Flipcart hold 26% in flying machine which is 100% subsidiary of Arvind fashion, non controlling interest is coming from there, though this is also an item of concern, need more clarity.

Can you please explain this in detail? If Fipkart holds 26% then Arvind Fashion can hold only 74%. Is that correct understanding.

Yes, in flying machines sales and profits, Flipkart gets 26%, remaining is under arvind fashion.

I believe Flying Machine is AFL’s own brand, then why is their 10-12% royalty?

Could it be that they’d sharing between themselves and Flipkart?

In FY23 - out of the consolidated net profit of Rs 87 Cr, 100 Cr came from 50% subsidiary PVH Arvind Fashion Private Limited. So ex of this subsidiary, company made loss of -13 Cr. Could anyone share some details on this subsidiary - what are the brands under this? How many outlets?

PVH hold Tommy and C&K.

Personal opinion:Sephora did had edge over reliance tira but management was more focused into clothing part

Business with huge potential and having revenue of 337 crore sold at 100 crore only!! cant digest

Hello everyone,

Thanks for sharing your thoughts in this thread. It helped me a lot in understanding the business.

In the Q2FY24 PPT, they’ve mentioned about “minority interest” and the profit that’s transferred to them is significant amounting to almost 40% of overall profit.

There was a question regarding this in Q2FY24 concall and mgmt mentioned it is linked to Tommy and CK.

I understand Flipkart holds a minority share in Flying machine brand.

To summarize,

Flying machine - Flipkart owns minority interest.

Tommy and CK - 50:50 JV with PVH

USPA and Arrow - Appears to me that whole profit stays with the company.

This implies company may own only ~4 complete brands effectively.

In Q2FY24, overall profit = 37 crores, minority interest share = 15 crore. From the above concall snippet, it can be safely concluded that minroity interest is PVH brands who owns 50% in Tommy and CK and 50% profit made from these brans transferred to PVH. So, this in effect makes Tommy and CK brands together made a profit of 30 crores.

Mgmt made it clear in the concall that Flying machine and Arrow are profitable with a low single digit EBITDA. Even if we assume nil profit from these 2 brands then we’re left with 7 crore and USPA.

Mgmt says USPA is their biggest brand with highest revenue and highest EBITDA in their portfolio but it appears it made only 7 crore profit. I have a very strong feeling this cannot be true for USPA brand.

Either my calculations are wrong or mgmt is not being clear with their profit sharing agreement with PVH. If anybody has made sense of this @Souresh_Pal @Simrat @akshat_investor , could you please shed some light?

From Subsidiary Annual reports we can see the below :

PVH (Tommy & CK) - 1040 cr Revenue, 100 cr Profit. (50% Share of this goes to PVH)

Arvind Youth Brands (Flying Machine) - 474 cr Revenue, -5 Cr Profit

Arvind Beauty Brands (Sephora) - 338 cr Revenue, -20 cr Profit (Sold to Ril)

Rest - ~3000 cr Revenue, 13 cr Profit

With Sephora exit, the remaining business FY22-23 Profit can be taken as 57 (37+20). Plus the sale proceeds can be used to reduce debt further, resulting in annual interest payment reduction by ~8 cr (100 * 8% interest),leading to like for like profit of 62.5 cr post tax (57 +5.5).

Do let me know if some false assumptions made.

@Shashank_Sinha1 Your calculation is spot on. I understand you’re referring to this from the FY23 annual report.

Arvind Lifestyle Brands Limited reported a revenue of INR 2240 crore, accompanied by a relatively modest profit of INR 3.60 crore. Notably, this includes the prominent USPA brand (recognized as the company’s best-selling brand with the highest EBITDA) and Arrow. The constrained profitability may stem from either Arrow facing losses in the previous year or the possibility that the entirety of the company’s interest payments is channeled through this subsidiary. The same pattern of less profitability is seen in the latest quarter also.

