. IMO, before seeking stock specific advice an investor must have following answers to the questions ready:

- What is your financial goals trying to achieve?

- What is your asset allocation based on your risk profile?

- How much you are planning your Networth to be exposed to equities?

- Have you estimated the potential risks, opportunity cost vis-a-vis your equity investments?

- More importantly your time horizon for investing and sticking to your defined investing objectives.

- Overall portfolio management strategy and risk mitigation plan.

Having above plan in place will ensure smooth ride over long run.

Next comes the specific feedback to stock selections. According to me and generally speaking over a last decade TCS, HDFC group, Bata, ITC demonstrated consistent performance. Rest of other stocks you need to monitor closely to avoid pain and heartburn. Find time to read many valuable threads in VP especially wizard of VP: Hitesh and Donald’s thread.

Happy investing!

VK

Disc.: invested in some of the above names in my PF.

Thank you for your feedback Vijay. And thanks a ton for directing me to Hitesh and Donald’s thread!!

Oracle financial- your rationale is cloud, however as per my limited understanding the listed Oracle financial is an ERP and not cloud part of Oracle. Pls correct me if wrong.

Better shift from delta corp

Goa tourism not starting soon

Delta is debt free, significant lands,assets, close to 400-500 Cr of cash in the portfolio and has growing online gaming business (Adda52) which is clocking 40 Cr of quarterly revenue and growing at over 30%. So even if casinos/Goa tourism don’t open, it may be able even with only online business in 3-4 quarters. Also they have been reducing costs in a big way. While they posted a loss in Q1, I remain bullish and rerating may happen much before the opening of physical assets.

Thanks for this, however this “Cloud” looks little misleading in terms of what we as investors are looking for. Not that the company wanted to mislead but seems we ourselves are getting the wrong connection. This “Cloud” looks to me as an extention of the Oracle Apps Finance …something like an Oracle Fusion or its big brother SAP HANA. These are the ERPs answer to the digital age so that they don’t die and remain meaningful…but in essence these are but ERP packages only and not a Cloud/Digital new age technology. These IT companies place the revenues from such apps under digital segment though but these are actually no new revenue sources but rather can be taken as clients adopting to new versions of ERP packages from these providers. So, in actuality, these are revenues from ERP stream for all such IT companies and I would not take them as a new age digital tech.

You are absolutely right. Digital revenues are skewed to show growth at times. Also, agree on the fact that too much should not be read into above snippet. Other facts I like, 1) cash on the books 2) Promoter holding 3) Dividend Payout 4) PE under 20.

Regret: Did not add when it was available at approx. 50% of the price today.

Indeed, Oracle does have a good foothold in Finance part of ERP, specially Banking. I am really not sure how SAP could not be leader in this segment of ERPs