If you have discerned the underlying reasons for this diminished profitability, could you please elucidate them?

Was looking at the P&L of 3 key subsidiaries of Arvind Fashion and Comparing the same with other retail fashion players for FY22-23. Though not like for like comparison ( Trent has non fashion business also, though very small. Metro also has multiple brands which might have different dynamics individually), it gives an idea regarding the key metrics to look at.

The key call-outs were :

-

Margin post commission & Royalty is the key monitorable as the the difference between this and Profit before tax is more or less constant for each brand/ retailer (except PVH where it seems very low and Trent where it is high). Min 35% seems critical for a ~7-8% PBT margin

-

Apart from Margin, Inventory is another key monitorable, as excess inventory would lead to higher markdown in future. Flying Machine, PVH and Metro all seem to be sitting on pretty high Stock Cover (> 230 days).

-

Gross Margin for Vedant is in another orbit all together. But, unless they crack the Women Ethnic Wear market, scalability might be a challenge.

Disc : Invested.

Whether commission is based on sale only or minimum commission is guaranteed!! Beacuse commission is high for Arvind compared to others…

Commission would be sale based in my opinion. Because Arvind sells more on SOR model rather than outright, its commission might be on the higher side.

Nice illustration, thanks for sharing here.

USPA and Arrow together have the highest(together with Trent) COGS of ~57%. Do you suspect this is attributed to discounts, or could it be indicative of Arrow sales operating at a break-even point?

Royalty and Margin are mostly will remain same in future as well for these brands. How do you think company can increase PBT?

Right now the entire growth seems to be coming from PVH group (Tommy & CK) only. US Polo & Arrow is flat YoY and Flying Machine seems to be going backward both on Sale and Margin.

Until and Unless Management is able to turn around Arrow and Flying Machine quickly, there might not be many triggers available for the near term as all the low hanging fruits of Debt reduction and discontinuation of loss making brands has already been actioned.

Disc : Invested

US POLO Has good profability but numbers are dragged due to ARROW…And overall Retail market was in mute condition only …So growth is inline of market…

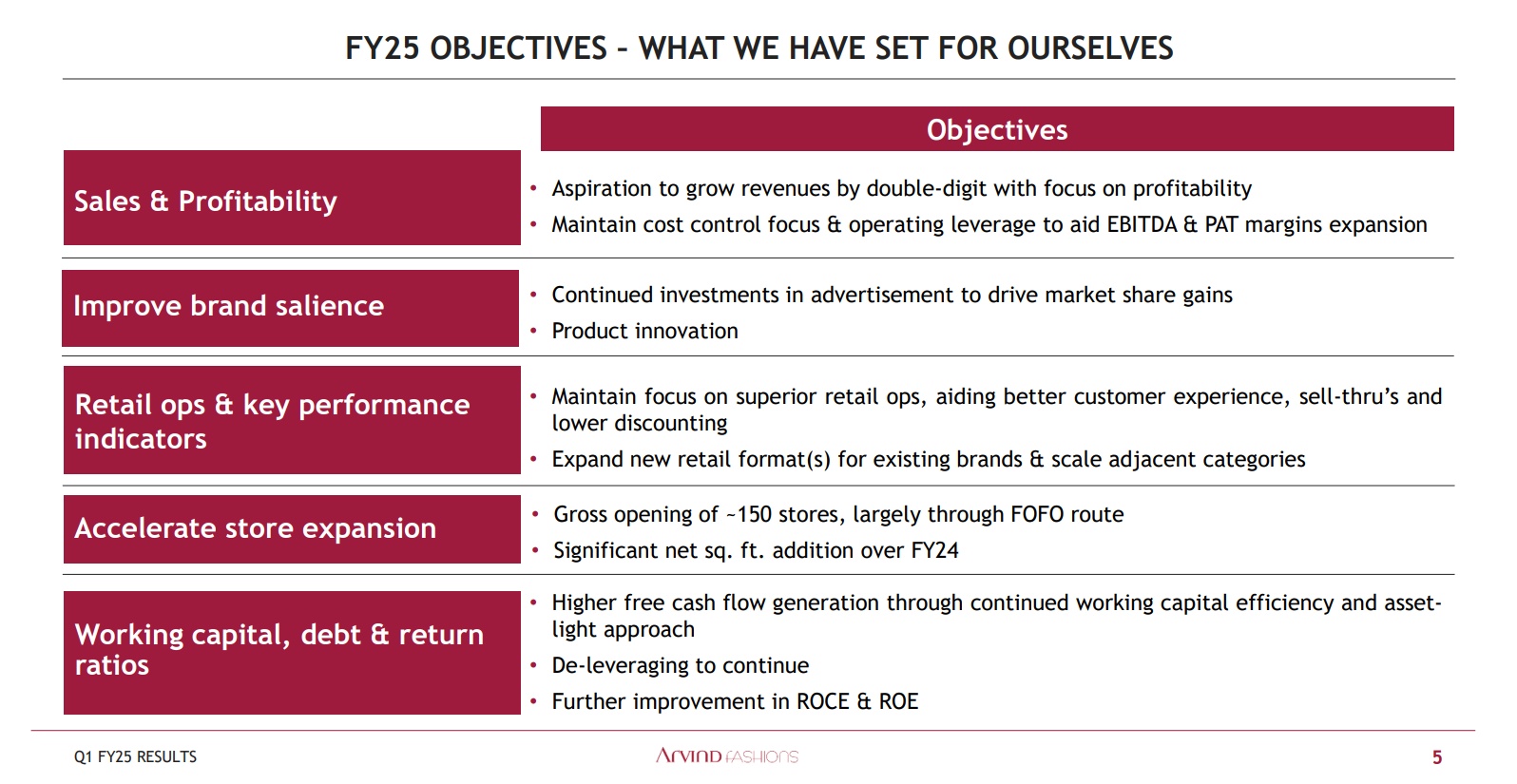

Arvind Fashions Q1 FY25 Analysis: Key takeaways!!

Arvind Fashions Limited (AFL) has delivered a strong performance in Q1 FY2025 amidst a challenging market environment. The company reported double-digit revenue growth, 1.5% like-to-like retail growth, and an 80 basis point increase in gross margin, which translated into a 100 basis point EBITDA margin expansion. This indicates the company’s ability to navigate through the tough macroeconomic conditions and continue its growth trajectory.

Strategic Initiatives:

AFL has been focused on implementing several strategic initiatives to drive growth and profitability. These include:

- Retail network expansion: The company added over 40,000 sq. ft. of net retail space in Q1 and remains committed to a 15% annual net retail space growth.

- Premiumization and category expansion: AFL has been successful in driving premiumization across its brands, leading to better price realization and improved profitability. The company is also focused on expanding into adjacent categories like footwear, womenswear, kidswear, and innerwear, which now contribute over 20% of the overall revenue.

- Online direct-to-consumer (D2C) business: AFL has been pivoting its online business towards a direct-to-consumer model, which has resulted in a healthy growth of over 60% year-on-year and improved channel profitability.

- Inventory management: The company has been able to maintain tight control over inventory, leading to a reduction in inventory days and improved stock turns, thereby enhancing its working capital efficiency and ROCE.

Trends and Themes:

The industry has been witnessing a trend towards casualization, which plays to the strength of AFL’s portfolio of brands, as they have a leadership position in the casual segment. Additionally, the company’s focus on premiumization and category expansion aligns with the broader trends of premiumization and diversification observed in the Indian apparel market.

Industry Tailwinds:

The Indian apparel market is expected to witness steady growth, driven by factors such as rising disposable incomes, increasing urbanization, and a growing middle-class population. The trend towards premiumization and casualization in the industry also presents favorable tailwinds for AFL’s portfolio of brands.

Industry Headwinds:

The apparel industry has been grappling with the impact of macroeconomic factors such as subdued consumer sentiment, elections, and weather patterns, which have affected overall market demand. The industry has also been challenged by increased competitive intensity and promotional activities.

Analyst Concerns and Management Response:

Analysts have raised concerns regarding the company’s like-to-like retail growth, which was impacted by the tough market conditions. The management has addressed this by highlighting that the 1.5% like-to-like growth is a satisfactory performance given the industry scenario, and the company has been able to maintain its focus on profitable growth through measures such as delayed discounting and premiumization.

Competitive Landscape:

AFL’s portfolio of strong brands, including Tommy Hilfiger, U.S. Polo Assn., and Calvin Klein, positions the company well in the competitive landscape. The company’s focus on product innovation, retail experience, and category diversification helps it differentiate itself from the competition.

Guidance and Outlook:

The management has guided for a high single-digit to double-digit revenue growth in the medium term, along with a commitment to expand EBITDA margins by at least 100 basis points annually. This reflects the company’s confidence in its growth strategies and ability to navigate through the challenging market environment.

Capital Allocation Strategy:

AFL has been focusing on maintaining a healthy balance sheet and reducing its net debt, which stood at around Rs. 225 crores as of Q1 FY2025. The company plans to utilize its free cash flow to further pare down its debt levels.

Opportunities and Risks:

Opportunities include the continued growth in the Indian apparel market, the trend towards premiumization and casualization, and the potential for further expansion in the online and adjacent categories. Risks include the impact of macroeconomic factors, increased competitive intensity, and regulatory changes in the industry.

Regulatory Environment:

The company is subject to various regulations governing the apparel industry in India, and any changes in the regulatory landscape could impact its operations. The management has highlighted their engagement with policymakers to address any regulatory changes, such as the recent developments in the footwear segment.

Customer Sentiment:

The management has emphasized the strong consumer appeal of its brands, which have been able to maintain their top-of-mind position despite the challenging market conditions. The company’s focus on product innovation, retail experience, and brand-building efforts have helped in sustaining customer sentiment.

Top 3 Takeaways:

- Arvind Fashions Limited has demonstrated resilience and agility in navigating the tough market environment, delivering a strong performance in Q1 FY2025.

- The company’s strategic initiatives, including retail expansion, premiumization, category diversification, and online D2C focus, have positioned it well to capitalize on industry trends and drive future growth.

- The management’s guidance for high single-digit to double-digit revenue growth and EBITDA margin expansion showcases its confidence in the company’s growth outlook, despite the near-term headwinds.

Arvind Fashion Ltd.

High D/E >1

Revenue will grow- 10-12% in near term, supported by strong market position of its apparel brands, increase in sales from adjacent categories, addition of new stores, improvement in performance of ‘Arrow’ and ‘Flying Machine’ brands, and increase in store efficiency.

AFL has planned capex of ₹100-120 crore per annum in FY25-FY26, which is expected to be funded through internal accruals.

Discontinuation of loss-making ‘Sephora’ business.

The company completed closure of most of its loss incurring brands and decided to focus on its five key brands (Tommy Hilfiger, U.S. Polo, Arrow, Flying Machine and Calvin Klein) with an aim to improve its profitability. Licenses of these existing international apparel brands are long term/perpetual.

ROCE will increase to 20%

It also encompasses various segments like men’s wear, women’s wear, kids wear, inner wear, footwear and accessories; albeit skewed towards men’s wear.

The company has a dedicated team for its adjacent categories (footwear, inner wear, kids wear, women wear and accessories), which has supported revenue of around ₹600 crore from adjacent categories in FY24. Adjacent categories account for over 15% of the revenue for some brands**. Going forward, the management plans to increase its sales in adjacent categories within its existing brands to improve demographic presence.**

In Q2FY24, AFL launched women wear line under U.S. Polo through online channels.

Wide distribution network with presence across multiple sales channels

Profitable track record of two years with expectation of further improvement in profitability

AFL witnessed gradual increase in share of full price sales across brands and lower discounting, improvement in performance of ‘Arrow’ brand,Flying Machine and closer of loss-making brands and benefits of operating leverage aided improvement in profitability in recent past.

However, AFL has taken steps to improve inventory turnover and collection period. The company’s gross operating cycle which elongated to nearly 400 days in FY21 mainly due to COVID-19 pandemic, improved to 197 days in FY24 (FY23: 174 days) supported by steps taken by the management to improve collection period, inventory turnover and store efficiency

Key weaknesses-

Operating performance exposed to economic down-cycles -Retail clothing and apparel industry has heavy dependence on the disposable income of its customer segment and is susceptible to economic cycles because of discretionary purchases. Retail clothing and apparel industry is facing subdued demand for value segment and online channel, which had an impact on its overall performance.

Highly competitive branded apparel retail industry- which exerts pressure on profitability margins The apparel retail sector in India is highly competitive with presence of many domestic and international brands and foray of large corporates like TATA group, Reliance group and Aditya Birla group.

Q1 FY25- Key highlights

Screenshot 2024-08-25 153121.png 67.5 KB

Screenshot 2024-08-25 153021.png 219.05 KB

Screenshot 2024-08-25 153004.png 78.11 KB

Stock inventory for coming seasion ie Q2 and Q3 will be good

The management is committed to increasing revenue growth and growing EBITDA by 100 basis points, with a medium-term goal of achieving 12-15% growth.

OPM increasing bcz of operating leverage, low discount giving,cost efficiency in sourcing,premiumization etc.

In terms of capex, the company plans to spend around 100 crores in FY’25, with investments in COCO stores, IT capex, and store renovations. The capex is expected to be funded internally, with strong cash flows from the Tommy brand. The company is cautious about inventory buildup and aims to bill closer to the season to ensure good sell-through rates.

Our net debt was around 225 crores. There is a seasonality, next quarter it could go up by 50-odd crores here because we have to build the inventory for the season and a bigger scale. But I think we will remain at this level and any free cash flow that we generate, we will try to pare down the debt level from that. So, I think we have been reducing our debt levels and that effort will continue.

Key Financial Metrics:

- Revenue growth of 10% compared to 5% in the previous quarter

- Gross margin increased by 80 basis points despite similar retail channel growth

- EBITDA margin at 13%, showing a 100 basis points improvement

Management Commentary Highlights:

- Focus on profitable growth, not just growth for the sake of growth

- Strong performance in online channel with B2C growing over 60%

- Aggressive expansion in MBO and department store channels

- U.S. Polo brand performing well with double-digit growth in sales and EBITDA

- Efforts to revamp Arrow and Flying Machine brands for higher growth

Insights into Business Verticals:

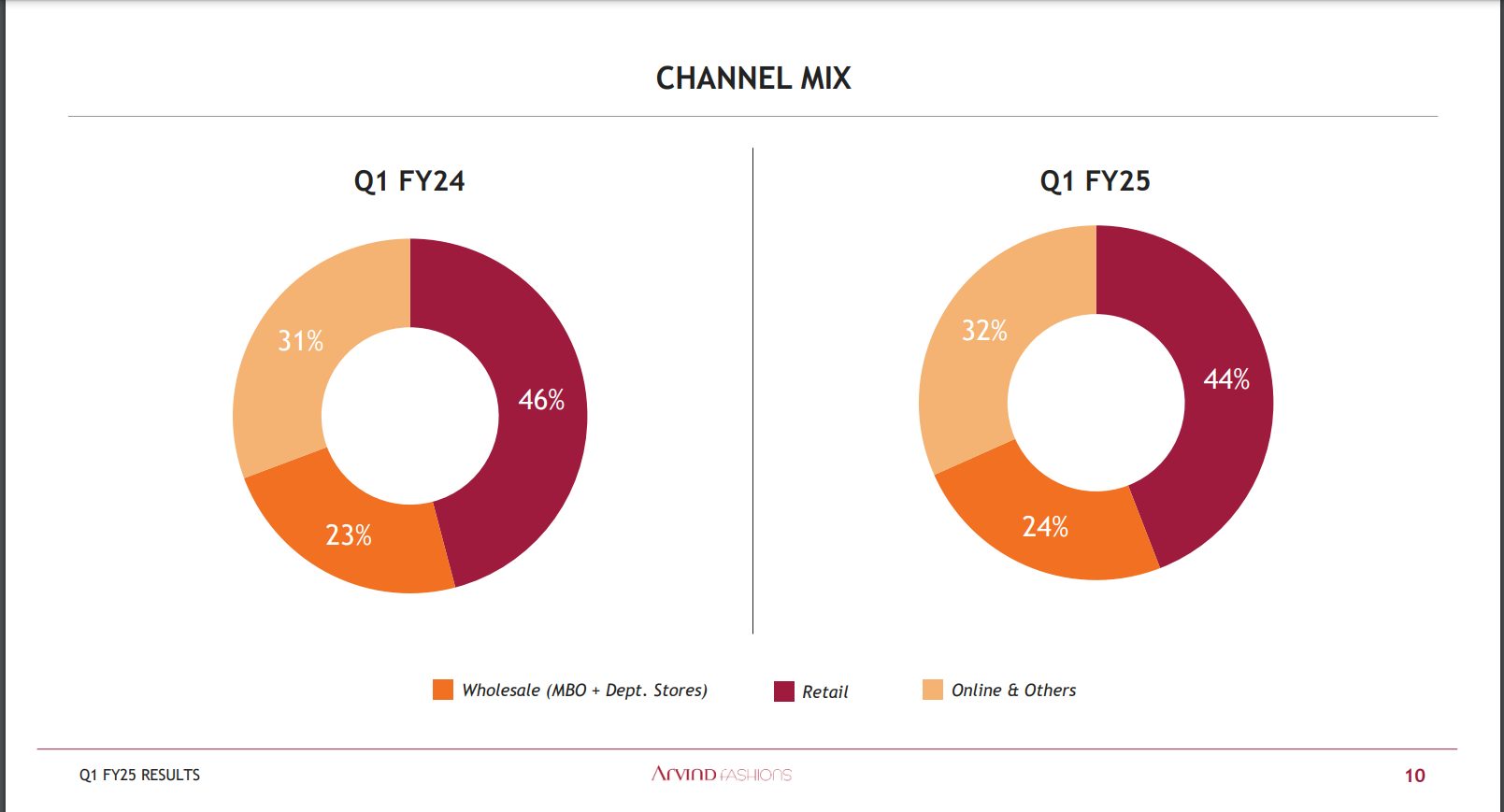

- Wholesale and retail channels both saw growth in revenue and channel profitability

- MBO channel grew handsomely due to distribution expansion and brand strength

- Department store channel saw good growth with healthy margin profile

- Online B2C business pivoting from wholesale towards B2C for healthy growth

Forward Guidance & Outlook:

-

Commitment to 15% net square foot addition in retail expansion

-

Expectation of higher revenue growth compared to previous quarters

-

Focus on increasing EBITDA margin by at least 100 basis points

-

Strategy to revamp Arrow and Flying Machine brands for higher growth and profitability

-

U.S. Polo brand expected to deliver similar profitability as Tommy and CK brands in the medium term

-

Continued efforts to improve stock turn and liquidate inventory for better margins and cash realization

Overall, the company is focused on profitable growth, with a strong performance in online and retail channels, aggressive expansion in MBO and department store channels, and efforts to revamp underperforming brands for higher growth and profitability. The management is optimistic about future growth prospects and committed to improving financial metrics, despite challenging market conditions.